Hello Friends

Good morning, good afternoon and good evening

So the EU Summit is finally over, the financial markets were waiting to see what would be next, would the EU leaders be able to come up with a solution to the problem the 17 nation zone is facing? Well it look like they have come up with some ideas, but only time will tell if these ideas will restore market’s confidence in the debt of the Euro zone.

There was three key agreements that took place late into Thursday night, let’s talk about them.

1. The first key agreement was about the bailout funds

Now the main issue here was where were the funds to come from to save Spain’s banks and possible Ireland.

There were organization that the money could come from. The first place would be the European Financial Stability Facility (EFSF) and the other organization would be the European Stability Mechanism (ESM). Now the problem here is that if the funds were to come from the ESM if the banks were to default then the ESM would have seniority over investors if and when money would be divided up amongst creditors.

But in any case the EU leaders decided that the funds would come from the EFSF and than from the ESM without the ESM taking precedence in the case of default.

2. The second key agreement involved a banking union

One of the big talks leading up the summit was the talks of creating a single governing body that would be responsible for the euro zone banks.

The point here is that before the crisis different banks followed different rules and with the implementation of this new body that should be up and running by the end of the year all the banks will have to follow the same rules and same regulations.

Another point that was made during the summit to move closer to unionizing banks was that banks will be expected to have a single deposit guarantee to instill confidence in savers. This would protect savers in the case that banks would go under.

3. The third key agreement involved growth

The EU leaders agreed to give the European Investment Bank (EIB) 10B Euros which would allow the investment bank to increase the amount they can lend to other financial institutions and business.

The idea here is that this will promote business and promote growth for the Europe.

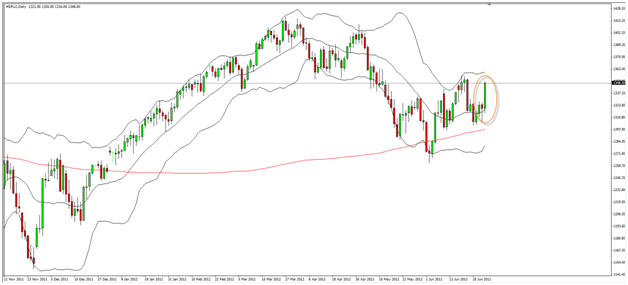

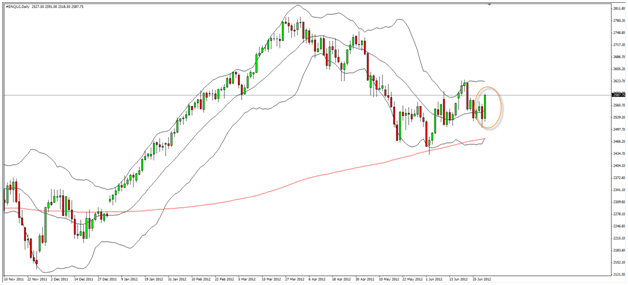

As a result of the news financial markets across the world exploded up as the summit alleviated concern that the banks will fail.

Take a look at the following indices

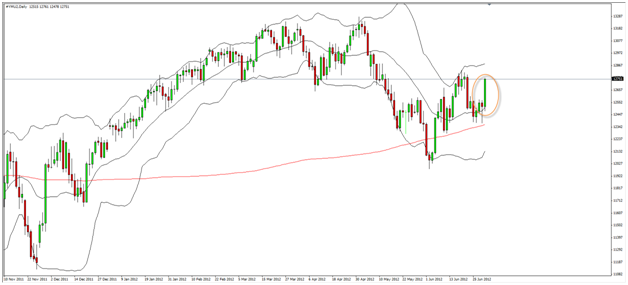

Taking a look at the EURUSD:

It seems that we are at a meeting of cross roads. We have a trend line on the Daily charts and a resistance level around 1.2675. If price can break both the trend line and the resistance and hold it is possible to see the Euro push up towards the next resistance area around 1.3020 which could also meets us at the 200MA of the Daily chart.

Well that is all for now

Until next time

Vladimir

[…] you would like to receive more information pertaining to garcinia cambogia without calcium – Read Homepage, kindly visit our own […]