I’ve broken down this article into 3 steps that each of you out there could take, that will bring you much much closer to the success.

However, I would like to start today’s article with the picture below. I found that picture on the internet and it caught my attention as it summarizes very well why many people fail in trading and in life.

Read it and think about it. Do you lean towards the left column or the right column based on how you live your life? Don’t take the written above as judgement if you are leaning towards the right hand side. Take it as new challenge and opportunity to change your life and the life of the people around you towards better.

The Change Starts In Your Mind!

STEP 1 – Strategy Hopping

Many of the students i mentor suffer from the same “disease” called “strategy hopping”. Let me explain what do I mean. Trade X buys system Y and starts trading.

Trader X loses 3 trades in a row and gives up on the system. So where does that leave him? He lost money from his trading, he “lost” money from the strategy he purchased as he is not going to use it anymore. Trader X is now pissed off to the market, the seller, the neighbor’s dog and probably the whole world.

Now let’s take a closer look and rewind a bit. What i have noticed as a seller and developer of trading systems is that huge percentage of the people have completely wrong perception of how trading works.

They just buy system X and start trading. Many won’t read the manuals/book that comes in the package. Many won’t practice on demo account until they are AT LEAST familiar of how that thing works.

Yes there are a lot of scams out there but it is your job to take responsibility and put as much effort as possible to first of all research the company/person you are buying from and then once you do, to learn the materials that you bought.

It doesn’t work like that: Buy -> Install -> Make 50% a month. NO!

I have said that many times and i will repeat it again – Any strategy or almost any, is able to produce money and good returns. If you learn it in-depth and you apply some very basic but crucial filters and rules, you will become a successful trader!

STEP 2 – Don’t Fear The Losses

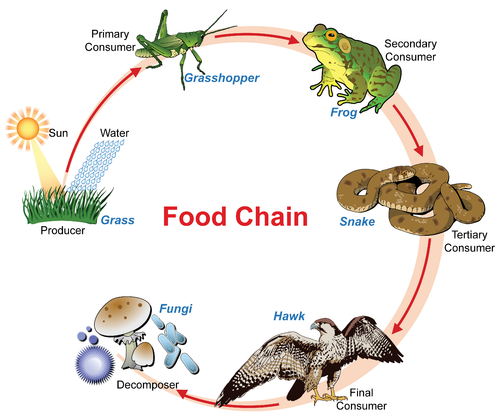

Losses are welcome but only when they are “healthy losses”. Think of it as the cycle of life in the jungle. Every animal and plant has its role. A predator kills to eat or protect territories.

The herbivorous animal eats plants, fruits and so on and so forth. This is the natural cycle. There are more grass eaters born than the ones who would become dinner for a predator. And this is how the life goes on.

What is not natural and “unhealthy loss” when humans interact and start building factories and pollute the habitat of this perfectly balanced world.

This is when plants die, leading to not enough food for herbivorous animals, which on the other hands means there is not enough food for the predators.

And this is when we lose species of rare animals or in other words – you find yourself with a blown up account.

What i’m trying to say is don’t be afraid of the losing trades BUT only if you traded by the rules. Don’t give up after 3 losing trades. Don’t throw a party when you hit 3 consecutive winners as well.

Try to leave the emotions aside and focus on the statistics. Trading is statistics! Nothing more. You earn more than you lose and you try to preserve as much as possible of your profits and not give it back to the market.

In summary: Be consistent in your actions. Don’t leave things unfinished. This is the mindset of a successful trader and successful person in life!

99% of the Beginner Trader’s Losing Trades are His Fault – The Remaining 1% is Part of the Statistics.

When you turn that percentage around and you go back over your trades and see that you followed the rules of the strategy and the trading plan, this is when you will start making money.

Losing trades PER THE RULES are more than welcome.

What you should leave behind is the trades that brought you loss/profit but you didn’t enter as per the rules. Those trades mess up the statistics and you lose money in the longer run.

STEP 3 – Fault & Blame

Scroll up and check out the image again.

Do you accept the responsibility for your mistakes?

Do you point finger at others when things go south?

Believe me I know how it feels to be mad at the market and you want to take it out to something or someone as yet once again the setup didn’t work out and you feel like you are going crazy.

It is perfectly normal but there is a secret of how to avoid such feelings/emotions. Ready? Here it is:

Just look at the BIG Picture!

I’m going back to the statistics. They are so important because when you know that after 100% trades you will make money if you follow the rules, there is no reason to involve emotions.

There is no reason to start looking for another system, when a losing streak of 4 trades comes your way. Believe it or not you will have to start learning from the scratch the new strategy and go over the same issues.

Then the process would repeat. The first drawdown will make you jump to another strategy like a grasshopper and you end up in this magical circle of disappointment and wasted money.

Instead try this: Once a losing trade comes along, stop and check it.

Was it YOU or Was it Part of the Statistics?

This is the most important question a trade should ask himself for each trade. If you want to go and do the extra mile, do that for your winning trades as well. Trust me. If you dedicate just a few seconds per trade, to analyze your trades for a month it will do miracles with your discipline!

Soon enough you will become a living and breathing Expert Advisor on steroids. You will acquire all the benefits of an EA (discipline and lack of emotions) while analyzing the markets as a human being which can take into consideration a million other factors that a software won’t.

Jean Claude Van Damme – Universal Soldier

Set these goals and become the universal trader!

Looking forward to your comments on the subject.

Yours,

Vladimir

Thank you vlad. This article is what to me seems to be a one-stop-shop for traders. Everything is laid out under one umbrella. What matters, i guess, is for traders to focus on the elements of this article and implement it and abide by it. Again, this is one of the other unique ways for vlad to help people succeed.

Thanks a lot

This says everything about how i have been reacting to my trading experience. To lose money and stay calm could be tough, but we must learn to put our emotions in check. Reason we need to start small and take it up to our dreams.

Very good words my friend

Thanks a lot guys glad you enjoyed.

Any suggestions other tips for other traders?

Thanks a lot guys glad you enjoyed.

Any suggestions other tips for other traders?

The way you have portrayed is fantastic.

To comment in one word…….. pictographic

Very very interesting, I loved it.