My dear reader, have these questions ever crossed your mind as a forex trader:

What is it that THEY have and I don’t?

How come there are only a hand-full of traders that make money and I’m not one of them?

I’m not stupid, i’m not lazy, I work hard and yet i’m not there…Why??

I think they did. I know they did crossed mine a few years back and i know students of mine are also wondering how and what… We all feel like the king of the jungle after a winning streak of a few positions, when levels are reached, orders are triggered and price moves in the right direction. Well…unfortunately for most trader’s it doesn’t go as smooth as that. And when we face our fears and emotions we start asking and doubting every single step of the process, even if we have a solid trading plan and money management.

In today’s article I want to focus on some key factors that could make a huge difference for you to be on the successful side rather than the losing side of the fence.

What is success? Can you define it for yourself? You should be able to, because there is no such thing as recipe for success that fits us all. Success is strictly individual form of achieving goals that we have set for ourselves. That could be anything from planting a tree, for our grandchildren to buying a vacation house on the Bahamas. It could materialistic or idealistic it doesn’t matter…

Every person should figure out for himself, what is his winning formula or recipe. The success is a mixture of qualities, purpose and wanting to have more of what you are doing. We are all different, we all have different qualities, purposes etc… This is why the recipe for success is strictly individual as well.

I made a small experiment. Found an online synonym dictionary and when i typed in success look what it returned. Keep in mind these are only the first and most tightly related 42 words. Aren’t these the ingredients that we develop during our life and then with these ingredients we formulate the recipe guys? I think yes:

Note #18 – Downfall. Failure is part of success believe me. As long as you get the point, and learn from your mistakes it is a strong success booster by itself. It shows you a lot more than you think.

We are all proud owners of some these qualities, but none of us have the same list as the other person. This is the beauty of it. We are all unique in our own way. That makes the world a great place!

Now that this question is covered, let’s move on to five of the most important aspect I think every person and trader should consider when creating his or her success formula.

#1 – SUCCESS USUALLY COMES AFTER MANY FAILURES AND TRIES

When you read this sub-title probably the first thing that comes to your mind is mr. Edison the inventor of the light-bulb.

“As an inventor, Edison made 1,000 unsuccessful attempts at inventing the light bulb. When a reporter asked, “How did it feel to fail 1,000 times?” Edison replied, “I didn’t fail 1,000 times. The light bulb was an invention with 1,000 steps.”

In other words, every downfall is a step up. Every failure is a step up. As long as you learn from it. Don’t be afraid to fail.

Some of the traders reading this article will never understand one simple thing. When you are losing you should not put the blame on the dog, kids, loud neighbors, slow internet connection, the sun eclipse or some African shaman. No! Put the blame on yourself. You are the only person responsible for clicking this Sell or Buy button. You and only you. No matter how many websites and signals you are following, no matter what analysts on Bloomberg are saying… Learn to take the responsibility for your actions. In trading and in life. When you start doing that, things will change for you. Even if you stop reading this article right now, and this is the only thing you remember from it.

Traders are not judged during their best days and raising performance chart, they are judged by how fast they stand up on their feet once the draw down comes and market is choppy like hell.

#2 – UNDERESTIMATING THE FOREX MARKET

This subject could take an article alone, however i want you to focus on the following – you must be prepared, and i mean very very well prepared before you start trading. Think of it as climbing Everest. Climbers would train and train and train, then they would train some more. They will also buy best equipment and only then, they will head up for the sky. You as a trader must do the same. It is not as simple as – get internet connection #1, get laptop #2, make a pile of of money #3. No! If it was that easy we would all be billionaires, crime wouldn’t exist, there would be no poverty and starving children in the third world countries and we would eat as much chocolate as we want without getting fat…Sadly this is not the truth.

You must equip yourself with good trading plan, good education, tons of practice, psychological education (very important one), a proven strategy and probably 10 more things i can’t think of right now. Take trading seriously. Respect it.

Have your toolbox ready before you jump in!

