Forex trading is a complex and challenging field that requires great skill, knowledge, and discipline. One of the most critical aspects of successful forex trading is mastering and controlling your emotions. In this article, we will discuss the importance of forex trading psychology and share some tips and strategies to help you improve your emotional control and boost your trading performance.

Explore My Free Mentorship Program

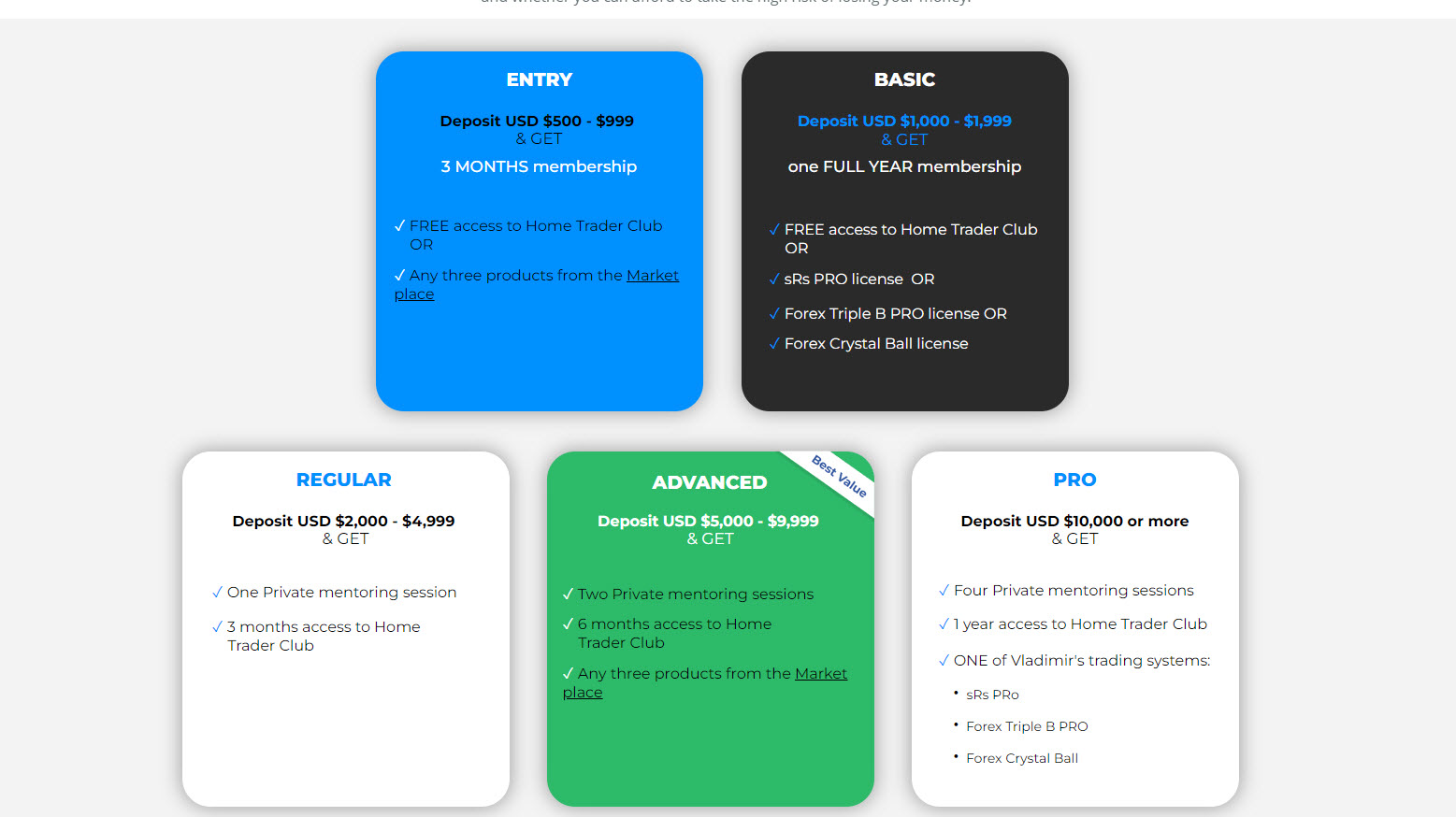

As an Internationally Certified Financial Technician (CFTe, IFTA) and former private capital hedge fund trader, I have successfully mentored numerous students who are now thriving in the trading world. Students who learned with me, are now full-time traders, work in the trading industry, run their own capital firms or are fully funded traders by private companies, develop automated trading solutions and manage others’ capitals. I am a very proud mentor and I am proud of the success stories I’ve helped create, and for a limited time, I’m offering my mentorship program for free through a partnership with Eight Cap broker. Join Eight Cap, become an active trader, and choose the offer that suits you best –

For more details, visit: Home Trader Club Mentorship Program

I’m excited to work with you and help you reach your desired level of success!

