Hi Traders! Arvinth here from the Home Trader Club team. The weekly summary and, review of October 25th 2024 is here. It is now time to recap and summarize the trade setups that we had during this week. Below you will find a short explanation of all the trade setups we had this week and how it has currently developed now.

Explore My Free Mentorship Program

As an Internationally Certified Financial Technician (CFTe, IFTA) and former private capital hedge fund trader, I have successfully mentored numerous students who are now thriving in the trading world. Students who learned with me, are now full-time traders, work in the trading industry, run their own capital firms or are fully funded traders by private companies, develop automated trading solutions and manage others’ capitals. I am a very proud mentor and I am proud of the success stories I’ve helped create, and for a limited time, I’m offering my mentorship program for free through a partnership with Eight Cap broker. Join Eight Cap, become an active trader, and choose the offer that suits you best –

For more details, visit: Home Trader Club Mentorship Program

I’m excited to work with you and help you reach your desired level of success!

Trading Ideas (Blog Posts)

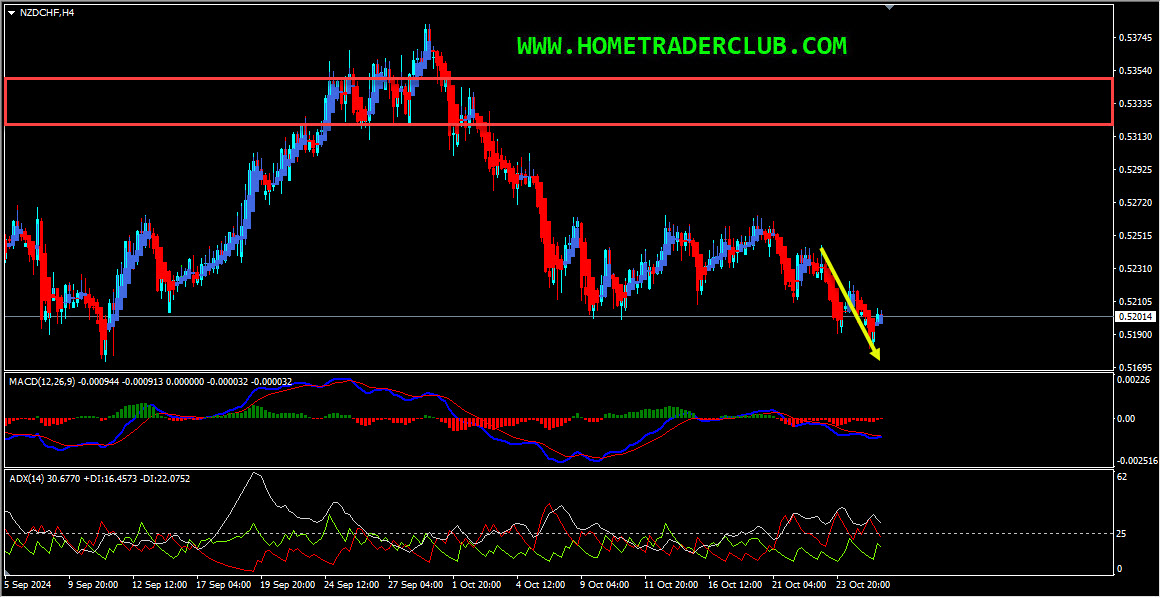

NZDCHF – My idea here was “On the H4 chart, currently, we have a strong bearish momentum and the price which is moving lower has broken below a strong support zone and is holding below it, we may consider this as evidence of bearish pressure. After the breakout, this strong support zone is acting as a strong resistance zone for us. Also, the price which is moving lower has created a bearish trend pattern in the form of three lower highs, lower lows which we may consider as another evidence of bearish pressure. Generally, after a bearish trend pattern, we may expect corrections and then further continuation lower. Currently it looks like a correction is happening. Also, based on the Heikin Ashi candles we can see that currently, we have strong bearish bodies in downward moving market conditions so it basically reflects a bearish environment. In addition to this, the ADX indicator gave a bearish signal here at the cross of -DI (red line) versus +DI (green line) and the main signal line (silver line) reads value over 25 which we may consider as yet another evidence of bearish pressure. So the bottom line here is that, everything looks good here for the bears and I expect the price to move lower further in the short term after pullbacks until the strong resistance zone (marked in red) shown in the image below holds”.

Current Scenario – In NZDCHF, based on the above-mentioned analysis, until the strong resistance zone holds I was expecting short term bearish moves to happen here. The price action followed my analysis exactly as I expected it to here. The price moved lower and delivered a nice move to the downside so far!

