Hello traders, Vladimir here from Home Trader Club – welcome to another Weekly Forex Forecast. As always, a big thank you to to Eight Cap broker for supporting our community. With their partnership, you can enjoy exclusive offers including up to one full year of free access to Home Trader Club, trading systems, strategies, mentoring sessions, and more. Check the link below this post for full details.

This week brings us an exciting lineup across the majors, commodities, and crypto. Let’s break it down pair by pair.

- 1 📺 Watch the Full Weekly Forecast Video

- 2 Explore My Free Mentorship Program

- 3 EUR/USD – Supply Zone Test and Bearish Divergence

- 4 GBP/USD – Bearish Correction Before Next Rally?

- 5 GOLD (XAU/USD) – False Breakouts on the Horizon

- 6 BITCOIN – Correction or Another Push Higher?

- 7 🔧 Pro Trading Tip

- 8 👥 Join the Home Trader Club

📺 Watch the Full Weekly Forecast Video

Don’t forget to Like, Comment, and Subscribe for more weekly plans and real-time insights.

Explore My Free Mentorship Program

As an Internationally Certified Financial Technician (CFTe, IFTA) and former private capital hedge fund trader, I have successfully mentored numerous students who are now thriving in the trading world. Students who learned with me, are now full-time traders, work in the trading industry, run their own capital firms or are fully funded traders by private companies, develop automated trading solutions and manage others’ capitals. I am a very proud mentor and I am proud of the success stories I’ve helped create, and for a limited time, I’m offering my mentorship program for free through a partnership with Eight Cap broker. Join Eight Cap, become an active trader, and choose the offer that suits you best –

For more details, visit: Home Trader Club Mentorship Program

I’m excited to work with you and help you reach your desired level of success!

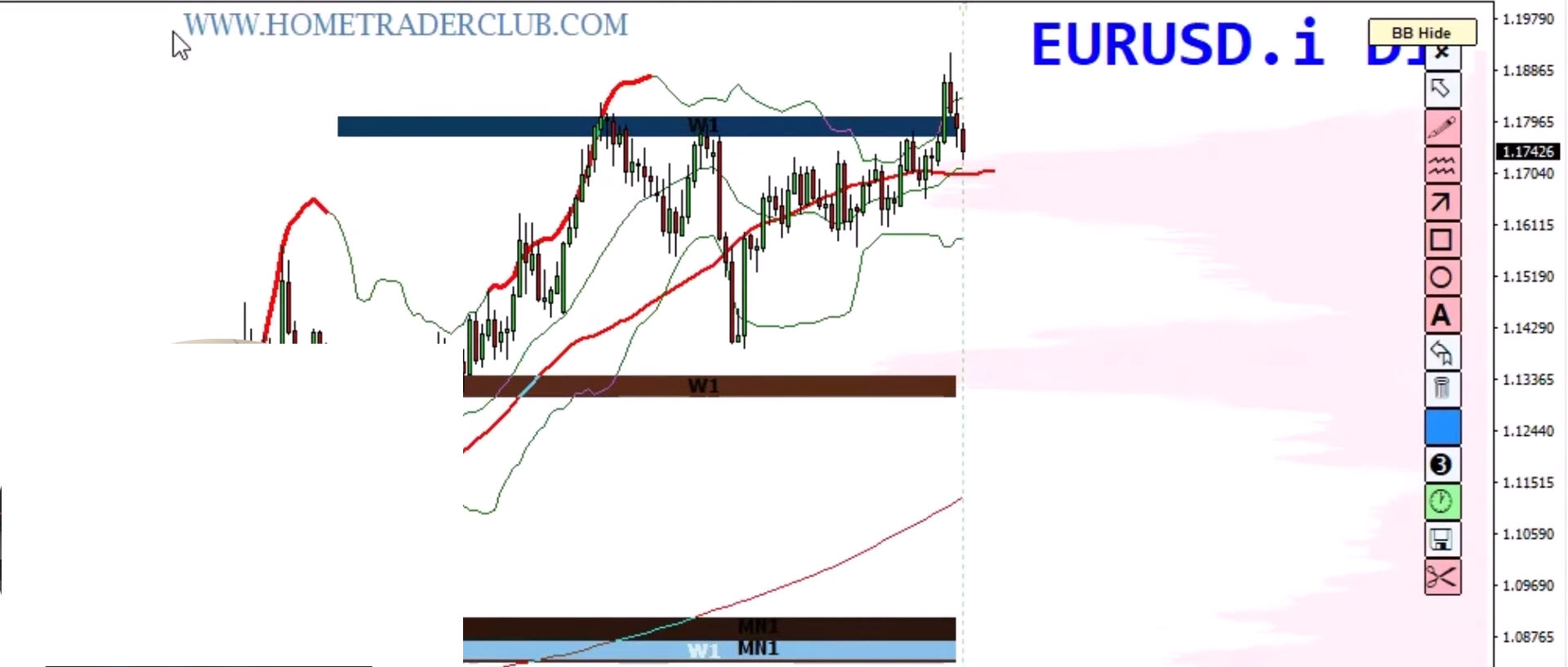

EUR/USD – Supply Zone Test and Bearish Divergence

Over the past few weeks, EUR/USD reached into the 1.19–1.20 resistance zone we’ve been watching closely. The rally stalled after the Fed cut rates but disappointed markets with a cautious tone, strengthening the dollar once again.

