Hello traders, Vladimir here from Home Trader Club, and welcome to another Weekly Forex Forecast! As always, a big thanks and thumbs up to our partners at Eight Cap Broker for supporting our community. You can continue enjoying all the exclusive offers we have together with them — including up to one full year of free access to Home Trader Club, all our trading systems and tools, private mentoring sessions, and much more.

- 1 Watch the Full Weekly Forecast Video

- 2 Explore My Free Mentorship Program

- 3 EUR/USD – Bearish Momentum Continues ?

- 4 USD/JPY – Range Bound with Divergence Potential ⚖️

- 5 EUR/CAD – False Break Setup Forming ?

- 6 GOLD (XAU/USD) – Overbought and Double Top Formation ?

- 7 Pro Trading Tip

- 8 Join the Home Trader Club

Watch the Full Weekly Forecast Video

Watch the Full Weekly Forecast Video

Don’t forget to Like, Comment, and Subscribe for more weekly plans and real-time insights.

Explore My Free Mentorship Program

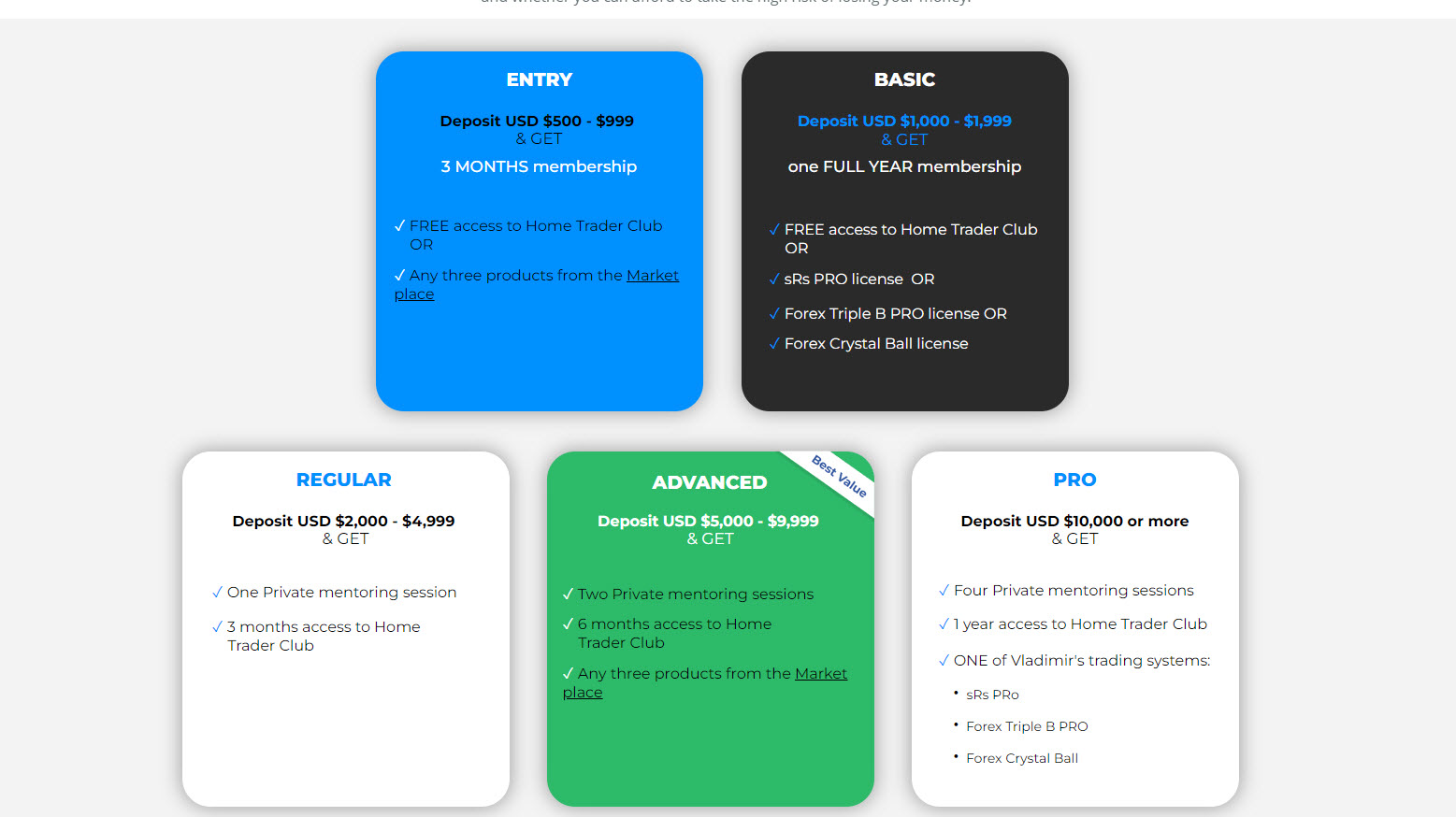

As an Internationally Certified Financial Technician (CFTe, IFTA) and former private capital hedge fund trader, I have successfully mentored numerous students who are now thriving in the trading world. Students who learned with me, are now full-time traders, work in the trading industry, run their own capital firms or are fully funded traders by private companies, develop automated trading solutions and manage others’ capitals. I am a very proud mentor and I am proud of the success stories I’ve helped create, and for a limited time, I’m offering my mentorship program for free through a partnership with Eight Cap broker. Join Eight Cap, become an active trader, and choose the offer that suits you best –

