Hello traders! I’m Vladimir Ribakov from the Home Trader Club, and I’m excited to present this week’s Forex Weekly Forecast for July 7-11, 2025. As always, a big thanks to Eight Cap for supporting our trading community. With Eight Cap, you can enjoy exclusive access to the Home Trader Club, full access to all our trading tools, semi-automated systems, and even private mentoring sessions with me. Check out the link in the description below for more details.

For more details, visit: Home Trader Club Mentorship Program

? Watch the Full Weekly Forecast Video

Click the link below to watch the forecast video on YouTube

Don’t forget to Like, Comment, and Subscribe for more weekly plans and real-time insights.

Explore My Free Mentorship Program

As an Internationally Certified Financial Technician (CFTe, IFTA) and former private capital hedge fund trader, I have successfully mentored numerous students who are now thriving in the trading world. Students who learned with me, are now full-time traders, work in the trading industry, run their own capital firms or are fully funded traders by private companies, develop automated trading solutions and manage others’ capitals. I am a very proud mentor and I am proud of the success stories I’ve helped create, and for a limited time, I’m offering my mentorship program for free through a partnership with Eight Cap broker. Join Eight Cap, become an active trader, and choose the offer that suits you best –

For more details, visit: Home Trader Club Mentorship Program

I’m excited to work with you and help you reach your desired level of success!

Let’s dive into the charts and explore this week’s trade setups for EUR/USD, GBP/USD, USD/JPY, and Gold (XAU/USD).

