Hi Traders! GBPAUD and EURJPY forecast follow up is here. On April 2nd 2020 I shared this “EURJPY Short Term Forecast” and “GBPAUD Forecast And Technical Analysis” posts with you. In this post lets do a recap of these setups and see how it has developed now. If you would like to learn more about the way we trade and the technical analysis we use then check out the Traders Academy Club. Spoiler alert – free memberships are available!

GBPAUD

GBPAUD H4 Chart Analysis – Bullish Channel, Potential Bearish Divergence, Volumes Indicator

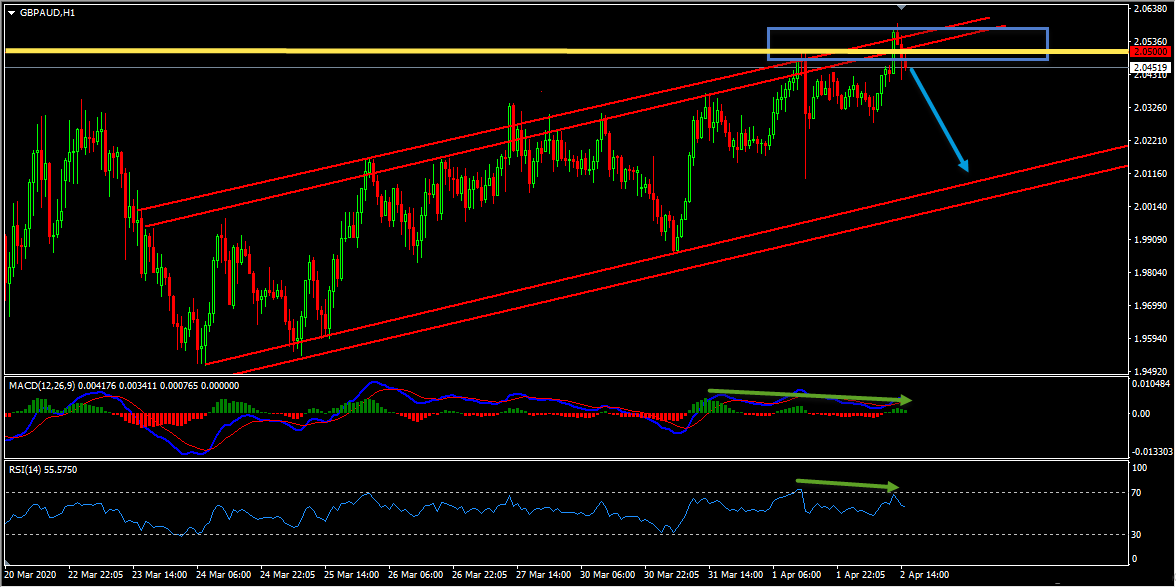

GBPAUD H1(1 Hour) Chart Analysis – Psychological Level, Important Resistance Zone, Bearish Divergence, RSI Indicator

