In just a few days, it’s conceivable that the European Union’s political and economic future could be reshaped by the UK’s June 23-scheduled referendum vote regarding whether Britain should retain membership in, or exit, the EU. Popularly known as ‘Brexit’—shorthand for Britain Exit—the vote outcome could have far-reaching consequences for not just the British and Eurozone economies, but also for global currency and equity markets in particular.

Today’s article considers the consequences either a remain or leave outcome might have on major currencies.

Prevailing opinion strongly holds that a Brexit from the European Union (EU) would hurt the pound sterling versus foreign currencies, especially vs the US dollar. The reason is simple—the UK’s current account deficit.

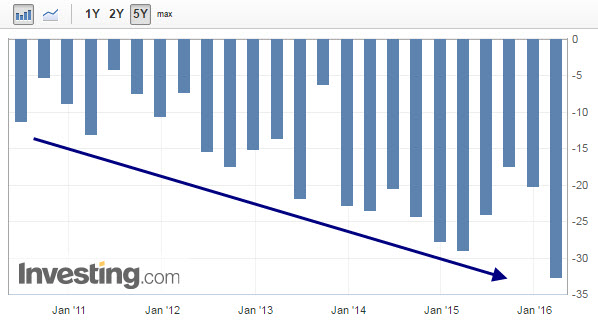

Current account, which Investopedia defines as “the difference between a nation’s savings and investment,” or more broadly, the difference between the amount of money flowing into and out of the country’s economy, is a critical indicator of a nation’s economic health. The UK’s current account deficit, as of Q1 2016, is -32.7B pounds sterling ($43.6B). According to the BBC that’s a record high for the UK.

If that number were shrinking, it would signal that the UK economy was on the right track. Unfortunately it’s been heading in the opposite direction. To make matters worse, it’s the UK’s largest current account deficit of the modern era, as illustrated in the graph below.

UK Current Account 2010-2016

For additional perspective, France’s current account total for the same period was -1.8B euro ($2.02B USD), while Germany’s average monthly current account for Q1 was plus 21.7B euro ($24.3B).

Broken down, the current account index measures the difference in value between exported and imported goods as well as services and interest payments during the reported month or months. The goods portion is the same as the monthly Trade Balance figure.

Currency exchange rates have a significant impact on a nation’s trade balance. Using the UK as an example, a weaker pound makes imported goods more expensive for UK consumers, but increases the competitiveness of UK goods to its export partners. A stronger pound would have the reverse effect—imported goods would be cheaper for UK citizens, but the country’s exports would be more expensive. Clearly, each scenario has its downside.

If the imbalance in either of the above scenarios becomes too great, the current account balance widens. When there’s a deficit, the economy weakens.

If the Brexit referendum outcome calls for a UK exit of the EU, sterling’s value could plummet in the aftermath, to some degree because of the expectation there would be a sudden slowdown or stoppage in foreign capital flows as EU trade agreements are nullified. According to Goldman Sachs this could hurt the pound by as much as 15-20%.

Technical analysis of the GBP/USD chart suggests the same. Taking the long term view (since we’re dealing with massive macro influences), we can see on the chart above that the current value of the GBP is at the lower end of its range over the past thirty years.

Its lowest level occurred during March 1985, at 1.0438. Should the GBP drop in response to the UK leaving the EU, ultimately its support levels could be at ranges that have not been tested for more than 30 years.

In such a case, we would identify the start of the next immediate support level at about 1.22. Support at this level does indeed give credence to Goldman’s gloomy prediction.

While it seems evident that a Brexit will affect the pound, the euro might also take a hit following the breakup. The UK’s exit could sow new seeds of instability in the region, especially among Eastern European countries that are already unhappy with the EU’s handling of the Syrian refugee crisis. Should the UK exit, many—if not all—of these countries might decide to follow the UK’s lead and leave as well.

Additionally, the UK’s departure might also damage the EU’s recovery from its own debt crisis, as revenues from remaining member states shrink. It would make sense then that the crumbling of the European Union would be disastrous for its currency.

In this scenario, we see the possibility of a 5-10% euro devaluation versus the dollar. Once the past year’s support levels are broken, the next stop down would be parity—a critical psychological level where the euro and dollar would be equally valued.

The last time the EURUSD stood at 1.00 was in late 2002. It rose steadily over the years since than, until it hit a high of 1.5990 during July 2008.

In the most dire scenario—should the euro break support at 1.00—there is a possibility thecurrency could go all the way down to retest its lowest lows, between 0.88 and 0.8252. This is highly unlikely. However, it may occur in the event of a domino effect following the UK exiting the EU. To hedge against this doomsday scenario, many FX analysts recommend the yen and Swiss franc as safe havens.

Source: Investing.com