| Download this article in PDF format or listen to it below | |

Trading on the forex market is becoming harder every single day, but don’t worry this doesn’t mean you can’t make money, this just tell us that we need to work a little bit harder, that’s all… Now today I would like to share three simple trading tips that will improve your trading instantly…

Trading Advice #1 -> Grind Your Way Up

The first thing you need to understand in trading is that you won’t make 50-60% income with every trade you made, you need to get rid of this gambling way of thinking, if you want to be successful. Trading is a real business like anything else, I know it’s hard to think like that when you are starting, but I live from my trading profits only for last few years (so I’m 100% sure it’s business)…

First of all, define risk per trade that will be acceptable for you and use it for each of your trades from now on… When I say define the risk, usually I suggest that you risk 1-2% for each trade (if you have smaller account let’s say below 5k you can move the risk to 5%) so you are sure that you won’t be stressed if you have a few bad trades… You can recover from 5% loss, but you can’t recover from 50% loss for sure!

So just go slow, step by step,grind your way up to the top 1% and don’t try to take any shortcuts…

Trading Advice #2 -> Simplify Your Strategy

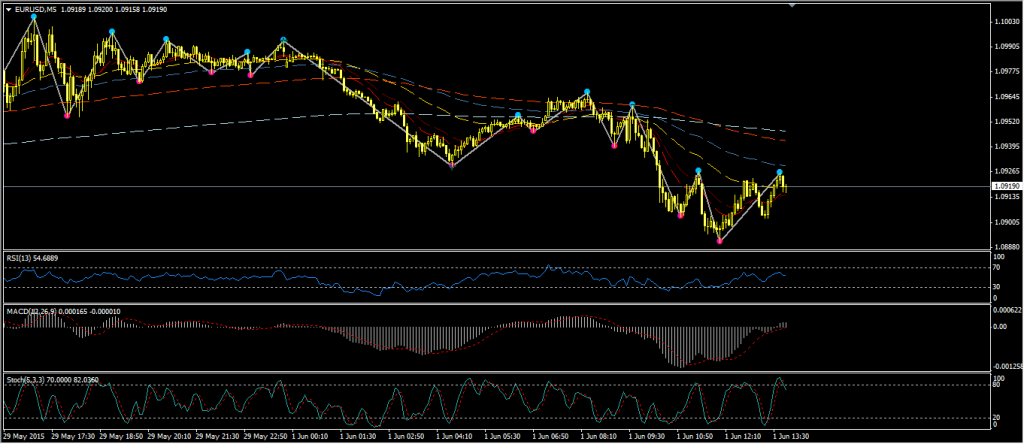

I checked a lot of strategies out there, and 90% of them have one thing in common, they are based on too many indicators! I know most people like indicators, I’m also from the people that use them from time to time to further confirm my trading strategy, but what are you going to get if you look the chart below.

On this chart, we can see that we have MACD, RSI, STOCHASTIC and 10 MOVING AVERAGES that make our chart look like Christmas three… But in reality that won’t help you at all, first of all MACD, RSI, STOCHASTIC are all oscillators that are using more or less the same values, so you are looking at same things presented in 3 different ways and if you pick one of them only, let say RSI, you’ll know the same information… after that let’s talk about MAs, for the last 3 years there was not 1 successful strategy that showed good results on the long run, market’s changed dramatically in the last couple of years so you need to be smarter now… I don’t say you shouldn’t use MAs in your trading but find 1-2 MAs and that’s all, don’t watch 10 or more it’s just waste of time (my suggestion is to use MA 13 or 50 since they still work ok).

So now when you know that you don’t need so many indicators to make money, go and make your strategy as simple as you can… Build rules when you go long and when you go short, develop how much pips should be your target and your stop loss, what’s the best time to trade… But at the end don’t forget to go and follow your rules once you build your plan.

Trading Advice #3 -> Trade Less Instruments = More Profit

The biggest mistake that I made in trading was that I was trading every pair that my broker offered and I don’t want you to fall into that same trap. First off all markets are correlated nowadays, especially after the last crash in 2008 so you can’t go long on let say $EURUSD and $USDCHF and expect to make money (they have inverse correlation) … So I want you to build a list of 5 pairs and stick to them, to help you a little bit you can separate pairs into groups like this:

USD GROUP: EURUSD AUDUSD GBPUSD USDCHF NZDUSD USDCAD …

JPY GROUP: EURJPY USDJPY AUDJPY GBPJPY EURJPY NZDJPY …

CROSS GROUP: GBPCHF EURGBP EURAUD AUDNZD EURCAD …

EXOTICS: USDNOK USDMXN USDSEK USDZAR…

Now from each group you should pick 1-2 pairs and only trade them, so don’t just go and pick up all pairs from USD GROUP they all have good correlation… let say you pick this $EURUSD, $USDCAD, $USDJPY, $GBPCHF, $EURAUD. Now go and try to trade only these pairs, when you have 5 pairs you’ll have better setups because you won’t look at 200 charts every day, you’ll only watch 5 and over time you’ll master these pairs… Try different strategies for the different pairs, and you’ll find out what pair let’s say reacts best to divergence and what pair follows moving averages good and build your plan like that.

Now you have few tips that are going to help you to make more profit for sure, just don’t forget one thing “To Become Succesful Trade You Need A Lot Of Things Working Together” so go slow and you are going to build you wealth for sure.

If you think there are some more tips that can help new traders to make more money just post it in the comment below.

About the author:

Nicola Delic is one of the leading analysts in Europe. He has been trading professionally for the

past six years now. Nicola is Market Analyst at InstaForex and also Chief Analyst at

Singapore Grand Capital. He is an expert on Elliot Waves and uses a combination of technical analysis

along with fundamental analysis for his trading. Nicola is also running his own online forex community.