The Euro traded higher during the start of this week, which was mainly due to the weakness in the US dollar. The main thing to note was the fact that the EURUSD pair managed to clear the 1.2400-20 resistance area, which later acted as a support for the pair. We need to see how long the pair can manage to hold the mentioned level and can it make it towards the 1.2550-1.2600 resistance zone.

There were a couple of important releases lined up during the London session yesterday, including the German CPI, French CPI and Portugal CPI. The outcome of the releases was mostly discouraging, which caused a minor downside in the EURUSD pair. However, the broken resistance area at 1.2420-00 acted as a support in that situation and protected the downside in the near term.

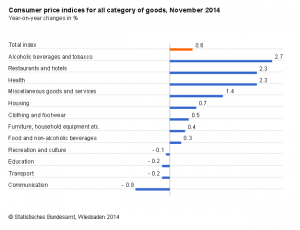

German CPI

The first important release during the London session yesterday in the Euro zone was the German consumer price index which was released by the Statistiches Bundesamt Deutschland. The market was expecting it to rise by 0.6% in November 2014, compared with November 2013. The end result was as expected as the German CPI came in at 0.6%, but was down one more time from the last time increase of 0.8%. The outcome was disappointing side and caused a downside reaction in the short term.

The EURUSD pair again came under pressure after the release and broadly tested the 1.2420 support area. There was a lot of buying interest seen around the mentioned level which protected the downside.

US Initial Jobless Claims

In the US, the Initial Jobless Claims were released by the US Department of Labor. The forecast was slated for a decline from the last reading of 297K to 295K in the week ending November 29, 2014. However, the outcome was better than expected, as the US initial jobless claims came in at 294K. The US continuing jobless claims were a bit disappointing as they came in at 2.514M.

Technically, the EURUSD pair has to clear the 1.2500 resistance area if it has to test the 1.2620 level. A convincing close above the same might be a bullish call for the Euro in the near term. On the downside, the 1.2400-20 might continue to act as a support for the pair.

So, keep an eye on all the important levels friends and trade accordingly.

Get my Daily Market forecast with trade opportunities HERE: http://vladblog.vforecast.hop.clickbank.net