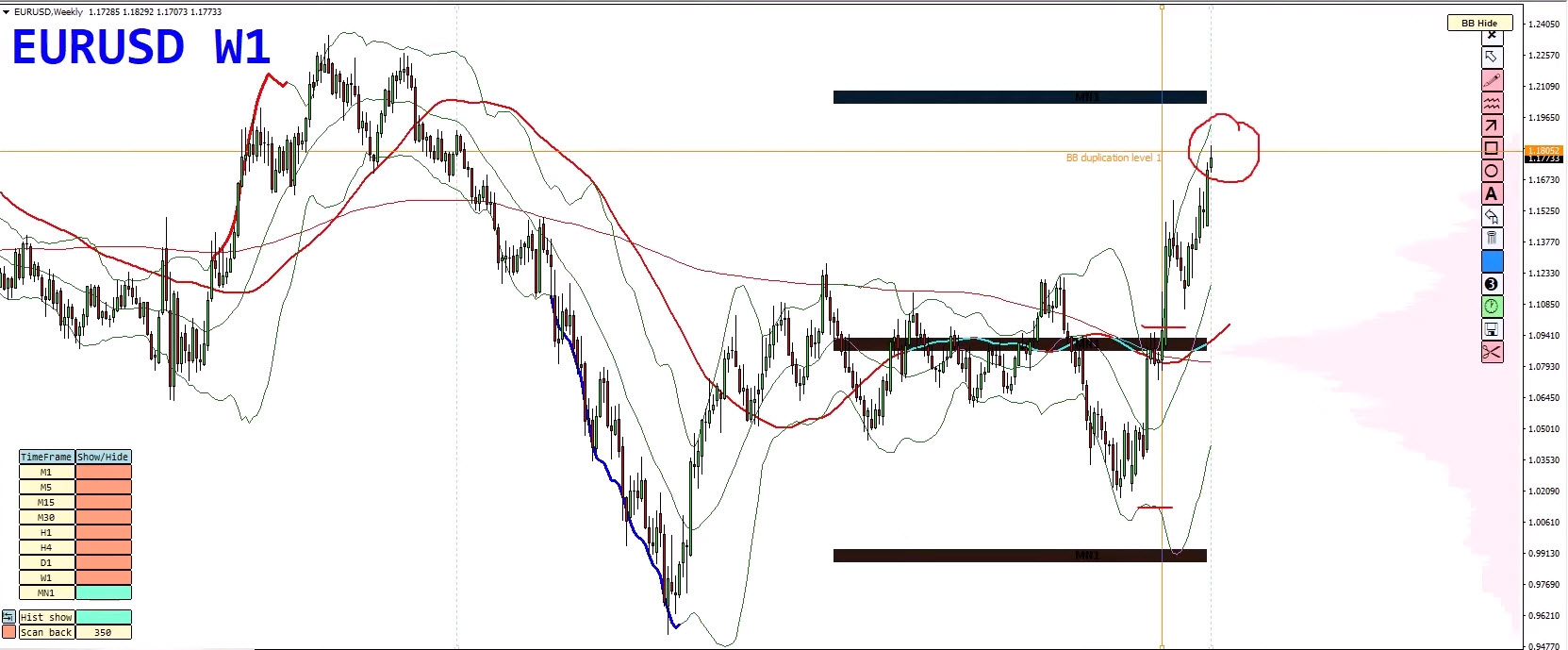

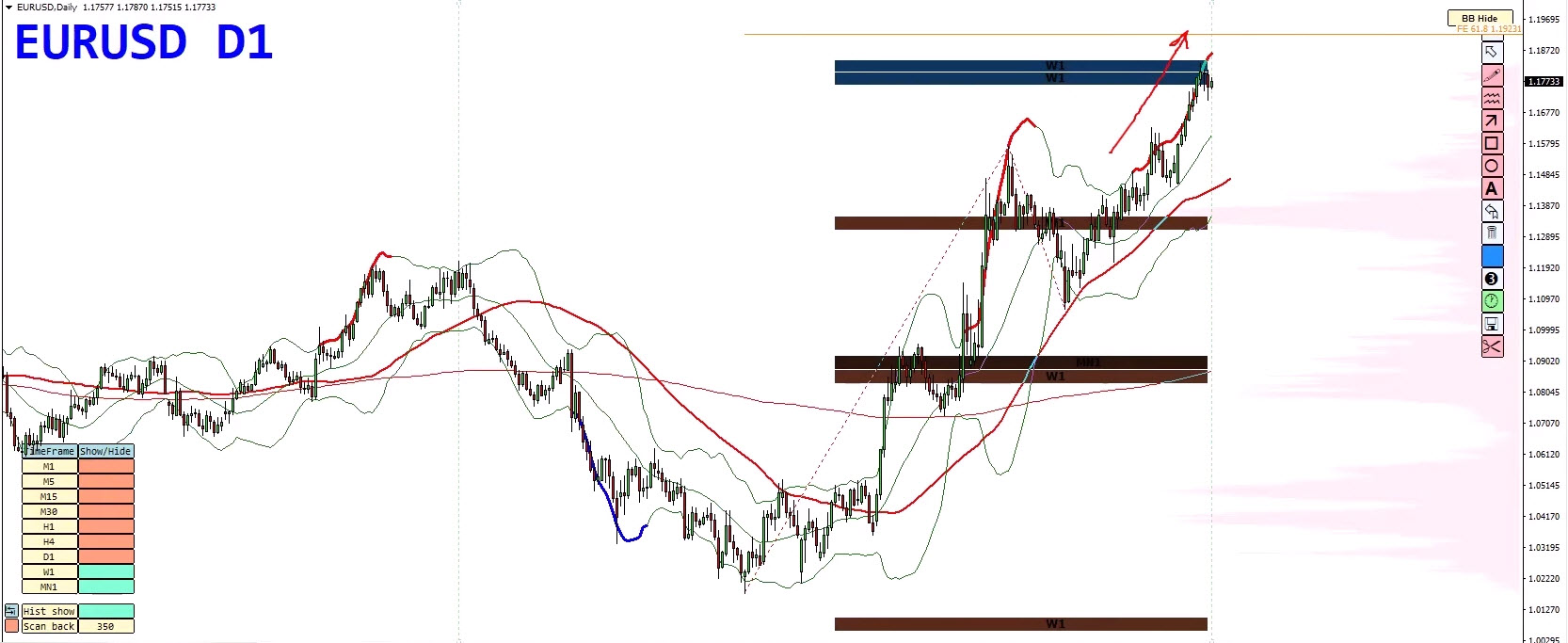

EUR/USD Forecast

Last week, we anticipated fake peaks before a reversal, and EUR/USD has been respecting that structure with a first attempt at a false breakout. I believe EUR/USD is nearing its peak. Here’s why:

- Weekly chart shows strong resistance at the 1.18–1.20 zone (broken support turned resistance).

- Bollinger Band duplication marks this as a high-pressure area.

- Daily chart shows a 61.8% Fibonacci extension and overriding upper Bollinger Band.

- Both MACD and RSI form bearish divergence.

These signs suggest a correction is due. I anticipate a drop to 1.16, 1.14, or possibly 1.11.

4H Scenarios:

- One more fake high followed by bearish divergence and reversal.

