Hi Traders, in today’s article I am going to explain about one of the favorite indicators among traders especially the new traders, I’m talking about the Stochastic Indicator and I would like to share with you what’s right to do and mainly what not to do.

The Stochastic Oscillator was developed by Dr. George Lane in late 1950’s. As designed by Lane, the Stochastic Oscillator presents the location of the closing price of a stock or (any other instrument) in relation to the high and low range of the price of that stock (or any other instrument) over a period of time, typically a 14 – day period (of course parameters could be changed).

The Stochastic Indicator (that belongs to the oscillators family) is basically a momentum indicator comparing a particular close price of any given instrument to the range of its prices over a specific period of time. The sensitivity of the oscillator to market movements is reducible by adjusting that time period or by taking a moving average of the results. The math is used to generate overbought and oversold trading signals, utilizing a 0-100 bounded range of values.

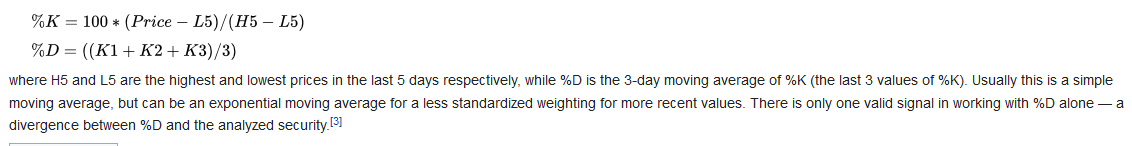

So the formula looks like this: (it’s directly from Wikipedia so you can find it there)

Sometimes I prefer that the approach with any indicator is that, what’s good for the creator should be definitely good for us, this is my personal approach of course many traders do different numbers, change here and there but I don’t see any reason for that because if it was good for the creator and he probably had some sense and logic behind it, so well for me it makes sense to stand to the standards.

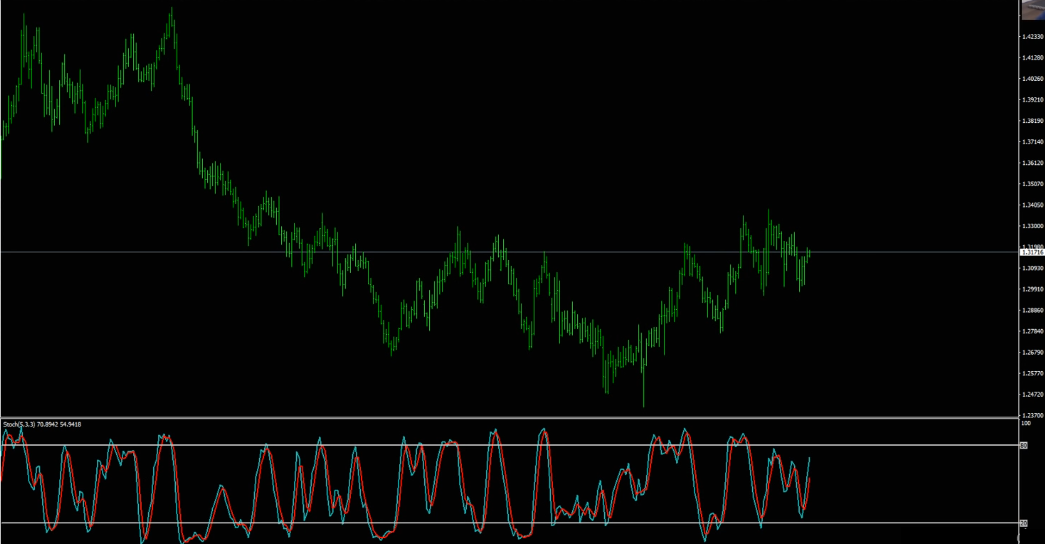

How Does It Look Like?

This is how the standard (5,3,3)Stochastic indicator looks like:

In the Stochastic indicator you can see the two moving average lines crossing each other. The Stochastic is arranged between 100 and 0, while the most important levels traders pay attention to are 80 and 20, where it’s considered to be overbought when the price is above 80 and oversold when the price is below 20. It sounds very easy right but however it comes with a lot of traps behind it and that’s what I want to cover in this article.