Technical Outlook:

-

Weekly Chart: Price is testing a strong supply zone with more than 20 candles riding the upper Bollinger Band. Similar structures in the past (2020) led to meaningful corrections.

-

Daily Chart: bearish divergence visible on both MACD and RSI.

We also have three lower highs, lower lows candle pattern.

-

Short-Term Levels:

-

Support: 1.17 – 1.1630

-

Resistance: 1.19 – 1.20

-

📌 Trading Plan: In the short term, buyers may attempt to defend the 1.17–1.1630 zone. Expect bounces, but rallies into supply remain sell opportunities. A deeper correction toward 1.15–1.14 is on the table if bearish pressure continues.

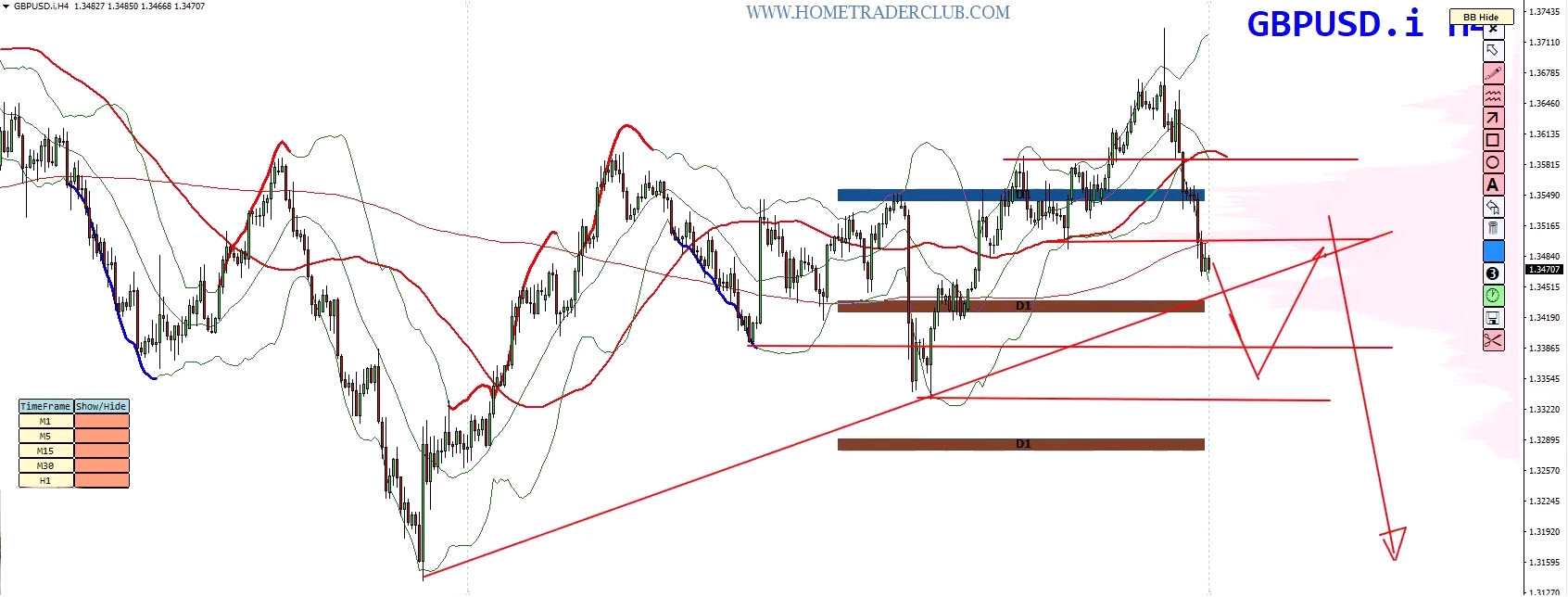

GBP/USD – Bearish Correction Before Next Rally?

The pound enjoyed a strong rally in recent weeks, but as anticipated, the supply zone rejected further upside. The Bank of England held rates, hinting at future cuts, which weighed on the pair.

Technical Outlook:

-

Daily & H4 Charts: Completed a bullish run with bearish divergence, now forming a corrective structure (zigzag pattern).

-

Histogram Divergence: Flipping from positive → negative → lower positive, a classical sign of sellers regaining control.

-

Key Levels:

-

Resistance: 1.35 – 1.36 (broken support turned resistance)

-

Support: Break of the rising trendline opens doors for deeper pullbacks.

-

📌 Trading Plan: Look for rallies into 1.35–1.36 to be rejected. As long as price holds below trendline resistance, sell-the-rallies remains the strategy. Medium term, the bullish cycle isn’t over, but correction still has room to extend.

