Hello traders, Vladimir here from Home Trader Club, and welcome to another Weekly Forex Forecast! As always, a big thanks and thumbs up to our partners at Eight Cap Broker for supporting our community. You can continue enjoying all the exclusive offers we have together with them — including up to one full year of free access to Home Trader Club, all our trading systems and tools, private mentoring sessions, and much more.

👉 Check out the exclusive offers via the link below the video or on vladimirribakov.com

Watch the Full Weekly Forecast Video

Watch the Full Weekly Forecast Video

Don’t forget to Like, Comment, and Subscribe for more weekly plans and real-time insights.

Explore My Free Mentorship Program

As an Internationally Certified Financial Technician (CFTe, IFTA) and former private capital hedge fund trader, I have successfully mentored numerous students who are now thriving in the trading world. Students who learned with me, are now full-time traders, work in the trading industry, run their own capital firms or are fully funded traders by private companies, develop automated trading solutions and manage others’ capitals. I am a very proud mentor and I am proud of the success stories I’ve helped create, and for a limited time, I’m offering my mentorship program for free through a partnership with Eight Cap broker. Join Eight Cap, become an active trader, and choose the offer that suits you best –

For more details, visit: Home Trader Club Mentorship Program

I’m excited to work with you and help you reach your desired level of success!

This week’s outlook continues to highlight a common theme across the major markets we track:

👉 The higher-timeframe cycles are not complete yet, and short-term strength still appears corrective.

👉 Sell-the-rallies remains the primary plan in most pairs.

Let’s break down each market with a clear, actionable technical outlook.