For more details, visit: Home Trader Club Mentorship Program

I’m excited to work with you and help you reach your desired level of success!

EUR/USD – Bearish Momentum Continues ?

The Euro-Dollar remains under pressure after completing a bearish divergence on the daily chart — higher highs on the price while the MACD shows lower highs.

On the 4-hour chart, we can clearly see three consecutive lower highs and lower lows, confirming the short-term bearish momentum.

Technical Outlook:

-

Daily: Bearish divergence between price and MACD

-

4H: False synchronization (lower lows on both price and MACD)

Sell the rallies is my plan either a potential ABCD or a range

-

Levels to Watch:

? Trading Plan: Sell the rallies.

As long as the bearish structure holds, short-term retraces are opportunities to join the downside. A break below the local lows could extend the move further toward the 1.06–1.05 area.

USD/JPY – Range Bound with Divergence Potential ⚖️

The Dollar-Yen continues to move within a wide weekly range, currently testing the upper boundary.

Two Possible Scenarios:

-

Bullish Breakout:

A break above the range high, followed by a retest, may open the door for a continuation to the upside. -

Bearish Reversal:

If price fails at the top of the range and completes a bearish divergence on the daily and 4-hour charts, we could see a push lower.

? Trading Plan: Wait for the completion of divergence setups and confirmation candles near the top of the range. Once momentum shifts, look for short entries aligned with the daily divergence.