What Are The Purposes Of Stochastic Indicator?

The Stochastic Oscillator formula works best in consistent trading ranges. To explain it another way we can say that the primary limitation of this indicator is that it has been known to produce fake or false signals. This happens when the trading signal is generated by the indicator, yet the price does not actually follow through, which can end up as a losing trade. During volatile/trending market conditions this can happen very often. One way to help with this is to take the price trend as a filter, where signals are only taken if they are in the same direction as the trend.

What Not To Do?

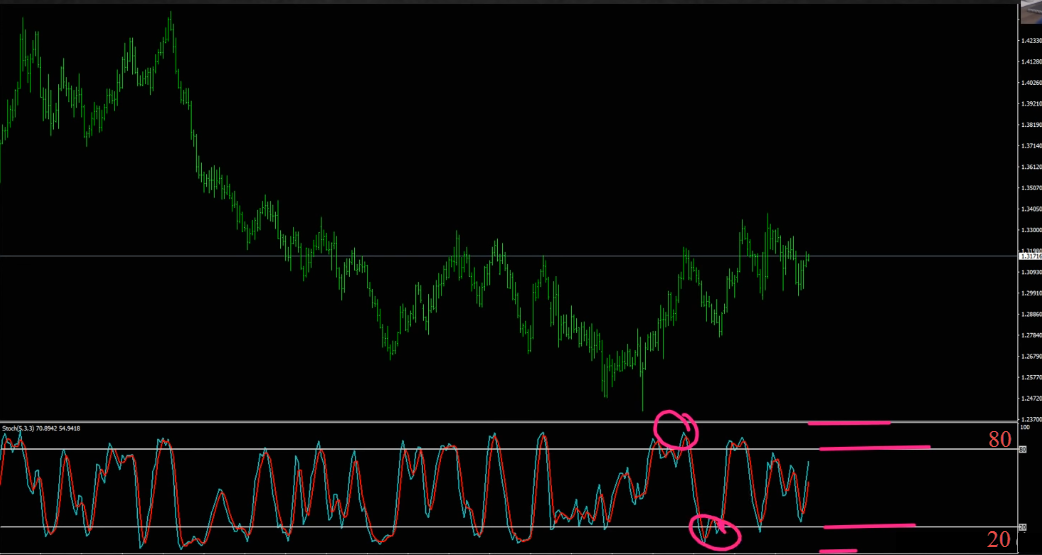

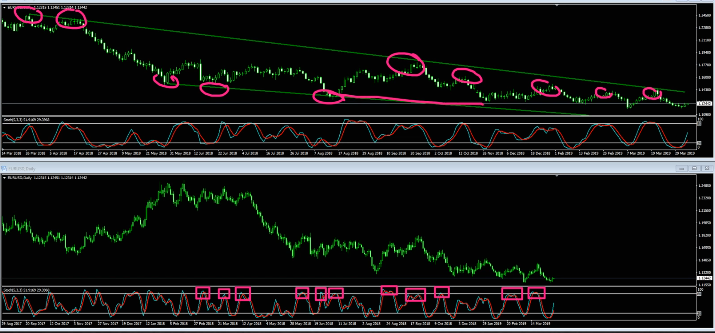

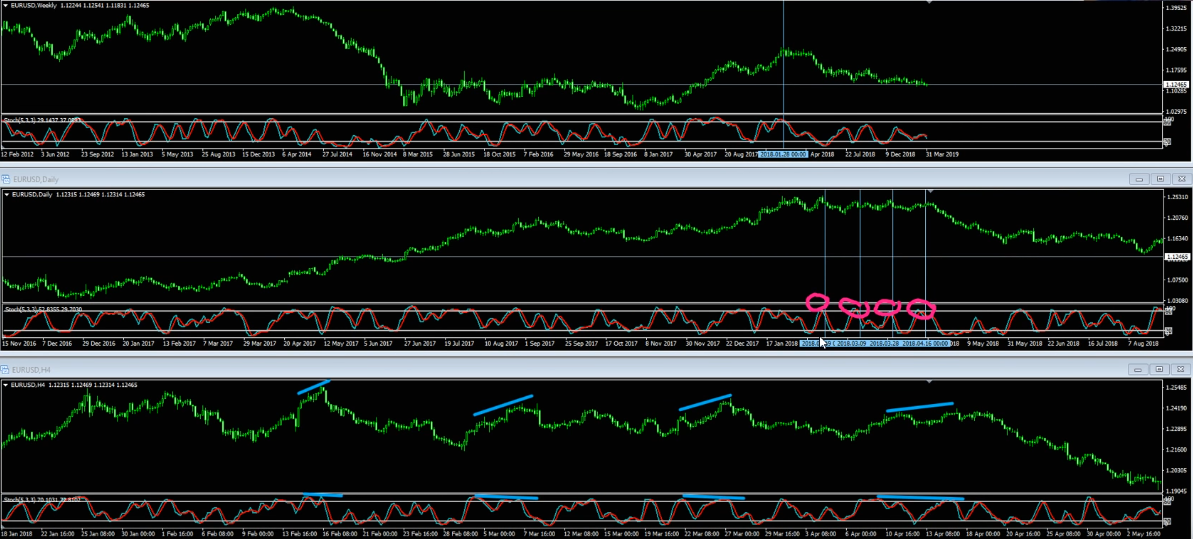

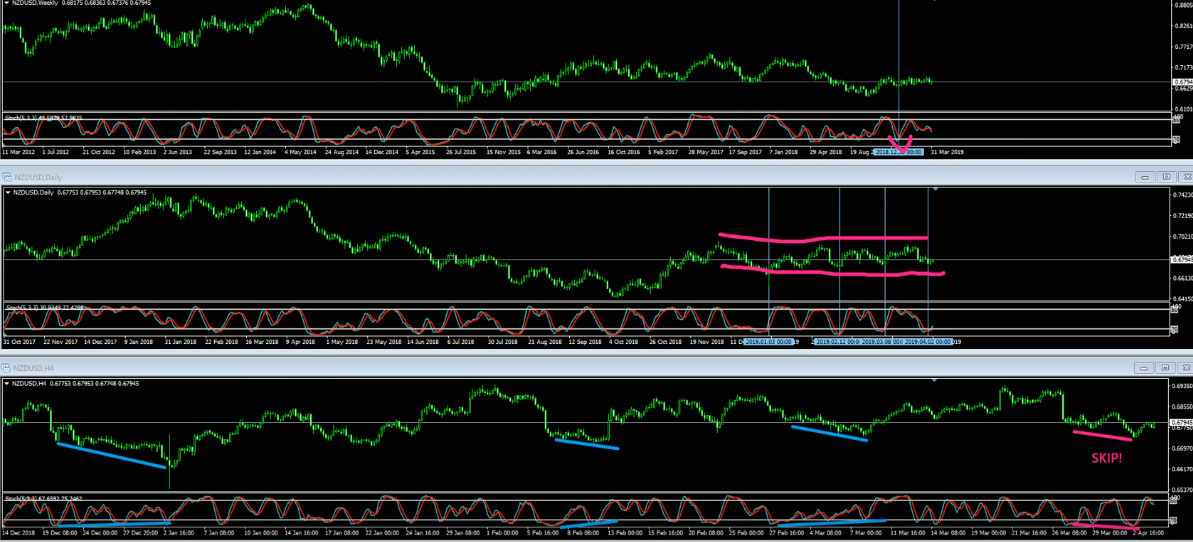

As I said before 80 overbought and below 20 oversold sounds extremely easy. Now look at the situations shown in the screenshot below, we can see that the Stochastic shows “oversold (below 20) many times (marked in pink) but a rally never happened”.