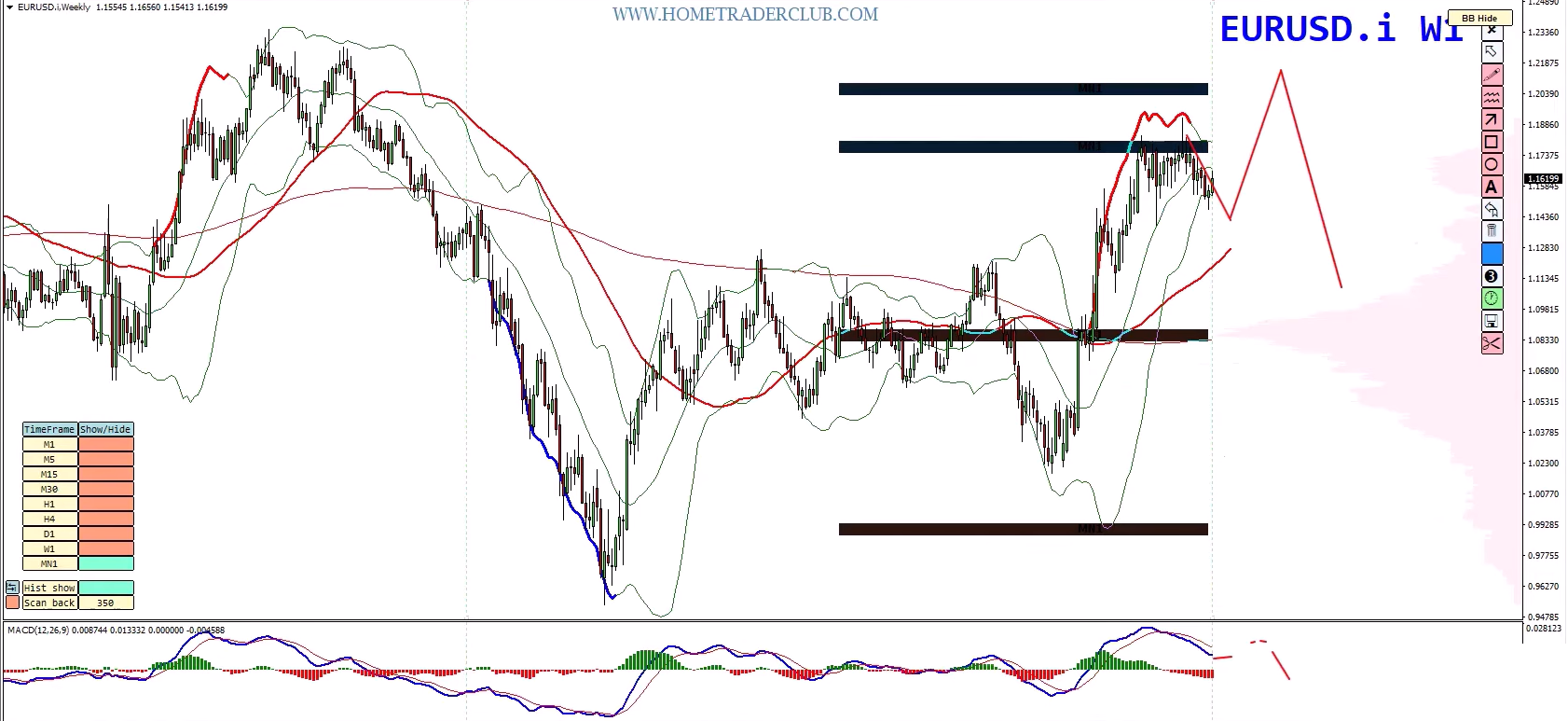

EUR/USD – Sell the Rallies as the Correction Develops

Higher-Timeframe Outlook

The weekly chart continues to support the larger bullish cycle in the long run.

However, on the daily chart the recent three-wave rally has produced a bearish divergence, suggesting that the corrective structure isn’t complete.

Two corrective paths remain likely:

-

ABCD correction before the next bullish continuation, or

-

Prolonged consolidation before a final drop and then the next leg higher.

In both cases, short-term rallies are expected to face selling pressure.

4H Chart – Key Levels

The structure is very clear:

✔️ Lower highs, lower lows — bearish sequence

✔️ Broken support → new resistance

✔️ Supply zones above acting as strong selling areas

Levels to watch for bearish setups:

-

1st supply zone: Previous highs & broken structure

-

2nd supply zone: Higher supply block with repeated seller activity

Trading Plan

Wait for the rally into these zones and look for:

✔️ Bearish divergence on lower timeframes

✔️ Price rejection (lower highs, lower lows restarting)

As long as those conditions align, selling the rallies remains the plan.

