Hi Traders! Oil short term forecast update and follow up is here. On September 30th I shared this “Oil Short Term Forecast” post in my blog. In this post, let’s do a recap of this setup and see how it has developed now. If you would like to learn more about the way we trade and the technical analysis we use then check out the Traders Academy Club. Spoiler alert – free memberships are available!

My Idea

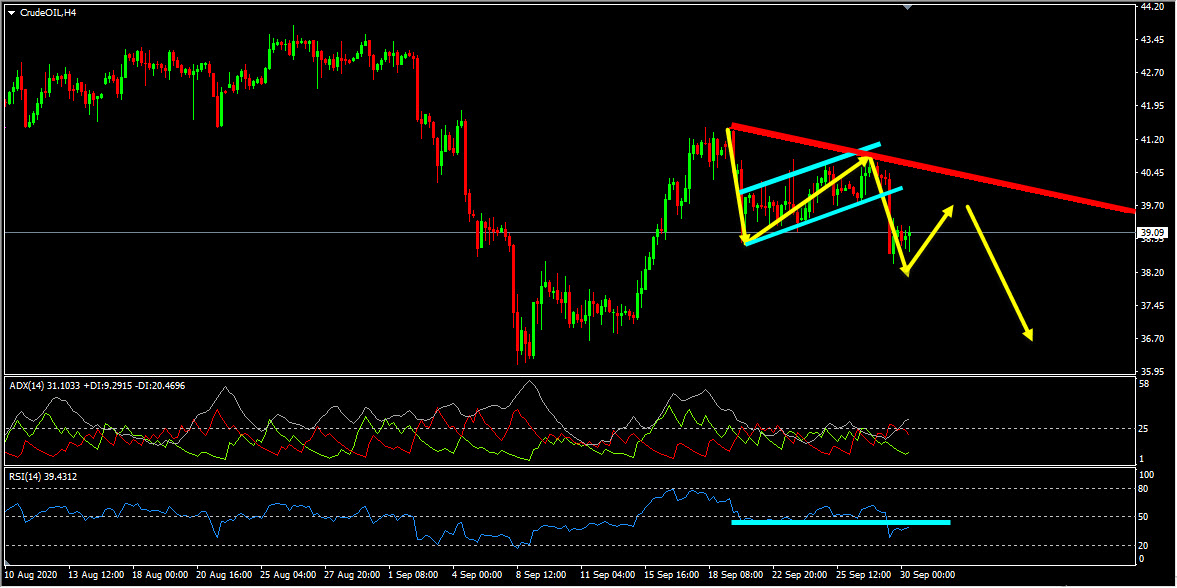

My idea here was “On the H4 chart, we had the first leg down and then the price was moving inside a consolidation. Currently, the price has broken below this consolidation and is holding below it, we may consider it as evidence of bearish pressure. Also, the ADX indicator gave a bearish signal at the cross of -DI (red line) versus +DI (green line), and the main signal line (silver line) reads value over 25, we may consider this as another evidence of bearish pressure. Also on the RSI indicator the price has broken below a strong support level and is holding below it we may consider this as yet another evidence of bearish pressure. We also have a good downtrend line that has formed until this downtrend line holds my short term view is bearish here. Alternatively, if the price moves higher, breaks and holds above this downtrend line then this short-term bearish view will be invalidated”.

