It would not be overkill to say that when you are a novice trying to tackle the foreign exchange markets it seems like you are not only immersed in terminology that appears to be a foreign language but is also confronted with a task that generates a far greater margin of failure than that of success.

Investing online, more specifically online forex trading, attracts several hundred thousands of investors from all walks of life while the prospect of being able to earn money from the comforts of your home or replacing your typical 9-to-5 job income seems far more appealing than having to drive to work and punching your time card.

Whatever your reasons may be for pursuing the risky yet highly rewarding foreign exchange industry just know that you are not alone and that you are free to leverage not only our vast expertise and experience but also the free resources and insight that we provide to you.

Knowing where to begin your forex trading journey is just as important as the end goal that you have in mind.

You have to reverse engineer the process and the best way to generate an effective game plan that will allow you to carry out your day trading endeavors the better you are setting yourself up for success.

To do this you need to understand the terminology of the territory that you are embarking upon which is why we have taken the time to compile an in-depth list of key forex trading terms and online trading terminology that should be known before undertaking the monumental task at hand.

Among the content you will find in our Forex Glossary includes:

- Fundamental Trading Terms

- Currency Pair Nicknames

- Terminology Used To Depict Trader & Market Behavior

- Additional Need-To-Know Forex Terms

With that being said and without further ado, we shall embark upon this journey, together and may you enlightenment to follow be all that you hoped for and more.

The Definition of Forex

Forex, referred to as a foreign exchange, refers to the foreign exchange market – the largest and most liquidated financial market in the world.

The foreign exchange market is a decentralized financial market and is referred to as an OTC (over-the-counter) market in which the foreign currencies of the world are traded.

Online Trading Dictionary

Analytics – Analytics may be defined as the detection, analysis, and relay of consequential patterns in data. To simplify, analytics seeks to explain or accurately reflect the relationship between data and effective decision making.

AUD – AUD, short for the Australian Dollar, is the official currency of Australia, Christmas Island, Nauru, Tuvalu, Papua New Guinea, and other South Pacific independent countries.

Bid/Ask Spread – The value difference that results between the bid and the ask (offer) price.

Base Currency – In a currency pair, it is the first currency whose value is gauged against the second currency.

Ex) Euro/Usd (Euro/U.S. Dollar) rate reflects a value of 1.08, meaning that one Euro is worth $1.08 U.S. dollar. Generally in forex, the US dollar is the based currency for quotes where quotes are expressed as a singular unit of $1 USD per quote currency.

Black Swan – Defined as an unforeseeable event, Black Swan events are characterized as anomalous events that may have catastrophic consequences.

Brexit – Short for British Exit, Brexit refers to the United Kingdom’s decision to leave the European Union (EU) as declared in a June 23, 2016 referendum.

Broker – Generally a firm or sometimes an individual that acts as an intermediary that brings together buyers and sellers for a commission or fee.

CAD – CAD, short for the Canadian dollar, is the national currency of Canada is and comprised of 100 cents.

Candlestick Chart – Also referred to as a Japanese candlestick chart is a financial chart that helps depict the price movements of currency, derivative, or security.

CFDs – CFDs, known as contracts for differences, is an advanced trading strategy where an agreement is struck between a trader and brokerage in the financial derivates trading market.

CHF – CHF symbolizes the Confoederatio Helvetica Franc and is the abbreviation of the Swiss Franc. Confoederatio Helvetica is Latin for Swiss Confederation while the CHF is the official legal tender of Liechtenstein and Switzerland.

Commission – A fee set forth by a service provider for offering the buying and selling of a product.

Commodities – Commodities are interchangeable goods of the same type used in commerce. Commonly calculated as inputs for the production of goods and services, the quality of commodities may vary but amongst producers, the quality appears relatively uniform.

Crash – A crash may be defined as a severe and substantial deprecation in the value of a market. Generally, a crash is a result of an inflated stock market, however, crashes may occur in any market as history has shown us only too well.

Crude Oil – Traded in the world-wide market in the form of spot contracts and derivative contracts, crude oil is a global commodity and is comprised of hydrocarbon deposits and various organic materials

Cryptocurrencies – The term, cryptocurrency derives from the origin of the encryption techniques that are employed to secure the networks which are used to authenticate blockchain technology.

