RSI is one of the most common trading indicators among traders and this is for a reason.

Due to its popularity and vast amount of users, the indicator has made its way to become one of the default indicators that you get in your trading platform and that applies to probably all of the platforms that you will find out there.

It is very simple to use, extremely easy to understand how it works and if used correctly you will be amazed what a good job it does. Let’s begin.

INTRODUCTION TO RSI

The relative strength index was developed by J. Welles Wilder and published in a 1978 book, New Concepts in Technical Trading Systems, and in Commodities magazine (now Futures magazine) in the June 1978 issue. It has become one of the most popular oscillator indices.

WHAT IS THE RSI INDICATOR?

The relative strength index (RSI) is a technical indicator used in the analysis of financial markets. It is intended to chart the current and historical strength or weakness of a stock or market based on the closing prices of a recent trading period. The indicator should not be confused with relative strength.

The RSI is classified as a momentum oscillator, measuring the velocity and magnitude of directional price movements. Momentum is the rate of the rise or fall in price.

The RSI computes momentum as the ratio of higher closes to lower closes: stocks which have had more or stronger positive changes have a higher RSI than stocks which have had more or stronger negative changes.

The RSI is most typically used on a 14-day time frame, measured on a scale from 0 to 100, with high and low levels marked at 70 and 30, respectively. Shorter or longer time frames are used for alternately shorter or longer outlooks. More extreme high and low levels—80 and 20, or 90 and 10—occur less frequently but indicate stronger momentum.

THE MATH BEHIND THE INDICATOR

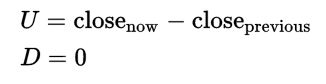

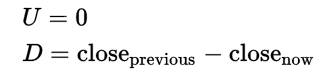

For each trading period an upward change U or downward change D is calculated. Up periods are characterized by the close being higher than the previous close:

Conversely, a down period is characterized by the close being lower than the previous period’s close (note that D is nonetheless a positive number),

If the last close is the same as the previous, both U and D are zero.

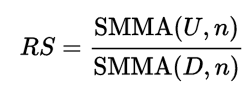

The average U and D are calculated using an n-period smoothed or modified moving average(SMMA or MMA) which is an exponentially smoothed Moving Average with α = 1/period.

Some commercial packages, like AIQ, use a standard exponential moving average (EMA) as the average instead of Wilder’s SMMA.

Wilder originally formulated the calculation of the moving average as: newval = (prevval * (period – 1) + newdata) / period.

This if fully equivalent to the aforementioned exponential smoothing.

New data is simply divided by period which is equal to the alpha calculated value of 1/period. Previous average values are modified by (period -1)/period which in effect is period/period – 1/period and finally 1 – 1/period which is 1 – alpha.

The ratio of these averages is the relative strength or relative strength factor:

If the average of D values is zero, then according to the equation, the RS value will approach infinity, so that the resulting RSI, as computed below, will approach 100.

The relative strength factor is then converted to a relative strength index between 0 and 100:

The smoothed moving averages should be appropriately initialized with a simple moving average using the first n values in the price series.

USING THE RSI INDICATOR

The RSI is presented on a graph above or below the price chart. The indicator has an upper line, typically at 70, a lower line at 30, and a dashed mid-line at 50. Wilder recommended a smoothing period of 14.

However my recommendation is to use 80 and 20 as your upper and lower levels when using the indicator to spot overbought and oversold situations.

Wilder positedthat when price moves up very rapidly, at some point it is considered overbought. Likewise, when price falls very rapidly, at some point it is considered oversold. In either case, Wilder deemed a reaction or reversal imminent.

The level of the RSI is a measure of the instrument’s recent trading strength. The slope of the RSI is directly proportional to the velocity of a change in the trend. The distance traveled by the RSI is proportional to the magnitude of the move.

Wilder believed that tops and bottoms are indicated when RSI goes above 70 or drops below 30.

Traditionally, RSI readings greater than the 70 level are considered to be in overbought territory, and RSI readings lower than the 30 level are considered to be in oversold territory.

In between the 30 and 70 level is considered neutral, with the 50 level a sign of no trend.

RSI AND DIVERGENCE

The indicator’s accuracy and reliability is further extended once there is a divergence between the price and the indicator.

Bearish divergence would suggest that the price is about to turn down while bullish divergence is a sign that the price will switch its direction to the upside.

Bullish divergence – price is making lower lows, RSI is creating higher lows.

Bearish divergence – price is making higher highs, RSI is making lower highs.

OVERBOUGHT AND OVERSOLD – WILDER’S WAY

One of the confirmations that Mr. Wilder was looking for is the false break of an oversold or overbought zone. For example, assume the RSI hits 76, pulls back to 72, then rises to 77. If it falls below 72, Wilder would consider this a “failure swing” above 70. The false break principle but applied to the indicator. Pretty cool right?

Same would go for the oversold zone. Let’s say price goes to 22, then 28, next it makes a new low at 20. Once it breaks above 22 we have a false break.

