Hi Traders! EURNZD short term forecast update and follow up is here. On February 6th 2024 I shared this “EURNZD Technical Analysis And Short Term Forecast” post in our blog. In this post, let’s do a recap of this setup and see how it has developed now. If you would like to learn more about the way we trade and the technical analysis we use then check out the Home Trader Club. Spoiler alert – free memberships are available!

My Idea

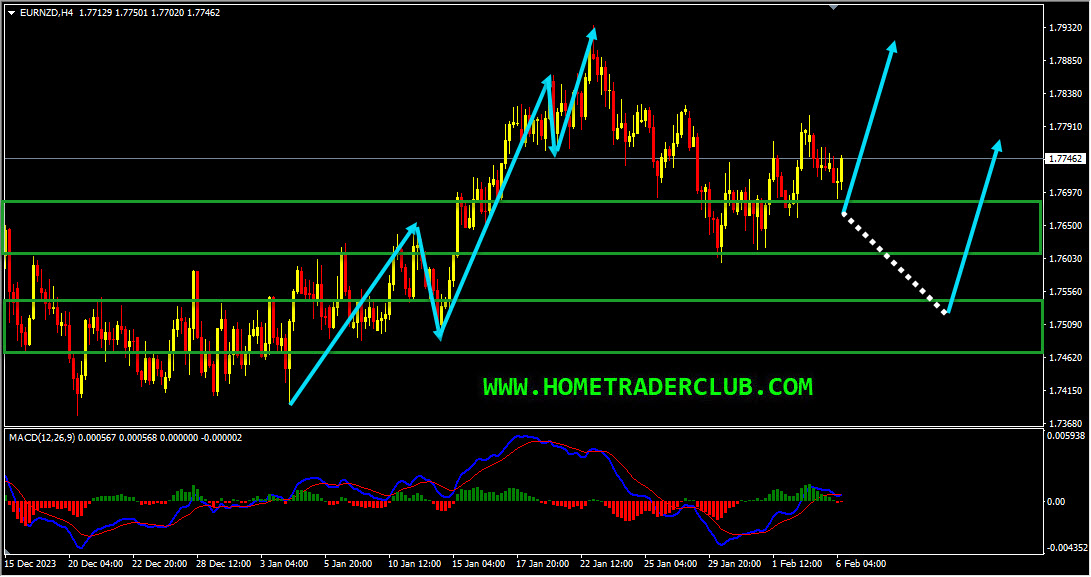

On the H4 chart, the price which is moving higher has created a bullish trend pattern in the form of three higher highs, higher lows, we may consider this as evidence of bullish pressure. Generally, after a bullish trend pattern, we may expect corrections and then potential continuation higher. Currently, it looks like a correction is happening. Also, there are no signs opposing this short term bullish view at the moment. In addition to this, we had two strong resistance zones that has formed and the price which was moving higher has broken above these zones and is holding above them. After the breakout these strong resistance zones are acting as two strong support zones for us. Until both these strong support zones shown in the image below (marked in green) holds my short term view remains bullish here and I expect the price to move higher further.

EURNZD H4(4 Hours) Chart Current Scenario

In this pair, based on my technical analysis I mentioned that “Until both these strong support zones shown in the image below (marked in green) holds my short term view remains bullish here and I expect the price to move higher further”. The price action followed my analysis exactly as I expected it to here. The price which was moving lower created a false break of the second strong support zone and then it moved higher from this zone. The price then moved higher further and delivered 520+ pips move!

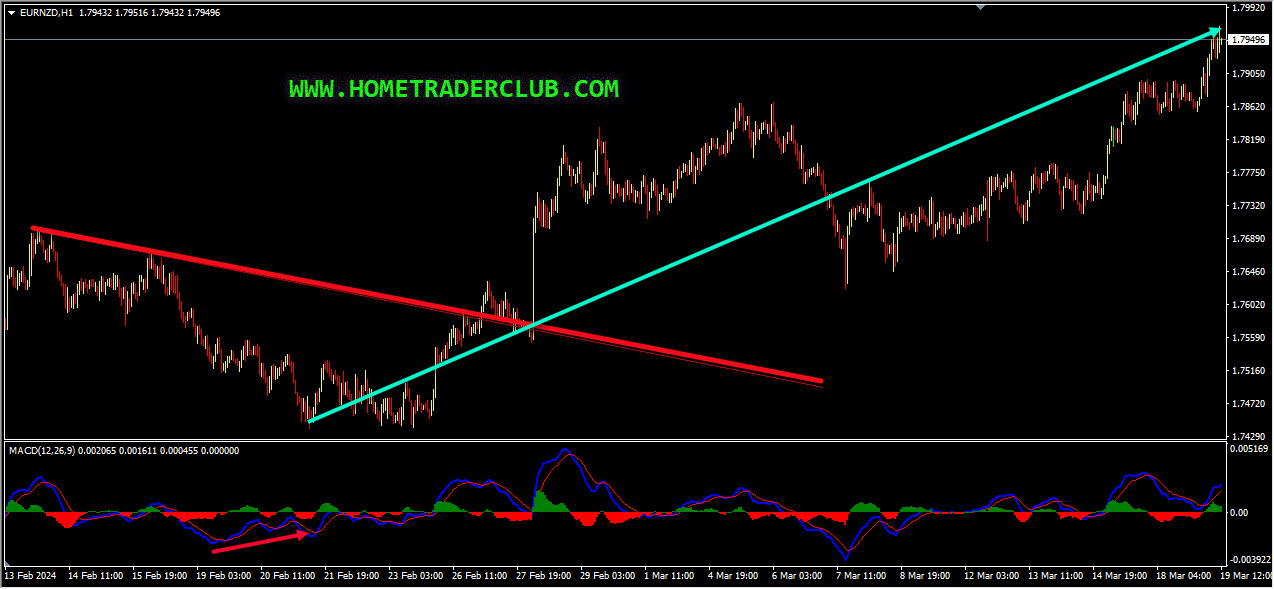

On the H1 chart, the market provided us with various facts supporting the bullish view. The price which was moving lower created a bullish divergence between the first low that has formed on 19th February 2024 and the second low that has formed on 21st February 2024 based on the MACD indicator. The price then moved higher and broke above the most recent downtrend line, we may consider these as facts provided by the market supporting the bullish view. Then as you can see in the image below how the price moved higher after that and provided an amazing move to the upside!

So, traders, this is why I wanted to show this example to help you understand how important it is to follow the facts. The facts were supporting the bullish view here and there were no signs against it. When the facts do happen as we expected you can see how the price perfectly moved as per the plan. Because these are the kind of hints the market provides us with the majority of the time and it’s our obligation as traders to be able to listen to these things that the market tells us and we should try to make the right actions accordingly.

For similar trade ideas and much more I invite you to

Also, you can get one of our strategies free of charge. You will find all the details here

Download our best forex indicators here

If you have any further questions, don’t hesitate to drop a comment below!

Happy Trading!

Arvinth Akash

Home Trader Club Team.