Hello traders, Vladimir here from Home Trader Club, and welcome to another Weekly Forex Forecast! As always, a big thanks and thumbs up to our partners at Eight Cap Broker for supporting our community. You can continue enjoying all the exclusive offers we have together with them — including up to one full year of free access to Home Trader Club, all our trading systems and tools, private mentoring sessions, and much more.

? Check out the exclusive offers via the link below the video or on vladimirribakov.com

Don’t forget to Like, Comment, and Subscribe for more weekly plans and real-time insights.

Explore My Free Mentorship Program

As an Internationally Certified Financial Technician (CFTe, IFTA) and former private capital hedge fund trader, I have successfully mentored numerous students who are now thriving in the trading world. Students who learned with me, are now full-time traders, work in the trading industry, run their own capital firms or are fully funded traders by private companies, develop automated trading solutions and manage others’ capitals. I am a very proud mentor and I am proud of the success stories I’ve helped create, and for a limited time, I’m offering my mentorship program for free through a partnership with Eight Cap broker. Join Eight Cap, become an active trader, and choose the offer that suits you best –

For more details, visit: Home Trader Club Mentorship Program

I’m excited to work with you and help you reach your desired level of success!

? EUR/USD – Correction Still in Play

The Euro Dollar (EUR/USD) continues to unfold within a corrective structure, and we appear to be nearing the end of a three-wave pattern. The ideal scenario suggests a completion of the ABCD correction around the 1.14 area or potentially lower, near 1.12–1.11.

As long as the recent highs hold, EUR/USD may have further downside potential.

Watch the key resistance zones carefully:

- 1.1550–1.1580 – Broken support now acting as resistance

- 1.1620 – Classical supply area

Unless these resistance zones are broken, the bias remains bearish, and deeper retracements are possible.

? GBP/USD – More Downside Before the Bottom

The Pound Dollar (GBP/USD) is also completing a corrective structure, following three waves up accompanied by a bearish divergence on the MACD.

Currently, price action is hovering around the 100% Fibonacci extension zone near 1.31, a level of high confluence.

However, it’s still premature to call a bottom. The ideal technical setup would include:

- Another final push down to complete the correction

- Formation of a bullish divergence on the MACD

Important resistance levels to monitor:

- 1.3160–1.3175

- 1.3210–1.3230

- 1.3280 zone

As long as these zones hold, rallies are likely to serve as sell opportunities. Once the divergence forms, we’ll look for potential long setups.

