Hi Traders! There are many techniques to join a trend. But the highest probability opportunities are the ones that are based on multi time frame analysis. I want to share with you an example to such trade we had in Traders Academy Club. That’s GBPNZD sell trade. If you would like to learn more about the way we trade and the technical analysis we use then check out the Traders Academy Club. Spoiler alert – free memberships are available!

My Idea

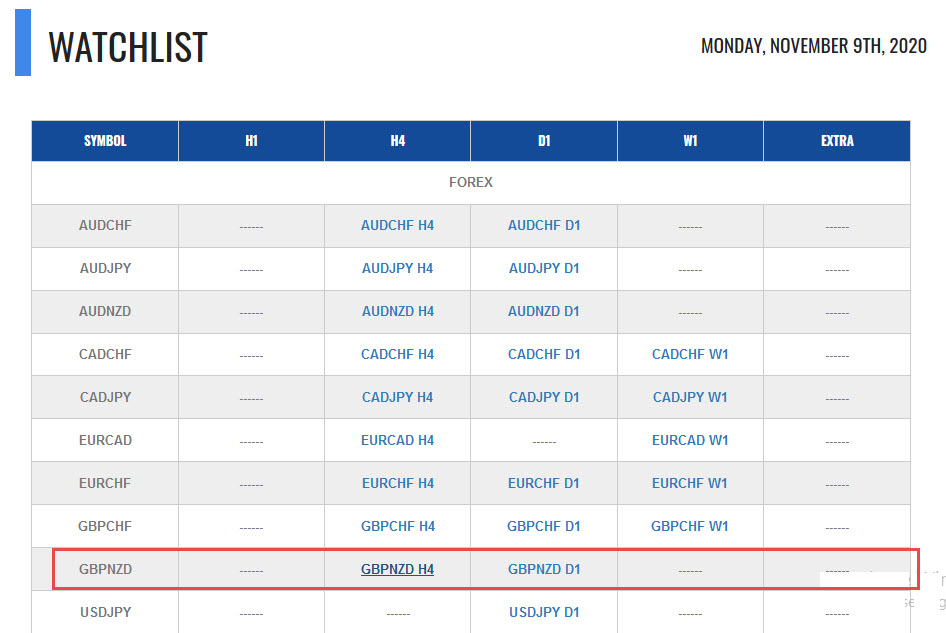

This is how the report looks like. A table with the hottest market opportunities, screenshot behind every pair and time frame (anything that is in blue inside the table is clickable and leads to a screenshot) + a summary in text format, kind of highlights. And of course Live Market Analysis every single day.

