If you were looking for “the best forex strategy” or “the best trading strategy” and google brought you here consider yourself a lucky person. Why you may wonder?

It is not because I’m going to reveal to you such a system or strategy but I will show you how to turn any trading strategy into the best one in the world!

Month after month I see educated traders, who have been around for at least 1-2 years now and have a good understanding of what is going on in the chart to still look for the so called ‘holy grail strategy’.

I understand it when I see it happening with beginner traders but it is really fascinating how a veteran trader might fall into the same trap.

Ladies and Gentlemen Traders – there is no such system because it is not the system (alone) that makes the money.

The consistently profitable trader has a good understanding of the markets such as technical/fundamental analysis. This same trader has a lot of patience and it is not afraid to skip a setup or five before the right one spears.

He is also extremely disciplined, has a proven trading plan which includes solid money and risk management. He has backtested, forward tested then traded live his system and he is pretty sure it works in the long run.

He trusts his system/strategy – he must.

But in order to build that trust he went over all the steps above.

Now when trading live and a drawdown of 1-2-4-6 trades in a row kicks in, THE trader is not worried. THE trader knows that in the long run he will make money and he DOESN’T jump to another system or strategy right away.

Why Would He?

If one thinks about it, most people who want to be traders act illogical when it comes to picking and sticking to strategies.

They start over every week or every other week. It is like going for driver’s license exam every week and every week you fail. Problem is you don’t study and practice before you go to take the exam next time, you just repeat the same mistakes over and over again.

Same happens to traders. They apply new strategy every week or every second week without learning from their mistakes – the real mistakes.

If you do what you have to do the correct way, you will have to do it only once before you start making money. It might take a few weeks or months but once you dedicate enough time to studying a given strategy, you will learn it in depth and this strategy will start bringing you money.

And what do 99% of the traders do? They switch strategies every Friday around noon. They have entered the infinity loop of “strategy hopping”. The loop looks like this:

- Buy a strategy – 99$ or $999 (it doesn’t really matter in the hands of this type of traders – the results will be the same at the end).

- 40% won’t read the manual and watch the tutorial videos that come with the strategy AT ALL. 40% will go over the educational materials with 1 eye on facebook. And the last third will actually sit down, read/watch the materials slowly, in depth, taking notes, checking examples on the chart etc…

- Majority of traders will conclude that this strategy is crap by next week and start looking for another one.

How I know these numbers?

Because I develop trading strategies and I see the questions that come into my email.

90% of the questions asked are covered in the trading manual that comes with the strategy. 90! This is indicative of how spoiled and lazy the human population has become.

How can you spend money on something and not even check it out? I’m talking about a PDF of 15-20 pages that takes approximately 15-20 minutes to read slowly and take notes.

On the other hand if you are going to try to get your drivers license, sit down and learn for the permit. Go over all the questions 1-2-3 times if needed until you make no mistakes or you make only a few.

Then go and practice to actually drive. Don’t practice 2 hours. Practice 40-50 hours. This way when you take both exams you will 99% pass.

I think you get the analogy here. When you purchase a system read and watch everything that comes in the package.

First time quickly just to get an idea what is where and how. Second time start going through the materials slower. Take notes and watch the live chart etc…Yes it will take more time to master it but it is better than losing money (trading live) or to go ahead and start over by purchasing another product and learning everything from the beginning.

And let’s move on to the second part.

How to Turn Any Strategy into the Best Trading Strategy in the World?

There are many factors that will influence your trading performance but in here I will cover the most crucial ones. If you make sure you comply with the rules below, it will be very very hard to end up losing in the longer run.

The Holy Grail List

- Risk:Reward Ratio

- Win/Loss Ratio

- Money Management

- Multiple Targets

- General Understanding Of The Market

- Fundamentals

Risk:Reward Ratio

Stay away from setups where you don’t get at least and I really mean at least 1:2 risk reward ratio for your money. What that means is: if you are going to potentially lose (risk/stop loss) $1, you want your potential reward to be at least $2 (take profit/target).

It get’s a bit complicated when we apply two targets but as a rule of the thumb remember that Target 1 should be twice as large from the Stop Loss.

Win/Loss Ratio

Win/Loss ratio is tightly correlated to the the risk:reward ratio and vice versa. The better the RR ratio, the worse the win/loss ratio would be.

That happens because if for example you are aiming for 50 pips and have a stop loss of 25 pips it is a lot easier for the price to hit your SL (it needs to move only 25 pips away from entry level) versus 50 pips that it has to go in order to reach your target.

So anytime you are running analysis on a strategy look for the correlation between these two.

Assuming that there is only 1 target for your trade and you are using risk:reward of 1:2, while your win/loss ratio is 35/65 (win 35 trades out of 100) you are still going to end up with a little profit at the end.

35 trades x $2 (profit) = +$70

65 trades x $1 (loss) = -$65

Total: +$5

The conclusion here is that if you have for example a win ratio of 25% while your Risk:Reward is 1:2 you are most likely going to lose money at the end. So just crunch some numbers and see what does the math says.

Money Management

Whatever you are going to use fixed lot or percentage of your account make sure to stick to your money management. Don’t trade fixed lots today and percentages on Tuesday.

Another important factor is to not go with too high risk. If you are using percentage don’t go over 2-3% per trade and this numbers apply only to people who have accounts smaller than $3000-4000. Money management is the heart of this operation. Strong heart means strong organism and healthy profits. Once your account grows lower the percentage.

