Stocks and commodities tumbled as China’s worsening Covid outbreak compounded fears sparked by faster Federal Reserve tightening. Bonds rose.

U.S. equity futures fell, pointing to extended losses for the S&P 500 after the gauge shed 2.8% Friday to reach the lowest level since mid-March. The Stoxx 600 Europe Index fell as much as 2.2%, with miners and energy firms at the forefront of losses. West Texas Intermediate futures slid more than 5% to trade below $98 a barrel amid a rout in other raw materials.

Fears of wider curbs in Beijing are spooking investors already fretting about the risk of a global slowdown as the Fed raises rates to tame inflation. A broad gauge of Chinese stocks dropped to the lowest in almost two years as policy makers put some areas of the capital under lockdown amid the government’s steadfast adherence to its Covid-zero policy.

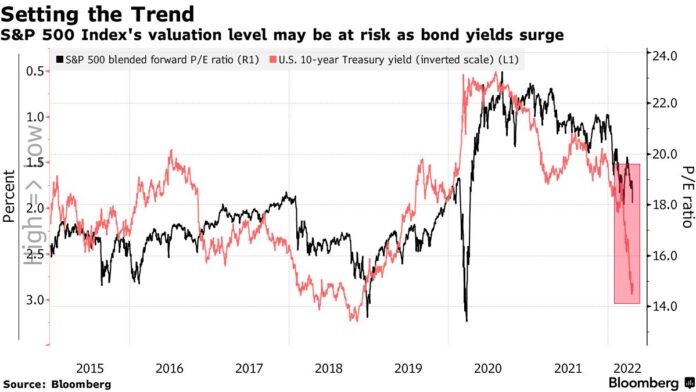

The S&P 500 is about to drop sharply, Morgan Stanley’s Mike Wilson warned, as investors struggle to find havens amid fears that aggressive Fed action will engineer a recession. Morgan Stanley strategists said a quickly tightening Fed is looking “right into the teeth of a slowdown” in a note Monday, and that crowded defensive stocks no longer pay.

A flight to havens lifted global government bonds, with the yield on the U.S. benchmark note down nine basis points. The dollar extended an advance, while the euro fell even after Emmanuel Macron’s win in the French election removed a key risk for markets.

Monday’s pullback in the soaring price of commodities since Russia’s invasion of Ukraine has done little to assuage concerns about runaway inflation.

Fed Jerome Powell had outlined his most bold approach yet to reining in surging prices and the European Central Bank signaled stronger tightening.

China’s central bank is in a different position as it looks to shore up its economy against slowdown, and on Monday it cut the amount of money that banks need to have in reserve for their foreign-currency holdings.

Meanwhile, U.S. Secretary of State Antony Blinken and Defense Secretary Lloyd Austin arrived in Kyiv for talks as the war enters its third month.

Events to watch this week:

- Tech earnings include Alphabet, Meta Platforms, Amazon, Apple

- EIA oil inventory report, Wednesday

- Australia CPI, Wednesday

- Bank of Japan monetary policy decision, Thursday

- U.S. 1Q GDP, weekly jobless claims, Thursday

- ECB publishes its economic bulletin, Thursday

Some of the main moves in markets:

Stocks

- Futures on the S&P 500 fell 0.8% as of 7:53 a.m. New York time

- Futures on the Nasdaq 100 fell 0.8%

- Futures on the Dow Jones Industrial Average fell 0.7%

- The Stoxx Europe 600 fell 1.8%

- The MSCI World index fell 0.7%

Currencies

- The Bloomberg Dollar Spot Index rose 0.3%

- The euro fell 0.4% to $1.0747

- The British pound fell 0.7% to $1.2749

- The Japanese yen rose 0.2% to 128.18 per dollar

Bonds

- The yield on 10-year Treasuries declined nine basis points to 2.81%

- Germany’s 10-year yield declined eight basis points to 0.89%

- Britain’s 10-year yield declined six basis points to 1.90%

Commodities

- West Texas Intermediate crude fell 5.3% to $96.61 a barrel

- Gold futures fell 1.3% to $1,908.80 an ounce