Watch the webinar of How To Trade Against The Trend – REVERSAL TRADING STRATEGY

Hi Traders! In this article, I would like to show you how to trade against the trend (Reversal Trading Strategy). We all have heard that “The Trend is your friend” but at some point, the trend ends. With the right technique and understanding of what a reversal is, you will be able to spot the opportunities that will provide you a high probability of success, and a high accuracy level in reversal trading strategy.

Reversal Strategies

Reversal strategies have a somewhat bad reputation and that’s understandable, given the fact you are trying to catch Tops or Bottoms. Statistically, the majority of the traders lose, even when they try to trade with the trend, left alone reversal trading. However, in order to deny something, I advise you to, first of all, learn as much as possible on the subject, test as much as possible and then make your own conclusions. Needless to say – any testing should be done in a controlled environment which in our case is Demo Account (virtual money).

Let’s try to answer the following questions:

So why is reversal trading so difficult for some?

How to know where the trend ends?

How to trade reversals with high accuracy?

Truth is, you should be more careful and more PATIENT! If you know what you are doing and how you are doing though, you can turn the odds in your favor and I didn’t even start on the potential risk-reward ratios that you can get from such trades.

Example

To present this strategy in action I will take an example that we discussed and traded in my trading club on GBPUSD.

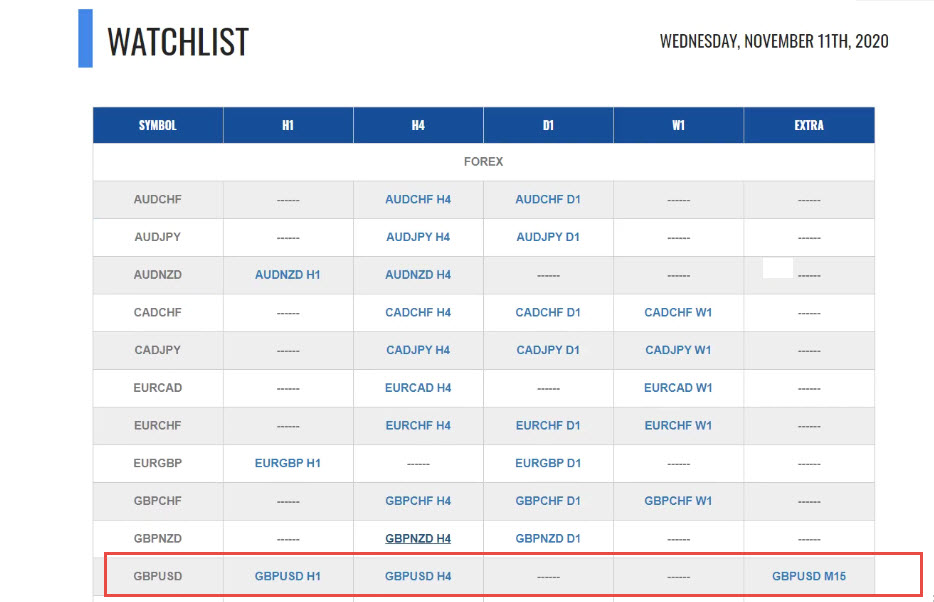

On the table below you can see my trading watch list. This list is all the trading opportunities I share with my followers on daily basis, in Traders Academy Club (you can join us here)

Looking at the H4 chart, we could see that the trend here is bullish, as we can see the price has created three higher highs, higher lows pattern which represents a bullish trend (it’s not a long term bullish trend, but this is what we have been facing for one and a half months).

So basically a question will arise here, if the trend is your friend why would we look to sell here, shouldn’t we look to join the trend?

The answer here is at some point the trend ends and at some point, a new trend begins, and it begins with a reversal. And there is one important thing that you have to understand when you are spotting reversals, at that very moment of that spot you will have no clue whether a new trend will develop or not. Most traders just fill themselves with wishes and fantasies, they catch a level, and they convince themselves that now it’s going to crash (especially if you follow some forums you will see some dramatic lines like 1000 pips move is about to come). The truth is, for most of the time the market doesn’t make such dramatic changes. For a trend to change it has way more to do than just follow some specific line that we draw. So every reversal starts at some point and I want you to remember that it might be a beginning of a new trend, or it might be just a correction before the continuation of the following trend as shown in the screenshot below.

How to Trade The Reversal?

There are five important steps involved in trading the reversal which is as follows:

Step 1 – STRONG LEVELS

First of all spot for a strong level, if you are looking for reversal or any reaction, the first thing that you should start with is the level. The ABC of trading, buy right above the support and sell right below the resistance. You should not expect market reactions and reversals from zones with no support or resistance. In this case on the GBPUSD chart, we have a psychological round number 1.33 level which has rejected the price, so based on this we have found a rejection zone here. This is a good area because this is the first level to pay attention to. (I also use the Fibonacci extension tool to find the key resistance/support levels and see where they are synchronized).

Note: If you want to learn about support and resistance you can find it here

Step 2 – MACD + RSI Divergence

Then the next thing that we notice here is the bearish divergence on both MACD and RSI indicators. I love RSI and MACD indicators. One of the reasons I love them so much is the way they show divergences. A divergence is in the core of the reversal strategy. Make sure you master divergences before you even consider trading reversal strategies.

Note: If you want to learn more in-depth insights about divergences, you can benefit greatly from the videos on my channel here while also embarking upon Divergence University for comprehensive divergence education.

