In this article, I’ll share with you my analysis on AUDNZD and GBPCAD.

AUDNZD is approaching towards a key volume-based area and a re-test of a broken trend line, around 1.07-1.0750, with a potential drop even below.

GBPCAD is about to complete daily double cycle around the daily supply zone and could build up a great resistance area at that zone.

A detailed analysis of these instruments are as follows.

You can watch the video explanation of this forecast here:

AUDNZD

Weekly timeframe – On the weekly chart, it looks like the price is trying to retest the broken falling trend line. Another technical condition that happened is, the band to band movement of the Bollinger Bands (straight move from upper to lower bollinger band). Adding to this, the dynamic support of the broken downtrend line, the ongoing dynamic support line (connecting the lows) and the volume profile based zone (based on the Key Trading Levels Indicator) creates a potential support zone where from I expect the price to bounce higher.

Daily time frame – On the daily chart, while measuring the waves of the bearish move using the Fibonacci expansion we have a massive Fibo zone which coincides with the weekly supportive area.

4H time frame – Based on the H4 chart’s price movement, I expect the price to move lower further and complete the structure of lower highs, lower lows. Once the price reaches the support zone, we may start to see reversal signs, for example, in the form of a bullish divergence completing on the MACD indicator, which indicates the beginning of a slow down and a possible turn around to provide some amazing buy opportunities.

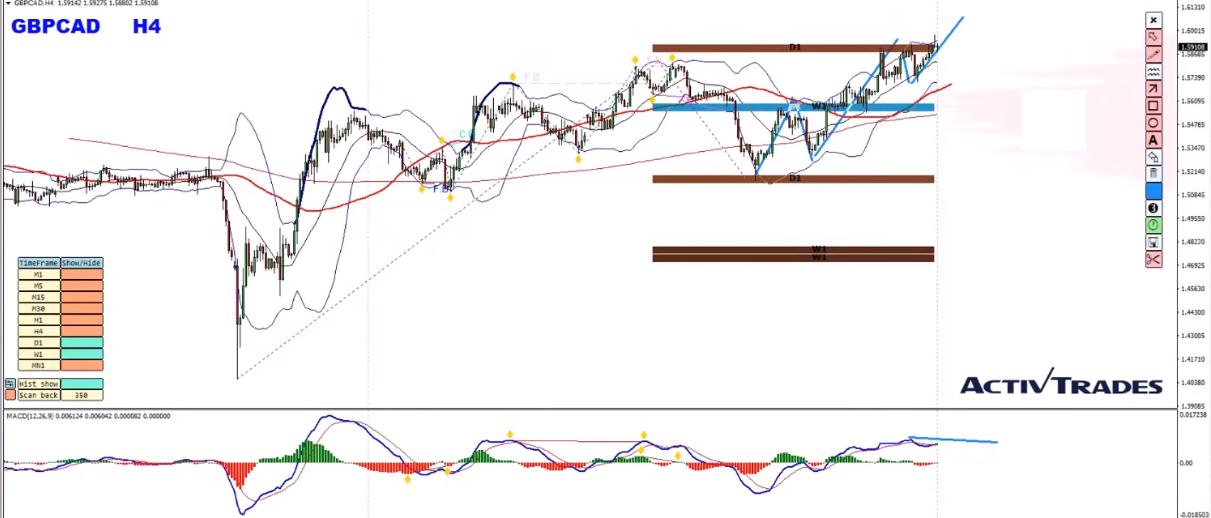

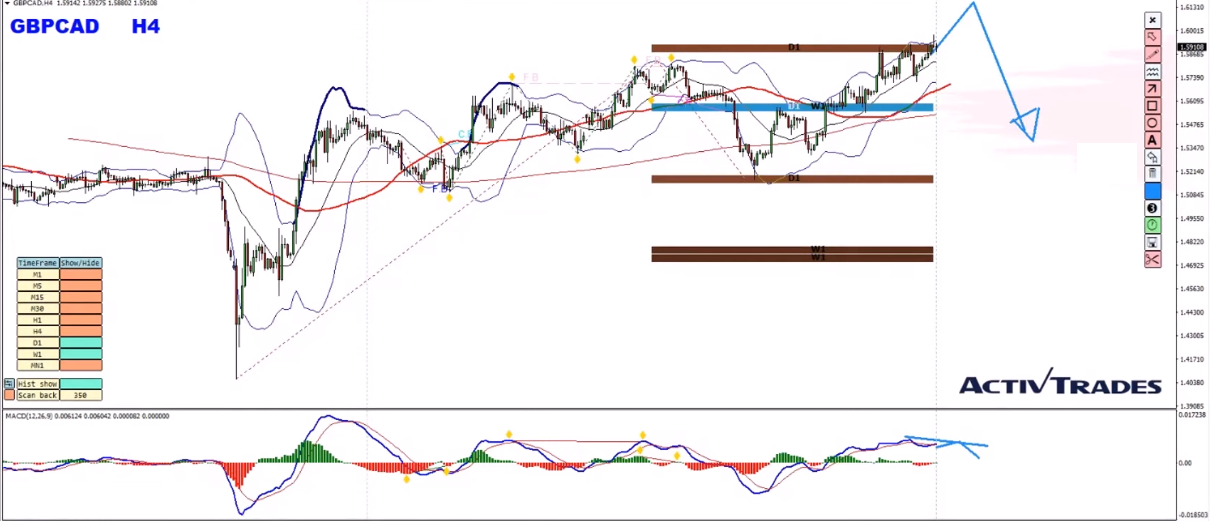

GBPCAD

Weekly timeframe – We can see on the weekly chart, that the broken dynamic support area is very close to be retested. I personally think this as a classical place for a potential rejection and the price to reverse.

Daily time frame – Moving down to the daily timeframe, I believe the price is building a double cycle with a potential bearish divergence on the moving averages of the MACD indicator. The 61.8% (around 1.62565) Fibonacci expansion level of the double cycle, the 1.60 psychological level and the supply areas creates a massive resistance zone for us.

4H time frame – On the H4 chart, we have a triple cycle to the upside and a bearish divergence is starting to build up based on the moving averages of the MACD indicator. This is an indication that the buyers are running out of steam.

The closer the price gets to the resistance zone mentioned above, the bearish pressure will build up and this corrective move to the downside might provide us a good sell opportunity in GBPCAD.

That would be all for this weekly forecast. I wish you a successful trading week ahead.

Our recommended CFD broker – ActivTrades

If you have any further questions, don’t hesitate to drop a comment below!

Yours to your success,

Vladimir Ribakov

Certified Financial Technician