The British pound was seen trading higher since the start of this week against the US dollar. The best part was that the GBPUSD pair broke the 1.6060 area, which acted as a support earlier and resistance later. So, the pair trading back above the same signals a bullish bias. However, we need a few more signs before we call it a short-term reversal. There were a couple of important economic releases lined up yesterday, including the UK industrial production data, manufacturing production and the NIESR GDP Estimate.

The outcome was fairly above the expectation, which helped the British pound to maintain the ground against its counterparts. However, one might also argue and say that the recent rise in the GBPUSD pair has more to do with the US dollar weakness and less to do with the British pound strength. This cannot be denied to a certain extent.

UK Industrial Production

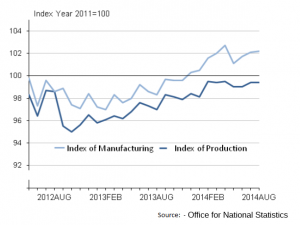

Yesterday, the UK Industrial Production was released by the National Statistics. The market was expecting it to register an increase of 0.2% in August 2014, compared to the previous month. However, the outcome was disappointing, as the UK Industrial Production remained flat in August 2014. The previous reading was also revised down from 0.5% to 0.4%.

In terms of yearly change, the UK production output increased by 2.5% in August 2014 compared with August 2013. This was also a 0.1% less than the market expectation. However, the best part was that the previous reading was revised up from 1.7% to 2.2%. The GBPUSD pair was seen trading slightly higher after the release, as the market was able to digest the outcome.

UK Manufacturing Production

Moreover, the UK manufacturing production was also released by the National Statistics at the same time. The market was expecting it to register an increase of 0.1% in August 2014, compared to the previous month. The outcome was in line with the expectation, as the UK manufacturing production rose by 0.1% in August 2014.

In terms of yearly change, the UK manufacturing production increased by 3.9% in August 2014 compared with August 2013. This was a 0.5% more than the market expectation. Furthermore, the previous reading was revised up from 2.2% to 3.5%. So, the outcome was very satisfactory, which lifted the GBPUSD pair. However, the pair failed to overtake an important resistance area around the 1.6110-20 levels after the release.

Technically, the GBPUSD managed to gain bids from a critical support area, which is a good sign for bulls. However, there is no denial that the 1.6120 level might present a tough challenge for the British pound buyers. As long as the pair is trading below the mentioned area it can continue trading lower. On the downside, the 1.6060-20 might act as a support moving ahead.

So, keep an eye on all the important levels friends and trade accordingly.

Get my Daily Market forecast with trade opportunities HERE: Vladimir’s Markets Forecast