What a day we had in regards to our Yen pairs that we have been patiently holding on to.

This morning we closed both our CADJPY and GBPJPY pairs in profit and we still hold on to USDJPY.

After weeks of patience it seems like the market is turning in our favor…or is it?

Let’s take a look at what cause the drop in the Japanese Yen

So just to retract what has happened today… the Japanese Yen soared by more than 1% against all the other major pairs that it trades against.

Why?

Well it seems that yesterday economic report stated that Japan had a trade surplus last month. For those who don’t know what a trade surplus is: it is when a country in this case Japan reports that they have a positive balance of trade. In this case Japan exports exceeded their imports. And this represents a net inflow of domestic currency from other markets like US like Swiss like England.

So with such great news, this boasted the idea that there might be a rebound in Japan’s economy.

Add on to that the bad news that came out of China and the Euro zone it seem like investors were running towards the yen for safety measures.

Today’s stats:

Yen strengthen 1.2% against the Dollar

Yen strengthen 1.4% against the Euro

So what does this mean for the USDJPY that we hold on to.

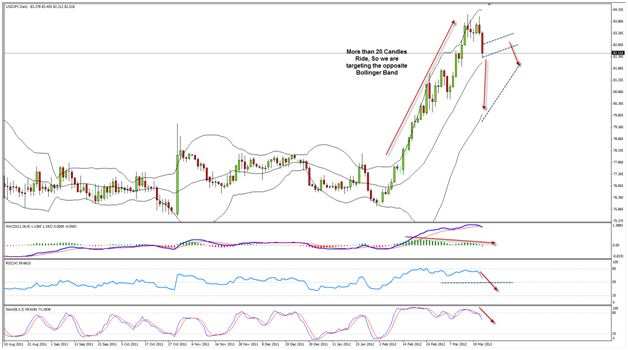

Take a look

So if we take a look at the chart we can see that we have had more than 20 candles riding the Bollinger Band so based on the rules we will be targeting the opposite boundary of the Bollinger Band. The only thing is will this news cause a direct drop down or could we see price maybe create a channel here go sideways for a bit and then continue the down move. And that my friends is just a question of time.

Have a great day

Vladimir