Welcome to this week’s Forex Forecast. As we step into December, we enter a unique trading environment:

✔ The markets often experience the classic “Santa Claus Rally” effect

✔ At the same time, volatility tends to decline slowly as we approach year-end

This combination creates opportunities — but also requires discipline, patience, and realistic expectations.

Before we dive in, a big thank you to our partners at Eight Cap Broker for supporting our community.

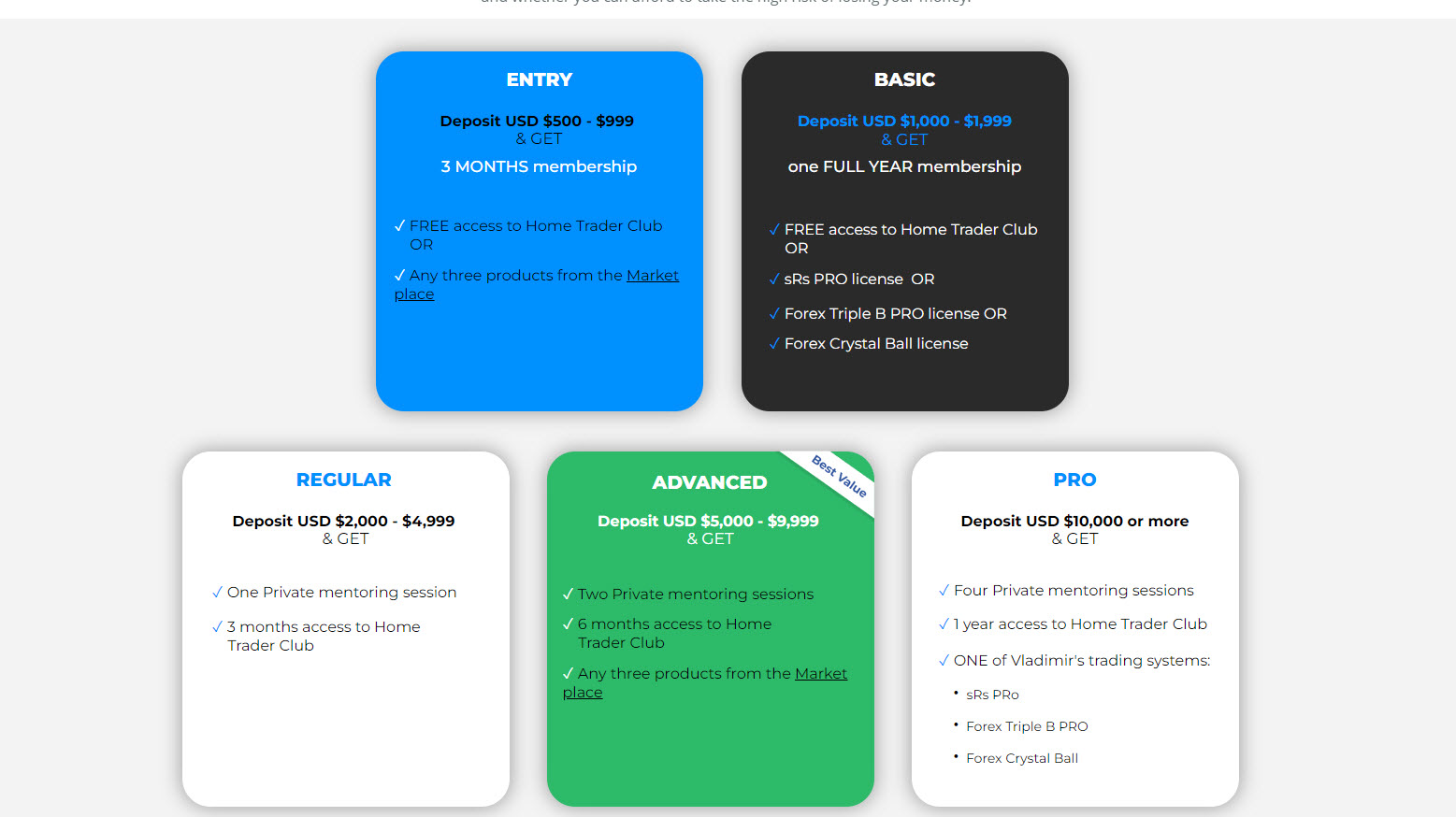

You can continue enjoying all the exclusive offers we have together with them — including up to one full year of free access to Home Trader Club, all our trading systems and tools, private mentoring sessions, and much more.

