Hello traders, Vladimir here from Home Trader Club with your weekly Forex forecast. A big thanks, as always, to Eight Cap broker for supporting our community. This week marks one of the most highly anticipated trading events of the year. On September 17, 2025, the Federal Reserve is set to announce its policy decision—potentially starting rate cuts or hinting at more to come later this year or early next year.

The markets are on edge:

-

If the Fed confirms the expected easing, the US Dollar could weaken further.

-

If the Fed disappoints or signals a slower pace, the Dollar may strengthen sharply.

Let’s break down the technical outlook for the EUR/USD, USD/JPY, and Gold (XAU/USD) and review the key trading scenarios for the week ahead.

📺 Watch the Full Weekly Forecast Video

Don’t forget to Like, Comment, and Subscribe for more weekly plans and real-time insights.

Explore My Free Mentorship Program

As an Internationally Certified Financial Technician (CFTe, IFTA) and former private capital hedge fund trader, I have successfully mentored numerous students who are now thriving in the trading world. Students who learned with me, are now full-time traders, work in the trading industry, run their own capital firms or are fully funded traders by private companies, develop automated trading solutions and manage others’ capitals. I am a very proud mentor and I am proud of the success stories I’ve helped create, and for a limited time, I’m offering my mentorship program for free through a partnership with Eight Cap broker. Join Eight Cap, become an active trader, and choose the offer that suits you best –

For more details, visit: Home Trader Club Mentorship Program

I’m excited to work with you and help you reach your desired level of success!

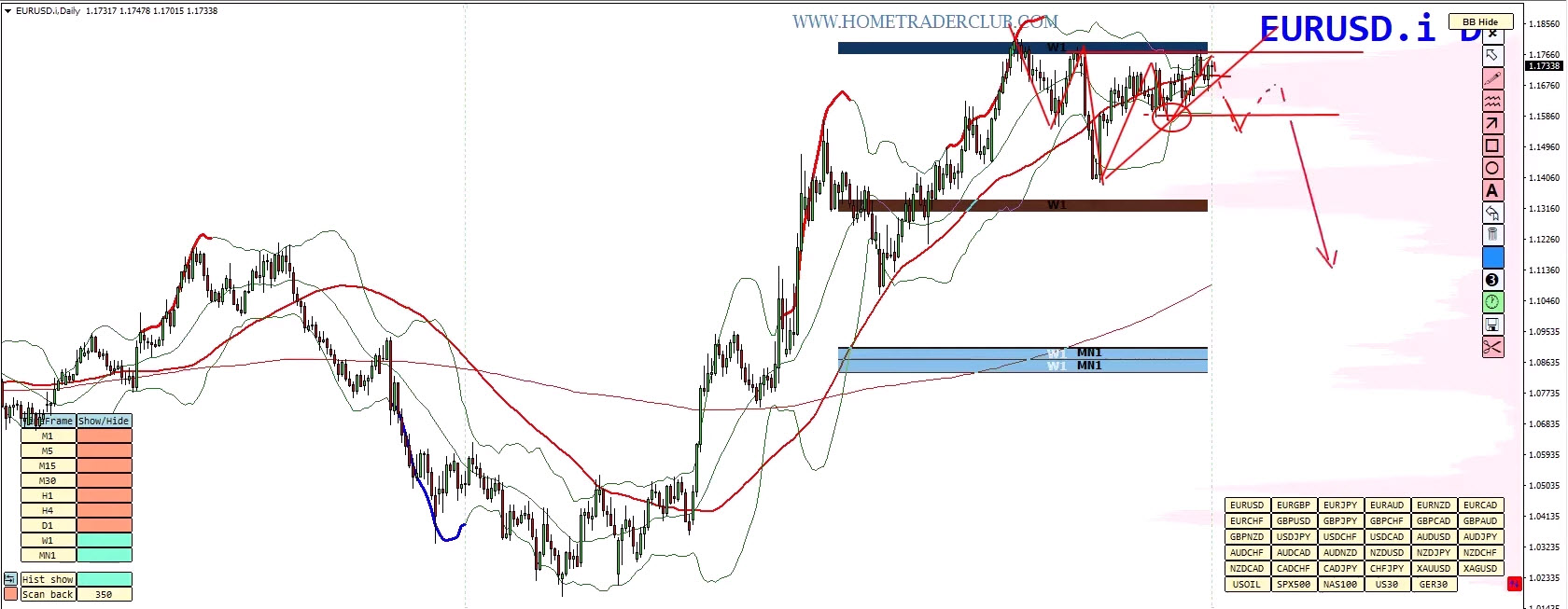

🌍 EUR/USD Forecast

Last week, the Euro broke above the falling trendline/ABCD structure, but price action since then has been flat as the market awaits the Fed’s decision.