Currency Pair – Expressed in a XXX/YYY format, currency pairs are a pair of currencies that reflect the value of one currency against another, in forex trading, traders are granted the opportunity to generate profits through the constantly fluctuating value of currency pairs.

Ex) EUR/USD, USD/CHF, USD/CAD, GBP/USD

Currency Trader – Also referred to as a forex trader, a currency trader is an individual who buys and/or sells currencies on the foreign exchange.

Euro – The euro is the official currency of the European member states who have embraced it as their nation’s currency. Symbolized as “EUR,” the euro is the second most traded currency just after the U.S. dollar.

Fundamental Analysis – A widely encompassing trading term, fundamental analysis is the analysis of a businesses’ financial health, competitors, and markets. The overall state of the economy along with underlying factors like earnings, employment, GDP, manufacturing, management, housing, production, and interest rates are also formulated into the practice of fundamental analysis.

GBP – The British pound sterling, abbreviated as GBP and denoted with the symbol (£), is the official currency of the United Kingdom, the South Sandwich Island, the British Antarctic Territory, the British Overseas Territories of South Georgia, the Isle of Man, the Channel Islands, and Zimbabwe and is the fourth most traded currency in the world.

Gold – Gold is a precious metal that is extracted from the earth in the form of gold ore. Once used as the main currency of choice in developed nations, its value reflects a strong correlation with the strength of major currencies being traded on the foreign exchange market.

JPY – JPY, short for Japanese yen, is denoted with currency symbol “¥” and is the official currency of the Republic of Union of Myanmar and Japan. In the foreign exchange market, the JPY is the third most frequently traded currency after the USD and EUR.

Leverage – A credit offered by a broker allowing forex traders to trade hold far greater trading position than they could afford via their own capital. Leverages are generally expressed as ratios, where the first number is used as a multiplying factor of your account balance.

Ex) 400:1, infers that you could hold a trade position that is 400 times greater than your account balance.

Lot – A lot is a unit of measurement that expresses trade size. In forex there is 3 common lot size that you should familiarize with:

- Micro-Lot is equivalent to $1,000 of a currency

- Mini-Lot is equivalent to $10,000 of a currency

- Standard Lot is equivalent to $100,000 of a currency

Majors/Minors – Generally currency pairs are categorized into one of two groups. Major currencies all involve the US dollar and tend to be more frequently traded while minor currency pairs include currency pairs that exclude the US dollar.

Margin – A portion of your balance required to make a trade where leverage is utilized. Generally, margin requirements are reflected as a percentage of the whole trading position.

Margin Call – When an investor’s margin account drops below a broker’s margin criteria, a margin call results between that investor’s broker and the trader. The broker demands that the trader either deposits additional capital or sells off preexisting securities to satisfy the minimum value required, otherwise known as the maintenance margin.

MetaTrader5 (MT5) – As a whole, MetaTrader5 is widely considered as one of the best applications for trading due to its capability of supporting algorithmic trading applications, such as Expert Advisors, Trading Robots, and Copy Trading.

NZD – The New Zealand dollar, denoted as NZD, is the legal tender and official currency of New Zealand. Factors that influence the value of the NZD include the balance of trade, since New Zealand’s GDP relies heavily on exports, along with tourism volume and economic reports.

NZD/USD – NZD/USD denotes the New Zealand dollar and U.S. dollar currency pair. Sometimes the NZD/USD is referred to as Kiwi or The Bird amongst forex traders while the NZD is considered a growth currency and the USD is well-known as a ‘safe-haven currency.’

Pip – A unit of measurement that reflects the change in value between two currencies.

Ex) Should the EUR/USD rise from a value of $1.1008 to $1.1009, that increase of $0.0001 is equivalent to one pip. For major currency pairs, pups are expressed as the fourth decimal value in a quote.

Regulation – A directive or rule created and maintained by an authority, generally a governing or regulatory body. (You can learn about all major forex regulations in our Definitive Guide to Forex Regulations in 2020).

Sentiment Trading – A trading methodology whose central driving force is steered by market sentiment. The primary ideology behind sentiment trading would be that the markets dictate price while sentiment analysis can be employed to gauge how traders feel about a particular stock, market, or underlying asset.