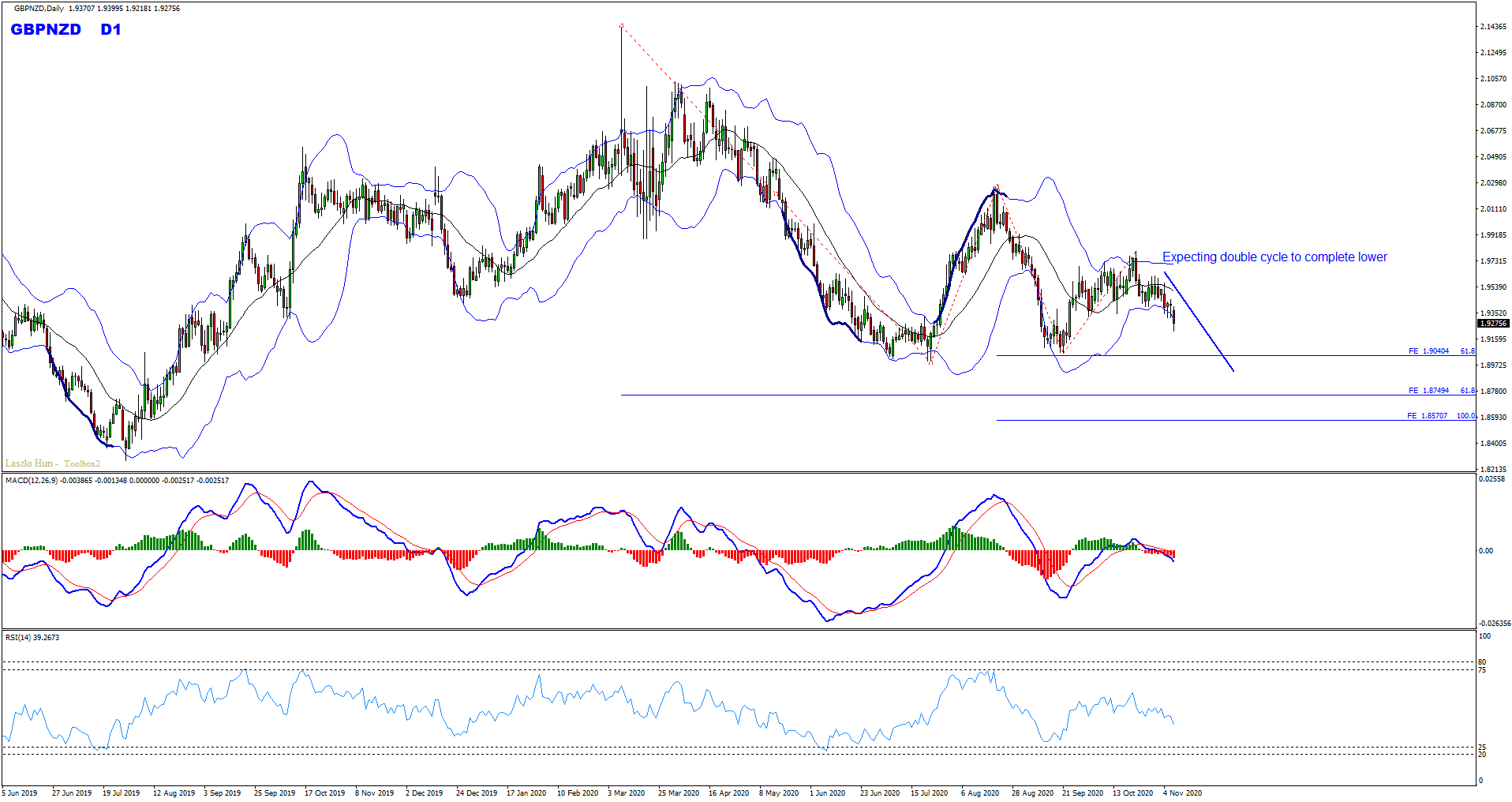

GBPNZD D1(Daily) Chart Analysis

On the daily chart, we had a potential big and small double wave that was forming. And while measuring the big first wave and the small first wave using the fibonacci expansion tool, we had a key support zone that had formed based on the 61.8%(1.87494) fibonacci expansion level of the first wave and the 100%(1.85707) fibonacci expansion level of the second wave. Price still had room lower towards this zone and there were no signs opposing this bearish view. So I moved to one timeframe lower to see if I can find evidences supporting this bearish view.

