Hi Traders!

Moving average is a trend following indicator. Will be very useful in trending market and will have no value in ranging market.

The very basic definition of the moving average is – average value of the last X period. So for example if you want to find the last 14 days average value you should use 14 MA

There are several types of moving average calculation – SMA, EMA, Smoothed and Linear weighted.

The difference of each is the way it’s calculated while the most common ones are – EMA and SMA.

-

1

Moving Average – What You Should Know

- 1.1 1. The Bigger the Moving Average – The Bigger Trend it Refers to.

- 1.2 2. You Don’t Need Several Moving Averages on the Chart to Have a Better Read of a Trend.

- 1.3 3. Use Multiplier of 2 or Higher between MAs you use.

- 1.4 4. Cross of MAs DOES NOT Guarantee You Will Get a Move of Hundreds of Pips.

- 1.5 5. Multi – Time Frame Usage of Moving Averages [Will Help You to Find More ReliableTrends to Trade]

Moving Average – What You Should Know

- The bigger the moving average – the bigger trend it refers to.

- You don’t need several moving averages on the chart to have a better read of a trend.

- Use multiplier of 2 or higher between MAs you use.

- Cross of moving averages DO NOT guarantee you will get a move of hundreds of pips.

- Multi – Time Frame usage of moving averages, will help you to find more reliable trends to trade!

1. The Bigger the Moving Average – The Bigger Trend it Refers to.

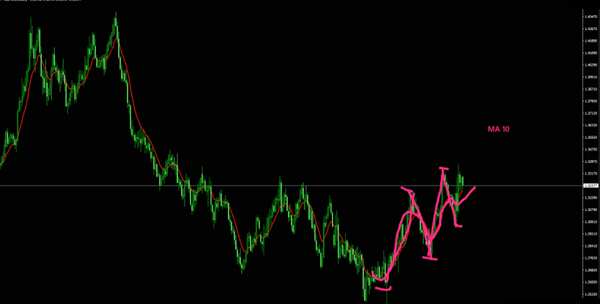

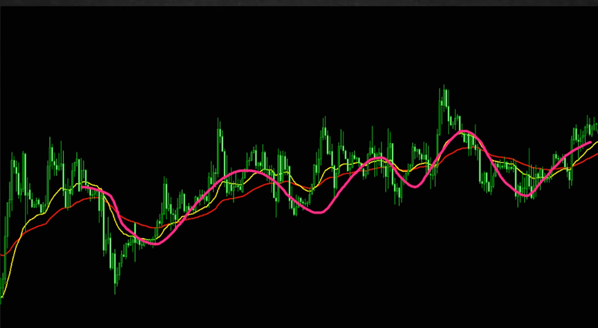

Take a look at the above image it is the moving average of 10. Look what happens when the moving average that changes the slope from down to up and up to down, look at the sizes of the moves from high to low on each of the time the slope changes, the moves are way smaller.

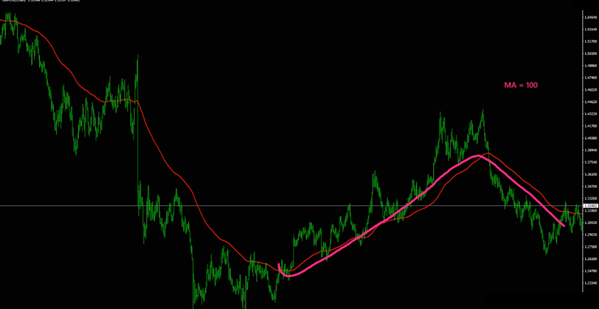

If you take a look at the moving average of 100 suddenly you get yourselves huge moves, so the bigger the number is the bigger the trend it represents.

If you go back to the logic of moving averages that I explained in the beginning you will understand how logical it is because the bigger the number you take, the bigger the period you refer to and bigger the volumes of the average it would be.

This is very important as you would see many traders change moving average, today they use 100, tomorrow they use 5 and the day after they use 23. They are so excited because they see that if it crosses or bounces or if it turns they have better chances. Every single moving average when you look backward would show you sometimes it bounced beautifully where it crossed beautifully and sometimes where it failed because every moving average represents different size of a trend, different period.

So of course among all the charts that you see some will fit in these numbers, it is important to understand that. Don’t try to figure out what is the best number for you before you understand this logic and what trends do you want to trade.

If you are a scalper you don’t want to use two moving averages of 200 for example. If you are a long term trader you don’t want to use the moving average of 5 days, it will mean nothing for you and your needs.