Only the last two (marked in blue) started a little rally. We can see how many fake signals it has produced, so the idea of the Stochastic was to generate the movement before the price actually follows that which is calculated by the mathematics behind it. The reality is different, in trending conditions, the traders are trying to catch a reversal point before it really happens.

You need to understand that this is wrong by its definition to try and gamble, to find when will be the retrace before the price give you the retrace signs, it doesn’t make sense, it’s like trying to cross the road for example and trying to guess where will be the green light before its actually green does it doesn’t make sense but I just want you to understand the logic behind it.

What To Do?

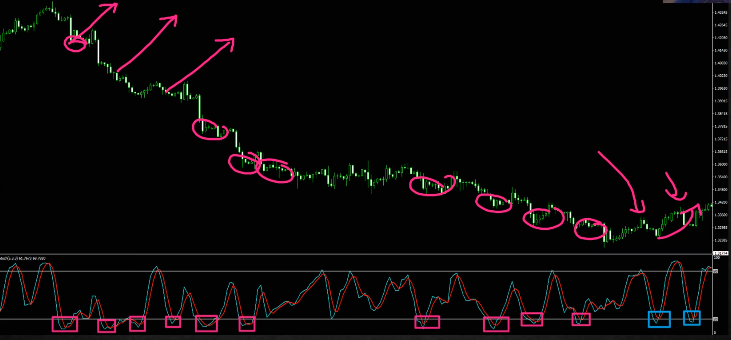

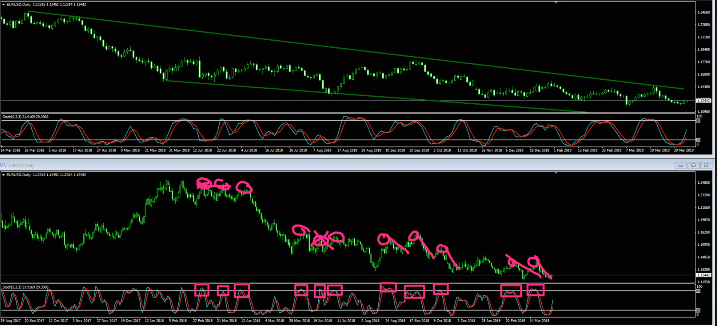

We need to work with trends, a bearish trend is when you have highs going down and lows going down. So in such situation when you have a definition for a bearish trend this is exactly where you will want to use the Stochastic in your favor

Every time the Stochastic would be above 80 you might be looking for sell opportunities and if you take a look at the below chart you can see that how beautifully it has worked in majority of the cases.

The trend could be defined with many different ways some traders prefer to use like I do, with the simple logics of lower highs, lower lows in a bearish trend or higher highs, higher lows in a bullish trend. Some traders prefer to use moving averages, MACD, Fibonacci, support resistances, etc.. It doesn’t matter how you define your trend, what does matter is when you use Stochastic try to use it in the trend when you are trying to catch the overbought or oversold situations. I am not a big fan of Stochastic however sometimes in some market conditions Stochastic could be the smartest tool to apply and use.

Trading Strategies

So the way we discussed about it before, Stochastic is the best to use in ranges, the way ranges tend to be created, when things slow down, for example if there was a trend and if it’s slowing down then there is a good possibility for a range. If the possibility for a range is increasing your usage of the Stochastic indicator would gain more value and will provide you better odds to be right in your trading decisions.

Trading is all about statistics, it’s a business of statistic so when you can improve your odds by making the right decision with your trade, you immediately increase the chance to end up with profits, there will be no guarantee and please don’t look for guarantees of making profits. Every single trade you take such things will never exist and the thing that you need to focus is to increase your probabilities. So what I want to show you is how things slow down and what do you need to pay attention to, for that you need to know a little basics of divergence. Trading divergence is a killer, when you have this tool in your arsenal and when you know to use it correctly then its definitely a killer! I created Divergence University exactly for that purpose.

Note: If you want to learn more in-depth insights about divergences, you can benefit greatly from the videos on my channel here while also embarking upon Divergence University for comprehensive divergence education.