2. Formation of a zigzag or range before breakdown.

Market Snapshot:

- 1M: +3%

- 7D: +1%

- 24H: Shrinking momentum

Bias: Nearing peak → Looking to sell the rallies

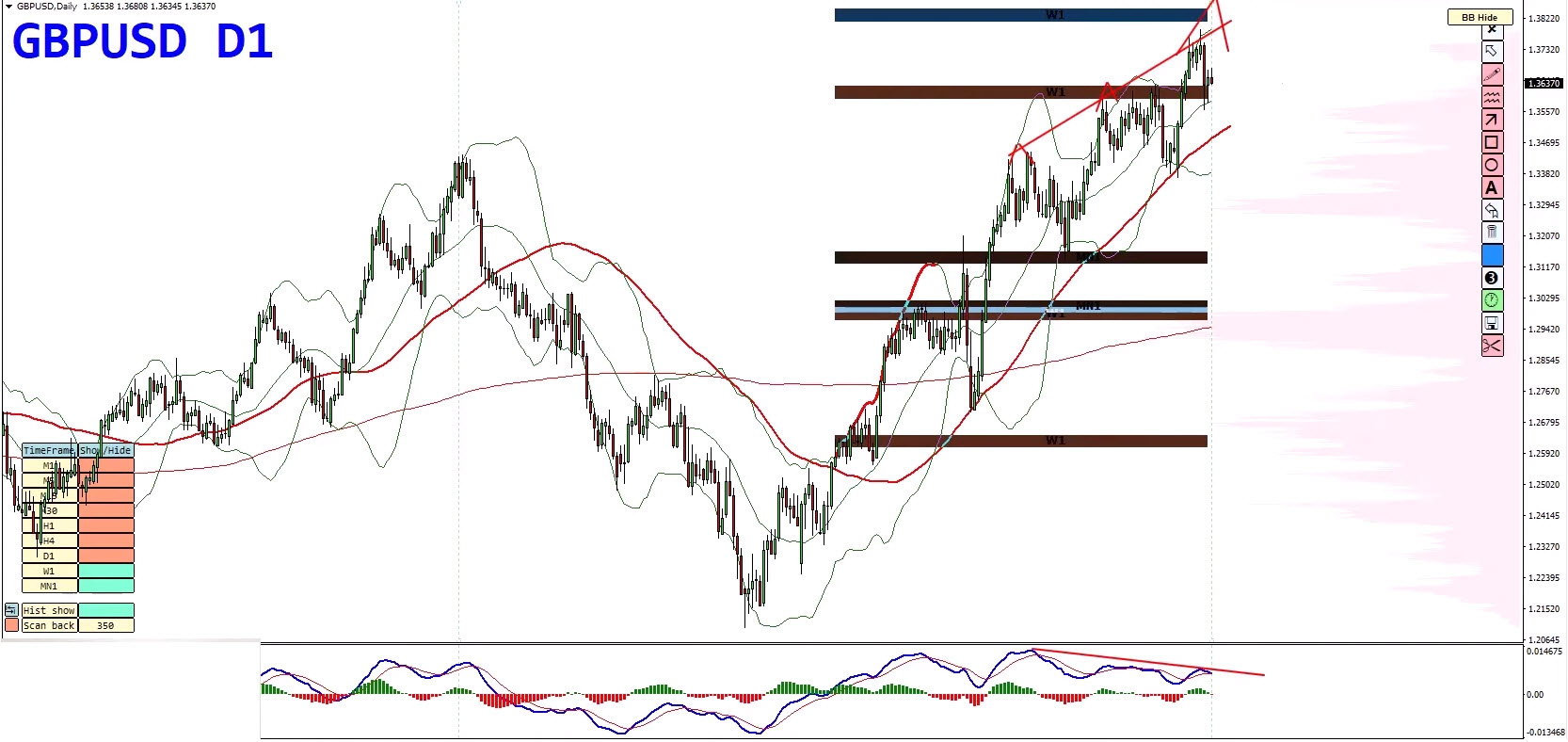

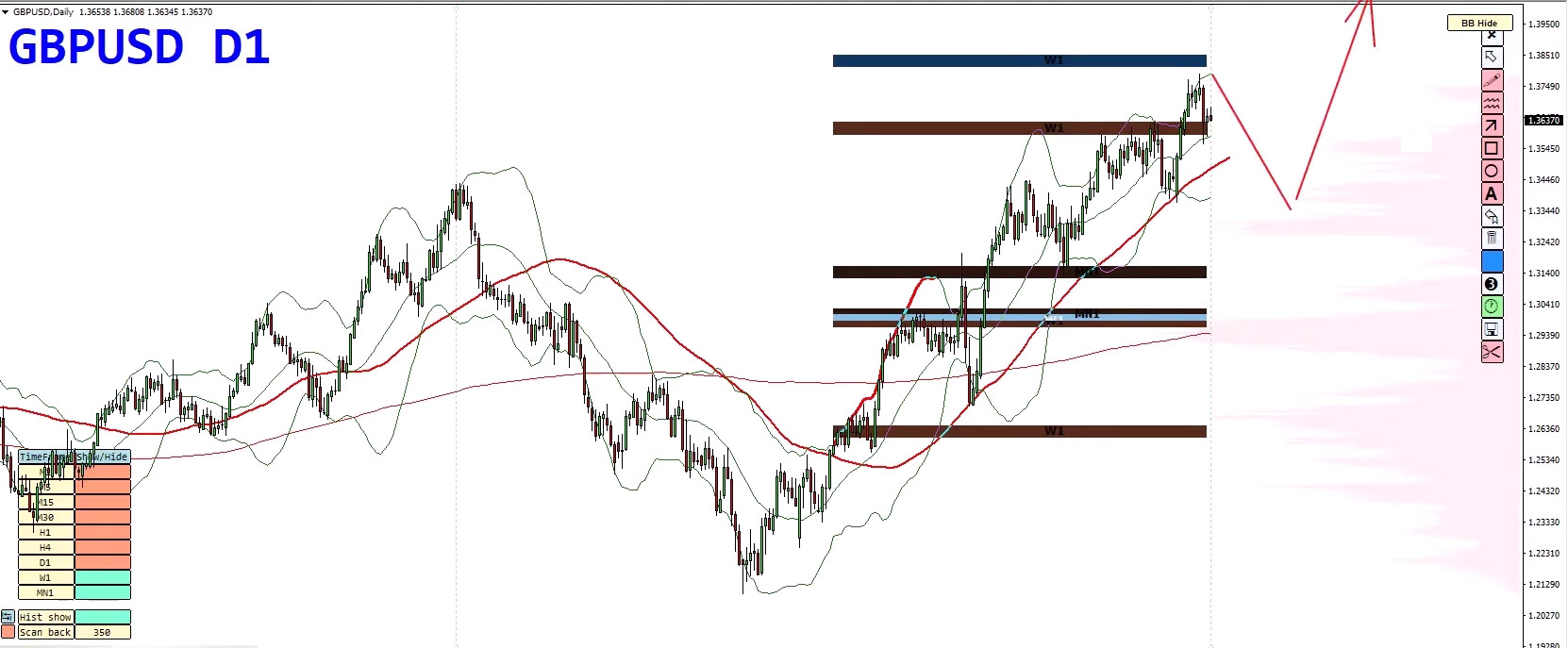

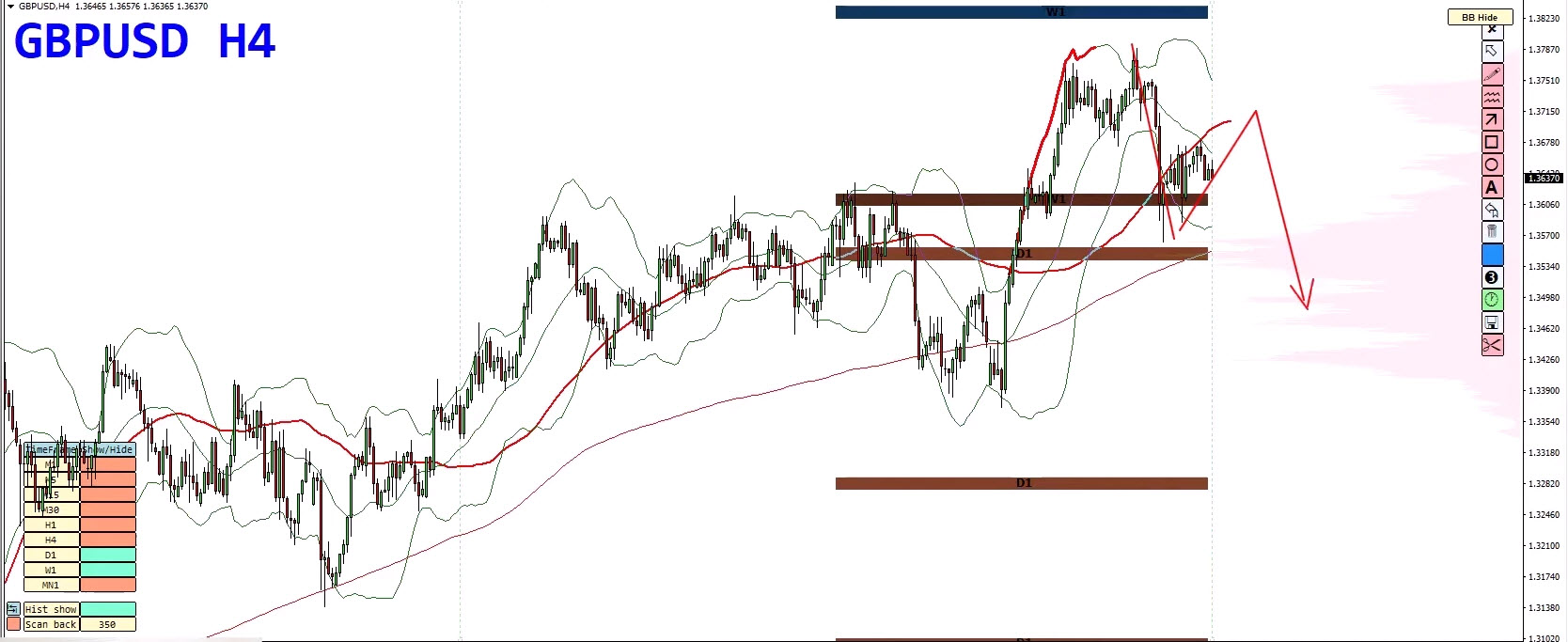

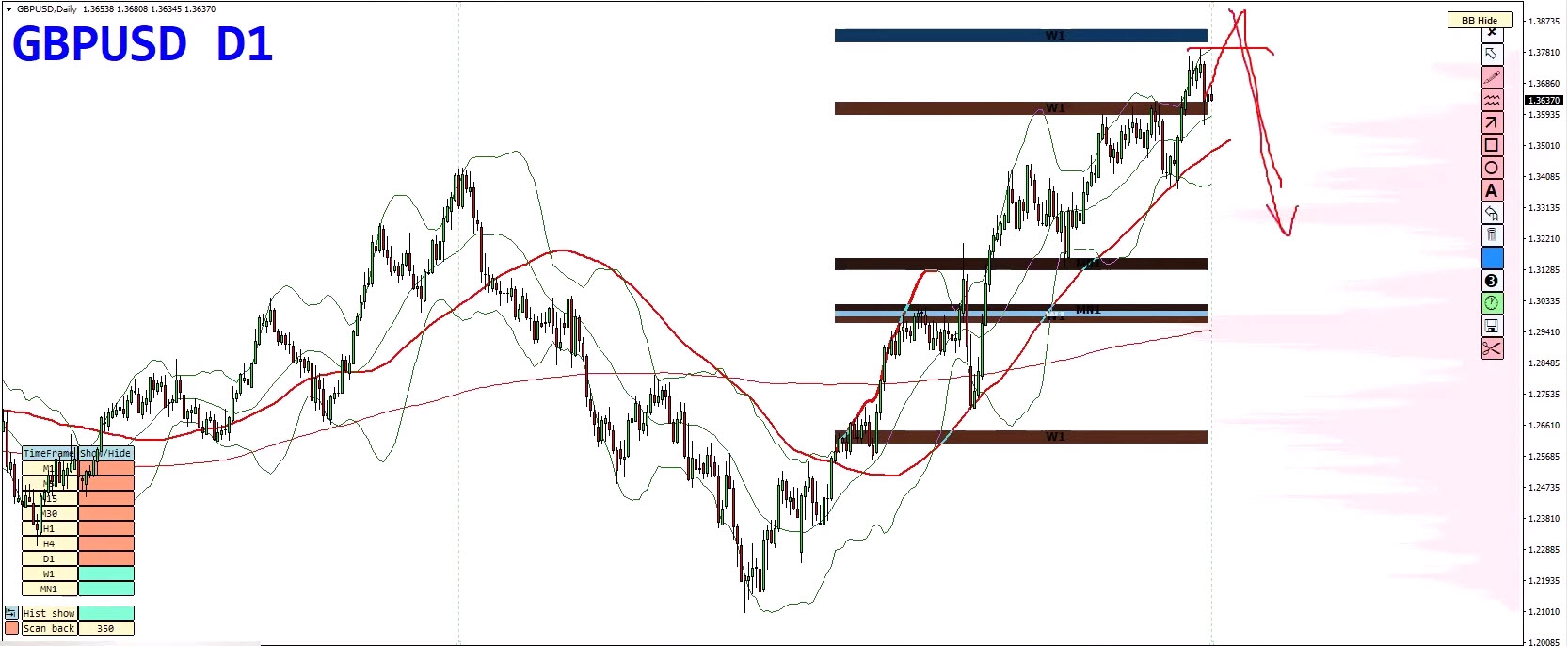

GBP/USD Forecast

The Pound delivered a textbook false breakout last week, validating our bearish divergence expectations.

Key points:

- At strong weekly resistance with Bollinger Band duplication pressure.

- Daily chart shows a peak with bearish divergence around 1.3750.

- Long-term trend remains bullish, but short-term corrections are likely.

What to expect:

- Potential second wave down (ABCD correction or zigzag).

- As long as 1.3785 holds, I’m looking to sell short-term rallies.

Even if the price creates a new high I would eventually expect a deeper correction to happen and I would expect the price to go lower to 1.34 to 1.32 area before the next buys would take control.

Market Snapshot:

- 1M: +0.9%

- 7D: +0.18%

- 24H: Flat

Bias: Correction mode → Sell rallies short-term, Buy dips long-term

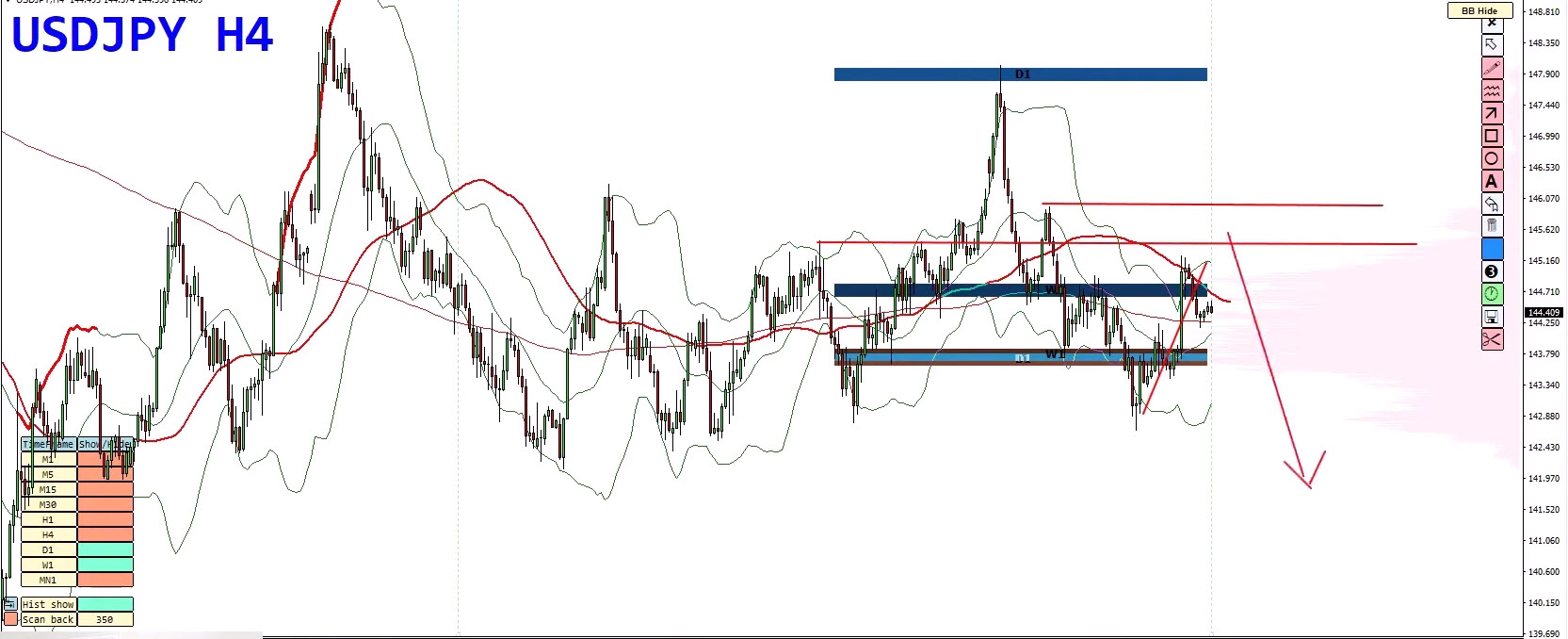

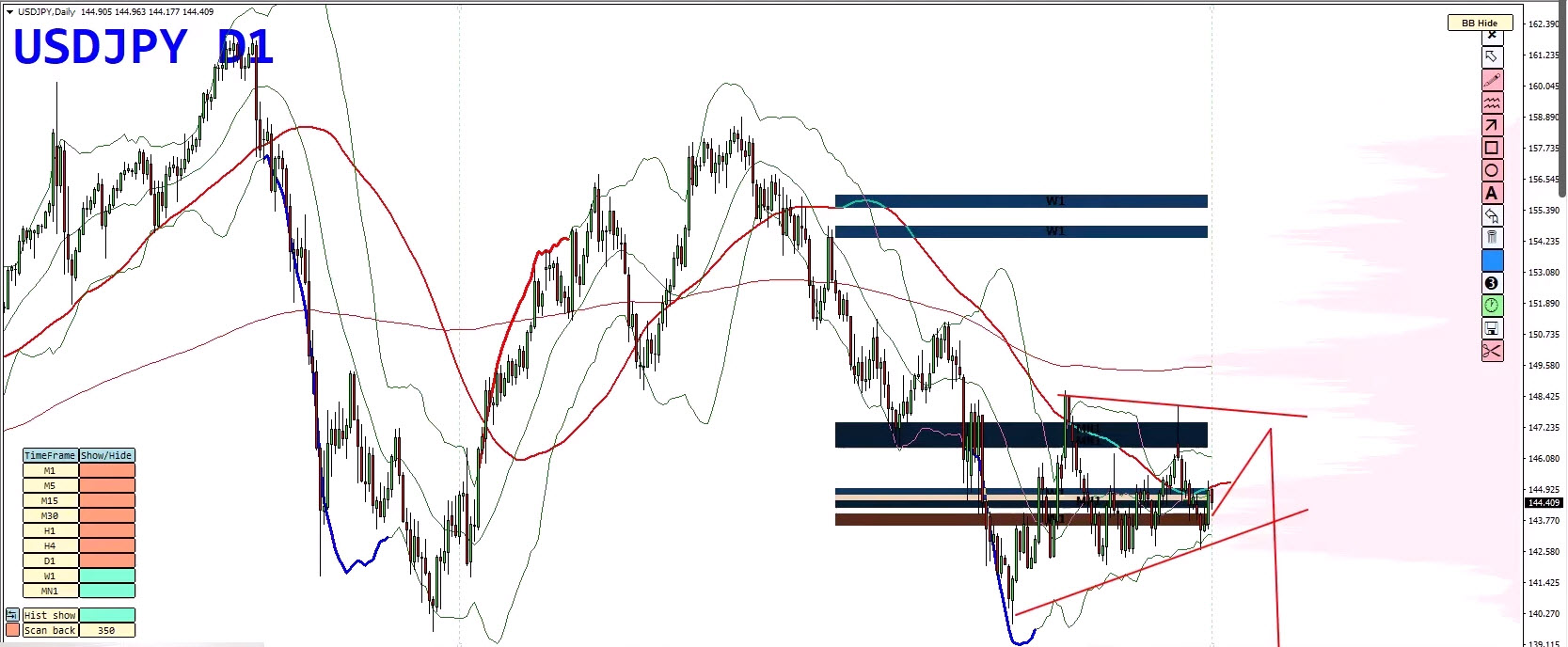

USD/JPY Forecast

Last week, we identified a trendline break that would trigger sell-the-rally setups. That has occurred, followed by a retracement.

- Resistance zones are holding.

- No significant break above previous peaks.

- Consolidation suggests potential for a drop to complete second leg of bearish cycle.

Scenarios:

- Extended consolidation before breakdown.

- Retest of recent highs, then bearish continuation.