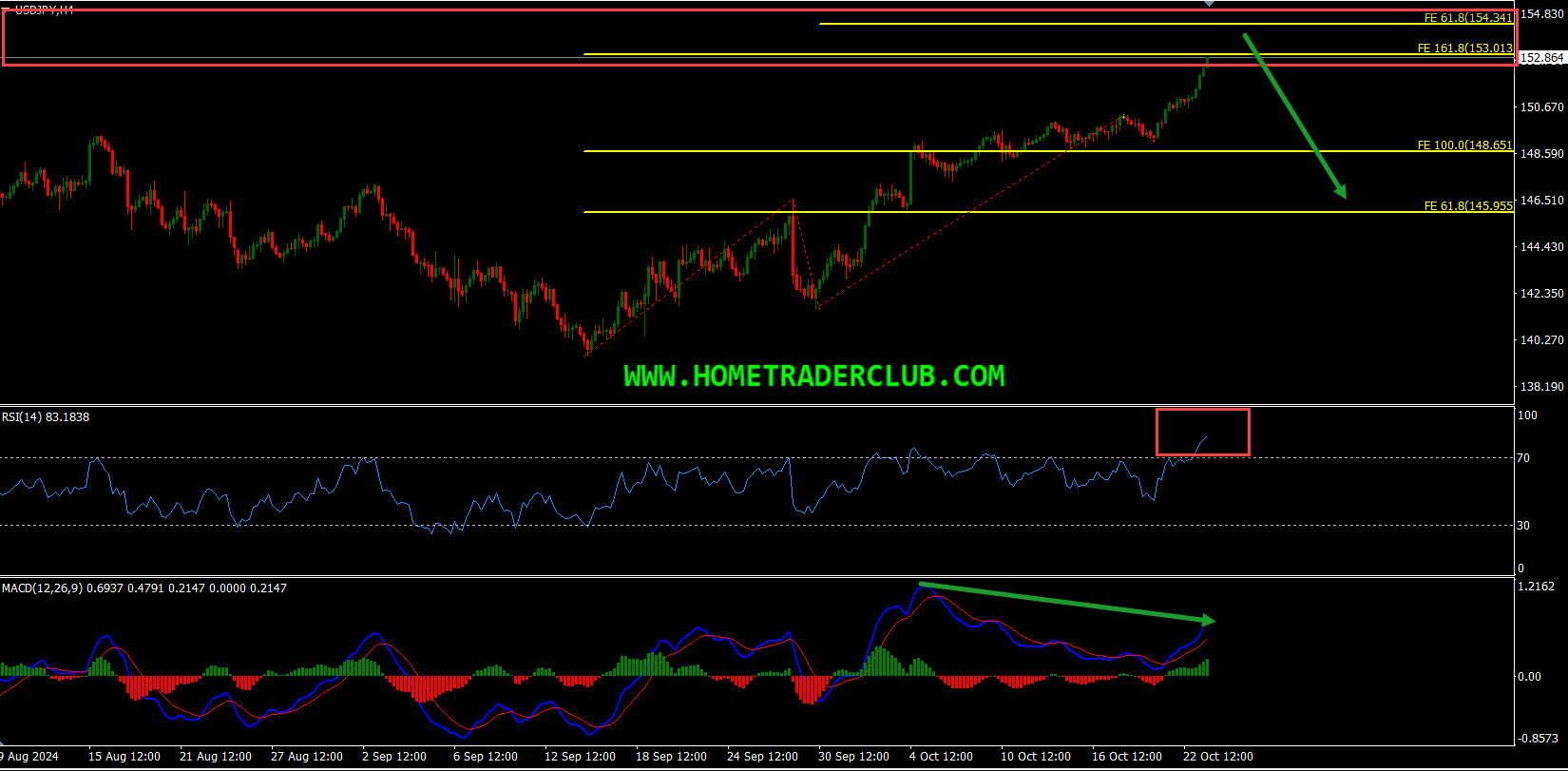

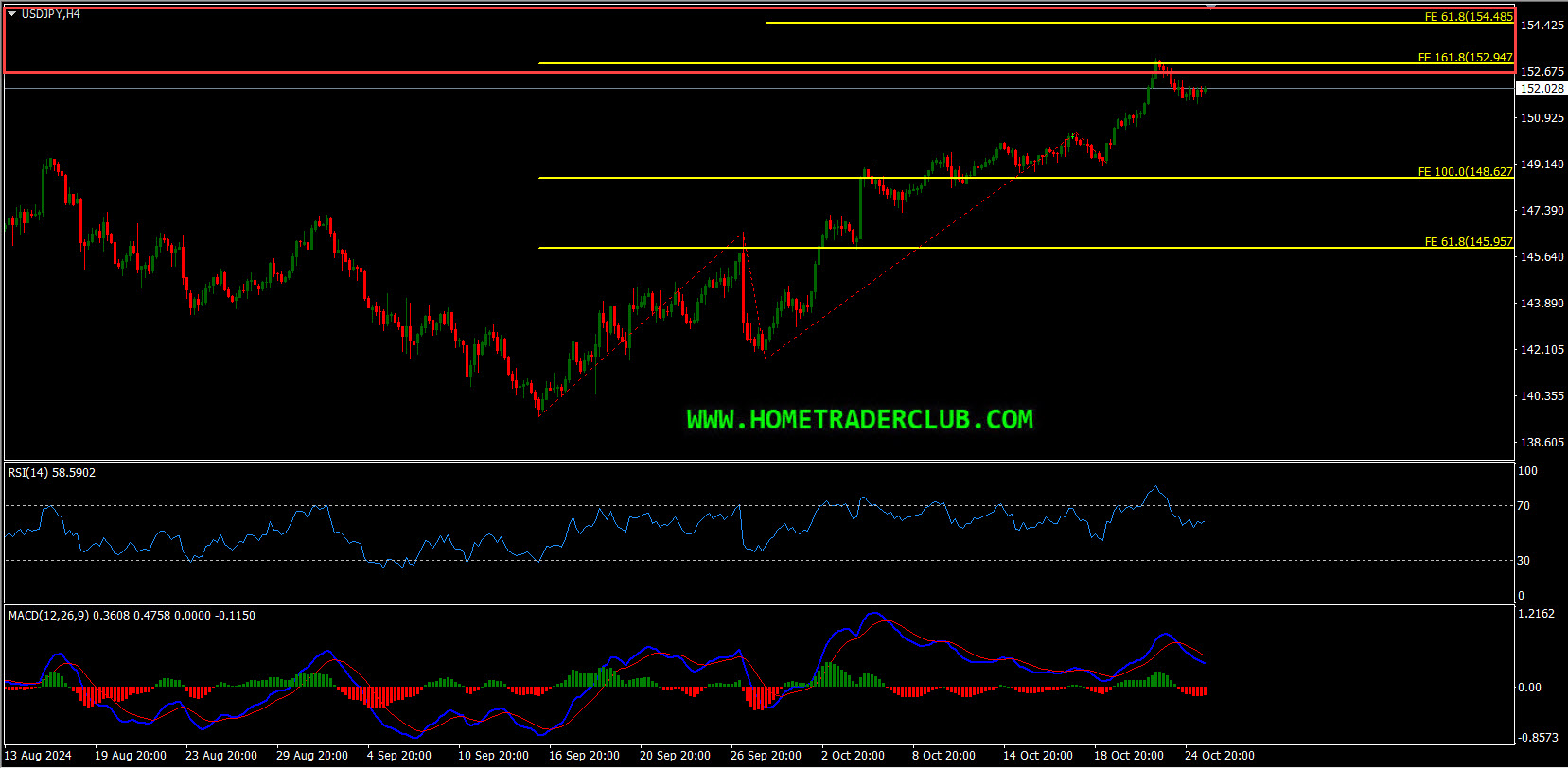

USDJPY – My idea here was “On the H4 chart, the price reached a key resistance zone that has formed based on the 161.8%(153.013) Fibonacci expansion level of the first wave and the 61.8%(154.341) Fibonacci expansion level of the second wave. The price has currently reached this key resistance zone. Also, we have a potential bearish divergence that is forming between the first high which formed at 149.117 and the second current high which formed at 153.180 based on the MACD indicator which we may consider as evidence of bearish pressure. In addition to this, the RSI indicator has reached the overbought level which we may consider as yet another evidence of bearish pressure. So basically I expect this pair to build more reversal signs soon, we may then expect potential short term bearish moves to happen here”.

Current Scenario – My plan still remains the same in USDJPY, that is until the key resistance zone shown in the image below holds my short term view remains bearish here and I expect the price to move lower further.

Dow Jones – My idea here was “On the H1 chart, currently, we have a strong bearish momentum and the price which is moving lower has broken below a strong support zone and is holding below it, we may consider this as evidence of bearish pressure. After the breakout, this strong support zone is acting as a strong resistance zone for us. Also, the price which is moving lower has created a bearish trend pattern in the form of three lower highs, lower lows which we may consider as evidence of bearish pressure. Generally, after a bearish trend pattern, we may expect corrections and then further continuation lower. Currently it looks like a correction is happening. Also, based on the Heikin Ashi candles we can see that currently, we have strong bearish bodies in downward moving market conditions so it basically reflects a bearish environment. In addition to this, the ADX indicator gave a bearish signal here at the cross of -DI (red line) versus +DI (green line) and the main signal line (silver line) reads value over 25 which we may consider as yet another evidence of bearish pressure. So the bottom line here is that, everything looks good here for the bears and I expect the price to move lower further in the short term after pullbacks until the strong resistance zone (marked in red) shown in the image below holds”.

Current Scenario – In Dow Jones, based on the above-mentioned analysis, until the strong resistance zone holds I was expecting short term bearish moves to happen after pullbacks. The price action followed my analysis exactly as I expected it to here. We had a pullback and then the price moved lower and delivered a nice move to the downside!

For similar trade ideas and much more I invite you to join the Home Trader Club and improve your trading with us.

You will also find a pretty extensive database of educational materials here in the blog – just use the search or check out the Forex Education section above.

If you have any further questions, don’t hesitate to drop a comment below!

Happy Trading!

Arvinth Akash

Home Trader Club Team.