Silver – Silver is a commodity whose precious metal is generally implemented in coins, jewelry, and electronics. Generally, traders employ a hedge fund strategy known as global macro as a precursor to determine opportune times to buy silver through commodity markets.

Slippage – A resulting difference that occurs between the requested bid price and the price acquired, generally a byproduct due to fluctuating market conditions (volatility).

Spread – The value difference between the bid and ask price.

Stop Loss – Used as a risk reduction method, stop loss relates to an order to sell a commodity or security at a predetermined price to limit a loss.

Take Profit – A trading command that is used that allows profits to be obtained after the price reaches a predetermined level.

Trade Size – A fixed fiat currency or percentage of your trading account balance used to execute a trade.

Trading Chart – A trading chart is a price chart that reflects an assets’ price over a designated period of time.

Trading Strategy – A strategy, oftentimes technically-based, that is used to help traders more accurately predict the future direction of an underlying asset.

Trading Systems – Softwares or technical solutions that are used to automated trading strategies and/or algorithms with the intention of simplifying trading for the investor.

Technical Analysis – An analysis methodology that is used for predicting the direction of trends, typically leverages the analysis of market cycles, trends, and patterns.

Technical Indicators – A mathematical calculation that is based upon historic price, open interest and volume of an underlying security that is used by traders who employ technical analysis.

Quote Currency – Also referred to as the counter currency, a quote currency is the second part of a quoted currency pair. (Remember, based currencies are the first quoted currency in a currency pair).

5 Nicknames for Currency Pairs

- Fiber oftentimes refers to the EUR/USD currency pair

- Aussie is a common reference to the AUD/USD currency pair

- Kiwi is well-known for the currency pair NZD/USD

- Cable is known as the GBP/USD currency pair

- Loonie is a nickname for the currency pair USD/CAD

Trader & Market Behavior Defining Terms

Below you will find an index of online trading terminology oftentimes used to explain market and trader behavior in forex trading.

Aggressive – Price action or a trader acting with conviction.

Bearish – A market declining in value, reflects a negative price direction.

Ex) The financial markets took a bearish hit after traders’ sentiment was affected by the Coronavirus pandemic.

Bullish – A market rising in value and showing signs of strength.

Ex) The financial markets will become bullish after the effects of COVID-19 wear off and trader sentiment is no longer affected.

Buy Dips – Generally associated with an intra-day trend, traders seek to buy between 20 to 30 pip pullbacks.

Choppy – Short-term price movements that are not consistent for aggressive trading.

Crater – Term used to describe a potential hard sell-off in the market.

Dispersion – A statistical term that relates the size of the distribution of values that are expected for a particular variable.

Downtrend – Also referred to as a bearish market, a downtrend is where the price of an underlying asset is decreasing in value.

Extended – A market that has been considered to travel too far, too fast.

Gunning – Referenced with respect to traders where traders seek to push stops or technical levels in the FX market.

Level – In regards to technical analysis, may reference a price zone or predetermined price that is considered significant.

Neutral – Price action that is neither increasing or decreasing in value much over an extended period of time.

Resistance Level – An upper price level for an underlying asset that has been repeatedly reached but not surpassed as a result of resistance from the market.

Support Level – A low price level for an underlying asset in which price meets but does not generally fall below in value.

Uptrend – Also referred to as a bullish market, an uptrend is where the price of an underlying asset is increasing in value.

Volatility – A statistical quantification of the dispersion of returns for an underlying asset, market index or particular security.

20 Need-To-Know Forex Terms

Arbitrage – The practice of conducting a simultaneous purchase or sale of a financial instrument in order to leverage small price differentials occurring between markets.

Chartist – An individual who relies upon charts to better interpret the historical price action of underlying assets to predict future price movements and trends.

Consumer Sentiment – A report created by the University of Michigan’s Consumer Survey Center that is used to gauge consumer optimism in regards to the US economy.

Conversion Rate – Conversion rates are defined as a rate that is used to compute all profits and losses of a particular currency into U.S. dollars.

Correlation – The measurement of the relationship between two assets; correlation does not infer causation.

Cross Rate – The exchange rate between two currencies.

Day Trading – The opening and closing of a position on the same day; day traders trend to invest short-term market movements.

Decentralized – Decentralized refers to the market not being controlled by an institution or an entity.

