Hi Traders! In today’s article I will explain the first secret pattern that I use on daily basis in my analysis – the Band to Band move in Bollinger bands. The band-to-band move pattern tells you where the price is expected to reverse which could be used as an entry point (picking up the end of a corrective move). It could also be used to find big trend reversal.

I personally love Bollinger bands and anyone out there using this fantastic indicator knows what I’m talking about and why I’m so connected to it! If you know how to use the Bollinger bands the correct way you will be amazed how much this indicator is telling you. Many traders believe that Bollinger bands is not a necessary tool for Forex, they think that its a good tool for options, CFD’s, etc… honestly I have no idea why they think so. The best of my entries and the best of my trades (many of them) are based on the Bollinger Bands. So I don’t know why they believe so, because in my POV Bollinger bands is one of the best technical tools ever created. I will explain why I think so, because Bollinger bands is 20 moving average with two shifts up and down which creates a beautiful tunnel and the price action is naturally moving inside each other and if the price runs away from this channel most likely they will try to get back.

In this article I am going to cover the following:

What Is A Band To Band Move?

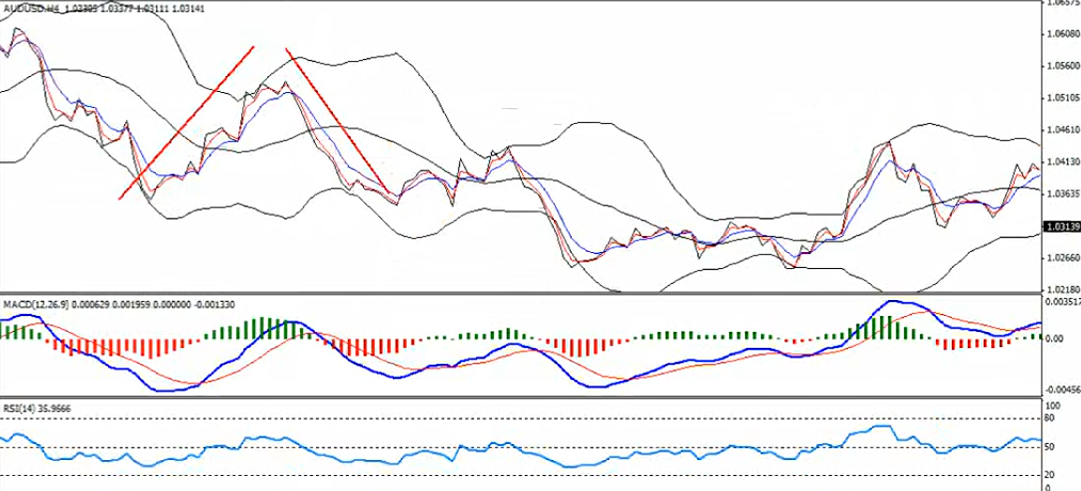

We have two amazing examples as shown in the screenshot below. In these examples I will explain which is the correct band to band move and which is not the correct band to band move.

The correct band to band move that we will use for our needs is the one in the right (marked in the screenshot with a green check mark).

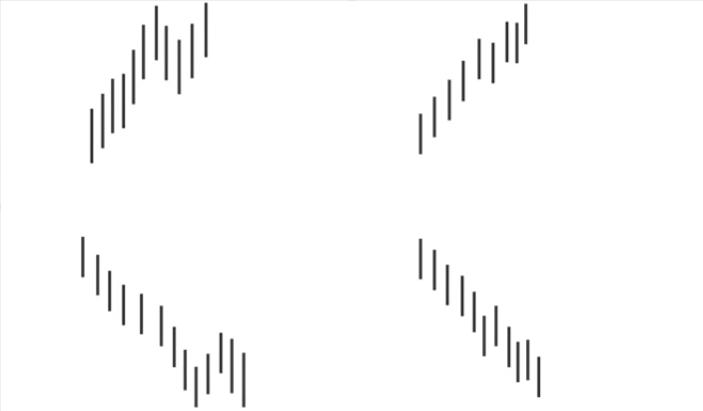

I will explain you why I chose the right one because the thing is we are looking for a move from band to band and we want it to be straight without corrections that interrupts the move. For example if we switch the candle chart to line chart as shown in the screenshot below, we can see that on the left side move we have corrections all the way and on the right side we can see that we have a straight, beautiful down move.

