Markets opened the week on a cautious note as investors readied for central bank updates on the outlook for interest rates and braced for a deluge of earnings.

On Wall Street, equity futures contracts were steady after the S&P 500 closed out a third week of gains and finished Friday near its record high. Europe’s Stoxx 600 index held near the highest level since January 2022, supported by rallying oil majors as heightened Middle East tensions drove up crude prices. BP Plc, Shell Plc and TotalEnergies SE all gained about 2%.

Brent and West Texas Intermediate crude touched their highest levels since November in intraday trading, before pulling back. The US said Iranian-backed militants killed three service members and wounded others in a drone attack in Jordan, with President Joe Biden pledging to retaliate.

Middle East developments add to an already crowded diary of major events for investors, with a Federal Reserve policy decision Wednesday, one from the Bank of England Thursday, and US payroll numbers Friday. There’s a blockbuster line-up of earnings too, with Apple Inc., Microsoft Corp. and Google parent Alphabet Inc. among those due to report.

“This week will be very important — earnings, central banks, geopolitical risk — these are three big factors that could move things,” said Andrea Tueni, head of sales trading at Saxo Banque France. “Even if volatility is still very low, you only need one of these three factors to catch fire and that could shake things up.”

The dollar was steady, while Treasury yields ticked lower.

Meanwhile, the euro slipped and European government bonds rallied on growing speculation that the European Central Bank could start cutting interest rates by April. Policymaker Francois Villeroy de Galhau at the weekend raised the prospect of easing at any of the ECB’s coming meetings. Governing Council member Peter Kazimir wrote in an opinion piece Monday that the ECB won’t rush into cuts, saying that June is more likely for a first move.

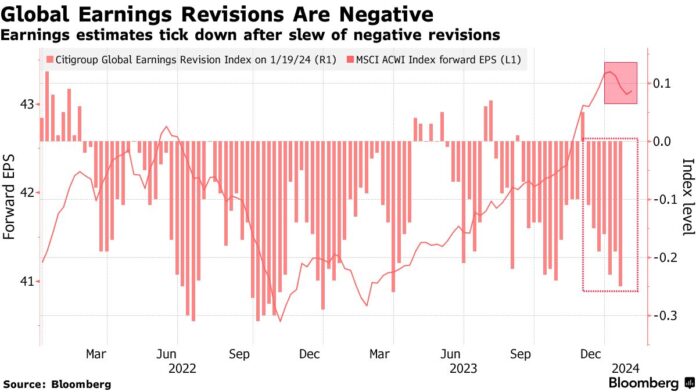

On the broader, global outlook for equities, UBS Group AG strategists led by Andrew Garthwaite warned that markets are set to confront a “difficult phase,” where slowing growth will start to dent earnings estimates. Predictions by analysts that revenues will rise strongly despite these conditions throw up a “very unusual” mismatch, according to the UBS team.

UBS now expects earnings to disappoint, because profit margins are under threat from rising wages and the delayed impact of higher interest rates. “The market is behaving as though weak economic data is good (more rate cuts, lower bond yields),” a team led by Garthwaite wrote. “At some point this relationship reverses.”

In Monday’s company news, Holcim Ltd. gained after the world’s largest cement maker said it plans to spin off its fast-growing North American business. Royal Philips NV fell 6% following news it’s suspending sales of sleep apnea devices and ventilators in the US. Bayer AG slumped after its Monsanto unit was ordered by a Pennsylvania jury to pay more than $2.2 billion to a former user of the Roundup weedkiller.

In Asian trading, a gauge of the region’s stocks gained amid optimism over China’s latest measures to bolster its equity market. China’s securities regulator said at the weekend it will halt the lending of certain shares for short selling from Monday. Chinese property shares erased an earlier gain after a Hong Kong court ordered the liquidation of China Evergrande Group. Trading in the company’s shares was suspended after it tumbled 21%.

Key events this week:

- Australia retail sales, Tuesday

- Eurozone economic confidence, GDP, consumer confidence, Tuesday

- European Central Bank board members Boris Vujcic and Philip Lane speak, Tuesday

- US Conf. Board consumer confidence, Tuesday

- Microsoft Corp., Alphabet Inc. to report earnings, Tuesday

- Australia CPI, Wednesday

- Japan industrial production, retail sales, Wednesday

- China non-manufacturing PMI, manufacturing PMI, Wednesday

- France CPI, Wednesday

- Germany CPI, unemployment, Wednesday

- ECB chief economist Philip Lane speaks, Wednesday

- Fed rate decision, US employment cost index, Wednesday

- Boeing Co. announces earnings, Wednesday

- US Treasury quarterly refunding, Wednesday

- Japan PMI, Thursday

- China Caixin manufacturing PMI, Thursday

- Eurozone S&P Global Manufacturing PMI, CPI, unemployment, Thursday

- Bank of England rate decision, Thursday

- ECB Governing Council member Mario Centeno speaks, Thursday

- US ISM Manufacturing, initial jobless claims, Thursday

- Apple Inc., Amazon.com Inc., Meta Platforms Inc. to report earnings, Thursday

- ECB Governing Council Member Mario Centeno speaks, Friday

- US employment report, University of Michigan consumer sentiment, factory orders, Friday

Some of the main moves in markets:

Stocks

- S&P 500 futures were little changed as of 7:08 a.m. New York time

- Nasdaq 100 futures rose 0.2%

- Futures on the Dow Jones Industrial Average were little changed

- The Stoxx Europe 600 was little changed

- The MSCI World index rose 0.1%

Currencies

- The Bloomberg Dollar Spot Index was little changed

- The euro fell 0.2% to $1.0827

- The British pound was little changed at $1.2701

- The Japanese yen rose 0.2% to 147.89 per dollar

Cryptocurrencies

- Bitcoin rose 0.9% to $42,349.64

- Ether rose 0.2% to $2,267.67

Bonds

- The yield on 10-year Treasuries declined three basis points to 4.10%

- Germany’s 10-year yield declined five basis points to 2.24%

- Britain’s 10-year yield declined five basis points to 3.91%

Commodities

- West Texas Intermediate crude was little changed

- Spot gold rose 0.5% to $2,029 an ounce