Hi Traders! Dax forecast update and follow up is here. On April 9th I shared this “Dax Forecast” in Trading View. If you would like to learn more about the way we trade and the technical analysis we use then check out the Traders Academy Club Spoiler alert – free memberships are available! In this post lets do a recap of this setup and see how it has developed now.

Missed this trade?

Never miss a trade opportunity again! Join the Traders Academy Club

Now lets summarize the idea first:

Dax D1 (Daily) Chart Analysis – Bearish Hidden Divergence

Dax H4 (4 Hours) Chart Analysis – Two Important Sell Zones, Bearish Divergence

We have two important sell zones that has formed based on the fibonacci expansion levels of the two waves we have. Bearish divergence.

Dax H1(1 Hour) Chart Analysis – Bearish Divergence

Dax H1(1 Hour) Chart Current Scenario

My view still remains the same here as the price is still holding around the first sell zone. The price moved higher but we still have the bearish divergence and the low at 10139 is still valid as well. If the price moves lower, breaks and holds below this low at 10139 we may then expect further continuation lower. Alternatively if the price moves higher then the next area to look for bearish setups with bearish evidences would be the second sell zone.

Until both these sell zones hold my view remains bearish here. In this idea the validation plan that I was looking for is the break of the low at 10139 which didn’t happen yet, the price moved higher but didn’t create any new low so this low is still valid for us. Even though the price moved higher it didn’t break above both the sell zones so it didn’t invalidate the bearish view either and we still have bearish divergence, so my plan remains the same here.

Until both these sell zones hold my view remains bearish here. In this idea the validation plan that I was looking for is the break of the low at 10139 which didn’t happen yet, the price moved higher but didn’t create any new low so this low is still valid for us. Even though the price moved higher it didn’t break above both the sell zones so it didn’t invalidate the bearish view either and we still have bearish divergence, so my plan remains the same here.

As traders we always have two choices, first one is to start and try to convince the market with many different variations like add positions or start to increase your lots, average down, etc… Or simply validate or invalidate your view, have alternative read, check again from the root of higher timeframe and make proper decisions according to the current market conditions. Always follow the facts, it doesn’t matter what view you had yesterday, what matters is what happens in the market today because the market is dynamic and it doesn’t necessarily have to agree with the way you see it. As long as the market follows my ideas and validates my setups I can trade and if it doesn’t switch, have a different read and turn around when required.

(Note: You can follow me here on Trading View and also on my blog to get similar ideas on daily basis)

Note: Right now with the Corona virus impact the real money flow is not there in the market, a lot of investors and traders are out of the market and are waiting for this crisis to come down. Many traders are sitting on the fence making nothing, what you would see on the market in such period in panics, there are a lot of random fast moves with high volatility, very serious moves, big volumes but these moves are not technical but in such cases its very important to wait for your setups, have your analysis. If the setup comes, trade it and value the risk, if you would be right in high volatility period then once it moves, it moves big and fast but if it doesn’t then you know your risk is limited. Don’t trade without planning your risk its a big mistake.

Watch my video on How to trade during Corona virus Crisis here

For similar trade ideas and much more join the Traders Academy Club and get access to our complete watch list and trade report.

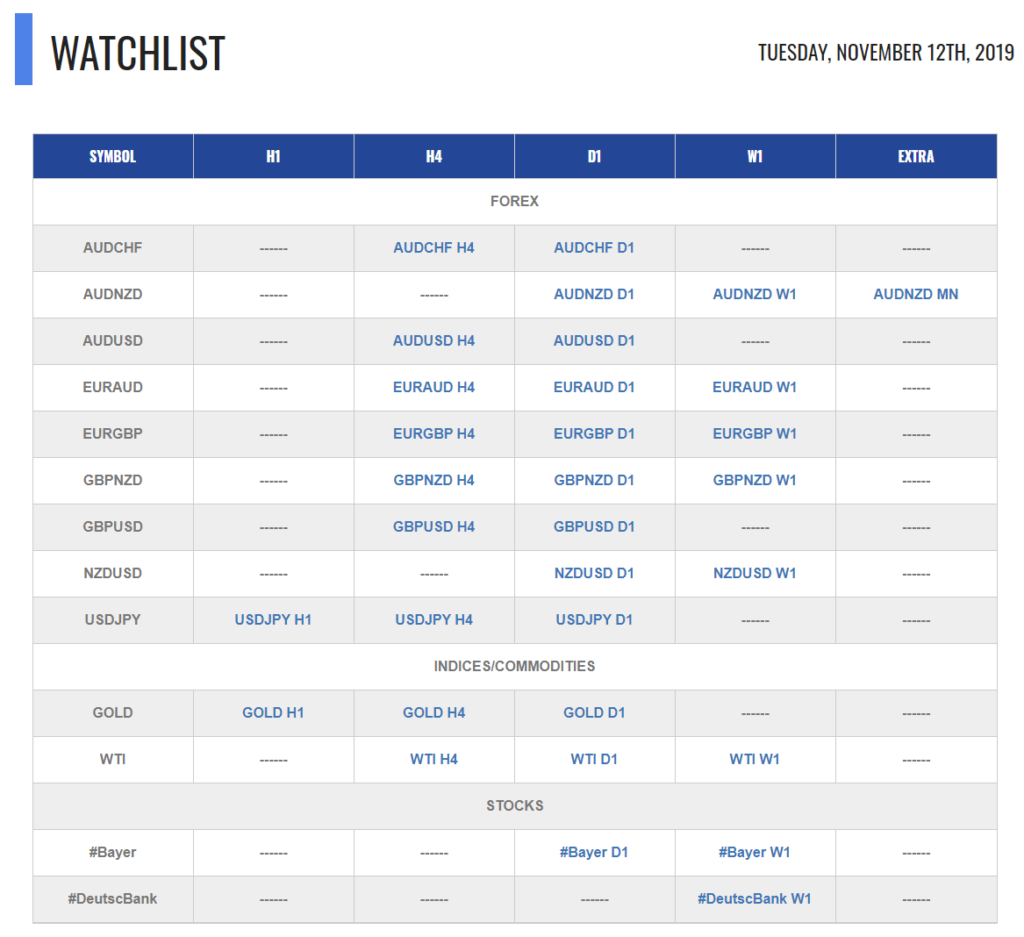

This is how the report looks like. A table with the hottest market opportunities, screenshot behind every pair and time frame (anything that is in blue inside the table is clickable and leads to a screenshot) + a summary in text format, kind of highlights. And of course Live Trading Room every single day.

If you have any further questions, don’t hesitate to drop a comment below!

To your success,

Vladimir Ribakov

Certified Financial Technician

Great blog to follow