? Check out the exclusive offers via the link below the video or on vladimirribakov.com

Don’t forget to Like, Comment, and Subscribe for more weekly plans and real-time insights.

Explore My Free Mentorship Program

As an Internationally Certified Financial Technician (CFTe, IFTA) and former private capital hedge fund trader, I have successfully mentored numerous students who are now thriving in the trading world. Students who learned with me, are now full-time traders, work in the trading industry, run their own capital firms or are fully funded traders by private companies, develop automated trading solutions and manage others’ capitals. I am a very proud mentor and I am proud of the success stories I’ve helped create, and for a limited time, I’m offering my mentorship program for free through a partnership with Eight Cap broker. Join Eight Cap, become an active trader, and choose the offer that suits you best –

For more details, visit: Home Trader Club Mentorship Program

I’m excited to work with you and help you reach your desired level of success!

EURUSD Forecast – December 2025

Main Bias: Short-term bearish pressure while long-term bullish cycle still intact

Key Levels: 1.1650 – 1.1780 resistance zone

Trading Focus: Sell setups if resistance holds; Buy dips only if bullish structure rebuilds

Long-Term Outlook

The broader bullish cycle on EURUSD is not yet complete, and I continue to expect an eventual move toward 1.2200 and possibly higher before the weekly cycle finishes.

Short-Term Structure

On the daily chart, the pair completed three strong bullish waves, which typically leads to corrective behavior — either:

Both remain possible.

Dropping to the 4-hour chart, price action shows:

-

Three lower highs & lower lows

-

Developing ABCD structure toward the downside

-

Potential completion of the daily correction zone

Key Zone to Watch

The area between 1.1650 – 1.1780 (including the psychological 1.1700 round number) is a critical resistance cluster, combining:

-

Multi-swing peaks

-

Volume-profile balanced zone

-

Classical supply area

-

Bearish MACD divergence pressure building

Trading Plan – EURUSD

Bearish Plan:

As long as price remains below 1.1780, watch for bearish triggers:

-

Resistance rejections

-

Bearish divergence on MACD

-

Failure to create higher highs

Bullish Plan:

Only if the daily chart forms clear higher highs & higher lows above the balance zone — then buy-the-dip becomes valid again.

