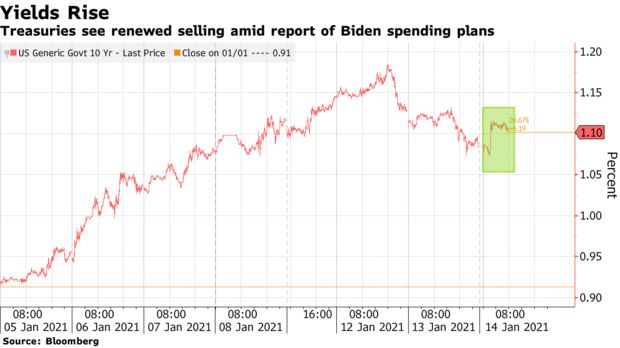

U.S. stocks rose for a third day and Treasury yields lingered near 10-month highs after a report suggested President-elect Joe Biden plans Covid-19 relief of about $2 trillion.

Biden’s advisers recently told allies in Congress about the cost of the package, CNN reported. Biden is expected to announce his economic support plans later in the day. The energy and industrial sectors led the benchmark S&P 500 higher. The dollar held a gain as U.S. initial jobless claims last week rose to 965,000 compared with the estimate of about 800,000.

In Europe, the Stoxx 600 Index climbed, led by cyclical shares. Carrefour fell as much as 7.4% after the French government expressed opposition to Canada’s Alimentation Couche-Tard buying the company. In Asia, Alibaba Group Holding Ltd. and Tencent Holdings Ltd. climbed after the U.S. decided against banning American investment in the Chinese tech giants.

Investors betting on an economic recovery this year are tolerating stretched stock valuations, partly because they expect further U.S. fiscal spending and better control of the pandemic with vaccines. With Biden due to take office within days, the transfer of power promises more turbulence. On Wednesday the House of Representatives voted to impeach President Donald Trump for a second time, though a Senate trial for Trump likely won’t get underway before his term ends on Jan. 20.

The latest comments from policy makers have also reinforced expectations of loose monetary policy, with Federal Reserve Governor Lael Brainard pushing back against suggestions the central bank could taper its bond-buying program this year. Fed chief Jerome Powell is due to discuss topics including the Fed’s policy framework later Thursday.

“This will be a great year for the economy and earnings, but just a good year for the stock market,” Bob Doll, chief equity strategist at Nuveen, said on Bloomberg TV. “In other words, I think multiples are held back a bit because of modestly rising interest rates and inflation.”

On the virus front, China recorded its first Covid-19 death since April as new clusters continued to expand.

Here are some key events coming up:

- JPMorgan Chase & Co., Citigroup Inc. and Wells Fargo & Co. are among firms due to report earnings.

- U.S. President-elect Joe Biden plans to lay out proposals for fiscal support on Thursday.

- Federal Reserve Chairman Jerome Powell takes part in a webinar on Thursday.

- U.S. retail sales, industrial production, business inventories and consumer sentiment figures are due Friday.

These are some of the main moves in markets:

|

Contents

hide

Stocks |

|

|

|

|

|

Currencies |

|||||

|

|||||

|

|||||

|

|||||

|

Commodities |

|

|