Market Snapshot:

- 1M: Neutral

- 7D & 24H: Entering negative territory

Bias: Bearish → Continue to sell rallies

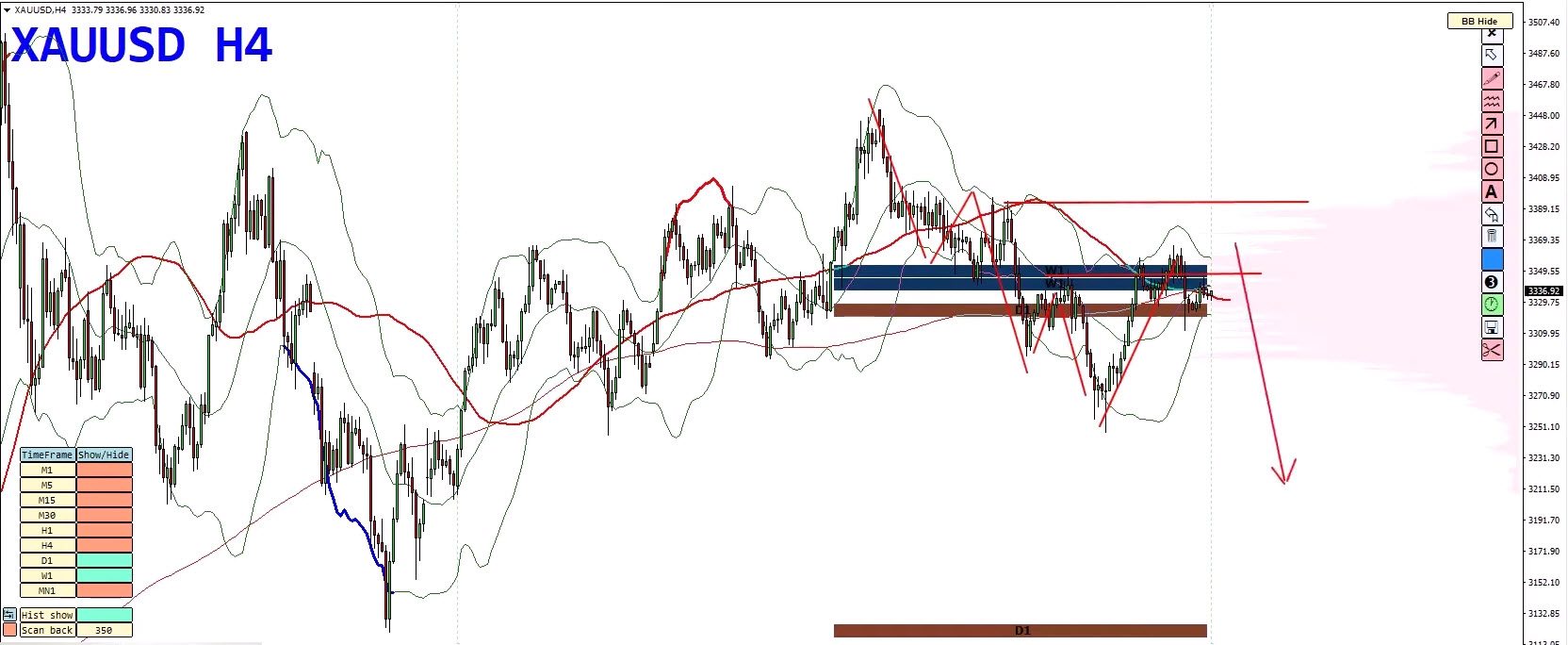

Gold (XAU/USD) Forecast

Gold hasn’t moved much recently, which raises flags. When gold fails to gain downside momentum, it could mean another rally attempt is brewing before the major reversal.

Short-Term Bearish View:

- Sequence of lower highs/lows still valid.

- As long as 3340–3395 zone holds, look for sell opportunities.

Alternate Scenario:

- Gold attempts one more fake breakout to complete weekly divergence before dropping.

Bias: Cautiously Bearish → Prefer to sell rallies while resistance holds

? Pro Trading Tip

Every forecast above is paired with two scenarios. Why? Because great trading is not about being right — it’s about being ready. Let the market confirm the bias. Use your system, manage risk, and execute only when the structure and confirmation align.

? Join the Home Trader Club

Want to access the tools, systems, and real-time education we use daily?

With Eight Cap Broker’s support, you can now enjoy up to one full year of access to the Home Trader Club — including:

-

All professional trading systems

-

Exclusive mentoring sessions

-

Real-time trade ideas and setups

-

Full access to our course library and trading marketplace

Wishing you a profitable week ahead!

Vladimir Ribakov

Internationally Certified Financial Technician

Home Trader Club