This week the economic events’ docket is light. However, there are two important events, which are likely to cause heavy movements for some of the major pairs. These events are the RBNZ (Reserve Bank of New Zealand) interest rate decision and Australia’s jobs report. Before discussing these events, let us first review some of the happenings of the last two days. There was only a handful of low-risk events scheduled during the last two days.

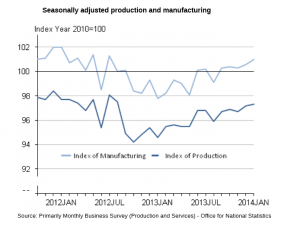

The market was mostly ranging, but there were some movements noted for the GBPUSD and AUDUSD pair. Both these pairs have been trading lower for the last two days. The GBPUSD has even traded a touch lower below the 1.6600 level. The UK industrial and manufacturing production data, which was released during the European session yesterday failed to impress the GBPUSD buyers. The official statement points that “the seasonally adjusted index increased by 2.9% between January 2013 and January 2014. The increases reflects rises of 3.3% in manufacturing; 12.6% in the water supply, sewerage & waste management sector. Offsetting these increases were falls of 3% in the electricity, gas, steam & air conditioning sector and 1.9% in mining & quarrying.”

Australia’s jobs report

The AUDUSD pair is also trading lower Intraday, as the Chinese imports and exports data were mixed. The pair even traded below the key 0.9000 level yesterday. The pair is eagerly waiting for the employment data for a spark. On Thursday, at GMT 00:30 AM, the Australia’s employment change, full employment change, participation rate and the unemployment rate data will be released. The market is expecting good jobs number this time around. The employment change is expected to jump up by 18K, and the unemployment rate is expected to remain stable at 6.0%.

It is worth mentioning that during the last week, the pair traded aggressively higher, and climbed above the 0.9100 level. After setting a short term top at around the 0.9132, the pair has traded lower. If the jobs report does not disappoint, then one can expect the pair to regain the bullish momentum above the 0.9000 level. On the other hand, if the jobs data miss the expectations, then one can witness further loses in the pair.

RBNZ interest rate decision

Another pair, which is very interesting is the NZDUSD. This pair also traded a lot higher during the last week, and even for the last two days. The New Zealand dollar traders are eagerly waiting for the RBNZ to announce the interest rates. One thing to keep in the mind is that the RBNZ is likely to raise rates by 25 Bps from 2.50% to 2.75% in March. This is one of the sole reasons for the strength in the pair. This might even drive the pair higher. On Wednesday, at GMT 08:00 PM, the central bank will announce the rates, and will also release a statement. The expectation of a rate hike is one of the key drivers, which is pushing the New Zealand dollar higher not only against the dollar, but also against the pound and the Australian dollar. If the central bank decides to hike the rates, then the pair might continue to trade higher in the short term. Remember, most of this is already priced in, so any disappointment may trigger pressure selling in the pair, and might raise concerns over the reliability of the central bank.

Technically, the pair traded above the 0.8500 level yesterday, but failed to maintain the gains, and traded lower. There is an important triangle forming on the weekly chart, as shown below. The triangle resistance sits at around the 0.8520/40 level. A break and close above this level will be very important in the medium term, as it will call for further gains in the pair. On the downside, the 0.8200 level is a key swing support area, which can hold the downside in the pair.

So, keep an eye on all important levels friends and trade accordingly.

Get my Daily Market forecast with trade opportunities HERE: Vladimir’s Markets Forecast

Happy Trading Friends!