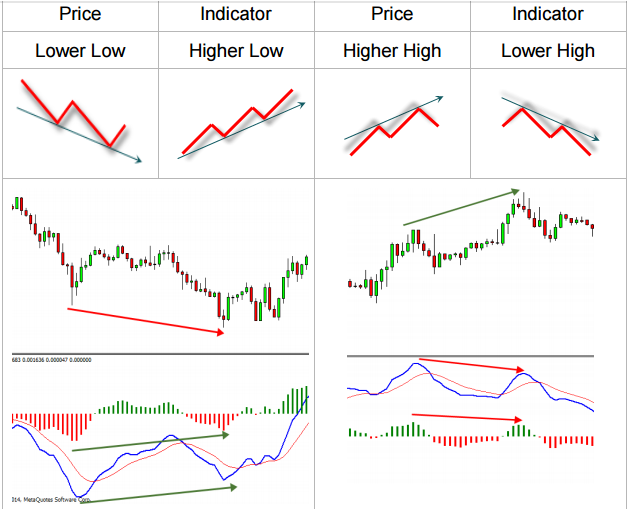

The idea here is very simple, in a bullish trend when the chart is creating higher highs but the indicator shows a slowdown and making lower highs this is a bearish divergence and hints that the chances are from here to the downside. The bullish divergence is exactly the opposite, that is in a downtrend when the market is making lower lows but the indicator makes higher lows and basically hints that the chances are from here to the upside this is the brief view.