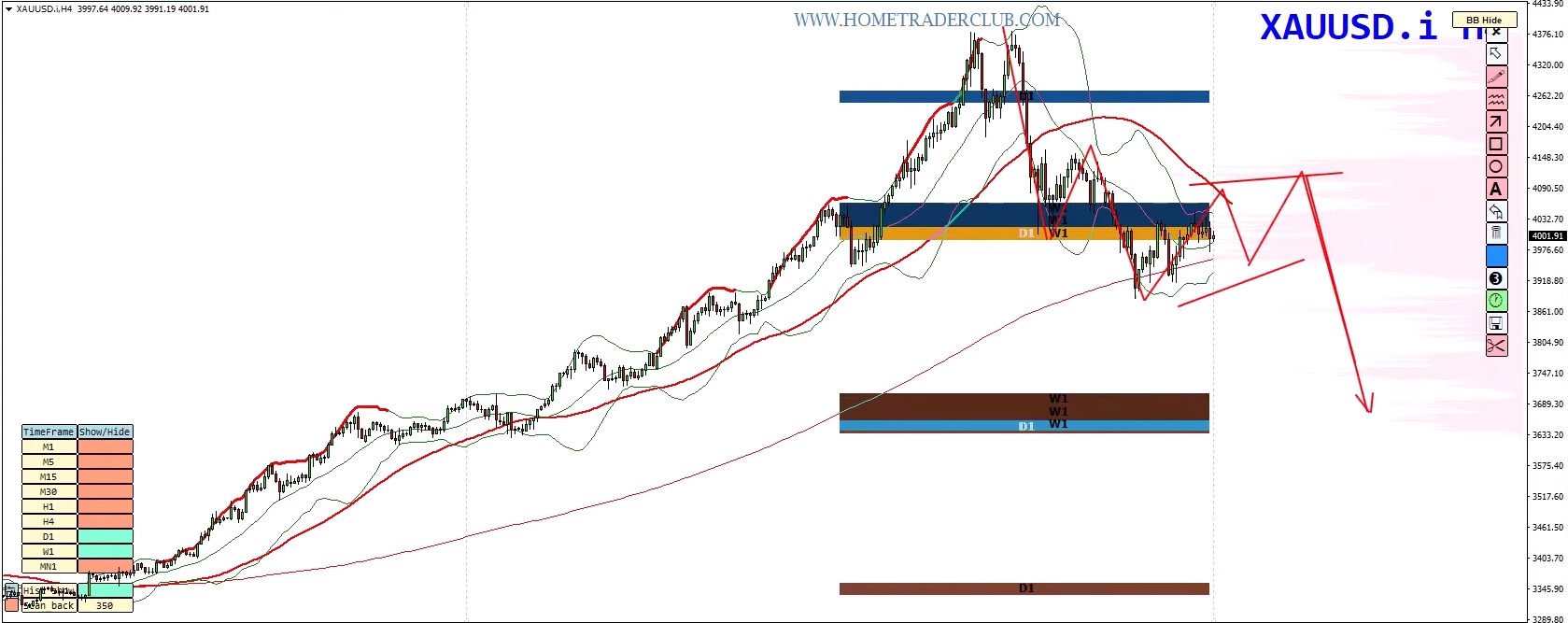

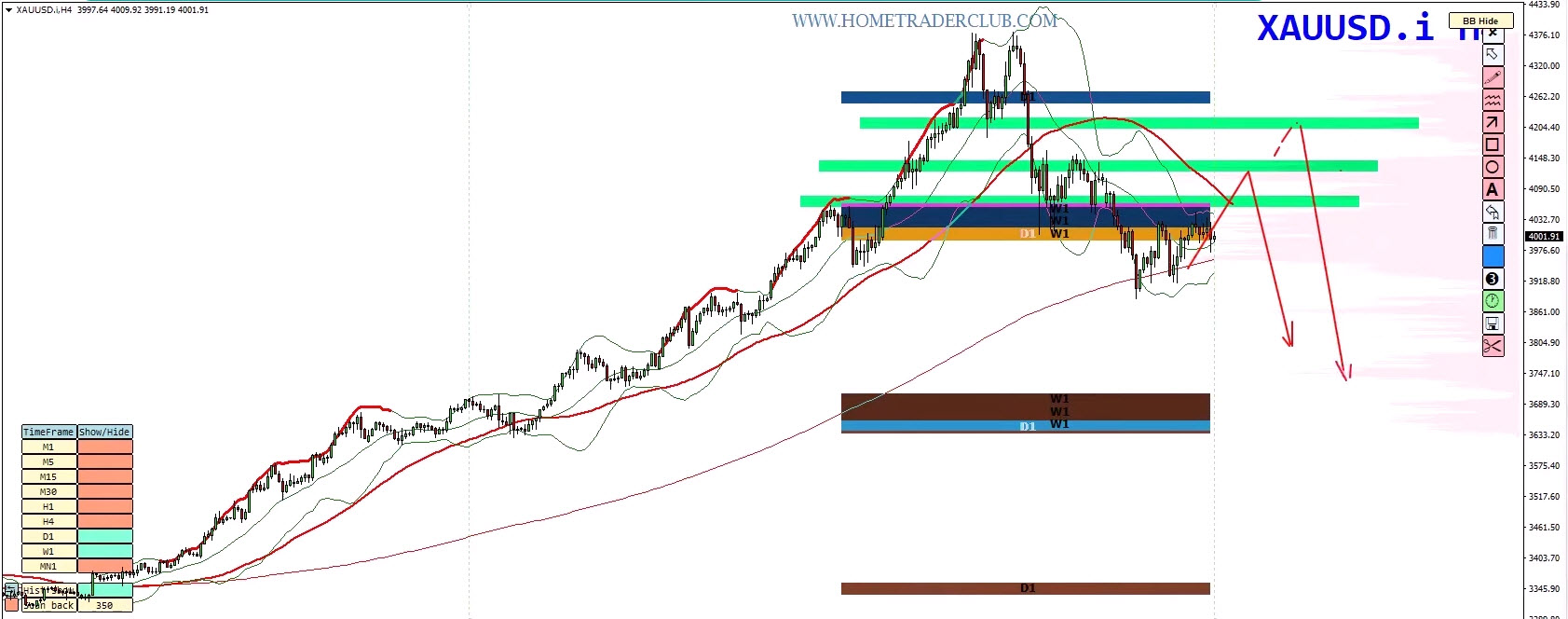

? GOLD – Correction Continues After the Peak

After reaching new all-time highs, Gold (XAU/USD) has entered a strong corrective phase. The RSI on the monthly, weekly, and daily charts all showed extreme overbought readings above 80, indicating the need for a cooldown.