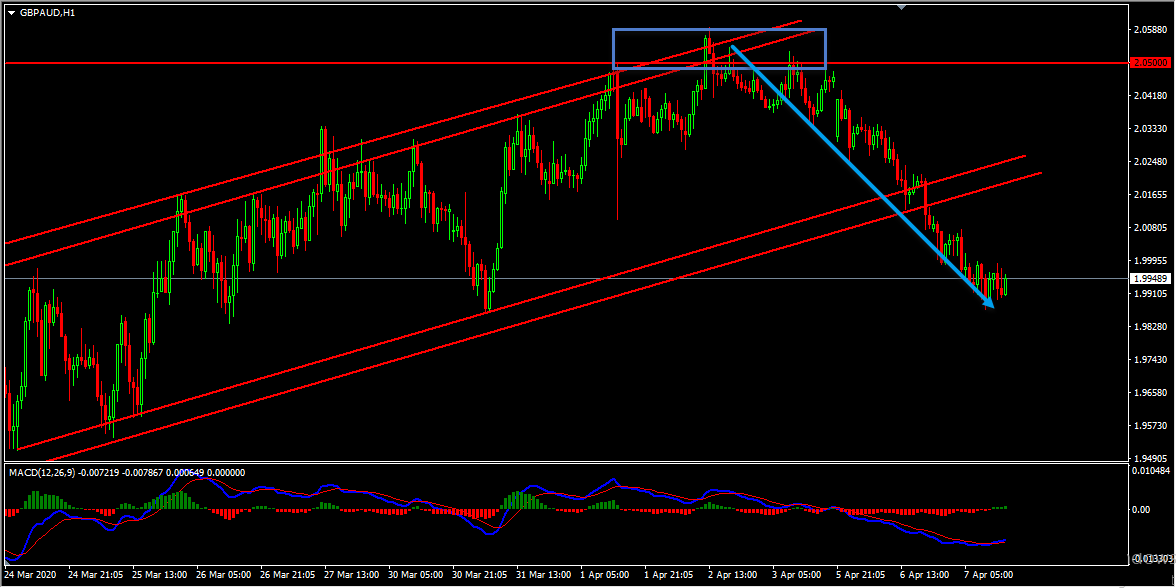

GBPAUD H1 Chart Current Scenario

Based on the above mentioned analysis my short term view was bearish here until the price respects the resistance zone. On the H1 chart the price respected the resistance zone and moved lower exactly as I expected. Currently the price has broken below the bottom of the channel and has moved lower further. We have collected fantastic profits with this trade!

EURJPY

EURJPY H4 (4 Hours) Chart Analysis – Bullish Channel Breakout, ADX Indicator, Heiken Ashi Candlesticks

In addition to this on the H4 chart, based on the Heikin Ashi candles we can see that currently we have strong bearish bodies in downward moving market conditions so it basically reflects a bearish environment, so until the condition changes my view remains bearish here.

EURJPY H1 (1 Hour) Chart Analysis – Heiken Ashi Candlesticks

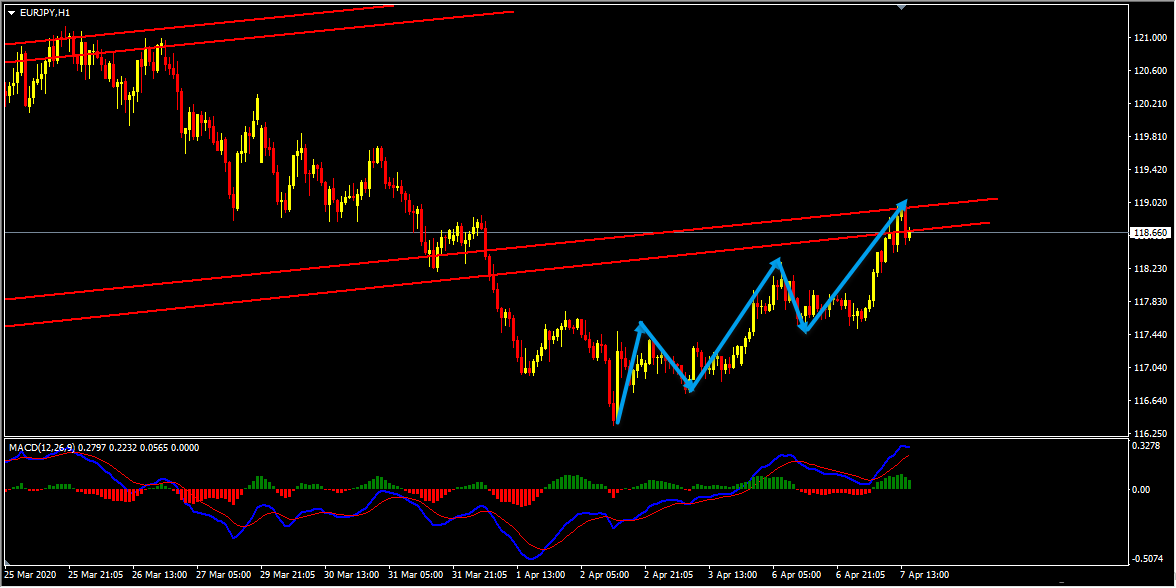

EURJPY H1 Chart Current Scenario

On the H1 chart the price moved higher and has currently reached the breakout zone but most importantly the price has created a bullish trend pattern thus invalidating my bearish view.