#3 – PATIENCE

This is one of the toughest ones, isn’t it? I know, it is hard for me as well, but i have learned to be. Why you may ask? Because it PAYS! It always pays and pays good. Once you burn yourself a few times, than you waited a few times, and compare your statement at the end you see the difference. Losing traders, maybe I should call them dreamers, they dream about making that cash, immediately if not sooner. Today, they must be richer, today!. They must make 30 % per month at least. No, no and no. How many times do you have to blow up your account? How much money do you have to lose before you get it? If I could sell this kind of lesson and experience to people i would be a millionaire.

You are a successful trader, and you are patient. Repeat that to yourself every single day, every single trade. Start repeating it right now. Trust me, you will make a lot more, really a lot more money if you are patient. Less trades (most times), more money. Successful traders wait, they are cheetahs in the savanna. When the right time comes, you attack full power.

Thing about it: are you a cheetah or antelope ? It is up to you to decide.

Here something Warren Buffet said that I think can teach us a lot: “Someone’s sitting in the shade today because someone planted a tree a long time ago.”

I would also like to share something funny but also meaningful. Patience is the key! (video will start from the right scene)

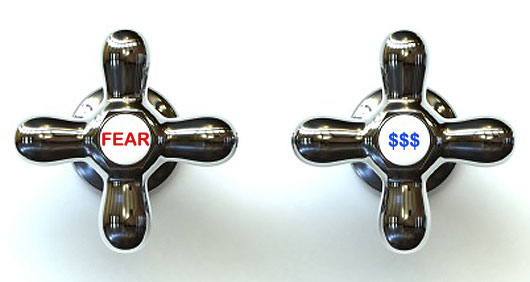

#4 – FEAR

When you start dealing with real cash there will be times when you will be scared. Literally scared. Don’t be ! If you are a solid trader with solid plan of action you must not fear the market. Face it and accept that you will lose money occasionally. I have said that many times and i will say it again – losing is part of this business. Don’t be afraid to lose. Also don’t look for a strategy or system that will give you 100% success. If that’s you right now, quit. Immediately remove your forex platforms from your computer, close your account and quit until you realize it. It will not happen. You may get 10-20 winners in a row but a losing trade will occur sooner or later, and that’s perfectly fine.

Beat the fear of losing if you have it. It is a must. Otherwise you will fail, be sure of that. What do you do when you have fear of heights ? You go to the highest building you have access to and you fight with that fear. Afraid to fly? Book yourself a flight ticket. I’m not saying go and lose all your money. No not at all. What i’m saying is, if you are at the phase of live trading (real money) do it gradually. Start with the smallest possible lot. When you lose just a few cents, it is different. Slowly build up the volume. You must be comfortable when you go to sleep and you have an open trade. This is the right amount of risk for you!

#5 – PUSHING THE MARKET INTO A TRADE

Sounds funny isn’t it? Some people really try to do that. These “some people” are the losing traders who spend hours and hours in front of the monitor convincing themselves that “this might turn into that and I can short it”. They would find setups and trade ideas that were not originally on their watch-list, that are not by rules of the strategy etc… Anything to be in a trade.

Successful traders on the other hand, have their watch-list and levels in place. Maybe even a limit order if not other confirmation is needed. What do they do, when market is ranging and far from their levels, and no good setups are present? They LEAVE the office and enjoy life, family or any other activity BUT trading. Why do you have to push it, if it is not there?

Trade for living, don’t live for trading.

This is why we have selected trading as our career. Because it gives us that freedom to go out on Tuesday afternoon and spend 3 hours with your kinds in the park when there is nothing interesting happening, or when you are already in a trade and you just need to wait. Have you forgotten? We didn’t sign up so we can spend 20 hours a day in front of the monitor. We want free time and consistent profits. The more of both we can get, the better. Why chain yourself?

I hope you have enjoyed these tips and cogitations of mine. I also hope that you will really think about each and every one of them before you hit the Sell/Buy button next time.

Yours,

Vladimir