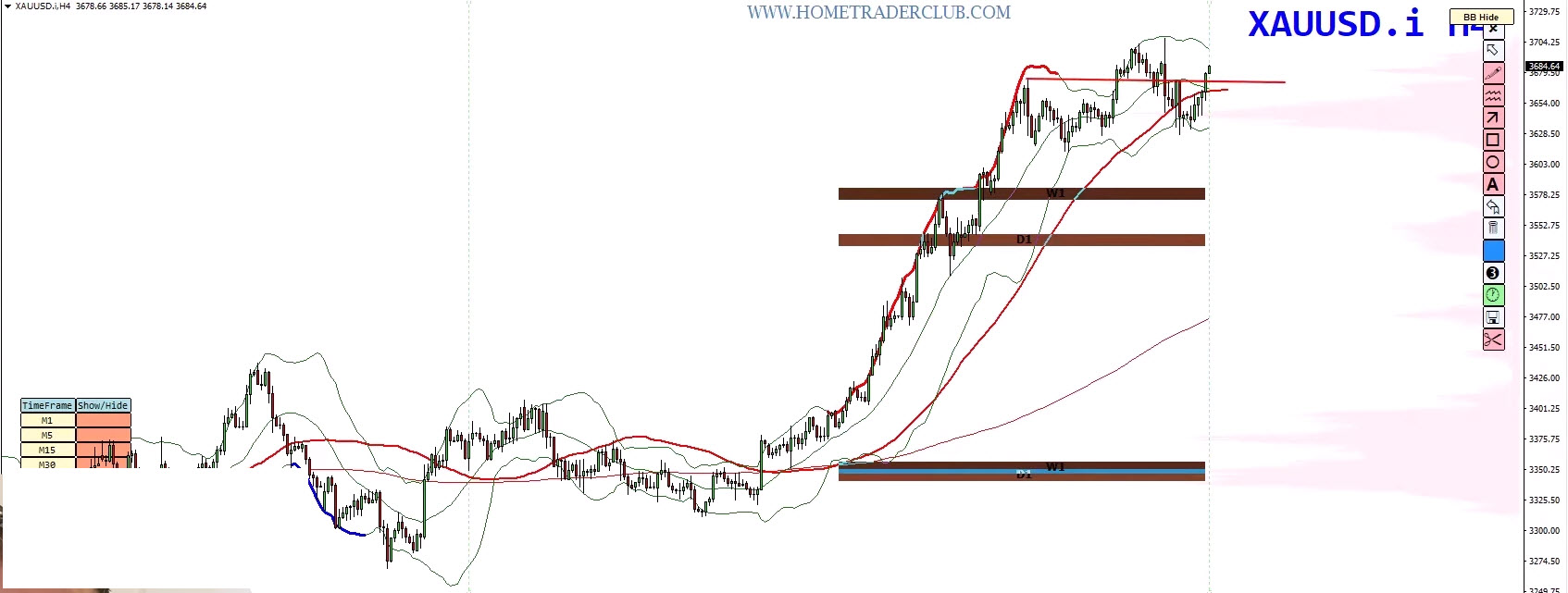

GOLD (XAU/USD) – False Breakouts on the Horizon

Gold has been flirting with false breakouts, and we may see another one developing.

Technical Outlook:

-

Weekly Chart: Potential bearish divergence forming (second peak still pending). We also have over riding condition on the upper Bollinger Band

-

Daily Chart: Overbought conditions, MACD divergence, and prior false breakout suggest weakness.

-

Scenarios:

📌 Trading Plan: Patience is key. Wait for confirmation (false breakout or wave structure completion) before entering short. Don’t rush – let the setup form.

BITCOIN – Correction or Another Push Higher?

Bitcoin continues to attract heavy attention. We previously identified a bearish divergence, which delivered the first leg lower.

The big question: what’s next?

Technical Outlook:

-

Scenario 1 (Ideal): Correction completes → bullish divergence forms → next rally resumes with the major trend.

-

Scenario 2: One more high before reversal, as weekly structure still holds higher highs & higher lows.

-

Key Levels:

-

Support: 105K – 100K (38–50% Fibonacci retracement)

-

Demand Zone: Prior lows + trendline support on H4

-

📌 Trading Plan: Watch for bullish divergence around 100K–105K. If demand holds, the bullish cycle remains intact.

A break below that zone would confirm a deeper correction.

🔧 Pro Trading Tip

Every forecast above is paired with two scenarios. Why? Because great trading is not about being right — it’s about being ready. Let the market confirm the bias. Use your system, manage risk, and execute only when the structure and confirmation align.

👥 Join the Home Trader Club

Want to access the tools, systems, and real-time education we use daily?

With Eight Cap Broker’s support, you can now enjoy up to one full year of access to the Home Trader Club — including:

-

All professional trading systems

-

Exclusive mentoring sessions

-

Real-time trade ideas and setups

-

Full access to our course library and trading marketplace

Wishing you a profitable week ahead!

Vladimir Ribakov

Internationally Certified Financial Technician

Home Trader Club