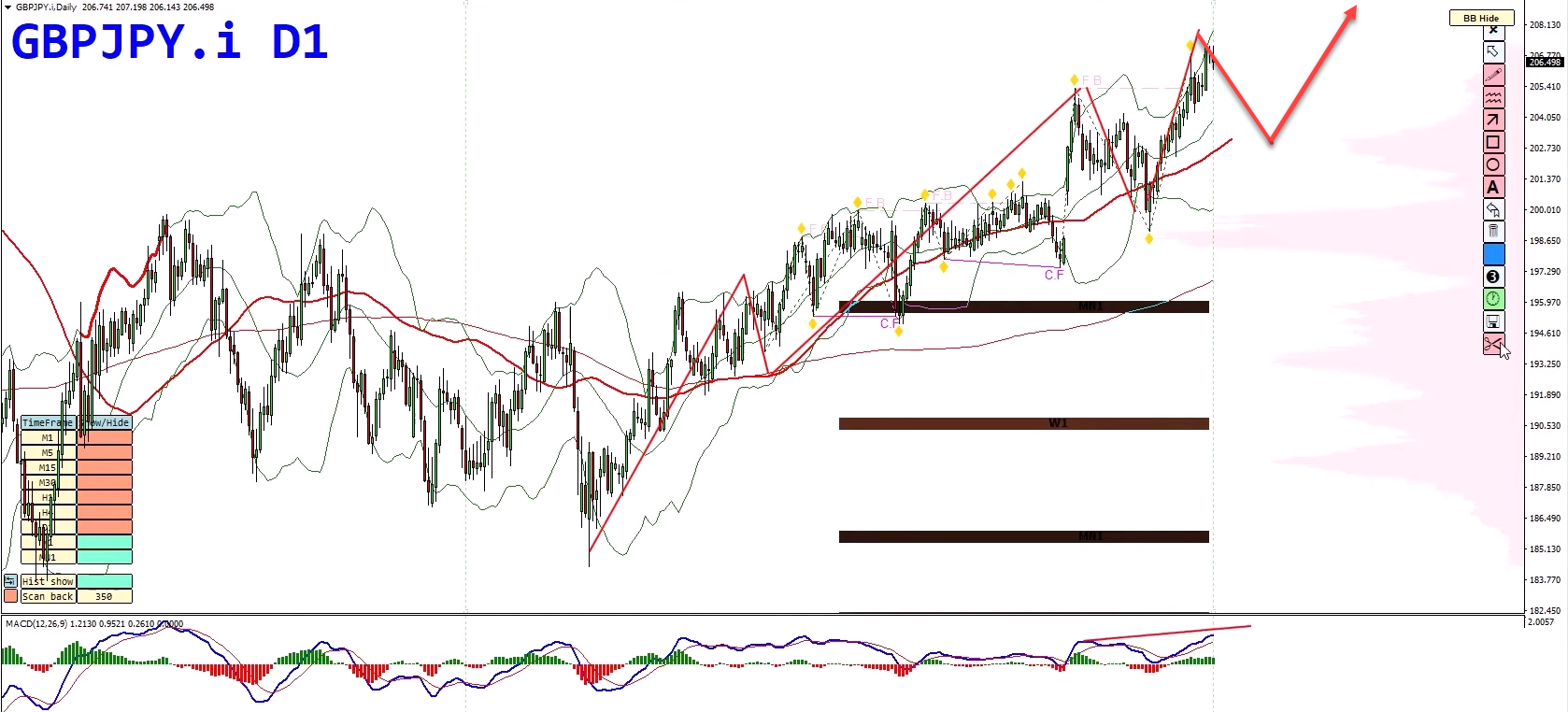

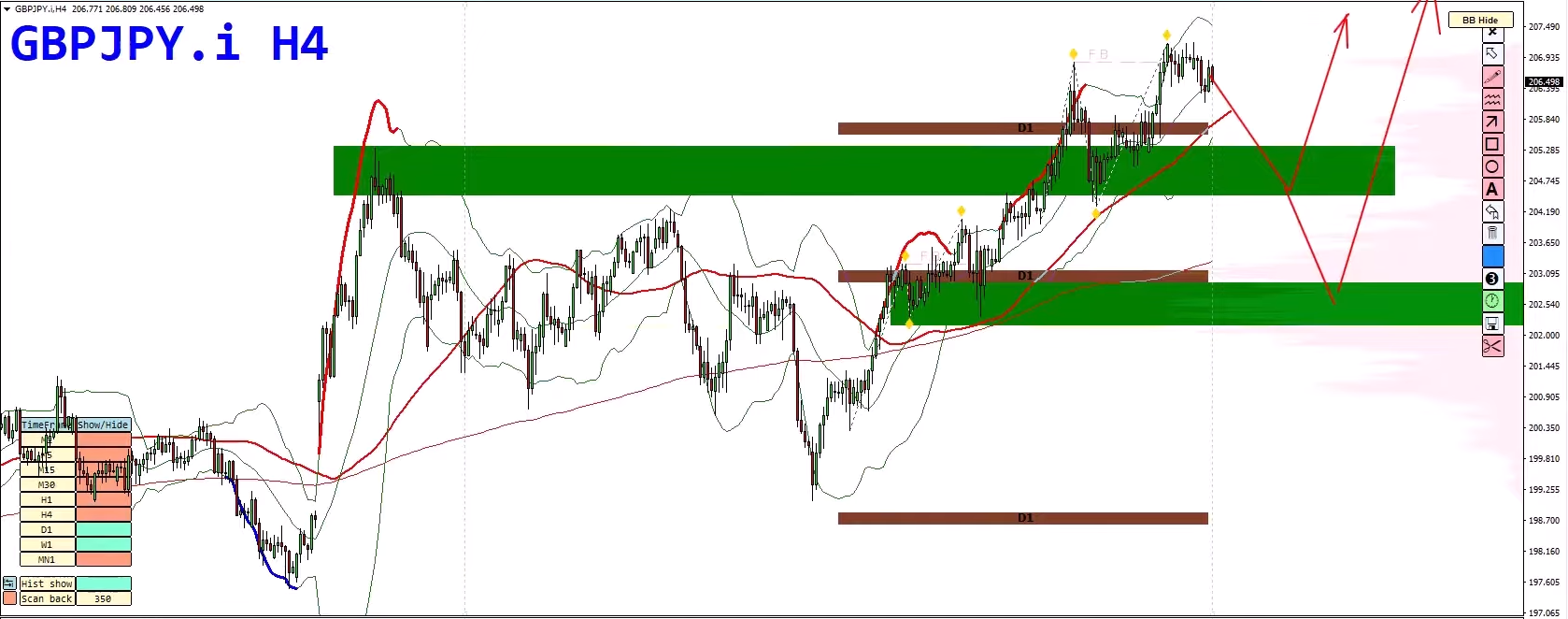

GBPJPY Forecast – December 2025

Main Bias: Bullish continuation short-term; potential long-term bearish reversal forming

Key Support Zone: 205.00 – 205.50

Trading Focus: Buy retracements while monthly peak develops

We haven’t covered GBPJPY for a while, but now it becomes extremely attractive again.

Long-Term Picture

On the monthly chart, GBPJPY approaches major supply levels and is completing a triple wave rally alongside a forming monthly bearish divergence.

This suggests that a massive long-term reversal is building — but not yet ready.

So far, the pair continues to push higher.

Weekly & Daily Structure

-

Weekly divergence is developing but not yet complete

-

Daily chart still shows higher highs & higher lows

-

No bearish divergence on MACD daily → bullish pressure intact

Short-Term (4H) Plan

The structure is clean: higher highs & higher lows.

The next buy zone sits around:

Key Buy Levels

✔ 205.00 – 205.50 demand zone

✔ Broken resistance turning to support

✔ Volume profile balance area

✔ Daily technical support

Trading Plan – GBPJPY

As long as price holds above 205.00 – 205.50:

➡️ Look for buys on retracements

The pair still has room toward the major monthly supply before a larger downturn begins.