The table above shows the effects of drawdown to your account with 2% risk and with 10% risk. So next time when you feel greedy and not following the rules of your trading plan remember this table (like the pictures they put on the cigarette packs to make you think twice before lighting up).

Huge Risk Per Trade Could Be Cancer For Your Account!

Multiple Targets

Having multiple targets allows you to ride trends. As you probably already know the forex market is ranging around 70-80% of the time and trending only 20-30%.

However when it starts moving the moves could be huge. It is always a good idea to have two targets (or 1 target and an exit plan) in order to catch such trends.

FYI: It is a common practice to set your stop loss to break even level once you hit target one.

General Understating Of The Markets (Multi-TimeFrame Confirmations)

This is probably the part which is going to take most of the time and effort you put into this business. In here we are going to put things as japanese candlesticks formations, price formation (chart patterns like triangles, wedges etc), support and resistance zones, basics of Fibonacci Extension and Retracement. The list goes on and on and it never actually ends.

Up until this very I still learn something new from time to time. Just make sure to lay the foundations of your trading fort. To more you learn, the more weapons you are going to have in your trading arsenal. Believe when you receive 3 or even 4 confirmations on the same setup you will feel the excitement.

What do I mean?

You get a sell signal and then you spot an extremely strong resistance level right above your entry level coming from daily and weekly charts. You also notice that there is a trend line coming down from the highs and on top of that this is Fibonacci Retracement 61.8% of the down move. Can it get any better than that?

I have found the “key” to my success in the Cycles. All markets move in cycles and it is very easy to spot where the price should be going next if you know how to read the cycles. This method of analysis is not a trading strategy. All it does is to show you the market direction. Then you can apply literally any trading strategy and trade only in the Cycle’s direction.

For example you spot a daily bullish cycle which has more room to go up on the Daily Chart. This is when you switch to M15 or H1 and start looking for buy signals with your favorite strategy!

Once the cycle has completed you may start looking for the reversal (sell). Cycles derive from Options (not binary options) which in other words means “smart money” or the big guys – institutional traders. If you follow what the big guys are doing, chances for failure are small.

If you are interested to learn more about the Art Of Cycle click here.

Fundamentals

During news prices tend to react and create huge spikes which might ruin a trade as well as reach your target within seconds. However we are in the business of trading, not gambling. It is best to be prepared and know the very basics when trading.

You don’t need a degree in business economics to read the fundamentals. There are websites that have “chewed and spit out” the information for you in understandable english. You just have to know where to look for it and what to look for.

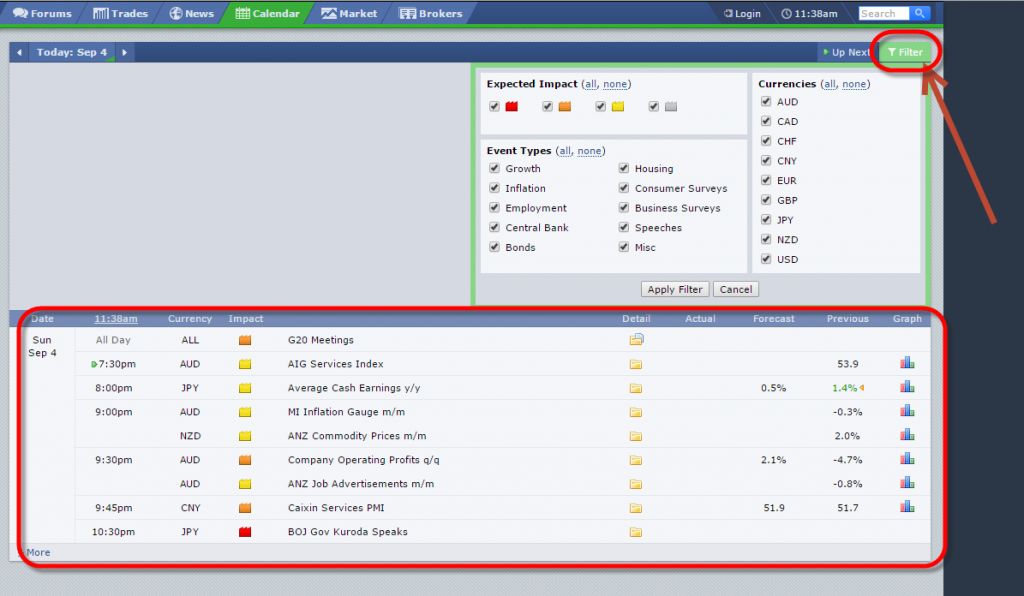

Such a website (probably one of the oldest out there) is forexfactory. On the main page you are going to see the main events that are going to take place for the selected period of time. I believe by default it will show you the daily agenda.

You can see the time, the currency that it will affect the most, the impact that it will most likely have (there 4 impact types – grey, yellow, orange, red – grey being the less important and red being super important), short description of the event, details, Actual Number, Forecast Number and Previous Number.

Thanks to those readings you can see when there will be important fundamental events and take the precautions you should take. For example if you are already in a trade you may want to close/set the stop loss to break even. If you are going to enter a trade, you might wait and do so until news are over. That mostly applies to intraday trades H1 and below.

you are welcome!

Thanks for sharing, much appreciated.

Very useful info, thanks Vlad.