Step 3 – MULTI TIME FRAME SUPPORT (ANALYSIS)

The way I always work is by using multi-timeframe analysis. If you are trading the H1 chart, and you start seeing reversal signs on the H1 chart alone, you might be in front of correction alone but not a real trend reversal. How do you know that (or should we say how do you make an educated guess with a high success rate) – simple: you look at the higher time frames. If the D1 chart is super bullish, doesn’t show any signs of reversal, why do you expect the H1 chart will signal a major trend reversal? Only once, two or three of the timeframes that you are working with, start showing the same thing, and this is when we are ready to look for the reversals.

So now we go to one timeframe lower which would be the H1 chart here. While looking at the H1 chart we could see on the wave shown in the screenshot below which is developing, we have a massive bearish divergence. And we can also see that each wave is getting smaller. This is a good sign which verifies that the price on the H4 chart has really reached some significant zone.

Then I pay attention to the fake spikes around the area shown in the screenshot below which we may consider as another sign favoring the bears, and this provides us the opportunity. From this moment what I will be looking for is my possible entries and I move down to the next lower timeframe to find the best opportunities to enter the trade.

Step 4 – Reversal Patterns

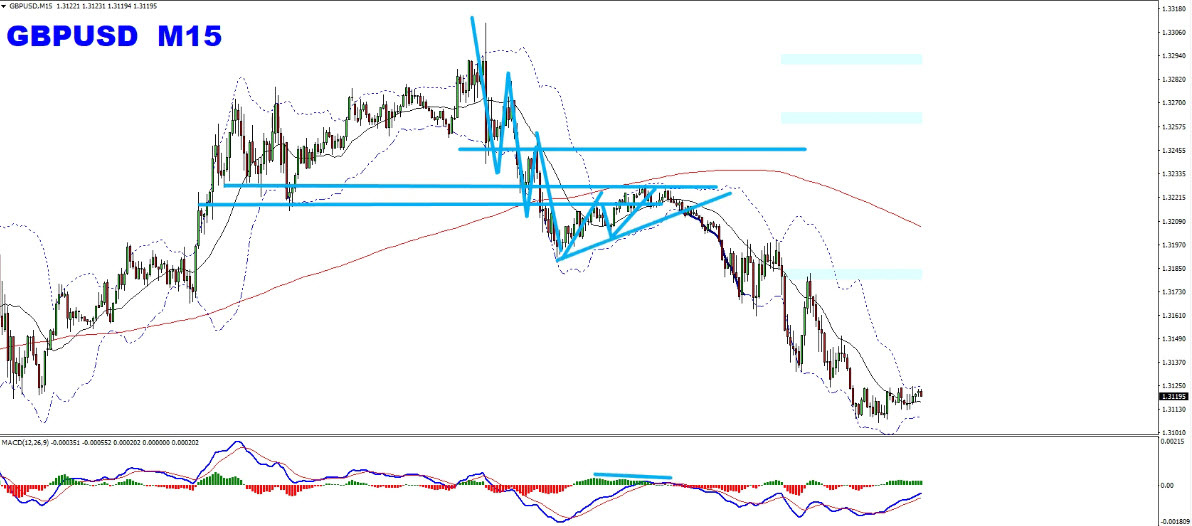

Moving down to the M15 chart (the third lower timeframe in my multi-time frame analysis) we could see that the price has created a series of lower highs, lower lows in the bearish direction. The main factor is that, this has happened in the opposite direction of the major trend. So we may consider these three lower highs, lower lows as evidence of bearish pressure and may look to sell pullbacks with more bearish evidences (bearish evidences could be in the form of candle stick patterns, false breaks, trend line breakout etc… supporting the bearish view.) this is because the more confirmations we have, the better. Using reversal patterns based on price action alone is a fantastic way to confirm your trades. Think about this – there are traders who rely on patterns alone to make a living, and in this case, we are using patterns as confirmation only! This is how you increase the accuracy of your trading strategy or method!

Step 5 – Specific Levels And Good Risk Reward Ratio

The next step here is to mark the specific levels and join the possible opportunities. This is how it worked out in this example. After the bearish trend pattern on the M15 chart, we were looking for pullbacks and then sells. The pullback happened in the form of an ABCD pattern, right back to the rejection zone shown in the screenshot below, we had a continuing bearish divergence and then the price moved lower and broke below the most recent uptrend line, we may consider these as evidences of bearish pressure. And at this moment we are good to enter the trade. Normally when you spot such an opportunity you would have a small risk and pretty deep reward as it all starts from the higher timeframe, thanks to the multi-timeframe analysis.

Conclusion

So traders, this is how I personally trade against the trend. Keep in mind that a reversal is not necessarily the beginning of a major trend, it could just be a correction to the existing trend. You can never predict in advance how big it will be, what you have to follow is the way the market develops, you should pay attention to the opposite movements and evidences. So the prediction game won’t work here, and we need to follow the facts provided by the market and take actions accordingly. Reversal strategies are very attractive because you are able to join at the very beginning of a new trend. If you learn how to manage your positions properly, a single trade that lasts a few weeks can make enough for you to reach your yearly goal. Since the high risk-reward ratio is in play when it comes to reversals, we can trade with tiny risk. Trust me from a psychological point of view this is a huge help.

These are some of the specific rules for reversals there are various other rules and strategies, to learn them I invite you to join me in my Traders Academy Club. You can also enjoy from our Live Market Analysis and our trading reports on a daily basis and improve your trading with us.

Also, you can get one of my strategies free of charge. You will find all the details here

Thank you for your time in reading this article.

Yours to success,

Vladimir Ribakov

Certified Financial Technician

Thank you