The preferred scenario involves two corrective waves down, possibly with a short-term range or brief upward retracement before another leg lower.

Key resistance (sell) zones include:

- $2,060 – Previous daily high

- $2,130–$2,140 – Supply zone of the current correction

- $2,200 – Broken support of the double top, now acting as resistance

As long as Gold remains below these levels, I continue to favor selling rallies toward completing the correction. Later, a bullish divergence may present an excellent long-term buy opportunity.

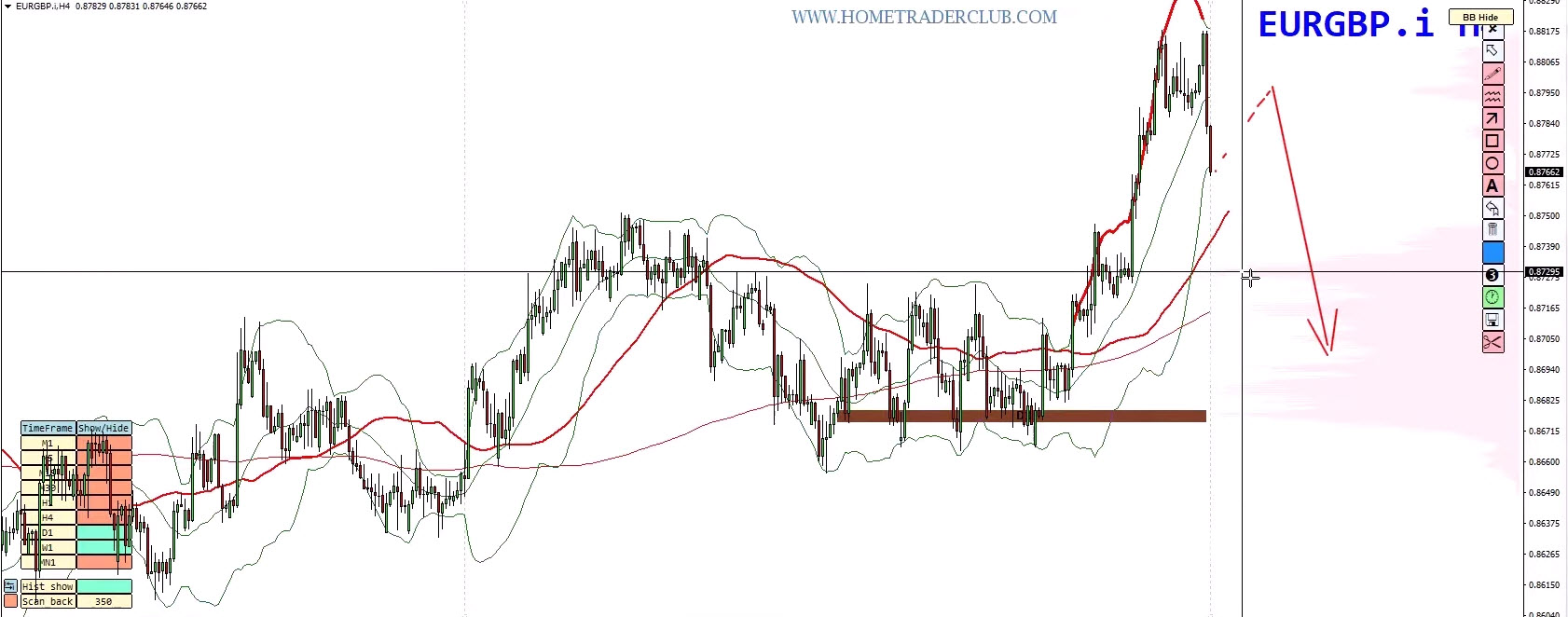

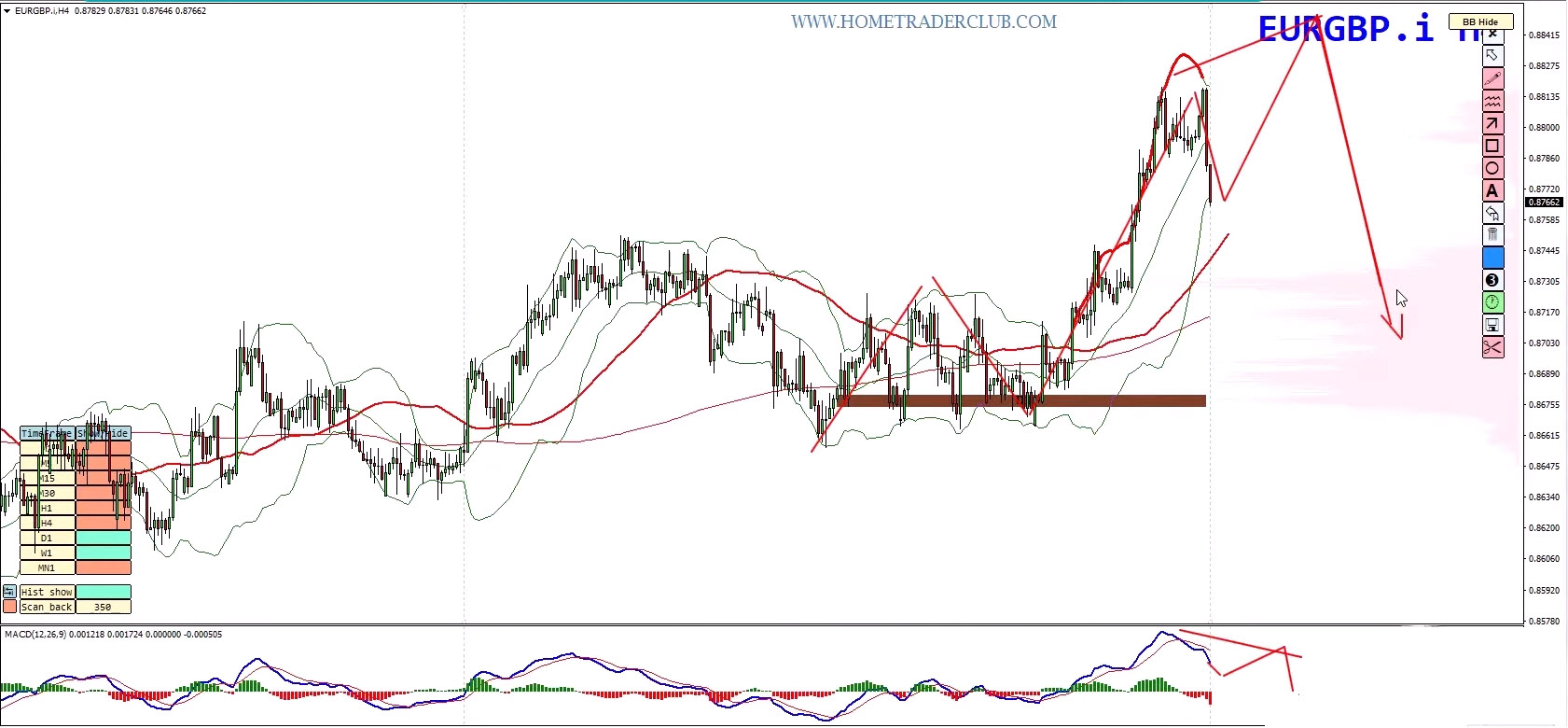

? EUR/GBP – Key Levels and Bearish Divergence

The Euro Pound (EUR/GBP) is currently testing a critical weekly supply zone. On both weekly and daily charts, we see a clear bearish divergence forming — price is making higher highs while MACD forms lower highs.

The double top has broken, followed by a strong bearish candle and multiple spikes, signaling potential exhaustion.

There are two possible scenarios:

- Immediate retracement and drop

- Targets: 0.8740–0.8720, next 0.8680–0.8660

2. Final push up before forming a deeper bearish divergence and then a major retrace or trend reversal

Either way, the bearish divergence across timeframes signals growing weakness, and traders should watch closely for confirmation patterns before entering.

Pro Trading Tip

Pro Trading Tip

Every forecast above is paired with two scenarios. Why? Because great trading is not about being right — it’s about being ready. Let the market confirm the bias. Use your system, manage risk, and execute only when the structure and confirmation align.

Join the Home Trader Club

Join the Home Trader Club

Want to access the tools, systems, and real-time education we use daily?

With Eight Cap Broker’s support, you can now enjoy up to one full year of access to the Home Trader Club — including:

-

All professional trading systems

-

Exclusive mentoring sessions

-

Real-time trade ideas and setups

-

Full access to our course library and trading marketplace

Wishing you a profitable week ahead!

Vladimir Ribakov

Internationally Certified Financial Technician

Home Trader Club