Australian PPI

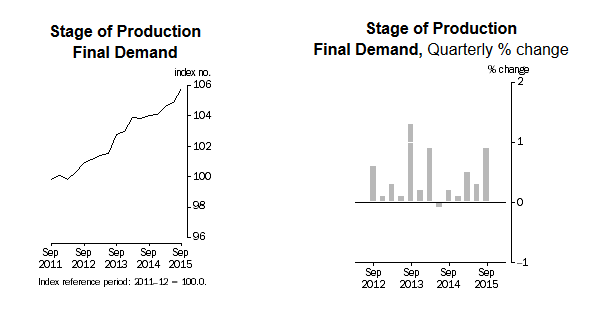

Today, Australia saw a couple of key economic releases including the Producer Price Index that represents the average changes in prices in the Australian markets by producers of commodities. It was reported by the Australian Bureau of Statistics and registered a growth rate of 0.9% in the PPI in the third quarter of 2015, compared with the preceding quarter and was above the market expectation.

When we analyze the year-over-year change, then the Australian PPI gained 1.7% in the third quarter of 2015, compared with the same quarter a year ago.

Moreover, the report mentioned that the “intermediate demand rose 0.7% in the September quarter 2015, and was mainly due to rises in the prices received for textile, clothing, footwear and leather manufacturing (+4.3%) and sheep, beef cattle grain farming and dairy farming (+8.8%)”.

Australian Private Sector Credit Report

Second important release was the Private Sector Credit that represents an amount of money that the Australian private sector borrows. It was reported by the Reserve Bank of Australia and the market was expecting an increase of 0.5% in September 2015, compared with the preceding month.

The outcome was above the forecast, as the Private Sector Credit registered a rise of 0.8%. Furthermore, the yearly change was 6.7% in September 2015, compared with the same month a year ago.

Technical Analysis – AUDUSD

The AUDUSD managed to gain traction during the Asian session today and traded higher close to the 0.7120 resistance area. The 0.7120-40 area represents a major hurdle for buyers, and they need to clear to it if the pair has to make a move higher.

On the downside, the 0.7080 is a monster support area, followed by the recent low of 0.7065. A break below it could take the AUDUSD pair towards the 0.70 handle.

Yours,

Vladimir