Five reasons why risk management is crucial for success in Forex trading. Forex trading is a dynamic and potentially lucrative financial market that offers opportunities for individuals to profit from fluctuations in currency exchange rates. However, it is also a market characterized by high volatility and inherent risks. Without proper risk management strategies in place, forex trading can lead to substantial losses and financial ruin. In this article, we will explore five key reasons why risk management is crucial for success in forex trading.

I invite you to join our trading family (Home Trader Club) and enjoy our REAL-TIME trading opportunities and REAL-TIME trading education.

Explore My Free Mentorship Program

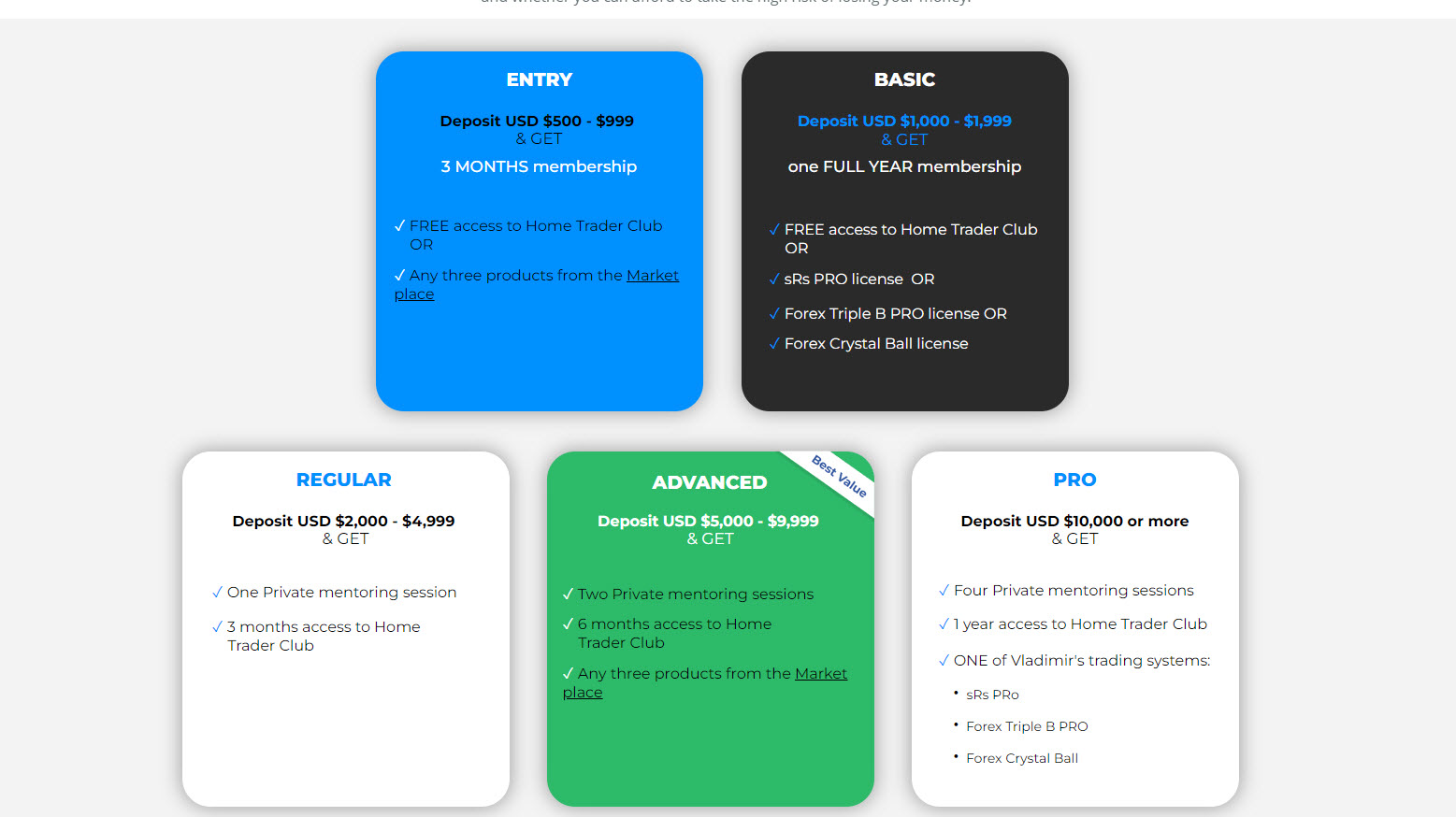

As an Internationally Certified Financial Technician (CFTe, IFTA) and former private capital hedge fund trader, I have successfully mentored numerous students who are now thriving in the trading world. Students who learned with me, are now full-time traders, work in the trading industry, run their own capital firms or are fully funded traders by private companies, develop automated trading solutions and manage others’ capitals. I am a very proud mentor and I am proud of the success stories I’ve helped create, and for a limited time, I’m offering my mentorship program for free through a partnership with Eight Cap broker. Join Eight Cap, become an active trader, and choose the offer that suits you best –

For more details, visit: Home Trader Club Mentorship Program

I’m excited to work with you and help you reach your desired level of success!

Capital Preservation

Capital preservation is an essential concept in forex trading that focuses on protecting and safeguarding one’s trading capital from significant losses. It is a fundamental aspect of risk management that aims to maintain the financial resources necessary for continued trading and long-term profitability.

One of the primary ways to preserve capital is through the use of stop-loss orders. By setting predetermined price levels at which a trade will be automatically closed, traders can limit potential losses. Stop-loss orders act as a safety net, ensuring that if the market moves against a trader’s position, the losses are contained within a predefined amount. This technique helps traders avoid the common pitfall of holding onto losing trades in the hope that the market will eventually turn in their favour.

