The GBPUSD pair has struggled in the recent times to hold the gains of last the few weeks. The pair has been trading lower after setting a short term peak above the 1.6800 level. Earlier, during this week, the pair fell below the 1.6460 level, where pair found some buyers and traded back above the 1.6500 level.

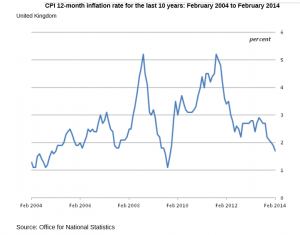

The UK inflation data was published by the National Statistics on Tuesday. The outcome was somehow mixed. The expectations were of stable readings, and the outcome was mostly in line with the forecast. The Consumer Prices Index (CPI) was up by 1.7% in the year to February 2014, down from 1.9% in January, and the Core CPI grew by 1.7% in the year to February 2014, up from 1.6% in January. The month-over-month CPI was also up by 0.5% in February.

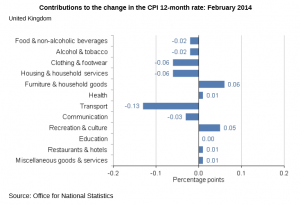

The report highlighted the reasons for the fall in CPI (YoY) from 1.9% to 1.7%. The main reason for fall in the Consumer Prices Index came from transport (principally motor fuels). Petrol prices fell by 0.8 pence per litre between January and February this year compared with a rise of 4.0 pence per litre between the same two months a year ago. Some of the other contributors were household services, clothing and footwear sectors. There were some sectors contributed in the rise, including furniture & household goods (climbed by 2.4% between January and February 2014 compared with a rise of 1.5% between the same two months a year earlier) and recreation & culture.

The UK retail price index data was also released. The report suggested that the RSI rate was down from 2.1% to 2.0% in February, and the 12-month rate for February 2014 stood at 2.7%. The RPI readings were mostly in line with the expectations, and showed no sign of caution.

The GBPUSD pair climbed a touch higher after the release. However, the up-move could not last long, as the pair found sellers again around the 1.6550/60 region and traded lower. Yesterday, the pair managed to pop higher from the 1.6520 support level, and traded as high as 1.6580 in the late US session. The pair stopped right around the down-move trend line, as can be seen in the 4 hour chart shown below. This trend line also coincides with the 55 moving average and previous swing high, which acted as a hurdle for the pair. However, later the pair popped a bit higher above the trend line. The double confluence zone of 100 and 200 moving averages at around 1.6620 is the next possible resistance zone for the pair, and sellers are expected to return around this zone. On the downside, the 1.6520 level remains the key for the pair.

Important events affecting GBPUSD

There are two important releases scheduled during the rest of the week in the UK, which could affect the GBPUSD pair.

UK Retail Sales data

UK GDP Figures

Both these events can have a huge impact on the pair, and might decide short term direction for the pair. The UK retail sales is slated to register a minor decline from the last outcome in January. So, if the reading surprise and improve more than expected, then we can see a jump up in GBPUSD pair. On the other hand, the pair might dive if the retail sales degrade further.

Similarly, UK GDP is slated to register 0.7% growth rate, down by 0.1%. If outcome comes out good, then this might also cause heavy movements in the pair.

So, keep an eye on all important events friends and trade accordingly.

Get my Daily Market forecast with trade opportunities HERE: Vladimir’s Markets Forecast

Happy Trading Friends!