Global markets made a shaky start to the second quarter of 2023 as OPEC+’s surprise plan to cut oil production revived concerns of elevated inflation and pushed traders to prune their wagers on a dovish tilt by the Federal Reserve.

Crude-oil futures advanced 6.6%, the most in almost a year, after the oil cartel announced an output reduction of more than 1 million barrels per day. Treasuries fell across the curve, with the policy-sensitive two-year yield jumping 7 basis points. Energy stocks rallied in Europe as well as in the US premarket session. The broader equity markets, however, were muted with the European benchmark little changed and US index futures mostly lower.

Monday’s market moves presented a contrast to a consensus view that drove up asset prices at the end of the first quarter, when Treasuries and stocks rallied amid expectations the banking turmoil in rich nations will encourage the Fed to pause interest-rate hikes and opt for a cut later this year. Those bets were now being revised: Money markets raised the probability of a quarter-point interest-rate hike in May to 65% from 55% seen earlier.

“The impact of this will feed into inflation data globally and means that inflation may take longer to return to target,” said Mark Dowding, the chief investment officer at BlueBay Asset Management. “This will mean that interest rates, once they peak, will need to stay at higher levels for longer.”

Brent crude posted the biggest gain since April 2022 while West Texas Intermediate advanced for the best day since May. The Organization of Petroleum Exporting Countries and allies including Russia pledged on Sunday to make the cuts from next month that will exceed 1 million barrels a day, with Saudi Arabia leading the way with 500,000 barrels.

A subgroup index of energy stocks in Europe jumped 4.4%, the most since November. BP Plc, Shell Plc and TotalEnergies SE, each of which rose at least 4.9%, contributed two-thirds of the gauge’s gains. Saudi stocks rallied for an eighth day Monday, the longest streak of gains since January 2022. In New York premarket trading, Marathon Oil rallied 7.6%, while APA Corp. and Halliburton Co. jumped more than 6.8% each.

Outside of the energy sector, however, the equity-market sentiment was muted. Europe’s Stoxx 600 index was little changed as 16 0f its 20 subgroups posted losses. Futures on the S&P 500 Index were down 0.2%, while Nasdaq 100 futures fell 0.8%. The S&P 500 had jumped 3.5% last week, the most since November, while the tech-heavy Nasdaq gauge notched its biggest quarterly gain since June 2020.

“We’re now probably about to enter a very short-term down leg again,” Paul Gambles, MBMG Group co-founder and managing partner, said on Bloomberg Television. “We’ve had a year of pretty irresponsible policy guides and all the damage that they’ve done is now starting to show up.”

Treasury yields rose across the curve, with UK and German government bonds joining the selloff. The dollar was little changed. The Japanese yen weakened as data showed confidence among the nation’s large manufacturers has worsened, adding to the case for the central bank to maintain ultra-easy monetary settings a while longer.

Gold edged higher, while the Swiss franc weakened against both the dollar and euro. In the alternatives universe, Bitcoin erased losses, holding above $28,000 apiece.

Key events this week:

- Eurozone S&P Global Eurozone Manufacturing PMI, Monday

- US construction spending, ISM manufacturing, light vehicle sales, Monday

- Eurozone PPI, Tuesday

- US factory orders, US durable goods, Tuesday

- Australia rate decision, Tuesday

- Cleveland Fed President Loretta Mester speaks, Tuesday

- Eurozone S&P Global Eurozone Services PMI, Wednesday

- US trade, Wednesday

- UBS annual general meeting, Wednesday

- US initial jobless claims, Thursday

- St. Louis Fed President James Bullard speaks, Thursday

- US unemployment, nonfarm payrolls, Friday

- Good Friday. US stock markets closed, bond markets close for part of the day

Some of the main moves in markets:

Stocks

- S&P 500 futures fell 0.2% as of 8:12 a.m. New York time

- Nasdaq 100 futures fell 0.8%

- Futures on the Dow Jones Industrial Average rose 0.3%

- The Stoxx Europe 600 was little changed

- The MSCI World index was little changed

Currencies

- The Bloomberg Dollar Spot Index fell 0.1%

- The euro rose 0.3% to $1.0868

- The British pound rose 0.4% to $1.2381

- The Japanese yen fell 0.1% to 133.02 per dollar

Cryptocurrencies

- Bitcoin rose 0.6% to $28,244.98

- Ether rose 1% to $1,807.46

Bonds

- The yield on 10-year Treasuries advanced four basis points to 3.51%

- Germany’s 10-year yield advanced three basis points to 2.32%

- Britain’s 10-year yield advanced three basis points to 3.52%

Commodities

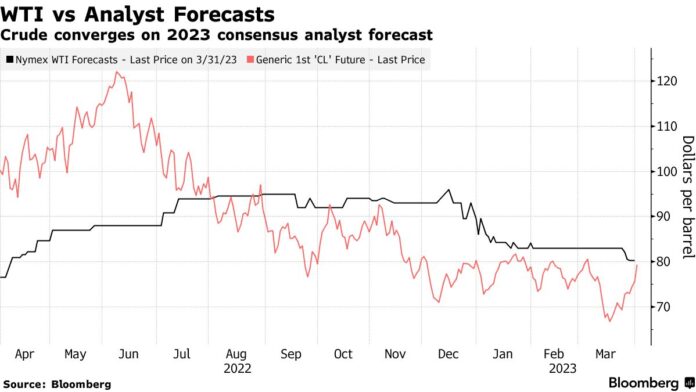

- West Texas Intermediate crude rose 6.4% to $80.55 a barrel

- Gold futures rose 0.4% to $1,994.10 an ounce