As traders we always have two choices, first one is to start and try to convince the market with many different variations like add positions or start to increase your lots, average down, etc… Or simply validate or invalidate your view, have alternative read, check again from the root of higher timeframe and make proper decisions according to the current market conditions. Always follow the facts, it doesn’t matter what view you had yesterday, what matters is what happens in the market today because the market is dynamic and it doesn’t necessarily have to agree with the way you see it. As long as the market follows my ideas and validates my setups I can trade and if it doesn’t switch, have a different read and turn around when required.

Watch my video on How to trade during Corona virus Crisis here

For similar trade ideas and much more join the Traders Academy Club and get access to our complete watch list and trade report.

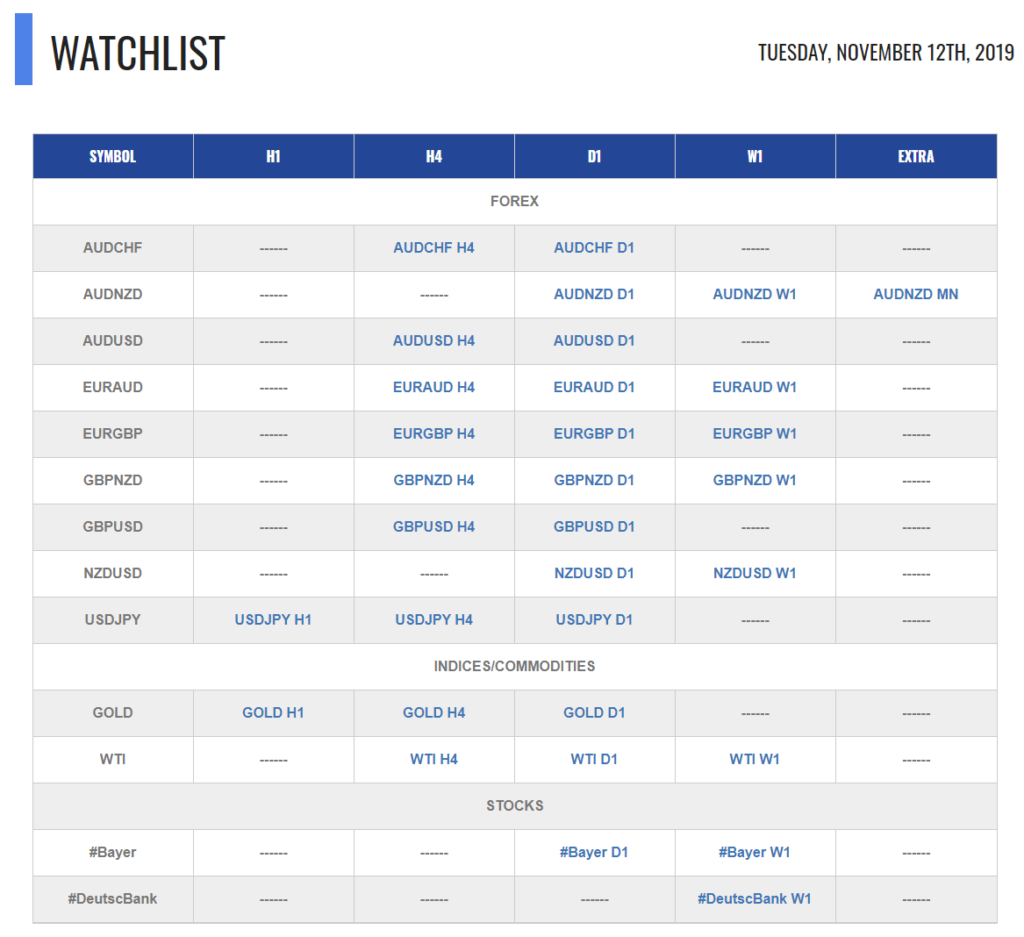

This is how the report looks like. A table with the hottest market opportunities, screenshot behind every pair and time frame (anything that is in blue inside the table is clickable and leads to a screenshot) + a summary in text format, kind of highlights. And of course Live Trading Room every single day.

If you have any further questions, don’t hesitate to drop a comment below!

To your success,

Vladimir Ribakov

Certified Financial Technician

your my hero and i follow you much more in your YouTube channel, I’m profitable because of the way you make analysis and i love it so much because it delivered the way you syncronys the market thanks,im preparing to subscribe to you traders academy club the following months

Thank you very much for your feedback sir

Looking forward seeing you with us