As I said earlier when prices go straight forward from band to band without making any corrections they are crossing from the Shift + to the Shift – with the simple average of 20. So when the price do not respect the 20, we want to see extreme move from band to band directly that is a straight move from one edge to the other and crossing it a little more. So this is the first condition that we wanted to see.

How Do We Define A Correction?

Personally I would say we can identify a correction with naked eyes, just check if we have a significant move or not and if the correction interrupts the move or not. On the left side move we can see that, we had several corrections and one the right side we can see that we had a clear down move without important corrections.

To understand this a little better, I created the below image for you. What you see on the right side is the correct one without corrections and what you see in the left side is the up move and then a correction. For example when the price is moving higher if it moves a bit lower and then if it continues higher again this is what we call as a correction.

Example of corrections

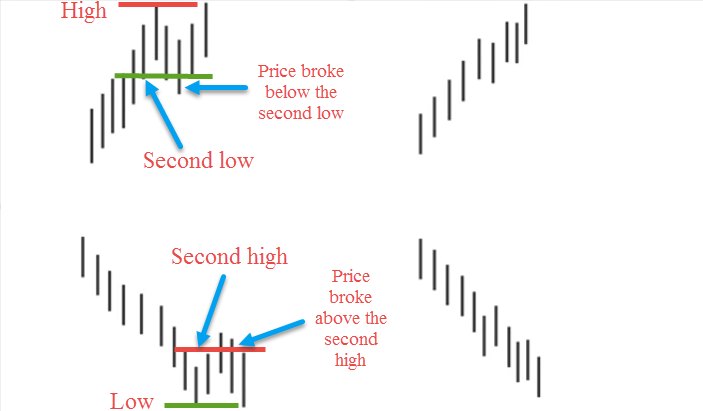

The correction can be validated based on the two candles rule, in the up move shown at the top left in the picture below, just take the last two candles that created the high and then the price moved lower and broke below the second low and only then the market continued higher. This is something that interrupts a straight move. Some market power (bulls or bears) were fighting here and what we wanted to see is a clear move without any fight between the bulls and bears. Similarly in the down move show at the bottom left in the picture below just take the last two candles that created the low and the price moved higher and broke above the second high and only then the market continued lower. This is something that interrupts a straight move and it is what we call as a correction.

Example of valid corrections using two candles rule

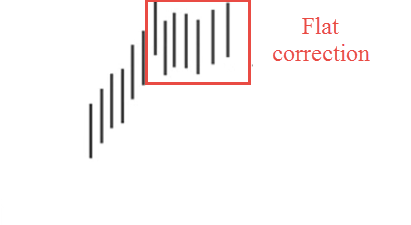

The correction might also happen as a flat one without breaking the high or low but still it interrupts the straight move and we cannot consider this as a good band to band move.

Example of flat correction

Types Of Band To Band Move

Band to band moves can be classified into two types which are as follows:

- Band To Band On A Wide Market Condition

- Band To Band On A Tight Market Condition

As I informed you earlier when we have this band to band move there are two situation when the Bollinger bands are wide or when the Bollinger bands are tight.

Example of wide and tight band to band move in the Bollingers Band

When we have a wide and tight band to band move like what is shown in the screenshot above. When the move is wide from the band to band in the Bollinger bands, the price can stop immediately once they reach the opposite band or it might go a little bit lower (or higher if its an upward move) to the maximum it will duplicate half of the move of the entire band to band move.

