Figuring out the best time to trade forex is a combination of your availability, your residing jurisdiction, understanding market overlaps, and knowing when the flood gates open to market participants eager to trade.

Before we dive into this discussion, it is important that you understand that the forex markets operate around-the-clock but is only available to retail traders 24-hours-a-day, 5 days a week.

Compared to the stock markets which operate for 8 hours per weekday, the foreign exchange markets are open 24-hours and generate a far greater monetary turnover than any other financial market in existence.

Forex Market Hours

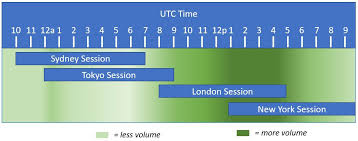

The following four market sessions are all represented in Eastern Standard Time (EST):

Tokyo (7:00 P.M. to 4:00 A.M.)

Tokyo was home to the first Asian trading session to open and it currently receives the largest proportion of Asian trading over that of Singapore and Hong Kong. If you are a forex trader who prefers more volatile currency pairs then you’ll likely benefit from trading the USD/JPY during the opening hours of the Tokyo session due to the substantial influence that the Bank of Japan possesses over the Japanese yen.

Sydney (5:00 P.M. to 2:00 A.M.)

The Sydney market session kicks off the official start of a trading day and while its market may pale in comparison to that of Tokyo and New York, there is generally a fair bit of investment activity that occurs during the opening of the session as a result of retail forex traders and financial institutions trying to convene after the closure of the foreign exchange markets that previous Friday afternoon.

London (3:00 A.M. to Noon)

The foreign exchange markets is dominated by the U.K. while London accounts for over 40% of global trading. It is well-known that the Bank of England (BoE) significantly impacts currency fluctuations as a result of the BoE determining monetary policies for the GBP and interest rates. It is also said that the origination of forex trends stems from the London trading session which is more ideal for technical analysis traders.

New York (8:00 A.M. to 5:00 P.M.)

Developments in the New York Stock Exchange (NYSE) may possess a powerful and simultaneous influence over the value of the U.S. dollar. This is largely in part due to the merging of companies, large finalized acquisitions, and the fact of how New York is the 2nd largest foreign exchange platform in the world. Additionally, the U.S. dollar is the most heavily traded currency pair in forex, therefore, the New York market session is a go-to amongst forex traders.

Forex Market Overlaps

Sydney/Tokyo (2:00 A.M. to 4:00 A.M.)

The 2-hour market overlap between the Sydney and Tokyo market sessions experience the second highest degree of market overlap trading behind that of the U.S./London overlap. While volatility may not be ideal for some forex traders, traders do sometimes leverage the more significant pip fluctuations that occur between the EUR/JPY.

London/Tokyo (3:00 A.M. to 4:00 A.M.)

The shortest market overlap, the London and Tokyo overlap experiences the least amount of forex trading. This is largely because the one-hour market overlap fails to provide much opportunity to seek out significant pip fluctuations and how most U.S. traders are sleeping during that hour.

U.S./London (8:00 A.M. to Noon)

The market overlap between the U.S. and London trading sessions is the largest overlap and it constitutes for over 70% of forex trades. A primarily driving force to this statistic would be how the U.S. dollar and the Euro are the two most heavily traded major currencies and as a result is one of the best times to trade forex given that volatility tends to be at its highest.

Significance of News Releases

Traders are better able to structure their trading schedule around market overlaps due to increased volatility and market participants but there is one significant determinant that can greatly influence the foreign exchange markets and that would be news releases.

Significant news releases have the power to escalate traditionally slow market periods and in effect possess even more clout when announcements go against the predicted forecast.

Access to an Economic Calendar is all you need to monitor News Releases and some examples of news releases to keep a lookout for include trade deficits, GDP data, unemployment rates, CPI data, and central bank meetings.

The Best Time to Trade Forex

The best time to trade forex would be when the markets are most active, this generally occurs during the market overlaps shared above with the U.S./London market overlap generating the largest proportion of forex trading volume.

With an increase in market participants comes an influx in currency pair fluctuation.

Generally, when only one market session is open, currency pairs reflect a tighter pip spread of around 30 pips of movement whereas during market overlaps pip movements can effortlessly generate movements upwards to 70 or more pips.

Closing Thoughts

The best time to trade forex would be during prime time market hours where participant and trade volume are at its highest.

Should your availability prohibit you from trading during market overlaps then you may want to consider seeking out more active trading hours that are flexible with your schedule.

Last but not least, we cannot overemphasis the importance of utilizing an economic calendar along with how it is more critical to differentiate between the news releases that should be followed over those that don’t necessarily affect your preferred currencies of choice.

Tim Lanoue

Guest Author

Resources:

https://books.google.com/books/about/Day_Trading_and_Swing_Trading_the_Curren.html?id=vGjpCgAAQBAJ

https://www.bankofengland.co.uk/

https://books.google.com/books?id=IEoWSFmwKLcC

https://www.investopedia.com/articles/forex/08/forex-trading-schedule-trading-times.asp