- Euro traded lower against the US Dollar after a test of the 1.0800-20 resistance area.

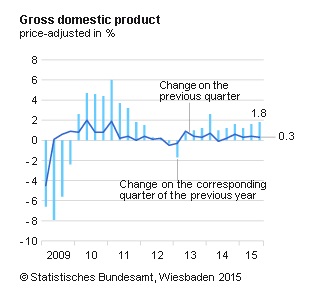

- German Gross Domestic Product released by the Statistisches Bundesamt Deutschland registered a decline from the last rate of 0.4% to 0.3% in Q3 2015.

- Spanish Consumer Price Index released by the National Institute of Statistics posted an increase of 0.6% in October 2015, whereas the market was expecting it to rise by 0.7%.

- French Gross Domestic Product released by INSEE gained by 0.3% as expected in Q3 2015.

German GDP

Today, the Euro Zone saw a couple of major economic releases, including the Gross Domestic Product, which is a measure of the total value of all goods and services produced by Germany was published by the Statistisches Bundesamt Deutschland. The forecast was lined up for an increase of 0.3% in the third quarter of 2015, compared with the preceding quarter. The outcome was in line with the forecast, as the GDP increase by 0.3%.

When considering the yearly change, then the German GDP rose 1.3% in the third quarter of 2015, compared with the same quarter a year ago. Overall, the outcome was in line with the forecast, but not encouraging to take the Euro higher.

The report stated that the “final consumption expenditure of both households and government was up again. By contrast, gross fixed capital formation decreased slightly. According to provisional calculations, the development of foreign trade also had a downward effect on growth because the increase in imports was markedly larger than that of exports”.

There was a downside reaction noted in the Euro during the London session, and the investors were not impressed by the result.

Spanish CPI

The Spanish Consumer Price Index, which is a measure of price movements by the comparison between the retail prices of a representative shopping basket of goods and services was reported by the National Institute of Statistics. The market was expecting a nice increase of 0.7% in October 2015, compared with the preceding month. However, the outcome was lower, as the Spanish CPI rose 0.6%.

Technical Analysis – EURUSD

The EURUSD corrected higher to trade near 1.0820 where it found sellers and after the economic releases in the Euro Zone, the pair started to move lower.

On the downside, the 1.0750 should hold if buyers have to prevent the downside else a move towards 1.0720 is possible.