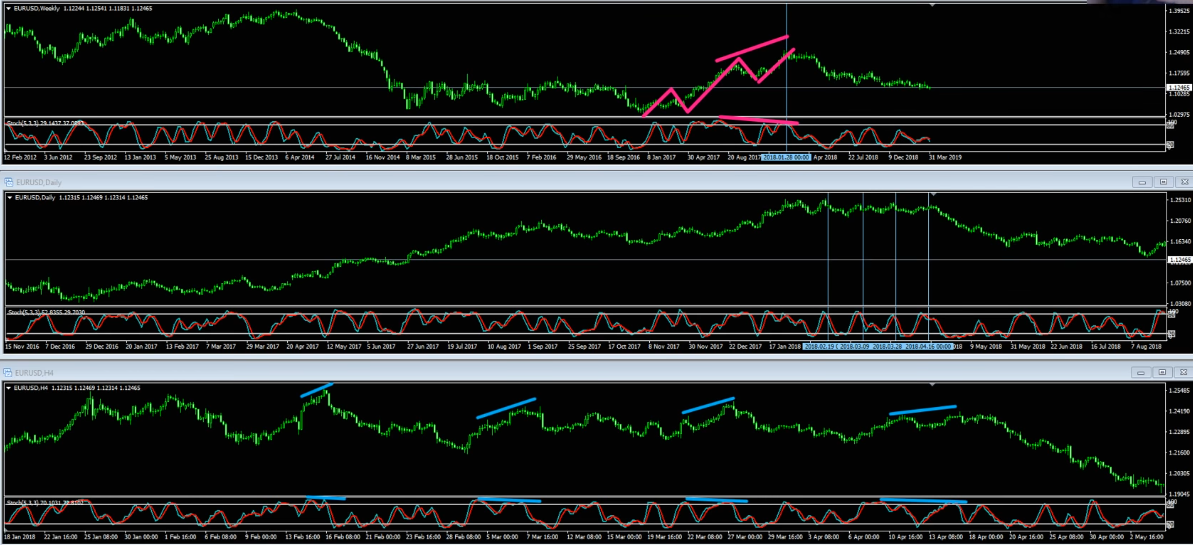

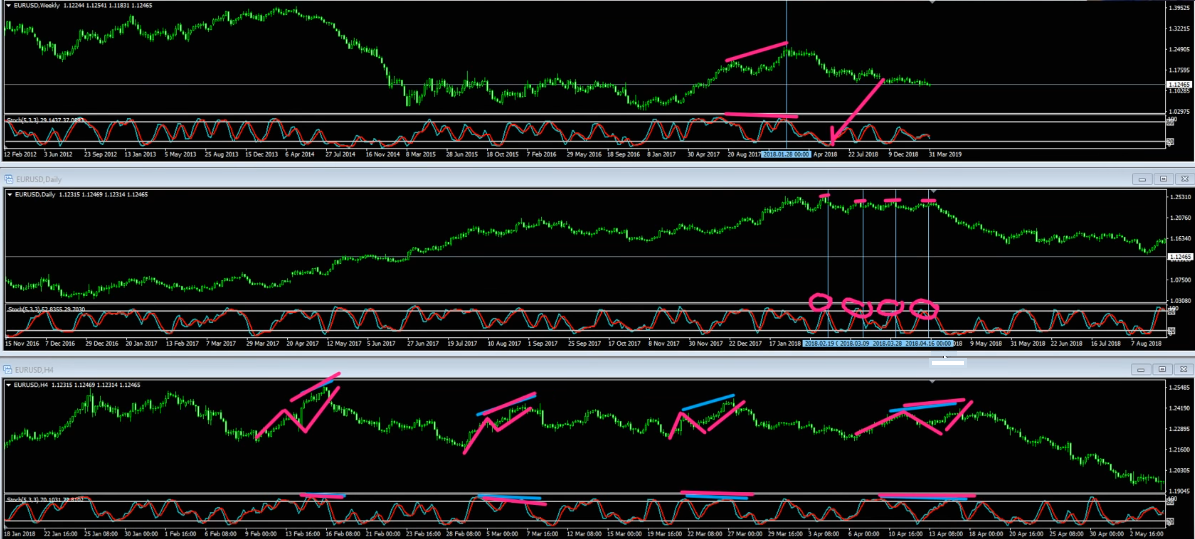

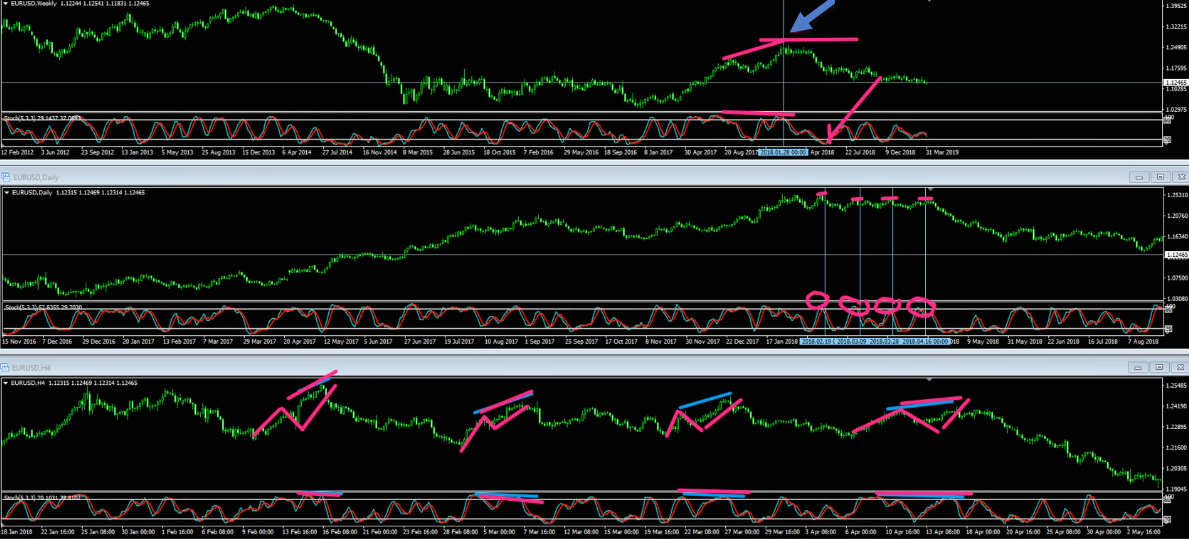

So what we do here is we start from any higher time frame, just for the case of the example I start from the weekly chart, the weekly shows here at the end of the bullish trend in the chart and if we take a look at the Stochastic indicator we can see that the highs are going down while the price is moving higher in the chart, this is called a bearish divergence. This means not necessarily a big reversal trend change will happen but it does mean that the market is slowing down, so your chances for the slowdown and a range comes after a trend and your chances to catch the range which is to be created are very high.