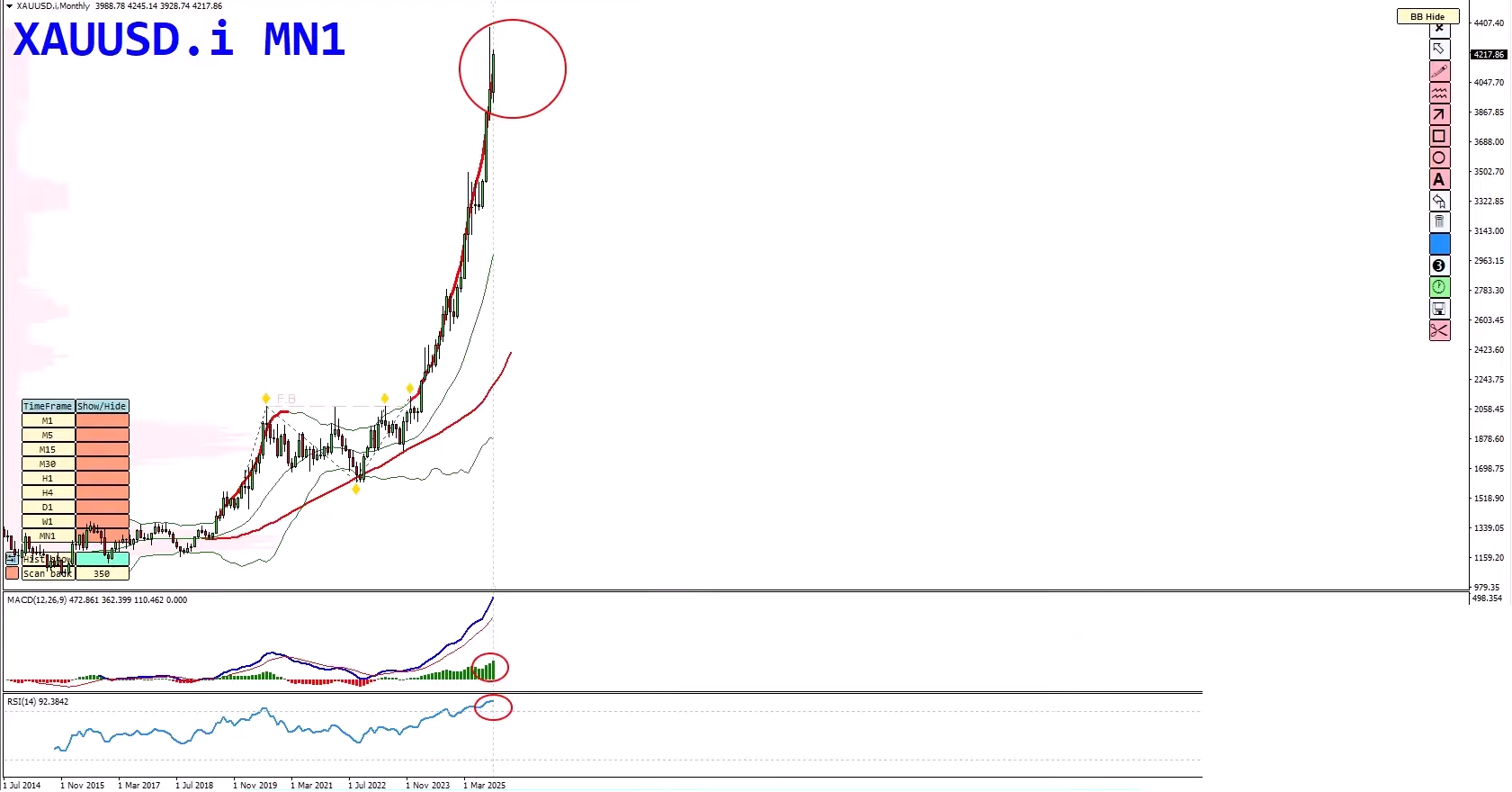

Gold Forecast – December 2025

Main Bias: Overbought and vulnerable; two major scenarios possible

Key Levels: Watch range and last swing low for breakout

Trading Focus: Prepare for either final push to new high or breakdown from range

While Silver printed new all-time highs, Gold is lagging behind, creating an interesting divergence.

Long-Term View

Gold is sitting at very extended, overbought conditions on higher timeframes:

Daily Structure: Two Scenarios

1️⃣ Bullish extension scenario:

Daily chart completes another push up, then forms a bearish divergence → ideal topping structure for sell opportunities.

2️⃣ Bearish breakdown scenario:

Daily structure already forming two-wave correction.

If the range breaks down and price closes below the recent low, momentum could accelerate sharply.

This opens a surprising but technically valid downside projection toward:

? $3,500 – $3,400

(yes, aggressive — but structurally possible)

4H Chart – Setup Confirmation

-

Watch the range boundaries

-

Breakdown AND close below the low → triggers bearish plan

-

Failed breakdown → look for continuation to a new peak and then divergence for a sell

Trading Plan – Gold

Bearish Setup:

Sell rallies ONLY if:

✔ Range breaks down

✔ New highs form with divergence

✔ Fake high forms (break above swing + close below)

Bitcoin Forecast – December 2025

Main Bias: Rally is temporary; bearish continuation expected afterward

Key Resistance Zone: 95,000 – 98,000 and up to 106,000

Trading Focus: Sell zones at top of the corrective rally

Bitcoin remains one of the most discussed assets lately.

Directional Expectation

I remain with my long-standing view:

➡️ The bearish move is not over

➡️ Current rallies are corrective, not impulsive

Daily Chart Highlights

-

Lower highs & lower lows remain intact

-

RSI rebounded from oversold → supports a temporary bullish correction

-

MACD likely to form bearish hidden divergence as price approaches resistance

Key Sell Zone

Between:

? 95,000 – 98,000

and extended range:

? Up to 106,000

This area contains:

-

Broken supports acting as resistance

-

Last significant swing highs

-

Major supply zone

4H Chart – Short-Term Buy Before the Big Sell

As long as the following supports hold:

-

Broken resistance acting as fresh support

-

Last low acting as demand

Bitcoin may continue its push upward before the next major sell-off.

Pro Trading Tip

Pro Trading Tip

Every forecast above is paired with two scenarios. Why? Because great trading is not about being right — it’s about being ready. Let the market confirm the bias. Use your system, manage risk, and execute only when the structure and confirmation align.

Join the Home Trader Club

Join the Home Trader Club

Want to access the tools, systems, and real-time education we use daily?

With Eight Cap Broker’s support, you can now enjoy up to one full year of access to the Home Trader Club — including:

-

All professional trading systems

-

Exclusive mentoring sessions

-

Real-time trade ideas and setups

-

Full access to our course library and trading marketplace

Wishing you a profitable week ahead!

Vladimir Ribakov

Internationally Certified Financial Technician

Home Trader Club

E-commerce Script