Bullish Scenario (Primary Outlook – 70–75% Probability)

-

The breakout momentum holds.

-

Price rallies towards 1.1900–1.2000, potentially extending to 1.2200–1.2300.

-

A new bearish divergence may form in that zone, signaling future selling opportunities.

Bearish Scenario (Alternative)

-

If the Fed disappoints and the Euro weakens, a break below recent lows could trigger a zigzag structure.

-

In this case, EUR/USD could retrace towards the 1.1400 supply zone, and possibly further to 1.1100.

📊 Market Strength Snapshot (Home Trader Club): EUR/USD remains fully bullish across monthly, weekly, and daily outlooks—supporting the upside bias, but caution is warranted around Fed news.

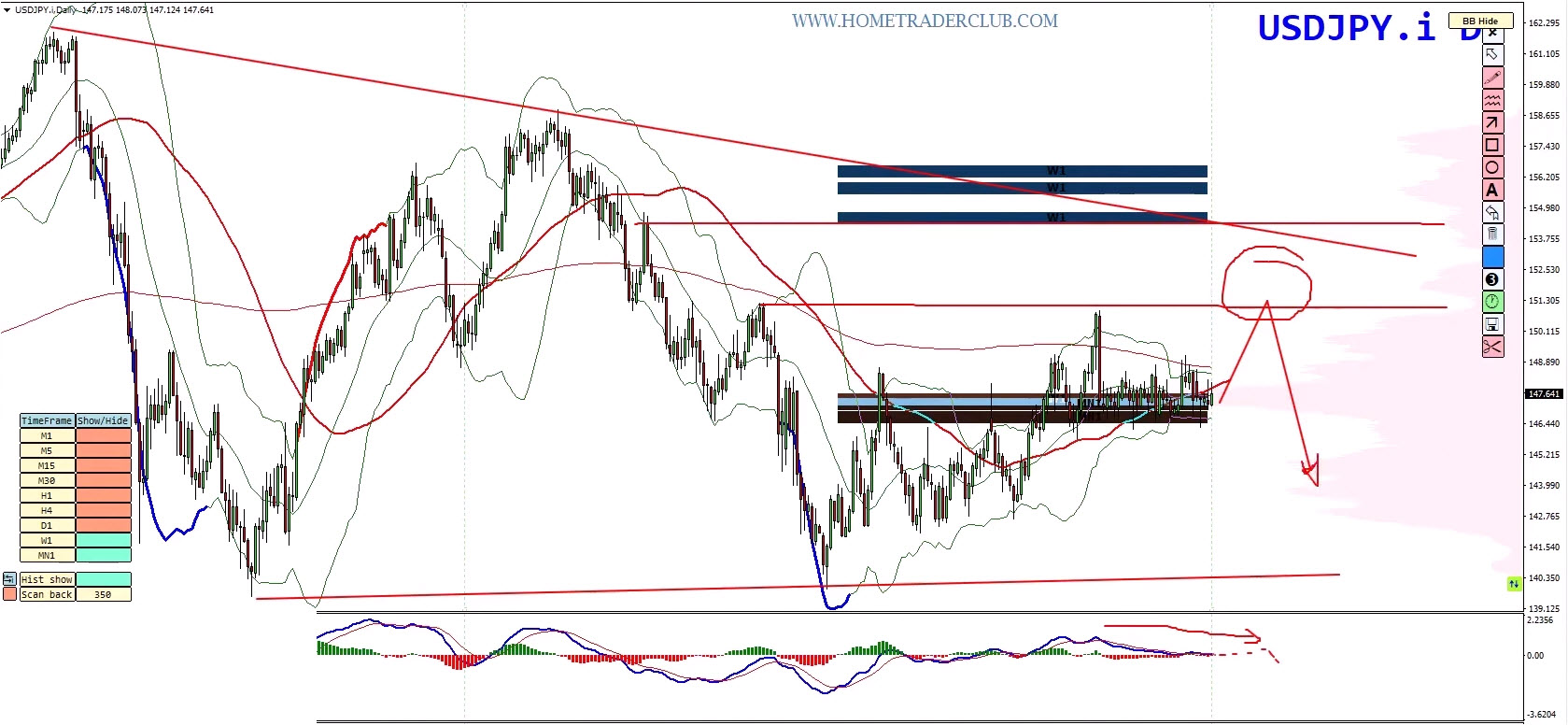

💹 USD/JPY Forecast

USD/JPY continues to consolidate, setting the stage for the next big move. The pair is still under bearish pressure, but two scenarios remain in play.

Bearish Scenario (Preferred)

-

Break below the support zone and rising trendline.