2. You Don’t Need Several Moving Averages on the Chart to Have a Better Read of a Trend.

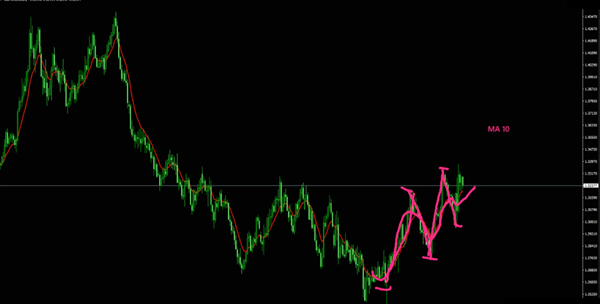

Many traders think that if I put more moving averages or more indicators I will have better read but the answer is no. What you will do is you will kill your picture and you will have harder times to make any kind of decision.

Take a look at the pictures above it has the same trend but it looks really different. In the first picture when I see the price crossing too much I know there is no real trend and if I take a look at the ugly crosses in the second picture it’s the same so why do you need so many moving average on your chart.

You could use two or three but you don’t need 10 or 15 on the chart it will not help you.

3. Use Multiplier of 2 or Higher between MAs you use.

If you use 2 or 3 moving averages you want to use multiplier of 2 or higher.

Many traders use moving averages that are too close, such as 8, 10, 12, 15, 17, 18, 20, etc… this will not help you because the closer the numbers are to each other the same trend it refers to and it will not give you much varying information.

If you take a look at 20 and 40 or 50 that will be different because it is the value of last 20 and last 40 or 50 days, twice the size and this might help you deduce trend behavior.

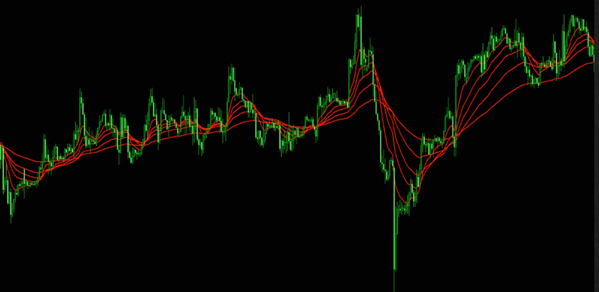

Take a look at the picture where the moving averages are too close to each other, they don’t help you, they don’t provide you with any extra information.

Now take a look at this picture below when the moving average is 10, 20 and 50 (just for example, it is at least multiplier of 2 between them).

First of all we can visually understand clear pictures and mainly it created trading zones for you when the price goes above moving average and comes back you have the zone. This zone is the distance between your moving average and when the price bounces back you know you are in a very strong zone and that there is a good likelihood you will see continuations from these areas.

Basically it makes you a bit wider, clearer dynamic resistance of prices, when you go down and visit such zones over and over again there is a good chance that you will see these bounces continuing well (of course in case if the trend is real because if it will be in consolidation it will not help you).

This is why it is very important to use the multiplier of 2 or even higher.

4. Cross of MAs DOES NOT Guarantee You Will Get a Move of Hundreds of Pips.

This is a very important one because many traders blindly believe that if moving average cross each other there will be huge move but the answer is no. The cross simply means the value of the moving average increase or decrease, how you use these values determines how good or bad you would be able to work with moving averages, you need to understand that.

In the above picture look how many empty crosses we have on the chart, this is why I said in the beginning that the moving average is wonderful in trends and less in consolidation.

5. Multi – Time Frame Usage of Moving Averages [Will Help You to Find More ReliableTrends to Trade]

This is my favorite one and exactly like anything else in the technical world this will help you find more reliable trends to trade. When you find situations when several timeframes (2, 3 or 4) show you the same direction that is the same slope of moving averages as shown in the example above you know that every time this synchronization happens you have better chances to find good opportunities.

If you have anything like what is shown in the above example that the direction is different it suggests you are in some period of correction. Once it changes down and become bearish again your chances to see that continue riding are increasing.

Think about it logically because right now on the above example we cross through the moving average and the slope changes on the H1 chart. Now look at the daily distance from its moving average and if the shorter timeframes change against there is a good chance you are for some kind of correction (there is a good chance that we are going to see something like what is shown in the screenshot).

That’s pretty much what it means and how you could use that in your favor, when you have the longer terms and shorter terms are synchronized and give you the same direction then you definitely wanted to trade it because it would simply provide you better chances to ride a more reliable trend.

You can watch the Moving Average Indicator webinar here:

I invite you to join me in my live trading rooms, on daily basis, and improve your trading with us.

Also you can get one of my strategies free of charge. You will find all the details here

Thank you for your time reading this article.

.

Yours to your success,

Vladimir Ribakov

Thanks Vlad for sharing this information

Very informative