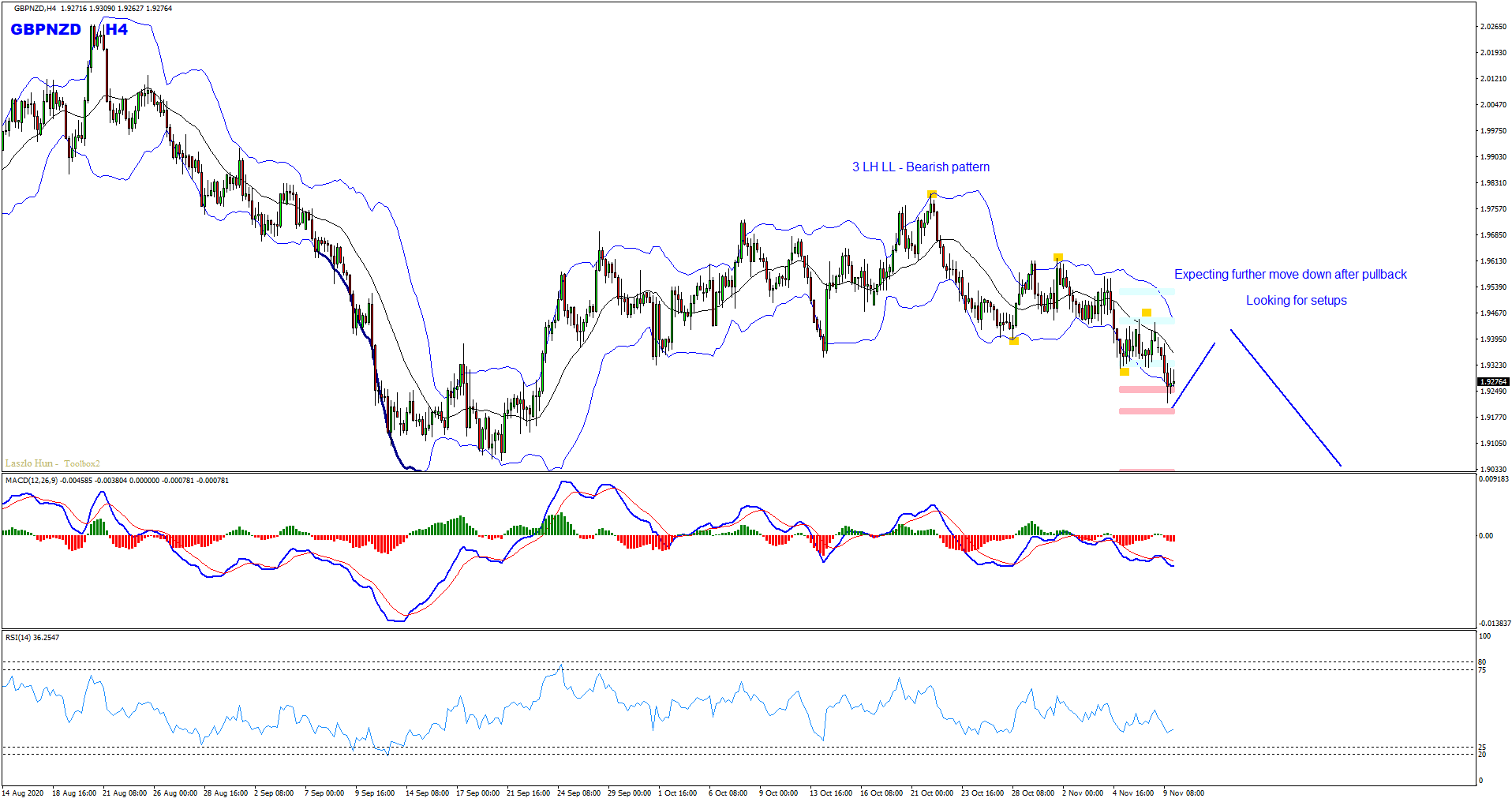

GBPNZD H4(4 Hours) Chart Analysis

Looking at the H4 chart the price had created a bearish trend pattern in the form of three lower highs, lower lows which we may consider as evidence of bearish pressure. Generally, after a bearish trend pattern, we may expect correction and then further continuation lower. So based on all this I was looking for further move down after pullbacks.

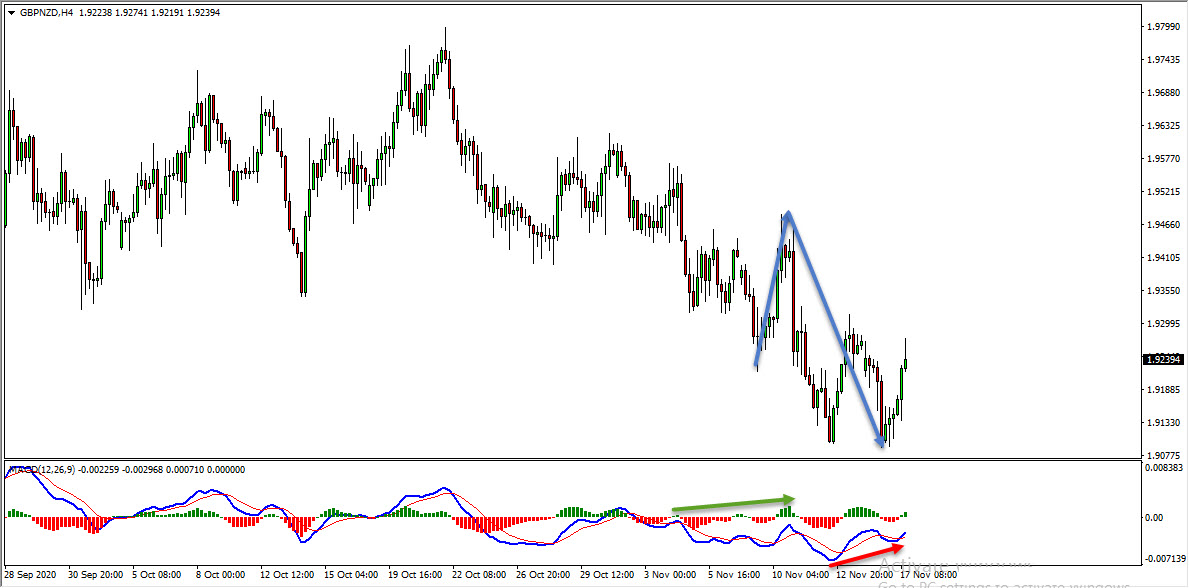

GBPNZD H4(4 Hours) Chart Current Scenario

On the H4 chart, we got a pullback and the price reached a “stop-loss hunting zone” and cleaned it. We then got a trigger based on one of the techniques I teach and that’s hidden divergence trading right on the stop-loss hunting zone. We had a bearish hidden divergence that has formed between the first high that has formed on 4th November 2020 and the second high that has formed on 10th November 2020 based on the MACD indicator and the sell setup got triggered. The price then moved lower further and provided more than 200 pips move so far.

Currently, on the H4 chart, we have a bullish divergence in play, this is something that we need to pay attention to. So if you are still involved in the sells then this is a good place to consider managing your trade and secure your profits (cash out or partial cash out or trailing protections or partial hedge, etc.. depending on the strategy that you work with).

Currently, on the H4 chart, we have a bullish divergence in play, this is something that we need to pay attention to. So if you are still involved in the sells then this is a good place to consider managing your trade and secure your profits (cash out or partial cash out or trailing protections or partial hedge, etc.. depending on the strategy that you work with).

Note: If you want to learn about Money Management you can find it here

For similar trade ideas and much more join the Traders Academy Club and get access to our complete watch list and trade report.

If you have any questions, don’t hesitate to drop a comment below!

To your success,

Vladimir Ribakov

Certified Financial Technician