The US dollar was seen trading higher against the British pound as it managed to gain buyers once again this week. The GBPUUSD pair climbed higher on Monday, but failed to capitalize on gains and moved lower again. There was an important resistance around the 1.5740 area, which proved vital one more time as the British pound struggled around the mentioned area and failed to break the same.

There were a couple of important economic releases lined up during the last couple of days, including the manufacturing PMI, construction PMI and consumer credit data. The outcome was mixed as one registered a better than expected reading and another one missed the forecast. The end result was the pair trading lower back below the 1.5700 area.

UK Manufacturing PMI

The first important release in the UK was the Manufacturing Purchasing Managers Index (PMI) released by both the Chartered Institute of Purchasing & Supply and the Markit Economics. The market was expecting the manufacturing PMI to decline from 53.2 to 53.0. However, the outcome was better than expected with a reading of 53.5. This was on the positive side, and the reaction in the GBPUSD was according to the outcome.

The GBPUSD was seen trading higher on Monday, as the pair managed to climb more than 80 pips. However, it was seen struggling around an important resistance around the 1.5700-40 area. The mentioned level acted as a monster hurdle for the pair in the near term.

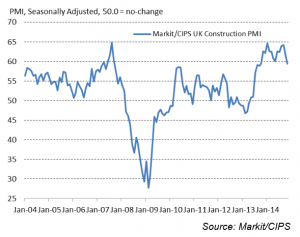

UK Construction PMI

Yesterday, the UK Construction Purchasing Managers Index (PMI) released by both the Chartered Institute of Purchasing & Supply and the Markit Economics. The market was expecting the manufacturing PMI to decline from 61.4 to 61.0 However, the outcome missed the mark, and registered around 2 point decline with a reading of 59.4. This was not that good, but overall the reading was still on the higher side and well above the 50 mark.

The report mentioned that the UK construction companies indicated a strong expansion of business activity in November, but the overall pace of growth moderated for the second month running to its least marked since October 2013. The GBPUSD pair was seen trading lower and sellers managed to break the 1.5700 support area.

UK Services PMI

Today, the UK services PMI will be released. The forecast is slated for a rise from 56.2 to 56.6. If the outcome misses the forecast, then the British pound might come under pressure moving ahead.

Technically, the GBPUSD has a support around the 1.5600 area. However, the recent failure around the 1.5700-40 area suggests that the pair might continue trading lower. There is a chance of a double top pattern forming as well, which might encourage sellers in the near term.

So, keep an eye on all the important levels friends and trade accordingly.

Get my Daily Market forecast with trade opportunities HERE: Vladimir’s Markets Forecast