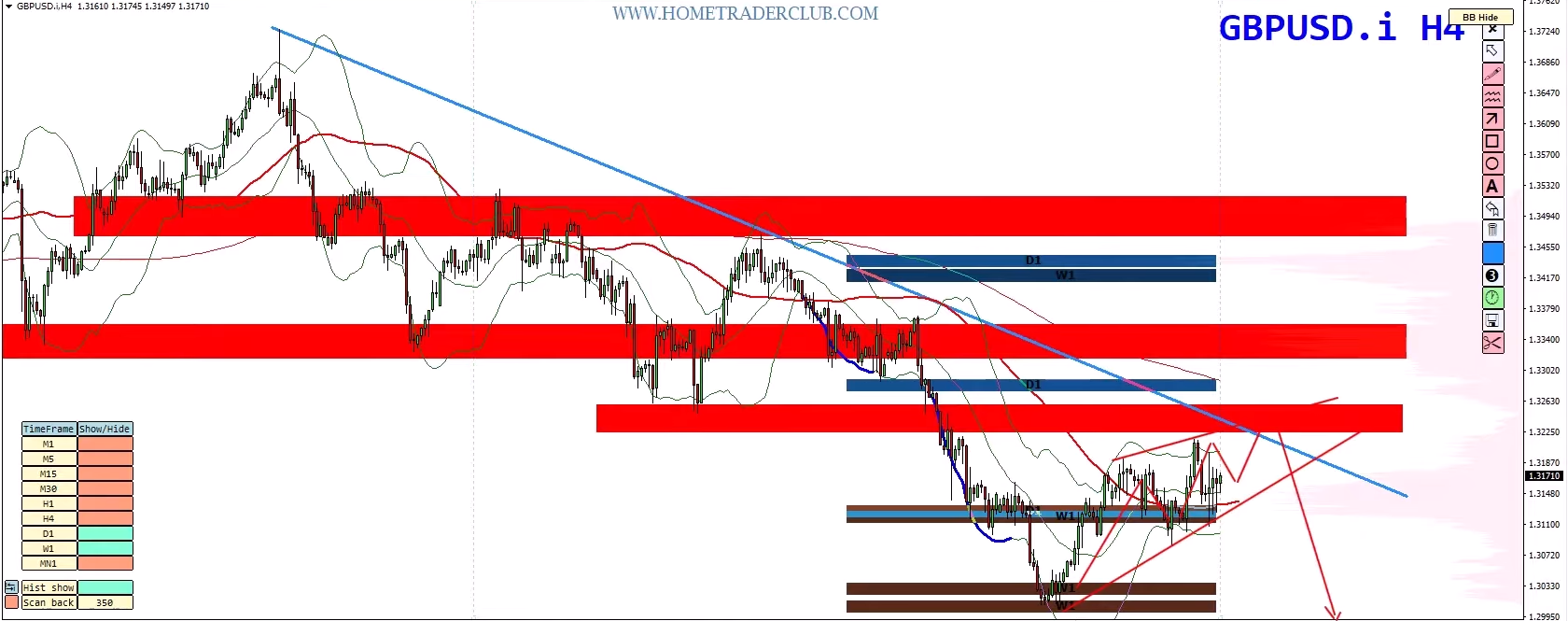

GBP/USD – Bearish Pressure Still Not Over

Higher-Timeframe View

Similar to EUR/USD, the Pound’s long-term bullish cycle is still incomplete. However, current momentum continues to point lower in the short term. So basically I am expecting short term bearish moves now before further continuation higher.

Unlike the EUR/USD, GBP/USD already developed two waves down, yet:

-

No bullish divergence

-

Indicators are still making lower lows

-

Price action remains decisively bearish

Daily Chart – Volume Profile “Balance Zone”

The daily chart reveals a massive balance zone created by volume distribution — important for locating future turning points. For now, price is still trading below this zone, confirming short-term bearish bias.

4H Chart – Key Selling Areas

Broken support levels are now acting as resistance. Three main zones remain relevant:

1️⃣ 1.3250 area – first broken support

2️⃣ 1.3320–1.3360 zone – cluster of former lows

3️⃣ 1.3470–1.3520 supply zone – previous swing highs and volume block

Possible Scenarios

-

A developing bearish divergence may form soon, indicating a consolidation range before another breakdown.

-

As long as trend structure stays bearish, sell any short-term rally into the resistance zones.

Plan remains unchanged: Sell the rallies.

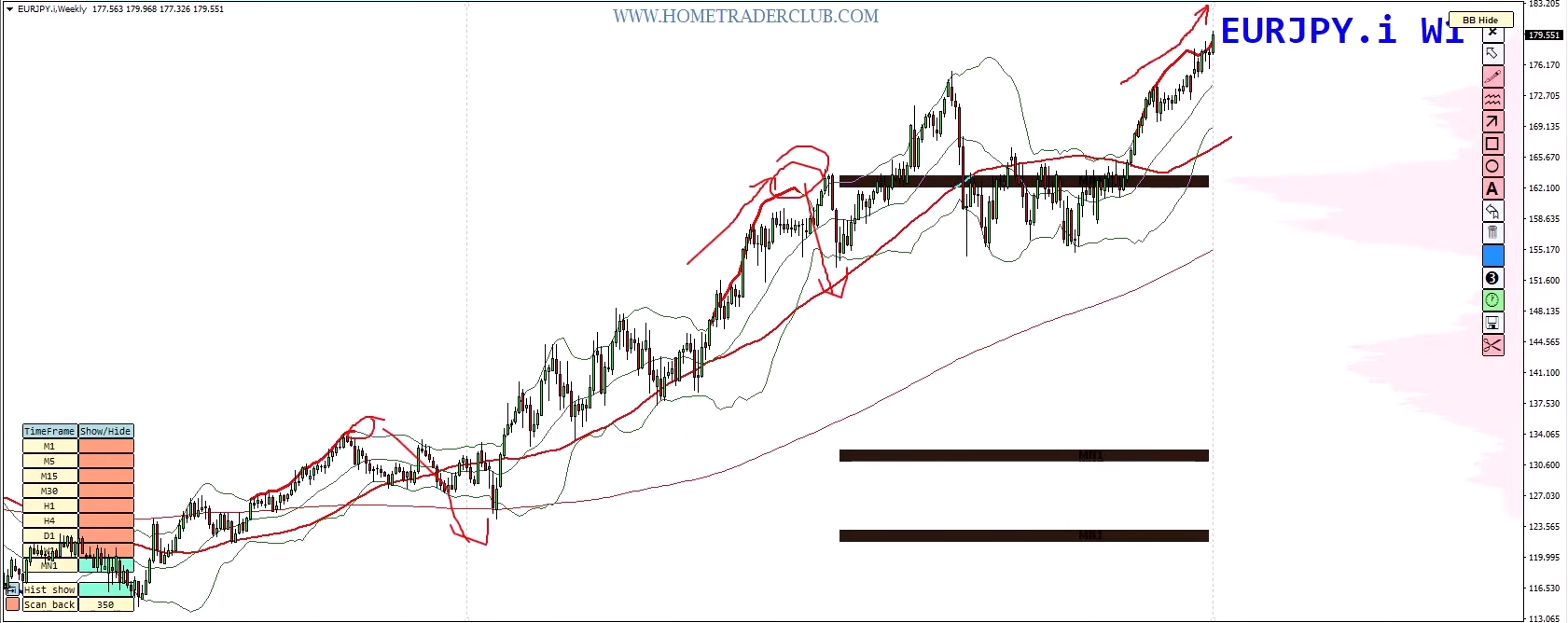

EUR/JPY – A Major Long-Term Opportunity Is Forming

Big Picture (Monthly & Weekly)