In the example below we see that bullish false break. The indicator created a low, then a lower low and at the end it failed to create lower values instead it pushed above the first one.

DRAWBACKS

Like any other indicator, RSI is not 100% reliable. If it was we would be all billionaires in a week. The main thing you need to look for when the indicator shows overbought or oversold zone. It is a time when the trend is strong and this move might continue trending rather than reverse right away.

Here is an example:

This is why using RSI on it’s own it is not a really good idea. You should apply other analysis to your trading before jumping into a trade.

RSI TRADING STRATEGY

The best strategy for RSI is the one that you feel comfortable with but most of all – you make money! There are many interpretations of how to use this indicator as explained above. Me personally, I use it two ways – to confirm overbought/oversold conditions on the chart as divergence indicator.

Once the price is above 80 or below 20 I would start looking for divergence in the opposite direction expecting the market to at least correct itself.

That could be done on the same time frame or on lower time frames. Here is an example:

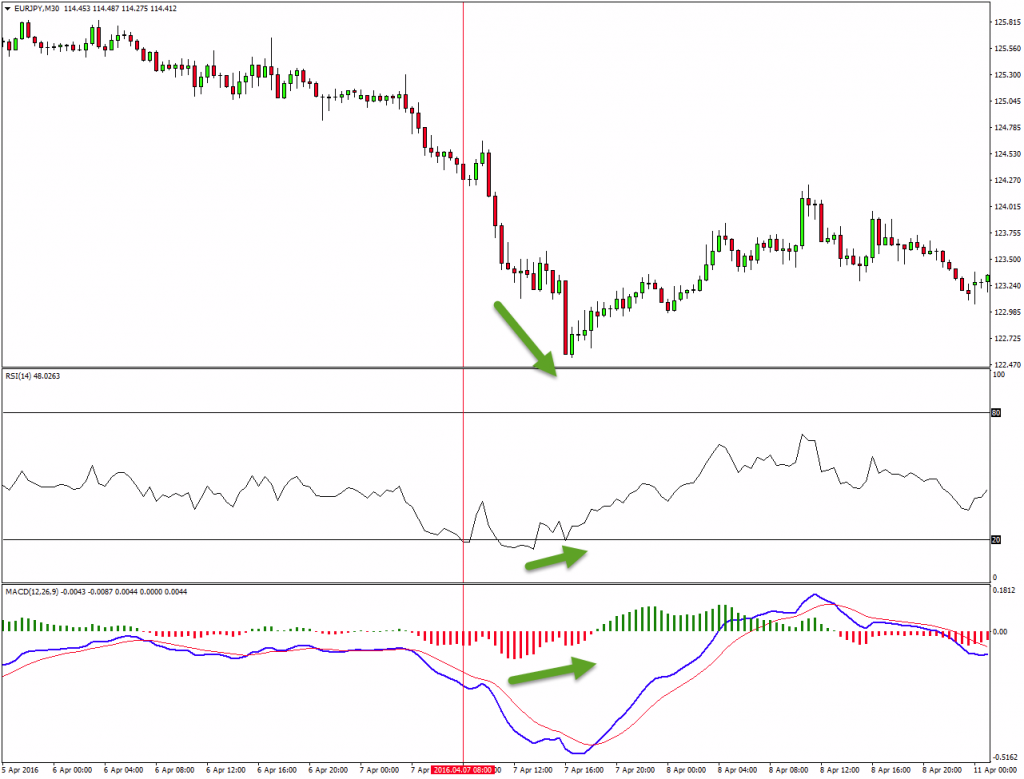

Step 1. Find overbought/oversold zone on the higher time frame. I use H4 chart in this example. The bar that I have marked with the vertical line closed at RSI 14 (below 20).

Step 2. Drop 1 or 2 time frames lower and look for bullish divergence to form.

In this case the divergence was well seen on the M30 chart. RSI and MACD histogram confirm the same bullish pressure. As an extra confirmation there is a marubozu candlestick pattern which is very rare and quite reliable. If you would like to learn some of the most reliable and accurate candlesticks patterns check out the 3 articles: Article 1, Article 2, Article 3.

In this situation our entry would be the green candle close which comes right after the marubozu candle. Stop loss would be placed below the low and target should be divided in two parts.

First target near the first resistance zone you see on the chart. Second target could be closed one an opposite divergence forms against you.

Of course you can modify the idea and make it suit your needs. If you are a part time trader you might use this strategy on the W1 / D1 chart together with the H4/H1 time frames for your entries. For the targets you can always apply your knowledge from the Fibonacci retracement methods.

I would love to hear about your experience with RSI. What’s your best way to use it? What do you think is good/bad about it? What to look for?

Thanks for your inputs in advance!

Yours,

Vladimir

Sources: en.wikipedia.org

God bless you brother for this awesome and great gift

You are very welcome

Thank you very much for your feedback

উ য

Thank you Vladimir, it was awesome explanation.

Thank you Benny!

Thanks

Very welcome

Could see an ultimate guide here really