Example of wide band to band move duplication

Example of tight band to band move duplication

When its a tight band to band move in the Bollinger bands and if its breaking out of the Bollinger bands, the price on 90% of the time will go for duplication one or two times or even more of the entire band to band move. When its tight and when we have straight break from band to band on 90% of the times it will make duplication at least one time. In the below example we can see that we have a tight band to band move and then we had a duplication of the entire band to band move more than twice.

Here is one more example of tight band to band up move in Bollinger bands, the move here is little bit less than double duplication.

What Happens After A Band To Band Move?

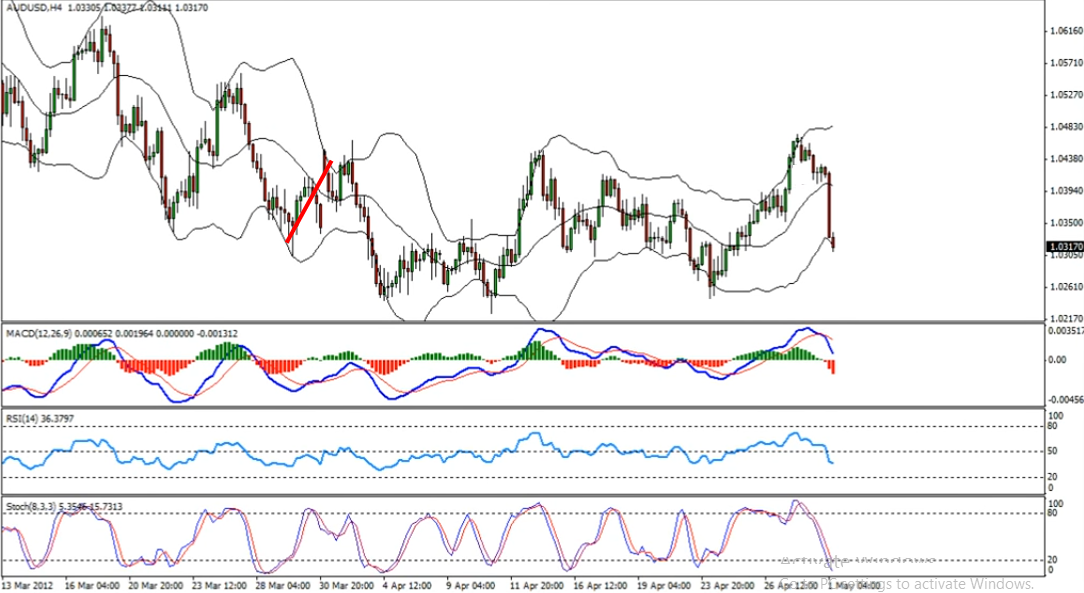

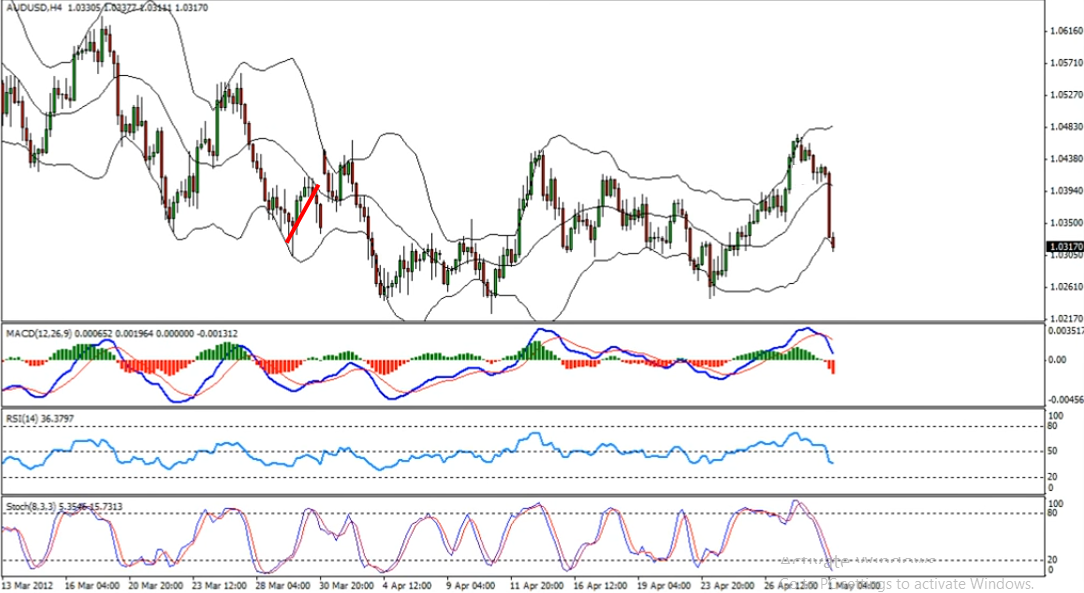

Band to band down move

After a band to band down move we want to see an oversold situation which can be found mainly using a Stochastic Oscillator ( it can also be spotted by RSI when it comes closer to extreme like the 20, 25 area), when the price is below the 20 then that’s an oversold situation. On 80% of the times it will make the move directly to the opposite band.

Example of direct move to the opposite band (oversold situation)

And on the rest of the 20% times it will just stop at the 20 MA.

Example of the move to the 20 MA (oversold situation)

Band to band up move

Whereas if its a band to band up move then its the vice versa where we wanted to see an over bought situation based on the Stochastic Oscillator (RSI is also around 75 which is extreme). In the below example the move is half tight, half wide so it could go for maximum duplication. We are looking for sell opportunities from the area shown in the picture below and we are looking for the price to go to the opposite band, it will go to the opposite band at 80% of the time.

Example of direct move to the opposite band (overbought situation)

And for the remaining 20% times it will make a stop at the 20 MA.

Example of the move to the 20 MA (overbought situation)

How Can We Enter The Trade?