Oil H4(4 Hours) Chart Current Scenario

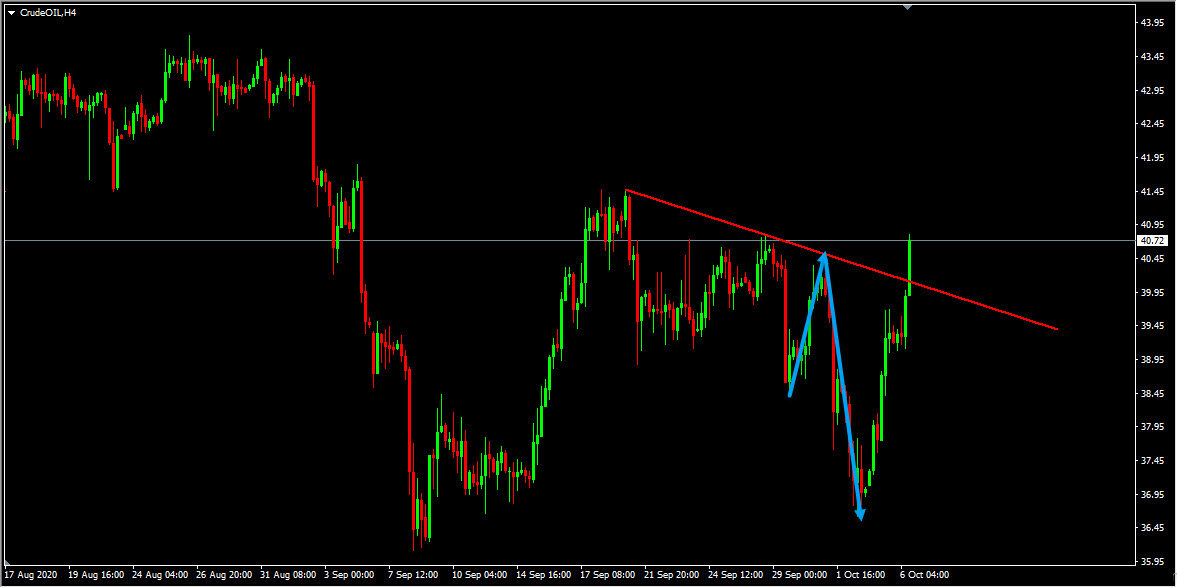

On the H4 chart, the price action followed my analysis. The price moved higher and respected the invalidation level (downtrend line) and then it moved lower and provided a fantastic move to the downside as you can see in the screenshot below.

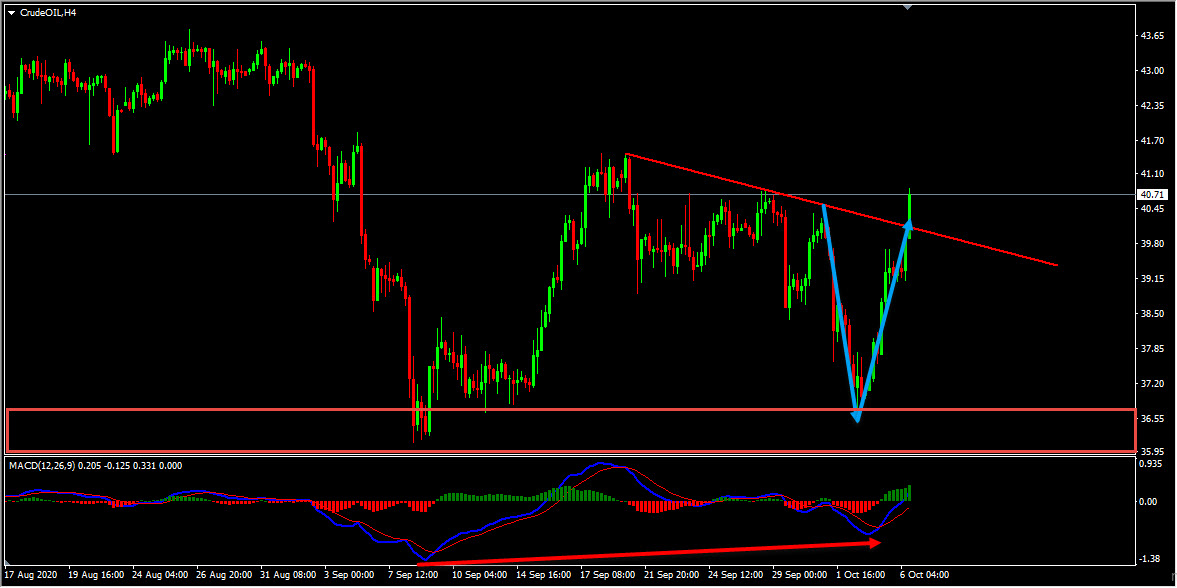

The price which was moving lower reached a strong support zone and in addition to this we had a slowing down momentum on the MACD indicator and then the price moved higher and created a “V” pattern as you can see in the screenshot below. The price then moved higher further and broke above the downtrend line. We may consider these as hints provided by the market indicating the bulls are here in play. When such things happen we shouldn’t expect anything bigger and the price to move lower further, you should always consider managing your trade and secure your profits (cash out or partial cash out or trailing protections or partial hedge, etc.. depending on the strategy that you work with).

