* Euro traded higher this week against the US Dollar, and the uptrend got traction after yesterday’s Fed interest rate decision.

* EURUSD is currently challenging an important resistance of 1.1440, which if breached might open the doors for more gains.

* In the Euro Zone today, the Current Account released by European Central Bank posted a trade surplus of €22.6B in July 2015, which was higher compared with the forecast of €21.3B.

Euro Zone Current Account

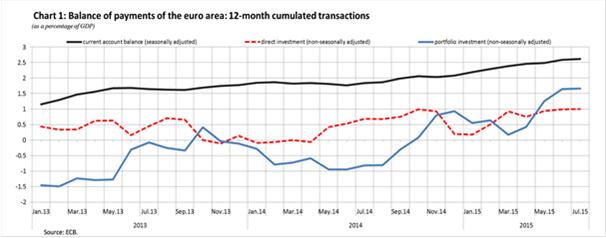

Earlier today during the London session, the Current Account, which is a net flow of current transactions, including goods, services, and interest payments into and out of the Euro-Zone was released by European Central Bank. The market was expecting a trade surplus of €21.3B in July 2015, compared with the last reading of €25.4B. The outcome was a bit better, as the trade surplus was of €22.6B (seasonally adjusted).

When we look at the yearly change, then the current account registered a trade surplus of €270.8 billion in July 2015, compared with the same month a year ago. The report stated that “increase in the current account surplus was due mainly to an increase in the surplus for goods (from €218.2 billion to €301.2 billion) and, to a lesser extent, to an increase in the surplus for primary income (from €33.8 billion to €42.4 billion) and a decrease in the deficit for secondary income (from €139.7 billion to €134.1 billion).”

The report helped the EURUSD to gain ground. It was already trading with a positive tone after the fed interest rate decision in which there was no major help for the greenback.

Technical Analysis – EURUSD

The Euro struggled once around the 1.1440, which ignited a corrective wave against the US Dollar. However, the EURUSD pair found support near the 1.1380 level and after the Euro Zone Current Account report, the pair spiked higher. The pair is currently making one more attempt to clear the 1.1440 level, and if they succeed a move towards 1.1500 is possible.