Divergence University – Vladimir Ribakov’s college-level trading school where traders can learn how to consistently invest Divergences and apply specialized trading strategies.

Financial Instrument – Sometimes called an asset or underlying asset, financial instruments are monetary contracts between two parties. These contracts may be established, traded, modified and settled.

Forex FX Delta – A semi-automated trading system that has been fine-tuned to accurately identify trading opportunities while gauging the projected price action of targeted assets; has generated over 14,500 pips to date and was created by Yordan Kuzmanov, a self-educated forex trader with a consistency and success rate unrivaled by most ‘professional’ forex traders. You may learn more about Forex FX Delta here.

Forex Triple B – One of the most dominant and versatile forex trading systems that autonomously employs Bollinger Band trading techniques that leverage the foreign exchange market to conquer pips and capitalize on divergence trading situations.

Hedging – An investment position that is geared towards diminishing the potential losses and/or gains that may result as a byproduct of a previously existing trade.

Money Management – An often overlooked yet crucial practice for reducing risk while investing; typically novice traders should no more than 3% to 5% of their account balance per trade.

Open Position – A trade that is currently active.

Over-The-Counter – Opposed to a regulated exchange trading platform, an OTC market occurs solely between dealers and principals (sometimes through telephone but primarily computer network).

Scalping – Sometimes referred to as short-term trading, scalping involves the investment of dozens to hundreds of trades per day where the objective is to scalp a small profit per trade due to exploiting the variance between the bid/ask spread.

sRs Trend Rider Pro – A high calibered trend-oriented trading system that has amassed nearly 6,000 pips since it’s inception. Considered the flagship trading of Vladimir Ribakov that relies upon exclusive system integrations such as sRs Sentiment, sRs Trade Manager, News Headlines, sRs Monitors, and more! (Learn more here!)

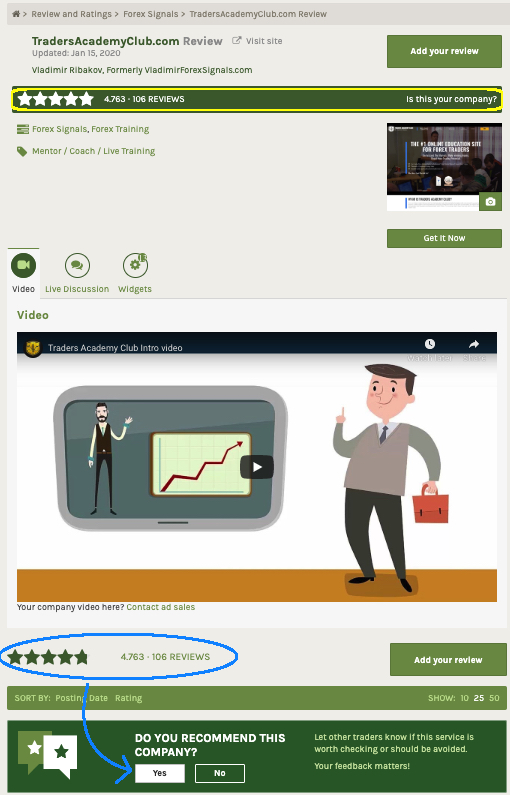

Traders Academy Club – An industry-leading educational service designed to educate online traders with college-level equivalent courses regarding the fundamentals, complexities, and need-to-know information designed to mold students into professional-level traders.

Vladimir Ribakov – An International Certified Technician and fulltime forex trader of 14+ years. Vladimir Ribakov is the creator and owner of Traders Academy Club and has one of the largest forex trading communities online (Visit Vladimir’s YouTube Channel of 91,000+ Subscribers!). To put it simply, Vladimir Ribakov is a Pioneer of the Forex Industry!

If you have questions regarding a particular Forex or believe that our forex glossary would benefit from a term addition please do not hesitate to share your feedback and suggestions in a comment below!

Disclaimer: Some of the information found on this page were formulated and gathered from the following sources:

-

“Forex Glossary” accessed April 5th, 2020, https://www.forex.com/en-us/education/glossary/.

-

“Forex Terminology & Dictionary” March 4th, 2020, accessed April 6th, 2020, https://www.topratedforexbrokers.com/education-and-guides/fx-dictionary/

-

“Forexpedia” accessed April 7th, 2020, https://www.babypips.com/forexpedia