Trading Bitcoins in 2017. When it comes to volatile currencies, none can quite compare to the allure and esteem of bitcoins (BTC). This cryptocurrency has stumped traders and analysts alike.

What was once a novel concept viewed as being the property of computer engineers and tech wizards, Bitcoin has increasingly entered the public lexicon. Today there is approximately $500m transacted globally with Bitcoin per day. More and more people have started to use the currency not only as a immutable store of value but also as a means of doing business.

However, when it comes to online trading, BTC seems to be in vogue. More and more traders like the volatile and sometimes predictable nature of it. Last year showed just how volatile BTC could be. It started off at $400 and then driven by a number of factors including investor risk aversion and Chinese investment controls it gyrated between 800 and 950. Beyond the fundamental drivers, BTC can also be analysed using all of the technical indicators one would use for traditional forex.

An overview of Bitcoin

For those of you who are more used to traditional Fiat currencies, understanding Bitcoin can be quite a step. The first and most important thing to realise is that BTC is not a physical asset in any way. In fact, it does not even exist in a digital form such as a file etc.

What Bitcoin is are a number of cryptographically signed transactions created over a large peer-to-peer network. This means that you cannot extract a “bitcoin” and attempt to sell it.

Unlike traditional central banks, these coins are not “created” by a central issuing authority but are generated by computers on a Peer to Peer network via a number of “hash” computations. A hash is essentially a cryptographic signature used in network security. This process of computers solving these hash problems is called “bitcoin mining”. These miners are then paid in BTC for the number of blocks which they solve. This BTC reward is where new Bitcoin enters circulation and increaes the supply.

The real genius behind bitcoin is the manner in which supply and hence inflation is limited. Every two weeks, the computational difficulty involved in solving the hash functions increases. This means that it becomes harder and harder for the miners to solve these transactional blocks and hence limits the supply of Bitcoins.

Demand Side Pressures

Fundamentally, there is increasing demand for BTC from a number of avenues. Firstly, they are almost always seen as a hedge for economic uncertainty and volatility. This was seen last year in the run up to the U.S. presidential election. BTC breached the $800 resistance level in the days post Trump election. This year is also frought with a number of geo-political risks including elections in Europe, uncertainty over Brexit and Trump’s economic policy.

BTC is also seen as a dollar hedge. The Trump economic stimulus that is about to be unleashed is bound to be one of the largest. This will drive dollar inflation and hence demand for hedges like gold and BTC.

Moreover, there may be a domino effect where in response to inflation pressures, the Fed may increases interest rates. This will lead to more demand for the dollar. This rise in demand for the dollar impacts on BTC indirectly. Investors in countries such as China which have currency controls see Bitcoin as the only way they can easily purchase dollars. This can be confirmed when looking at the slower appreciation of the dollar to the Chinese yuan than BTC to the dollar.

There is also the transactional aspect of BTC that is on the rise. Compared to traditional currency transfers, BTC has relatively low transactions fees. They are also easy to send and require a mere digital wallet one your PC. There have also been a number of payment processors that have cater specifically to online stores such that they can accept payments in Bitcoin. This can be evidenced by the amount of online retailers which now accept BTC as a form of payment.

Supply Side Pressures

On the other side of the equation, there are some definite supply side pressures that appear to be driving up the price of Bitcoin. Just as designed, the complications in mining BTC in the blockchain have resulted in less miners providing their services (at least with low fees). This means that there are naturally less coins being mined and hence a higher price for the coins.

One indication of the difficulty involved in mining these coins is the average confirmation time per transaction. It has gone from an average of about 40 minutes last year to 100 minutes this year and appears to still be climbing. The longer that it takes the miners to clear transcations, the less BTC rewards they get for it and hence less Bitcoin supply growth.

These supply side pressures cannot be easily remedied unless more computing power is made instantly available. This is not something that can necessarily happen overnight and requires improvements in technology that usually take a few years to manifest.

Outlook for BTC in 2017

Given the above demand and supply considerations, it is likely that BTC will continue its upward trend. However, there are a few policy indicators to watch which can alter the shape of the market and tip either demand or supply.

If more governments decide to crack down on BTC purchases because of exchange controls or capital flight, this could impact on the price and demand of BTC. However, it is entirely conceivable that the black market price of BTC will increase substantially in the countries that face these restrictions.