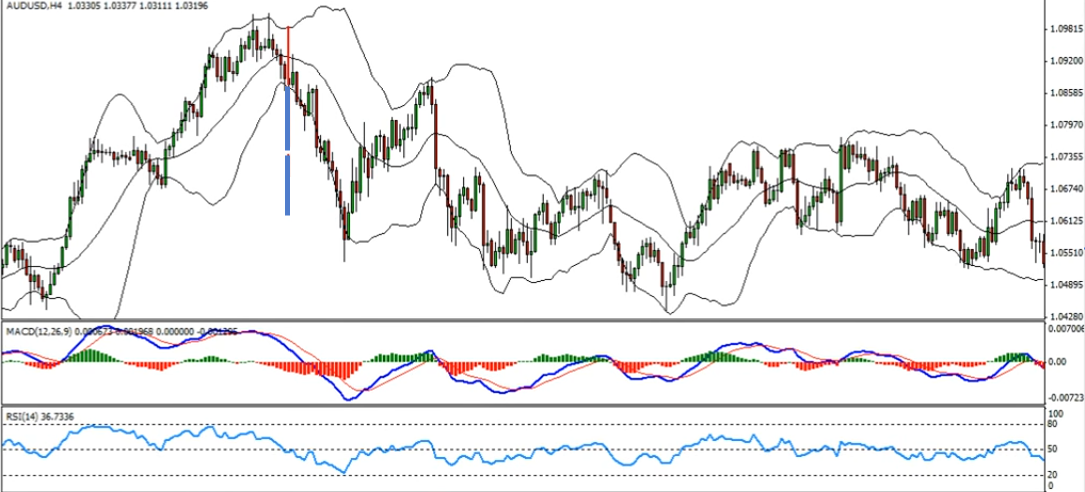

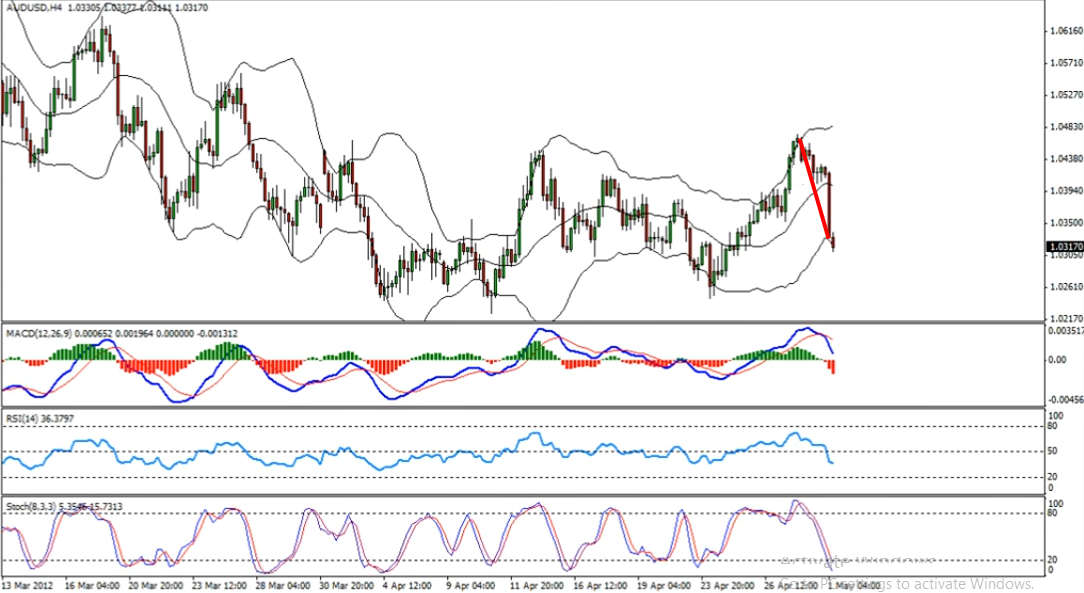

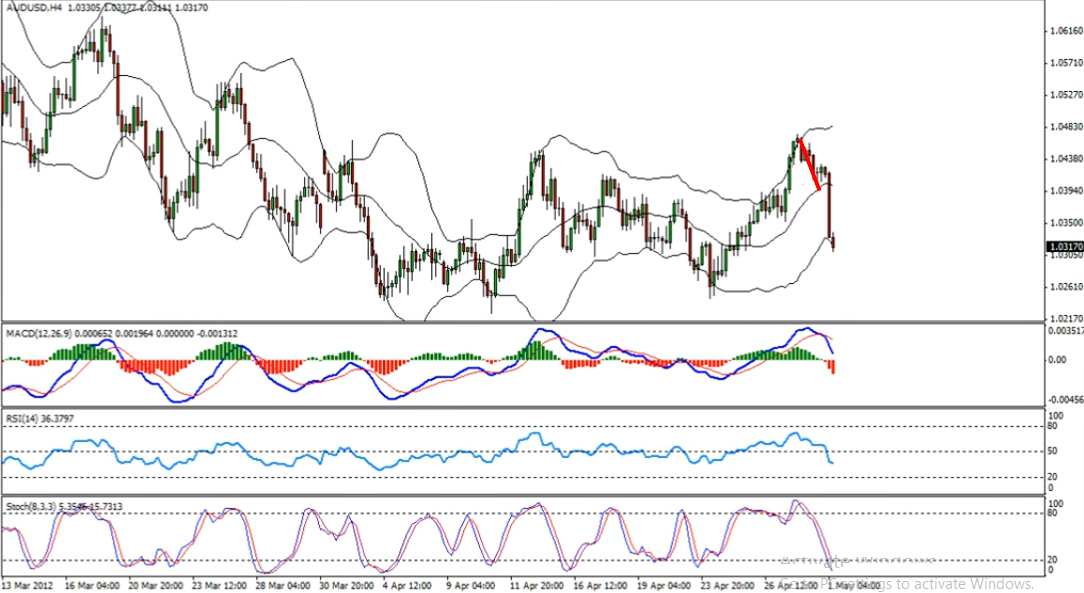

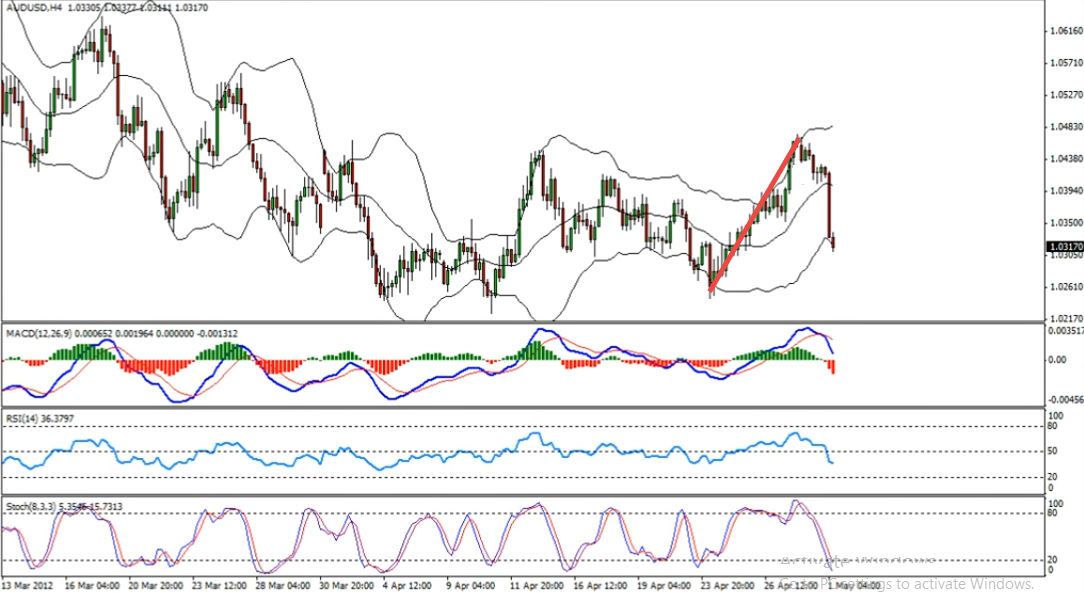

The entry here is simple, we have to find divergence, it could be any kind of divergence for example continuing, regular or even hidden divergence on the same timeframe where the band to band move happened or one timeframe lower. For example in the below example we had a band to band move on the H4 chart.