-

“Sell the rallies” setups align with indicators and price action.

-

Downside target: below 140.00, completing the ABCD corrective wave.

Alternative Bullish Scenario

-

If price rallies first, it may retest the 151.00–154.00 supply zone.

-

From this zone, a weekly bearish divergence may form, providing a stronger sell opportunity.

📊 Market Strength Snapshot: Sellers dominate USD/JPY, keeping the bias bearish unless a strong upside surprise develops.

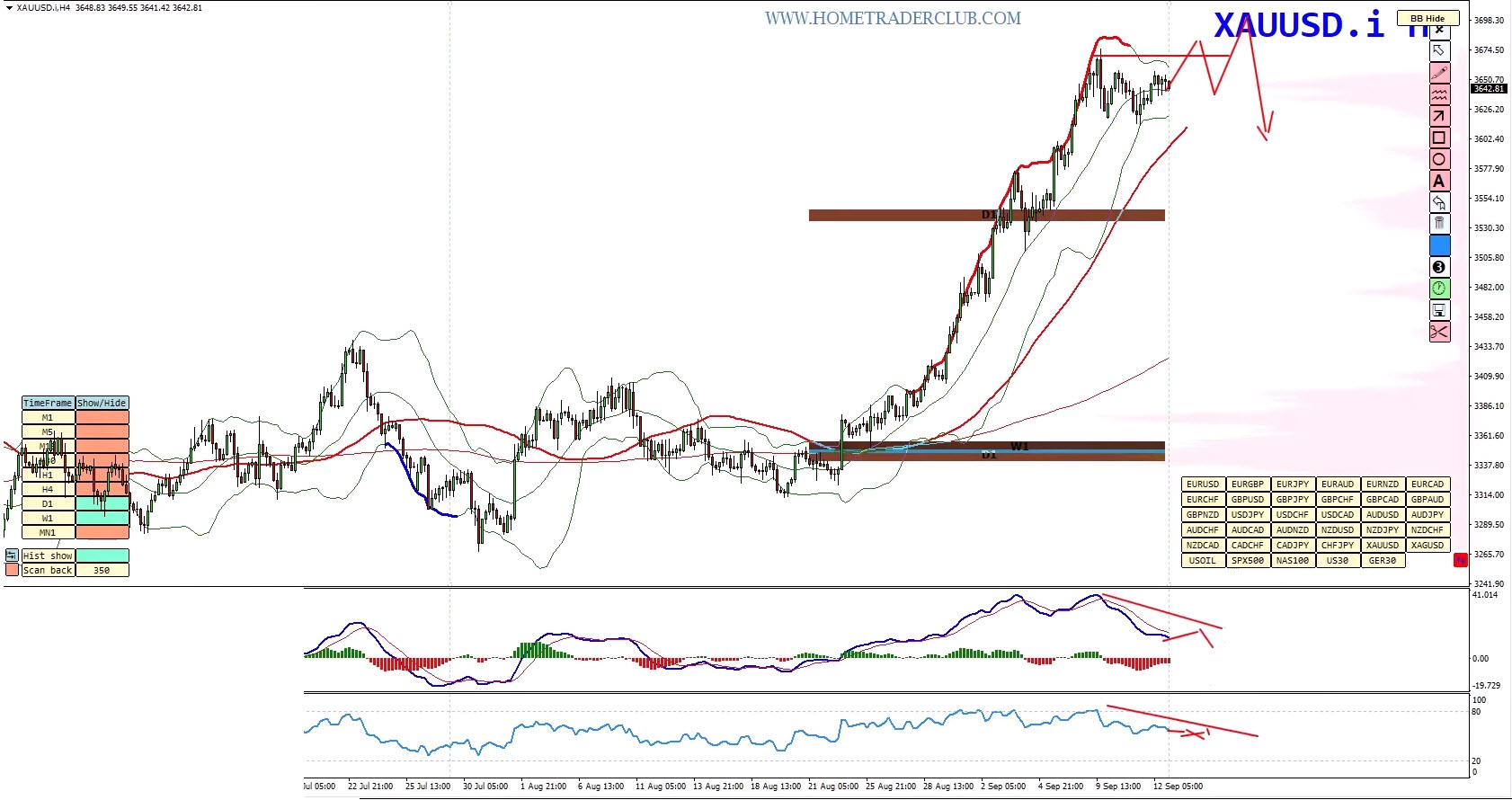

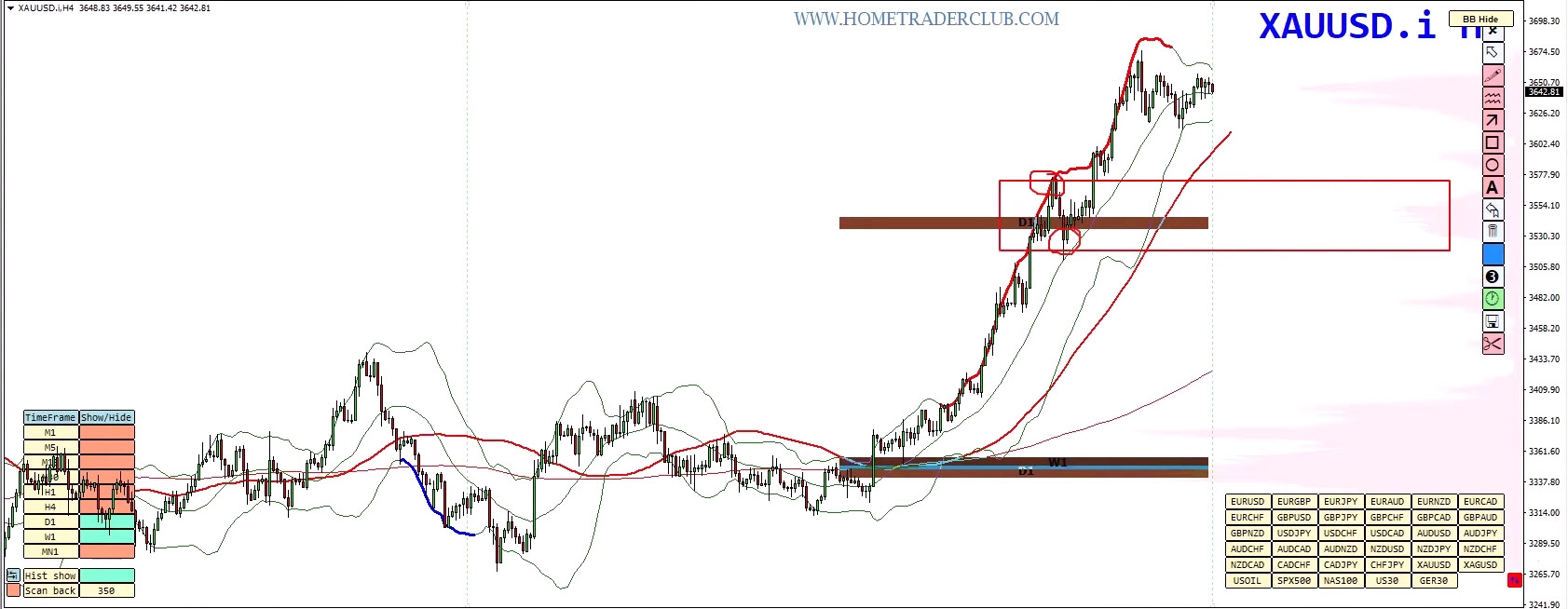

🏆 Gold (XAU/USD) Forecast

Gold remains in a powerful bullish trend, but extreme overbought conditions suggest the rally is nearing exhaustion.

Bearish Reversal Setup (Main Focus)

-

Look for false breakout (new highs rejected quickly).

-

If confirmed, a correction could send Gold towards 3575–3510 zone.

Alternative Zigzag Scenario

-

Two waves down, two waves up, followed by a downside breakout.

-

This correction could extend and I believe it opens up the possibility towards the zone 3575 – 3505 shown in the image below before buyers re-enter.

📊 With the monthly chart overbought and a weekly divergence developing, the risk of a deeper correction in Gold is growing, though timing remains uncertain.

📌 Trading Plan & Key Takeaway

This week’s Fed decision is the catalyst that will set the tone for EUR/USD, USD/JPY, and Gold:

-

EUR/USD: Bullish bias toward 1.20+, but Fed disappointment could flip sentiment lower.

-

USD/JPY: Bearish setups dominate, but a retest of 151–154 supply zone could be an even better short.

-

Gold: Trend strong, but extreme conditions suggest preparing for reversal opportunities.

👉 As always, the market doesn’t care what we want. Our job is to react to price action and execute prepared trading plans.

🔧 Pro Trading Tip

Every forecast above is paired with two scenarios. Why? Because great trading is not about being right — it’s about being ready. Let the market confirm the bias. Use your system, manage risk, and execute only when the structure and confirmation align.

👥 Join the Home Trader Club

Want to access the tools, systems, and real-time education we use daily?

With Eight Cap Broker’s support, you can now enjoy up to one full year of access to the Home Trader Club — including:

-

All professional trading systems

-

Exclusive mentoring sessions

-

Real-time trade ideas and setups

-

Full access to our course library and trading marketplace

Wishing you a profitable week ahead!

Vladimir Ribakov

Internationally Certified Financial Technician

Home Trader Club