Some of the most respected names in the Bitcoin industry are also forecasting a large increase in the price of BTC this year. According to Vinny Lingham, $3,000 is his best estimate of what to expect for 2017.

BTC Technical Analysis

As mentioned, BTC is a highly volatile currency and has some of the largest swings sometimes and occassionally without warning. This can be advantageous for the technical trader. Taking a look at charts, tools and indicators can give the trader an indication of the direction.

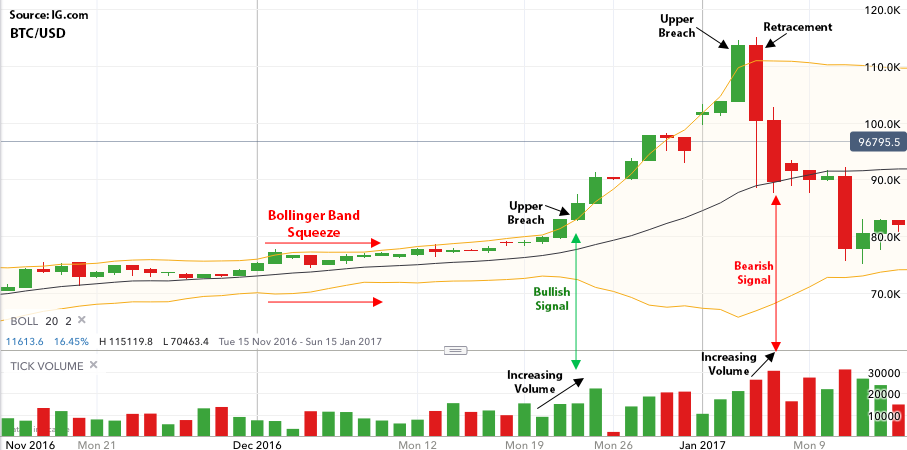

For example, let’s take a look at the below daily candlestick chart of BTC in the month of January this year. We have also plotted the (20, 2) Bollinger bands. Using only these two indicators, there was the opportunity for a skilled technician to profit from its breach of the $1,100 level and the following retracement.

What one can see on the chart is the Bollinger Band Squeeze that was forming from the middle of December. This was also a period of relatively low volatility during the festive season. On the 21st of December, one could see that the price breached the upper Bollinger band with increasing volume. In order to make certain that it was not a resistance level, an examination of the next candle was required. This indeed closed at a higher level than the previous candle and is a bullish indicator.

Of course, given the volatility in BTC, it is always advisable to place adequate stops in your positions. However, these stops should not be too close to the entry level. This is because BTC is still quite illuquid in low volume sessions. There could be gaps in the price that could go through tight stops Another interesting point was on the 4th of January. As one can see, the price breached the upper band again. However, on this occasion the band operated as a resistance level. This was confirmed by the preceding candle closing considerably below and beyond the upper band. One could also see that the volume on the downside was increasing substantially. This was naturally a bearish indicator and the trader could have made a profit on the retracement of BTC all the way to below $800 in mid-January.

Which Trading Platform to use?

Given the popularity of Bitcoin among traders these days, they are offered on a number of trading platforms already. These include forex brokers who offer BTC on margin or as CFDs as well as Binary Option Brokers.

Of course, these Bitcoins on trading platforms can’t be used for transactional purposes. Similar to sending foreign exchange to another individual, you will need a Bitcoin transaction marketplace. There are a few including coinbase and bitstamp. These allow you to buy BTC directly with your Bank or PayPal account and send it to another wallet address.

Conclusion

Bitcoin is indeed one of the most important monetary developments of the 21st century. As more and more people realise the benefits of transacting with crypto currency online, its adoption will increase.

For the avid Forex trader, BTC presents an interesting opportunity to trade a number of new Bitcoin crosses. Through a measured approach of both fundamental and technical analysis one can profit from the vagaries in its market price.

Author’s Name: Janet Preston

Author’s Website: binarytradingclub.com

Short biography of the author:

Janet is one of the founding members at the Binary Trading Club. She used to work as a trader in the city of London but decided to give it up and create a club to help fellow traders.

Thanks

Good article!!

Excellent article on Bitcoins