Note: If you want to learn about Money Management you can find it here

This is a good example of how the market provided us with hints supporting the bearish view first. Then as you can see in the screenshot above how the price moved lower after that. Then the price provided us contradictory signs supporting the bullish view and as you can see in the screenshot above how the price moved higher after that. This is why I always say that as traders we should follow the facts and hints that the market provides us and take the right actions accordingly.

For similar trade ideas and much more join the Traders Academy Club and get access to our complete watch list and trade report.

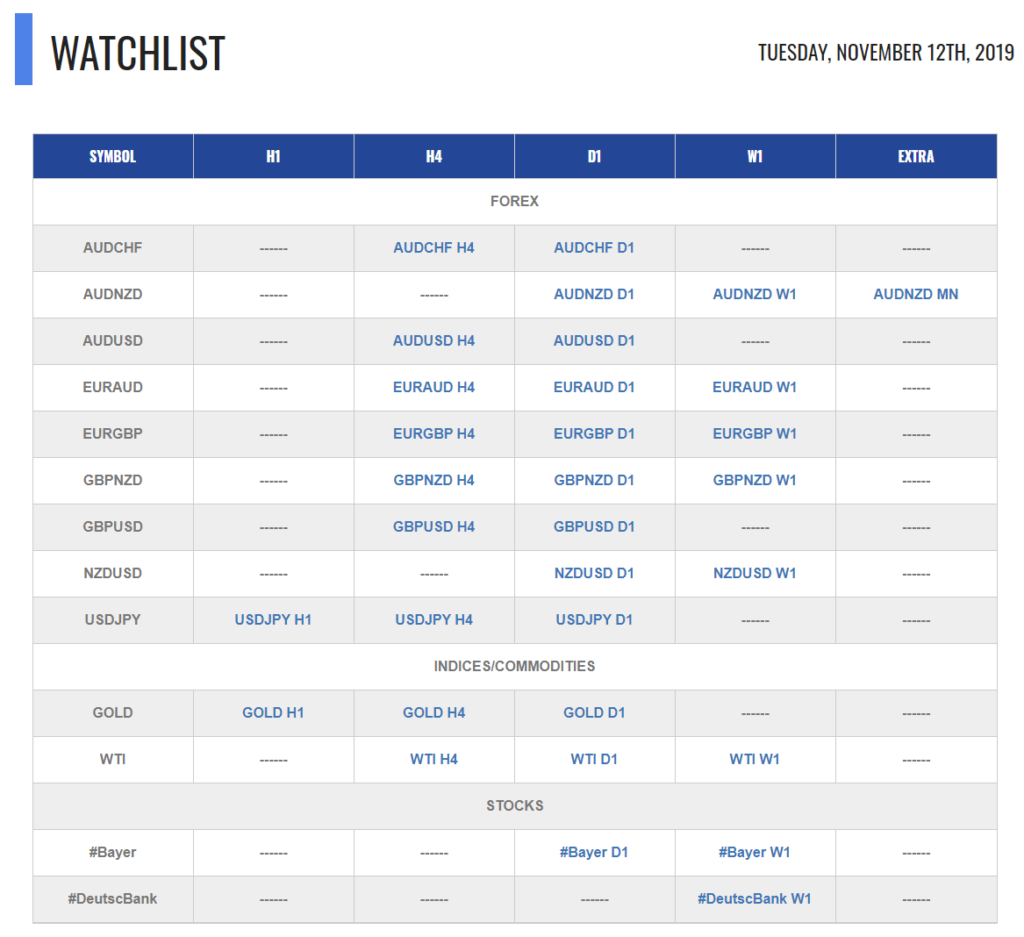

This is how the report looks like. A table with the hottest market opportunities, screenshot behind every pair and time frame (anything that is in blue inside the table is clickable and leads to a screenshot) + a summary in text format, kind of highlights. And of course, Live Market Analysis every single day.

If you have any further questions, don’t hesitate to drop a comment below!

To your success,

Vladimir Ribakov

Certified Financial Technician