EUR/JPY continues to show classic signs of a maturing bullish cycle:

✔️ Bearish divergence on MACD developing

✔️ Price printing higher highs, while MACD prepares lower highs

✔️ Weekly candles riding the upper Bollinger Band for 20+ bars — historically followed by meaningful corrections

This is not yet a sell, but it is the early phase of a high-probability long-term reversal setup.

Daily Chart

-

Clear bearish divergence building

-

Price testing a dynamic resistance line

-

Sellers are likely to appear around the psychological 180.00 zone

4H Chart – Timing the Entry

The conditions to watch for:

-

Completion of the three-wave structure

-

Higher highs on price, but lower highs on MACD

-

RSI likely to confirm

-

Another Bollinger Band override, similar to previous turning points

Expect the correction toward:

-

178.00

-

177.00

-

Possibly 176.00–175.00 in deeper legs

This pair may deliver one of the best setups in the coming weeks — patience is key.

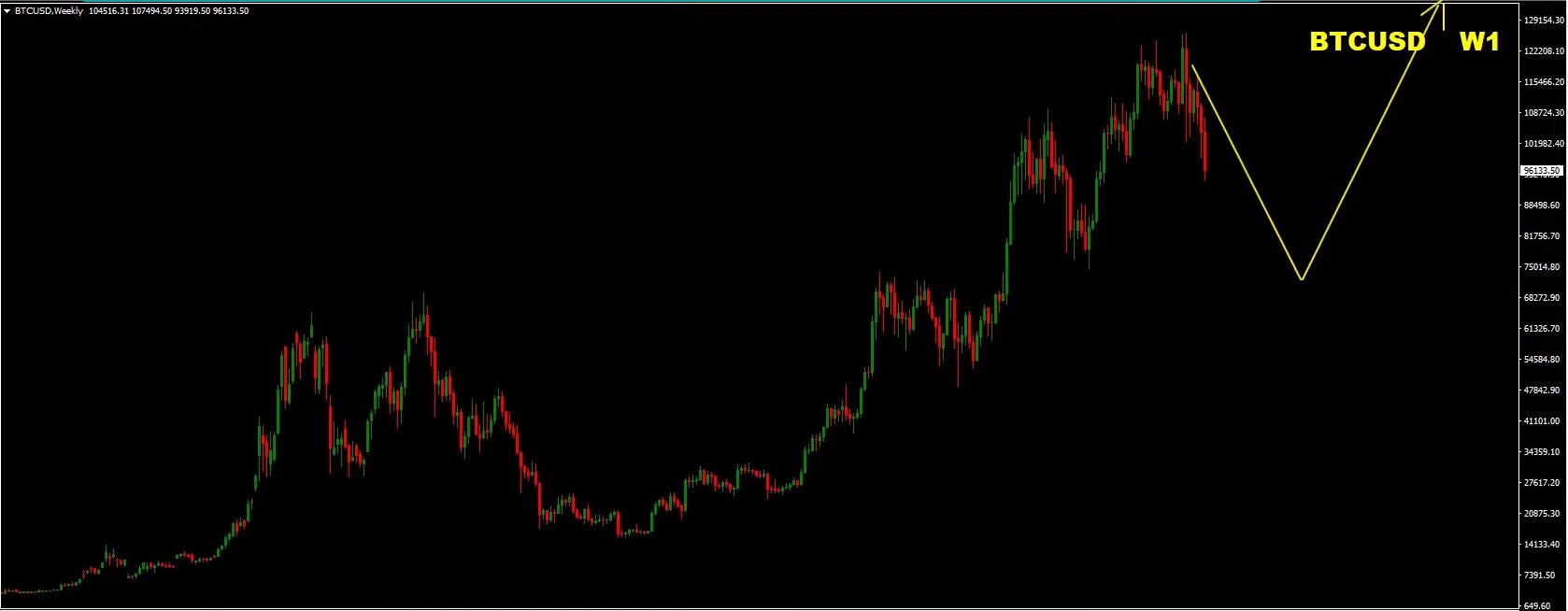

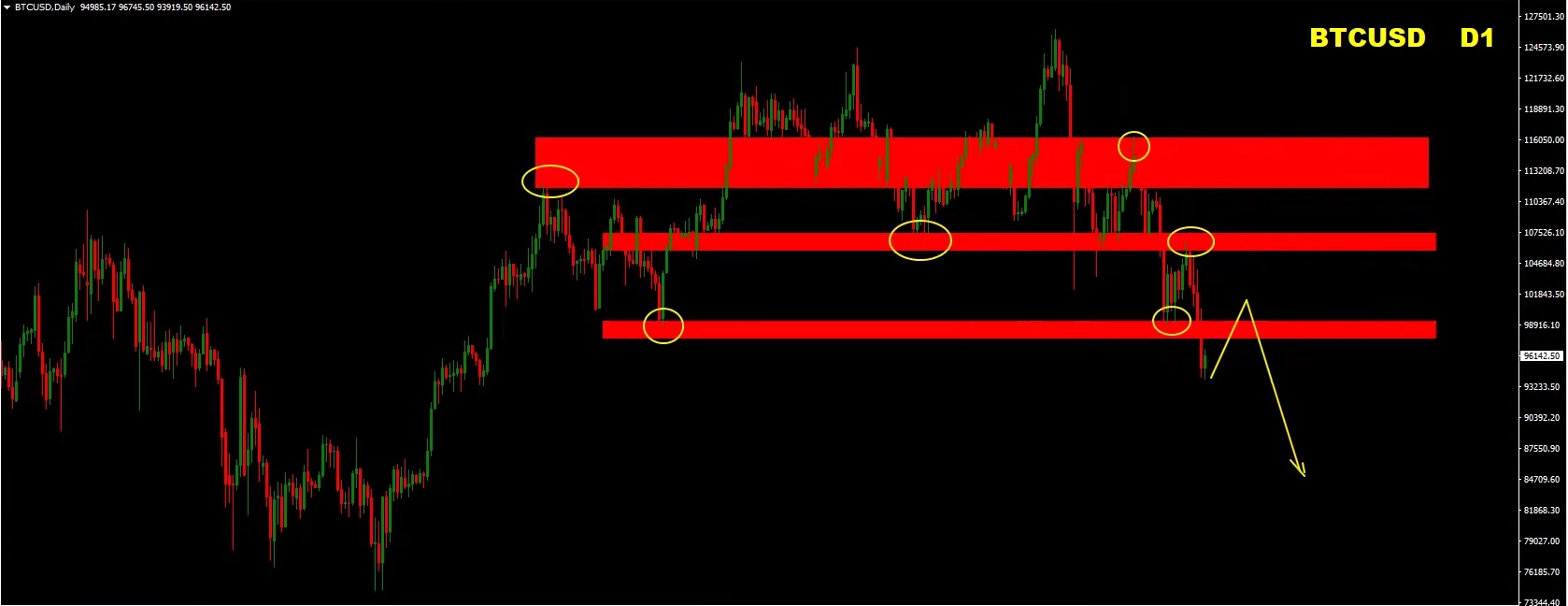

Bitcoin – Bearish Correction Still in Play

Bitcoin’s recent drop should not surprise regular viewers — we highlighted the bearish divergence weeks ago. The long-term bullish cycle is not finished, but the current environment is dominated by downside corrective pressure.

Daily Chart

-

Sequence of lower highs & lower lows

-

MACD and RSI continuing downward

-

No reversal structure yet

Pullbacks are welcome, but they are still expected to attract sellers.

Key Resistance Zones to Sell

1️⃣ $98,000–$99,000 – broken support

2️⃣ $105,000–$107,000 – multi-touch supply zone

3️⃣ $111,000–$116,000 – final resistance cluster from previous highs

Lower Timeframes

We’re starting to see a slowdown, but without confirmation on higher timeframes, it should be treated only as a pullback.

Plan:

Wait for rallies into the resistance zones, look for price rejection, and join the ongoing bearish momentum.

Join the Home Trader Club

Join the Home Trader Club

Want to access the tools, systems, and real-time education we use daily?

With Eight Cap Broker’s support, you can now enjoy up to one full year of access to the Home Trader Club — including:

-

All professional trading systems

-

Exclusive mentoring sessions

-

Real-time trade ideas and setups

-

Full access to our course library and trading marketplace

Wishing you a profitable week ahead!

Vladimir Ribakov

Internationally Certified Financial Technician

Home Trader Club