So you define that and also you can see that the Stochastic on the weekly chart is above the 80 with bearish divergence. From that moment you start to look on a daily chart (you can do this as long as the weekly has not reached its oversold conditions) and we can see that the daily is above 80 as well.

This moment where you find the daily is above the 80 and is aiming to cross. What you have to do now is, go to another lower time frame so we have three time frames involved (again this is my personal view, I am not saying this is the best way but this is how I love to use Stochastic to generate or to strengthen my view about any pairs and its powerful). We drop to the third timeframe, in this case H4 (4 Hours) chart and what we want to see here is bearish divergences on the H4 chart, that is rallies and divergences. You can see in the screenshot below that this has happened every single time when the daily is above 80.

if you get these conditions then this is where you would want to look for your possible trade. What we got here is a slow down from the weekly, the daily supporting this weekly view, of course everything remains as long as the weekly top shown in the screenshot below (marked in blue arrow) holds because if it breaks that, then it means maybe the trend is not over but as long as it holds we are under the assumption of a slowdown.

So here the weekly top holds, the daily has reached its 80 and then we move to one time frame lower and confirm the corrective cycle rally, normally in two waves sometimes in three waves and then it ends up with the bearish divergence. This would be the place where you would want to look for your possible trades and to ride the trends as they develop.

