Stocks fell as investors assessed the latest signs of economic malaise from the US and China amid speculation about the Federal Reserve’s rate-hike trajectory. Treasuries gained, while the dollar held steady.

The S&P 500 turned lower after briefly trading little changed. The tech-heavy Nasdaq 100 underperformed major benchmarks. Data Monday showed New York state manufacturing activity unexpectedly contracted in May for the second time in three months, stoking concerns of slowing economic activity that may complicate the Fed’s policy path.

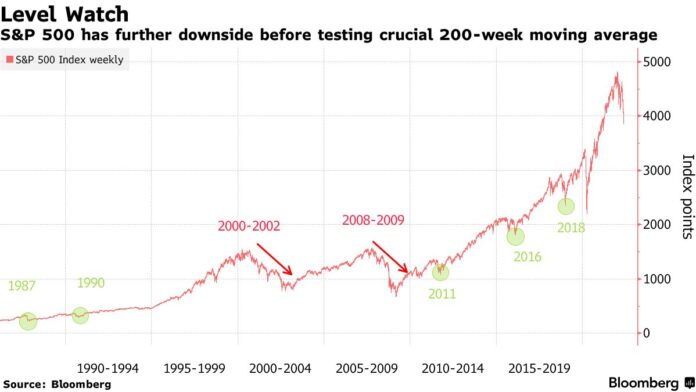

The risk of an economic downturn amid price pressures and rising borrowing costs remains the major worry for markets. Goldman Sachs Group Inc. Senior Chairman Lloyd Blankfein urged companies and consumers to gird for a US recession, saying it’s a “very, very high risk.” Traders remain wary of calling a bottom for equities despite a 17% drop in global shares this year, with Morgan Stanley warning that any bounce in US stocks would be a bear-market rally and more declines lie ahead.

The New York Fed’s data are the first of several regional Fed manufacturing numbers set for release over the coming weeks. Similarly disappointing figures may temper bets on a steep rate-hike cycle as the Fed battles inflation. Meanwhile, China’s industrial output and consumer spending hit the worst levels since the pandemic began, hurt by Covid lockdowns.

Market commentary

- “Sentiment has been decimated and many ‘weak longs’ out of the market, which is what needs to happen before bottoms can form,” Tom Essaye, a former Merrill Lynch trader who founded The Sevens Report newsletter, said in a note. “We do expect a bounce from here (perhaps to 4,200 or even higher) but for a true, sustainable bottom to occur, we need to see the factors behind these declines start to get better.”

- “There’s still a lot of concerns. We got some disappointing data from China today,” Esty Dwek, chief investment officer at Flowbank, said on Bloomberg TV. “We just see that there’s a lack of buyers in this market. There’s still a lot of fear and so we probably have a little bit more to go on the downside.”

- “You’ve got investors pulling back from the market in the expectation that we’re going to have a recession,” David Donabedian, chief investment officer of CIBC Private Wealth Management, said by phone. “It’s hard to, frankly, make a strong argument against that, the idea that we’ll have a recession. We know that that’s what Federal Reserve tightening produces most of the time, it’s a recession. And so you have to have a good answer to the question of why would this time be different, and it’s not that easy to come up with that answer, frankly.”

Meanwhile, the European Commission warned the euro area’s pandemic recovery would almost grind to a halt, while prices would surge even more quickly if there are serious disruptions to natural-gas supplies from Russia. Traders are also watching efforts by Finland and Sweden to join the North Atlantic Treaty Organization in the wake of Russia’s invasion of Ukraine.

Cryptocurrencies dipped as the mood in stocks weakened. That took Bitcoin back to around the $30,000 level.

What to watch this week:

- Fed Chair Jerome Powell among slate of Fed speakers Tuesday

- Reserve Bank of Australia releases minutes of its May policy meeting Tuesday

- G-7 finance ministers and central bankers meeting Wednesday

- Eurozone, UK CPI Wednesday

- Philadelphia Fed President Patrick Harker speaks Wednesday

- China loan prime rates Friday

Some of the main moves in markets:

Stocks

- The S&P 500 fell 0.5% as of 10:46 a.m. New York time

- The Nasdaq 100 fell 1%

- The Dow Jones Industrial Average fell 0.3%

- The Stoxx Europe 600 was little changed

- The MSCI World index fell 0.3%

Currencies

- The Bloomberg Dollar Spot Index was little changed

- The euro was little changed at $1.0404

- The British pound was little changed at $1.2256

- The Japanese yen was little changed at 129.12 per dollar

Bonds

- The yield on 10-year Treasuries declined five basis points to 2.87%

- Germany’s 10-year yield was little changed at 0.94%

- Britain’s 10-year yield was little changed at 1.75%

Commodities

- West Texas Intermediate crude rose 0.9% to $111.46 a barrel

- Gold futures rose 0.3% to $1,813.40 an ounce