Watch my video here to learn in detail about Stop Loss and how to use it

Get our Stop Loss Trailer Pro here

Position sizing is another critical element of capital preservation. It entails assessing the optimal allocation of capital for each trade. By considering factors such as risk tolerance, account size, and the specific trade setup, traders can determine the optimal position size. Controlling the size of each position ensures that no single trade carries too much risk, protecting the overall trading capital from excessive exposure.

Emotional Control

Emotional control is a crucial aspect of risk management in forex trading, as it plays a significant role in making rational and objective trading decisions. The forex market can be highly volatile, leading to intense emotions such as fear, greed, and anxiety. Effective risk management techniques help traders maintain emotional control and prevent impulsive and irrational behaviours that can lead to significant losses.

One way to achieve emotional control is by setting predefined risk limits. Traders can establish a maximum amount of capital they are willing to risk on each trade or per day. By determining these risk limits in advance, traders create a structured framework that helps them evaluate potential trades objectively, without being swayed by momentary emotions. This approach allows traders to make decisions based on rational analysis rather than emotional reactions to market fluctuations.

Additionally, having a well-defined trading plan and sticking to it can contribute to emotional control. A trading plan outlines specific entry and exit criteria, risk management strategies, and overall trading goals. By following a predetermined plan, traders can avoid impulsive decisions driven by emotions and adhere to a disciplined approach. This discipline helps traders stay focused and reduces the likelihood of making emotionally driven trades that can lead to losses.

You can learn about Forex Trading Psychology: Mastering & Controlling Your Emotions

Consistency in Performance:

Consistency in performance is a key objective in forex trading and is closely tied to effective risk management. It refers to the ability to achieve steady and sustainable returns over the long term, rather than relying on sporadic or erratic trading outcomes. Implementing risk management strategies plays a crucial role in maintaining consistency in performance.

One way risk management promotes consistency is by helping traders avoid excessive drawdowns. Drawdown refers to the decline in a trader’s trading account from its peak value. By implementing appropriate risk management techniques, such as setting stop-loss orders and utilizing position-sizing strategies, traders can limit the impact of losing trades on their overall portfolio. This ensures that a series of losses does not deplete a significant portion of the trading capital, enabling traders to continue trading and recover more effectively.

Moreover, risk management allows traders to focus on achieving a favorable risk-reward ratio in their trades. By setting risk-reward ratios that ensure the potential reward outweighs the potential risk, traders can tilt the odds in their favor. This means that even if not all trades are profitable, the gains from successful trades can offset losses, resulting in consistent profitability over time. Consistency in performance builds confidence, reduces emotional stress, and helps traders refine their strategies to improve their overall trading outcomes.

Learn the truth about money and risk management here

Adaptability to Market Conditions:

Adaptability to market conditions is a vital aspect of risk management in forex trading. The forex market is dynamic and subject to constantly changing conditions, including economic news, geopolitical events, and shifts in market sentiment. Traders who prioritize adaptability are better equipped to navigate through different market scenarios and mitigate the impact of unexpected events.

One way to enhance adaptability is through diversification. By diversifying their portfolios, traders spread their investments across various currency pairs or even other financial instruments. Diversification helps reduce the risk associated with exposure to a single currency or market. If one currency pair or market experiences adverse movements, the impact on the overall portfolio is cushioned by the performance of other diversified positions.

Furthermore, effective risk management involves the prudent use of leverage and hedging techniques. Leveraging allows traders to control larger positions with a smaller amount of capital, amplifying potential gains but also magnifying potential losses. By using appropriate leverage, traders can adapt to market conditions and control risk exposure. Hedging involves taking positions that offset potential losses in existing positions. It provides a form of insurance against adverse market movements and helps mitigate the impact of unexpected events.

Watch my webinar on Why 90% Of Forex Traders LOSE BADLY and How To

CHANGE IT Forever!

Learn about the Forex Trading Mistakes You MUST Avoid

Long-Term Sustainability:

Long-term sustainability is a crucial objective in forex trading, and it relies on effective risk management strategies. It refers to the ability of traders to maintain their trading activities over an extended period while generating consistent profits and avoiding significant losses that could jeopardize their trading capital.

Risk management plays a pivotal role in achieving long-term sustainability by protecting trading capital from excessive losses. By implementing risk management techniques such as appropriate position sizing and setting predefined risk limits, traders can control their risk exposure and avoid significant drawdowns. This approach ensures that even during periods of market turbulence or a series of losing trades, the trading capital remains intact, allowing traders to continue participating in the market and seize profitable opportunities when they arise.

Additionally, risk management supports sustainable trading by fostering discipline and consistency. By following a well-defined trading plan and adhering to risk management rules, traders can develop a disciplined mindset that reduces impulsive and emotional decision-making. Consistency in applying risk management strategies helps traders refine their trading approach, adapt to changing market conditions, and improve their overall performance over time. This consistency builds confidence, enhances trading skills, and increases the likelihood of long-term success in forex trading.

Get your copy of my professional Risk Manager EA here

Get the best of our trading solutions here.

To understand the differences between our systems, check our road map here.

Conclusion

To summarize, effective risk management is a critical element for achieving success in forex trading. It helps traders preserve capital, maintain emotional control, achieve consistency in performance, adapt to market conditions, and ensure long-term sustainability. By implementing effective risk management strategies, traders can navigate the challenges of the forex market and increase their chances of achieving their financial goals. Remember, in forex trading, it is not just about making profits but also about managing risks effectively.

If you have any questions, don’t hesitate to drop a comment below!

Yours to your success,

Vladimir Ribakov

Internationally Certified Financial Technician