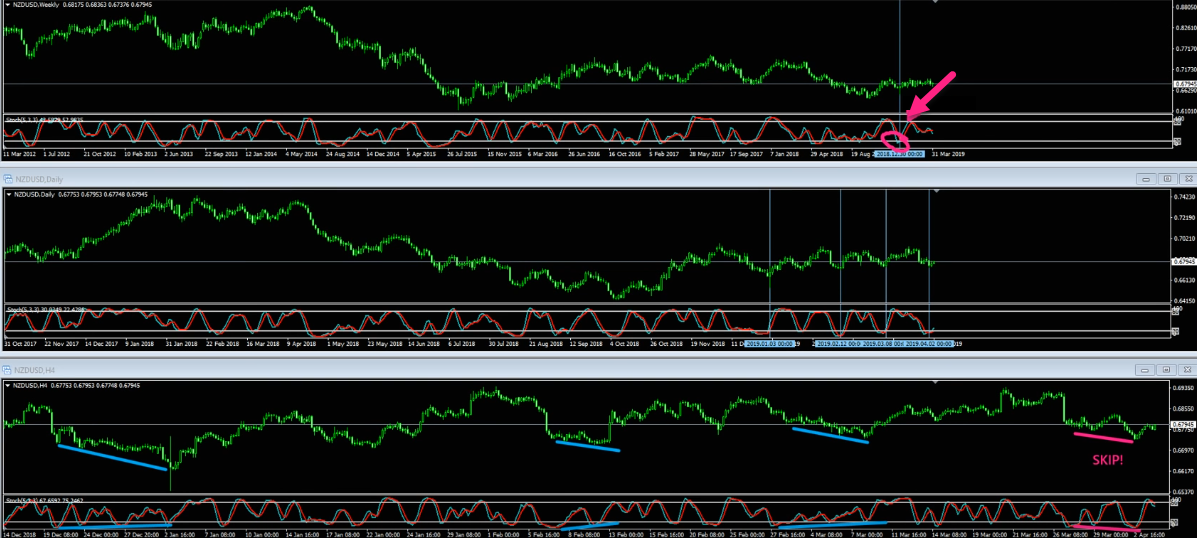

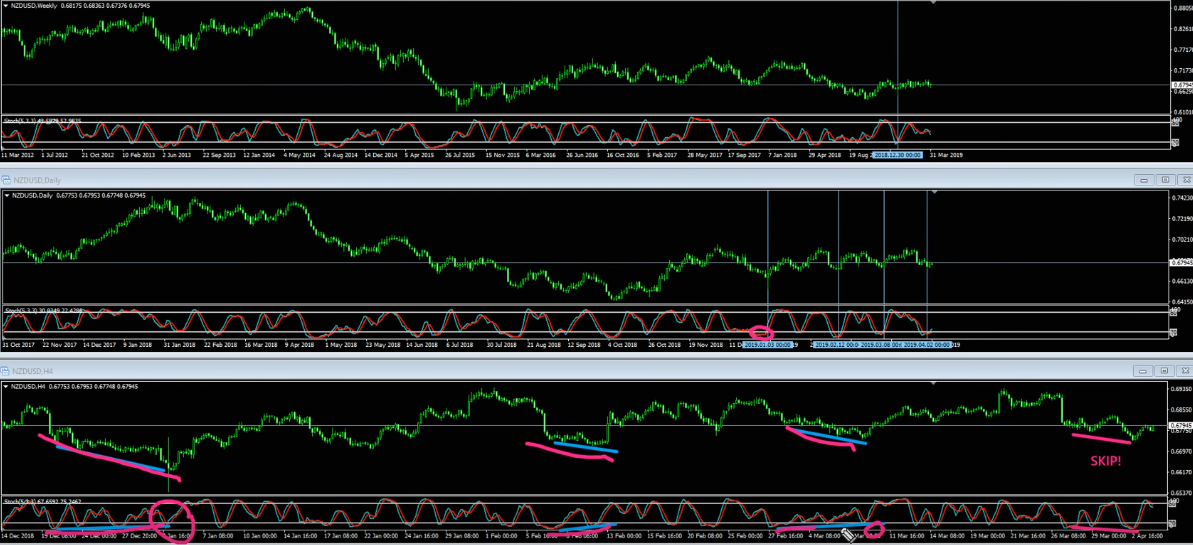

I want to show you one more example so you can get a clear idea. Take a look at the New Zealand dollar, on the weekly chart we are crossing right below the 20 from that moment and as long as we hold completely below the 80 you can see here it didn’t reach (it almost reached) so as long as we are below that we are looking here for possible rallies to happen.

Assuming the daily is moving in a ranging condition because if the weekly is crossing below the 20 you might expect some slow down.

Basically from this moment you start to look for the places where the daily is below 20 and on this moment you would want to see bullish divergence on the H4 chart and I have marked the bullish divergences as shown in the screenshot below, these are the places where you would want to look for your possible trade.

In the above screenshot if you take a look at the last one, I have mentioned it as a “skip” because there is no bullish divergence. Remember in bullish divergence the chart has to make lower lows and the indicator has to make higher lows, in this case you don’t have it, as you have lower lows on the indicator as well, so that’s exactly the place where you would not want to get involved in a trade. That’s why I included this example so you don’t get tempted to go ahead and look for buys whatever happens, most likely there will be some other good opportunities.

So traders, this is what I wanted to share with you all about the Stochastic Indicator.

Watch the webinar of How To Trade Successfully With Stochastic Indicator

I invite you to join me in my live trading rooms, on daily basis, and improve your trading with us.

Also you can get one of my strategies free of charge. You will find all the details here

Thank you for your time reading this article.

To your success,

Vladimir Ribakov

Great explaination Of the Stochastic Indicator Vladimir. Ive learned a lot. I just wish I could see the charts that you used a bit bigger. I cant see the time frame figures or where exactly where the lines cross below 20 or above 80. But I could hear you talk about it so I basicly figured it out. I wish I could enlarge the charts to view them better. Thankyou.

Thank you very much Paul

You can actually click the image, it enlarges it

Not too big, but still clearer

Ahhhh! this post was really really useful

Thank you for explaining about this indicator Vlad. It’s wonderful.

Great piece of information Vladimir. Thank you so much.