Understanding the Role of Emotions in Forex Trading

Forex trading is a highly emotional endeavour. The financial markets are inherently unpredictable and subject to sudden and unexpected changes. As they navigate the markets, traders often experience various emotions, including fear, greed, anxiety, and excitement. These emotions can significantly impact trading decisions, leading to impulsive and irrational behaviour, poor decision-making, and financial losses.

Emotions can be both beneficial and detrimental to forex trading. On the one hand, emotions can help traders to stay motivated and focused on their goals. Positive emotions, such as excitement and confidence, can provide a sense of motivation and energy that can drive traders to take risks and make profitable trades. On the other hand, negative emotions, such as fear and greed, can cloud judgment and lead to poor decision-making.

The key to successful forex trading is learning to manage and control emotions effectively. This requires a deep understanding of the psychology of trading and the ability to recognize and manage emotions in real-time.

I highly recommend you watch the “ TERRIBLE Forex Trading Mistakes “ playlist!

Tips for Mastering and Controlling Your Emotions in Forex Trading

Develop a Trading Plan

Developing a comprehensive trading plan is essential to mastering and controlling emotions in forex trading. A trading plan should outline a trader’s goals, risk management, and exit strategies. It should also include a set of rules for managing emotions and controlling behaviour.

A trading plan provides structure and guidance for traders, reducing uncertainty and anxiety. It can help traders to stay focused on their goals and make rational decisions based on their strategies rather than emotions. A well-crafted trading plan can help traders identify potential risks and opportunities and clearly understand how to react to different market conditions.

When developing a trading plan, traders should consider their risk tolerance, trading style, and financial goals. The plan should be flexible and adaptable, allowing for market and personal changes. Traders should regularly review and update their trading plan to remain relevant and effective.

By having a clear and concise trading plan in place, traders can reduce the impact of emotions on their decision-making process and improve their overall trading performance.

Watch how to build a good trading plan here

Manage Risk Effectively

Managing risk effectively is another critical step in mastering and controlling emotions in forex trading. Risk management strategies help traders to identify potential risks and reduce the impact of market volatility on their trading performance.

Traders can manage risk in various ways, including setting stop-loss orders, using appropriate leverage, and diversifying their trading portfolios. A stop-loss order is a type of order that automatically closes a trade when a specified price level is reached, helping traders to limit their losses. Using appropriate leverage is also crucial to managing risk, as it helps traders to avoid overexposure to the market.

You can watch my video here to learn in detail about Stop Loss and how to use it correctly.

You can get our Stop Loss Trailer Pro here

Diversifying a trading portfolio can help traders to spread their risk across multiple markets and instruments, reducing the impact of any single trade or market event. Traders should also consider using hedging strategies, such as options or futures contracts, to protect against potential losses.

Effective risk management can help traders reduce negative emotions, such as fear and anxiety, on their decision-making process. By clearly understanding their risk exposure and implementing appropriate risk management strategies, traders can reduce uncertainty and improve their overall trading performance.

Learn the truth about money and risk management here

Practice Patience

Patience is a critical skill for forex traders. The markets can be unpredictable and subject to sudden changes, so it is important to be patient and wait for the right opportunities to present themselves. Impulsive trades driven by fear or greed are often the result of impatience and can lead to significant losses.

However, by taking a patient and disciplined approach to trade, traders can reduce the impact of emotions on their decision-making process. Patience involves waiting for the right trading opportunities and avoiding impulsive trades based on emotional reactions.

To practice patience in forex trading, traders should develop and stick to a clear trading plan. They should also avoid trading based on rumours or short-term market fluctuations, which can lead to impulsive decision-making and emotional trading.

Traders should also develop a long-term perspective on trading and avoid getting too caught up in short-term gains or losses. By focusing on their overall trading performance and goals, traders can reduce the impact of emotions on their decision-making process and improve their overall trading performance.

Practicing patience requires discipline and self-control, but it can ultimately lead to more successful and profitable trading outcomes.

Watch my webinar on Why 90% Of Forex Traders LOSE BADLY and How To CHANGE IT Forever!

Develop a Positive Mindset

Developing a positive mindset is another critical component of mastering your emotions in forex trading. Positive thinking can help to reduce stress and anxiety, improve confidence, and enhance decision-making skills. Positive affirmations, visualization, and meditation are powerful tools that can help to cultivate a positive mindset.

To develop a positive mindset, traders should focus on the long term and avoid getting too caught up in short-term market fluctuations. They should also maintain a sense of perspective and avoid overreacting to individual trades or events.