Example of band to band move on the H4 chart

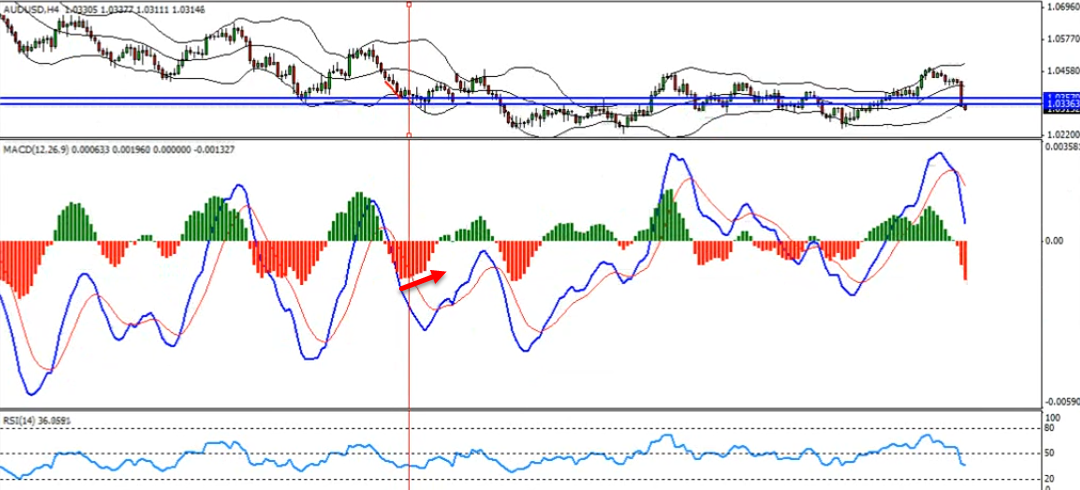

We then moved to one timeframe lower that is to the H1 chart where we had an extreme divergence (extreme divergence is the new high of the MACD with the RSI reaching its extreme) which means the price can definitely go lower. Not just that we also had a band to band move with almost a double duplication.

Example of extreme divergence and band to band move duplication on H1 chart

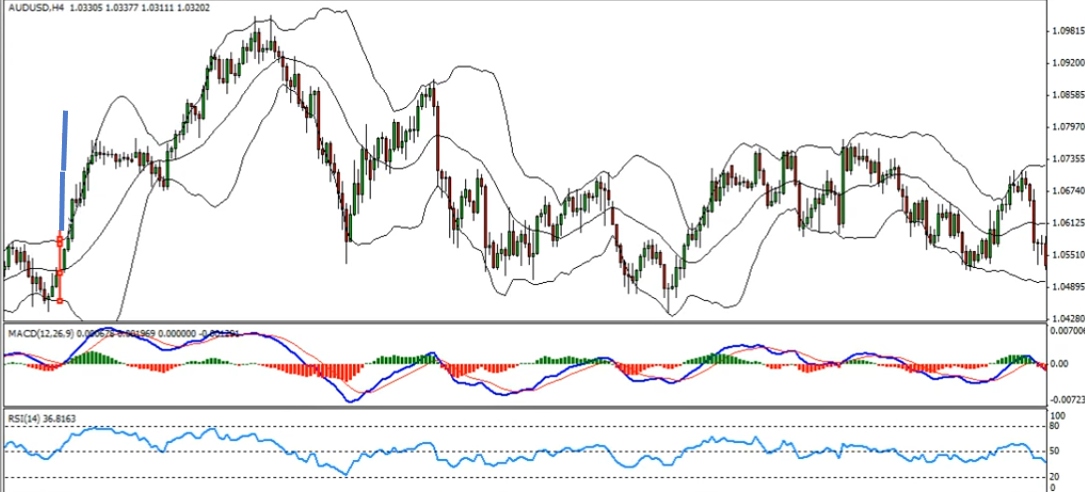

Here is one more example, we had a band to band move on the H4 chart but we didn’t have any divergence on the area marked in blue in the image below.

So we moved to one timeframe lower, in this case the H1 chart where we had continuing bullish divergence and with this continuing divergence shown in the image below we started our attack.

The price went a little bit more lower and with the beautiful H1 continuing bullish divergence and then we also got a H4 bullish slope as well.

Then the move to the opposite band happened.

Extra Tips and Notes

- Bollinger bands are not 100% right but it is a very reliable tool and when its combined with divergences, it gives us the best entries).

- Bollinger bands is only a visual tool, those of you who don’t trade visual things and don’t believe in it then you don’t need the Bollinger bands.

- We don’t have tools to measure if its a wide or tight band to band move in the Bollinger bands we just have to do it visually by using naked eyes).

- If you want to learn more in-depth insights about divergences, you can benefit greatly from the videos on my channel here while also embarking upon Divergence University for comprehensive divergence education.

So traders this is where we stop the part 1 of the Bollinger bands secret pattern article.

Watch the webinar of Bollinger Bands Secret Pattern Part 1

I invite you to join me in my live trading rooms, on daily basis, and improve your trading with us.

Also you can get one of my strategies free of charge. You will find all the details here

Thank you for your time reading this article.

To your success,

Vladimir Ribakov

Cool…getting to know a lot information on Bollinger bands

Thanks Vlad, it was very useful