There were few important releases earlier during the yesterday’s European and the New York session, including the French GDP, German GDP, Euro zone GDP, Euro zone inflation data, US inflation data and NY empire state manufacturing index. The main events out of these, which cause heavy movements in the US dollar and the Euro were the Euro zone and the US inflation data.

Euro Zone inflation Data

The Euro zone Consumer Price Index (CPI) data released by the Eurostat earlier during yesterday’s London session. The market was expecting a rise of 0.7% in the Consumer Price Index in April, 2014. The outcome was as expected, as the Euro area annual inflation was 0.7% in April 2014, up from 0.5% in March. A year earlier the rate was 1.2% and the monthly inflation i.e. month-over-month change was 0.2% in April 2014.

The areas contributing to the downfall in the annual inflation were Greece (-1.6%), Bulgaria (-1.3%), Cyprus (-0.4%), Hungary and Slovakia (both -0.2%), Croatia and Portugal (both -0.1%). On the other hand, the areas contributing to the rise in the Consumer Price Index were Austria and Romania (both 1.6%), Finland (1.3%) and Germany (1.1%).

The EURUSD pair was seen trading lower after the release. The downside pressure was immense, as the pair broke an important support level at 1.3700. The pair even traded close to the 1.3650 level to trade as low as 1.3647. The sellers were seen controlling the momentum, as the buyers stepped aside.

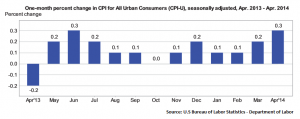

US inflation data

Later during the New York session, the US Consumer Price Index (CPI) data released by the US Department of Labor Statistics. The market was expecting a rise of 0.3 percent in the Consumer Price Index in April, 2014 on a seasonally adjusted basis. The outcome was as expected, as the US inflation was reported 0.3% in April 2014. Over the last 12 months, all items index increased 2.0 percent before seasonal adjustment, according to the report, which was also as expected.

The surprise came from the core Consumer Price Index. The market was expecting a rise of 0.1 percent in the core Consumer Price Index in April, 2014 on a seasonally adjusted basis. However, the outcome was better than expected, as the report suggested that the index for all items less food and energy rose 0.2 percent in April, with most of its major components posting increases, including shelter, medical care, airline fares, new vehicles, used cars and trucks, and recreation.

The US dollar was seen trading higher as an early reaction after the data release. However, later the US dollar lost the ground, especially against the Euro and the British pound. The EURUSD and GBPUSD pairs recovered some of the lost ground intraday during the later part of the NY session.

Technically, the EURUSD pair dropped below the 100 and 55 simple moving average on the daily chart yesterday. The pair even breached the 200 day SMA, but later bounced sharply to trade above the same. There is also a trend line coinciding around the 200 day SMA. So, this particular area might act as a strong support for the pair. On the upside, the broken 100 and 55 day SMA might act as a resistance in the short term. Only a break above the 100 day SMA might call for more gains the pair in the coming days, else the downside pressure remains intact for the pair.

So, keep an eye on all the important levels friends and trade accordingly.

Get my Daily Market forecast with trade opportunities HERE: Vladimir’s Markets Forecast

Happy Trading Friends!