Traders can also benefit from adopting a growth mindset, which involves embracing challenges, learning from mistakes, and seeing failures as opportunities for growth. A growth mindset can help traders maintain a positive attitude toward trading and avoid being discouraged by setbacks.

Positive self-talk can also be an effective tool for developing a positive mindset. Traders can use positive affirmations and visualizations to stay focused, build confidence, and maintain a positive attitude toward trading.

By developing a positive mindset, traders can reduce the impact of negative emotions, such as fear and anxiety, on their decision-making process. They can also maintain a sense of perspective and avoid getting too emotionally attached to individual trades or events, leading to improved trading performance.

Know about the 15 Factors That Ruin Your Trading here

Maintain Discipline

Maintaining discipline is crucial for successful forex trading. It requires a strong commitment to following your trading plan, managing risk, and controlling emotions. Discipline can be challenging, especially during periods of market volatility, but it is essential for long-term success.

To maintain discipline in forex trading, traders should establish clear rules and guidelines for their trading activities. These rules should be based on a comprehensive trading plan that outlines trading strategies, risk management, and exit strategies.

Traders should also avoid making impulsive or emotional trading decisions. They should stick to their trading plan and avoid chasing market trends or reacting to short-term market fluctuations.

Maintaining discipline also involves managing emotions effectively. Traders should recognize and acknowledge their emotional reactions to market events but avoid making trading decisions based solely on these emotions. Instead, they should take a step back, re-evaluate the situation, and make rational decisions based on their trading plan and risk management strategies.

Consistent practice and regular self-assessment can also help traders to maintain discipline in their trading activities. Traders should regularly review their performance and identify areas where they can improve their discipline and decision-making.

By maintaining discipline, traders can reduce the impact of negative emotions on their trading performance, avoid impulsive or emotional trading decisions, and increase their overall profitability in forex trading.

Take Breaks and Practice Self-Care

Forex trading can be intense and stressful, affecting mental and physical health. Taking breaks, practicing self-care, and engaging in relaxing activities can help to reduce stress and improve emotional well-being. Regular exercise, healthy eating, and getting enough sleep are essential for optimal forex trading performance.

Traders should take regular breaks from trading to rest and recharge. This could involve taking a short walk, engaging in physical exercise, or engaging in relaxation techniques such as meditation or deep breathing exercises. Regular breaks can help to reduce stress, improve mental clarity, and prevent burnout.

Practicing self-care also involves maintaining a healthy lifestyle, such as getting enough sleep, eating a balanced diet, and staying hydrated. These practices can help traders to maintain physical and mental health and reduce the impact of negative emotions on their trading performance.

Traders should also seek support from friends, family, or a professional therapist if needed. Talking to someone can help to reduce stress, provide perspective, and improve mental health.

By taking breaks and practicing self-care, traders can reduce the impact of negative emotions such as stress, anxiety, and burnout on their trading performance. This can lead to improved mental clarity, better decision-making, and increased overall profitability in forex trading.

Seek Support and Learn from Others

Forex trading can be a lonely and isolating experience. It is essential to seek support and learn from others in the industry. Joining trading communities, attending seminars and webinars, and seeking guidance from experienced traders or mentors can help to enhance knowledge, skills, and emotional control.

Traders can seek support from other traders through online communities, forums, or social media groups. These communities can provide valuable insights and tips on trading strategies and risk management. Traders can also benefit from connecting with more experienced traders who can provide mentorship and guidance.

Learning from others also involves reviewing past trades and analyzing trading performance. Traders can identify areas where they need improvement and seek feedback from others on their trading strategies and decision-making process. This feedback can help traders adjust their trading plan and improve their overall trading performance.

Traders can also benefit from attending trading workshops, seminars, or webinars to learn from industry experts and improve their trading skills. These events can provide valuable insights into market trends, trading strategies, and risk management techniques.

By seeking support and learning from others, traders can reduce the impact of negative emotions such as self-doubt, fear, and anxiety. They can also gain valuable insights and advice on trading strategies and risk management, leading to improved trading performance and increased profitability in forex trading.

I invite you to join our trading family (Home Trader Club) where you can connect with like-minded traders, share insights, learn from each other, get mentoring and enjoy our REAL-TIME trading opportunities and REAL-TIME trading education.

Conclusion

In conclusion, mastering and controlling emotions is crucial to successful forex trading. Emotions can both help and hinder trading performance and understanding the role of emotions in forex trading is essential. By developing a comprehensive trading plan, managing risk effectively, practicing patience, developing a positive mindset, maintaining discipline, taking breaks and practicing self-care, and seeking support from others, traders can improve their emotional control and boost their trading performance. As the forex market continues to evolve and become more complex, managing emotions will become an increasingly important skill for traders to master. Mastering and controlling emotions is a critical part of successful trading.