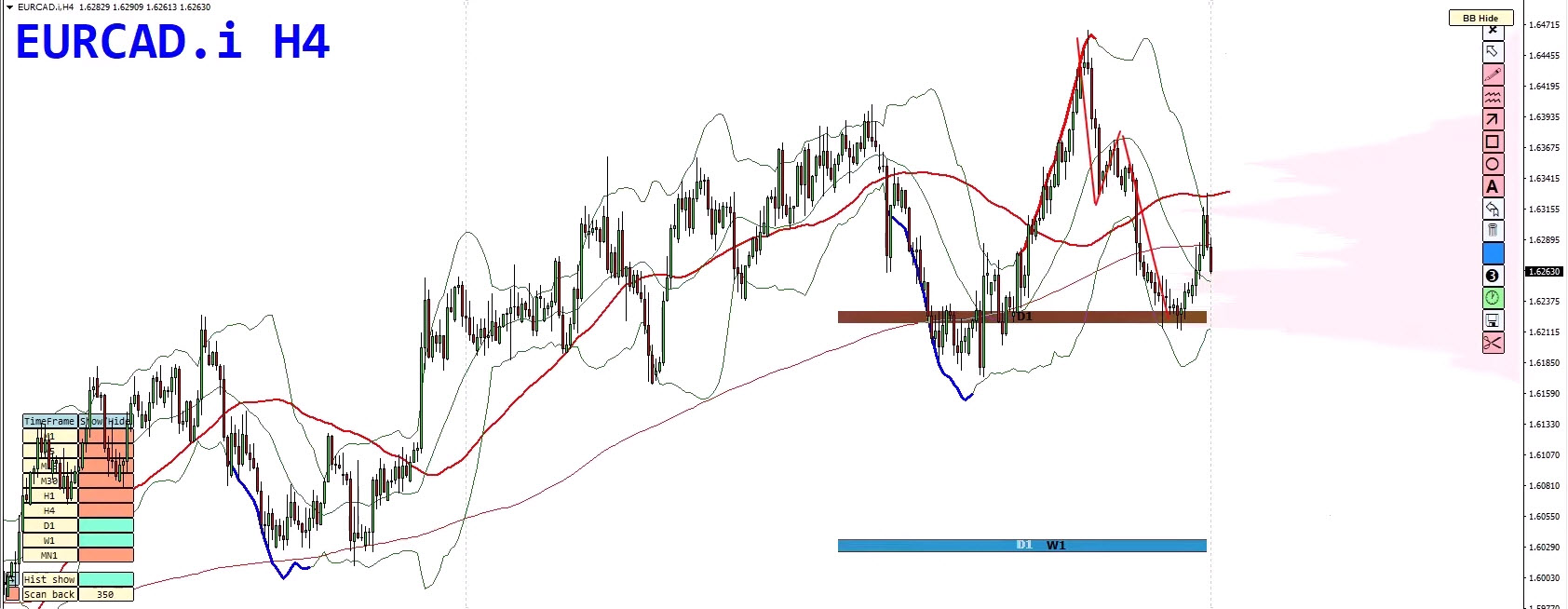

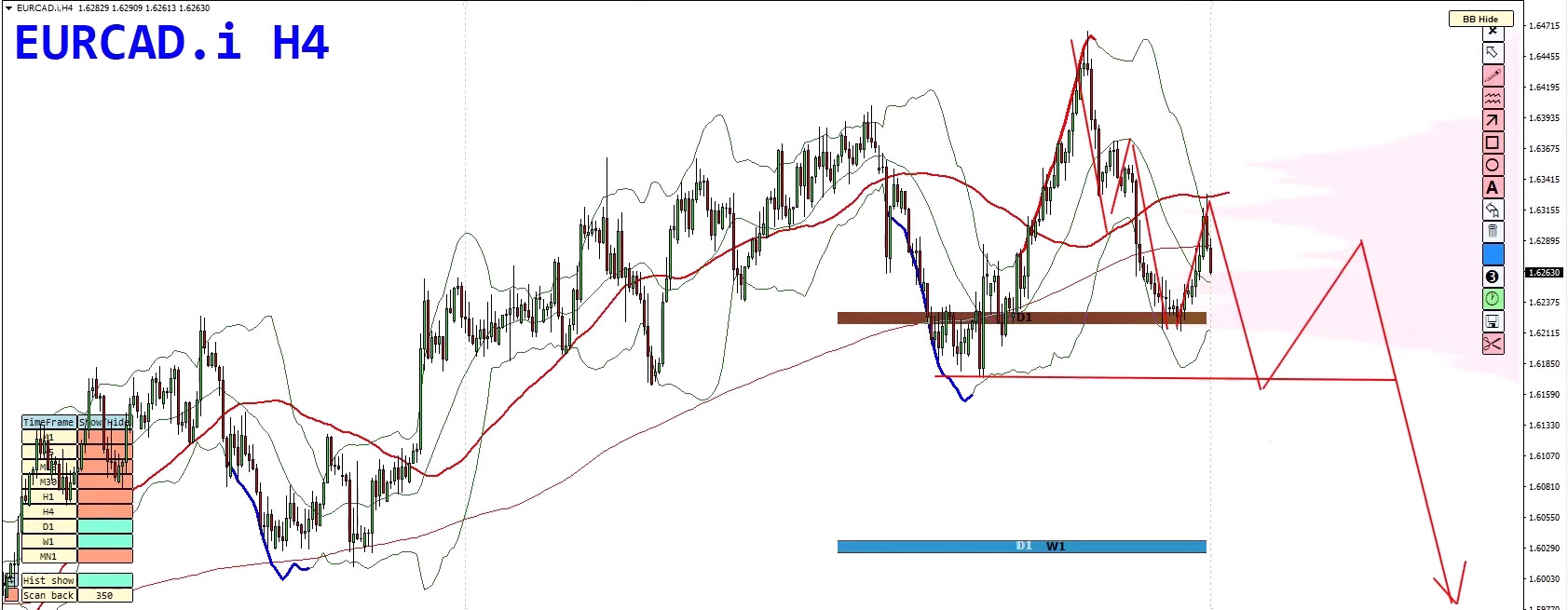

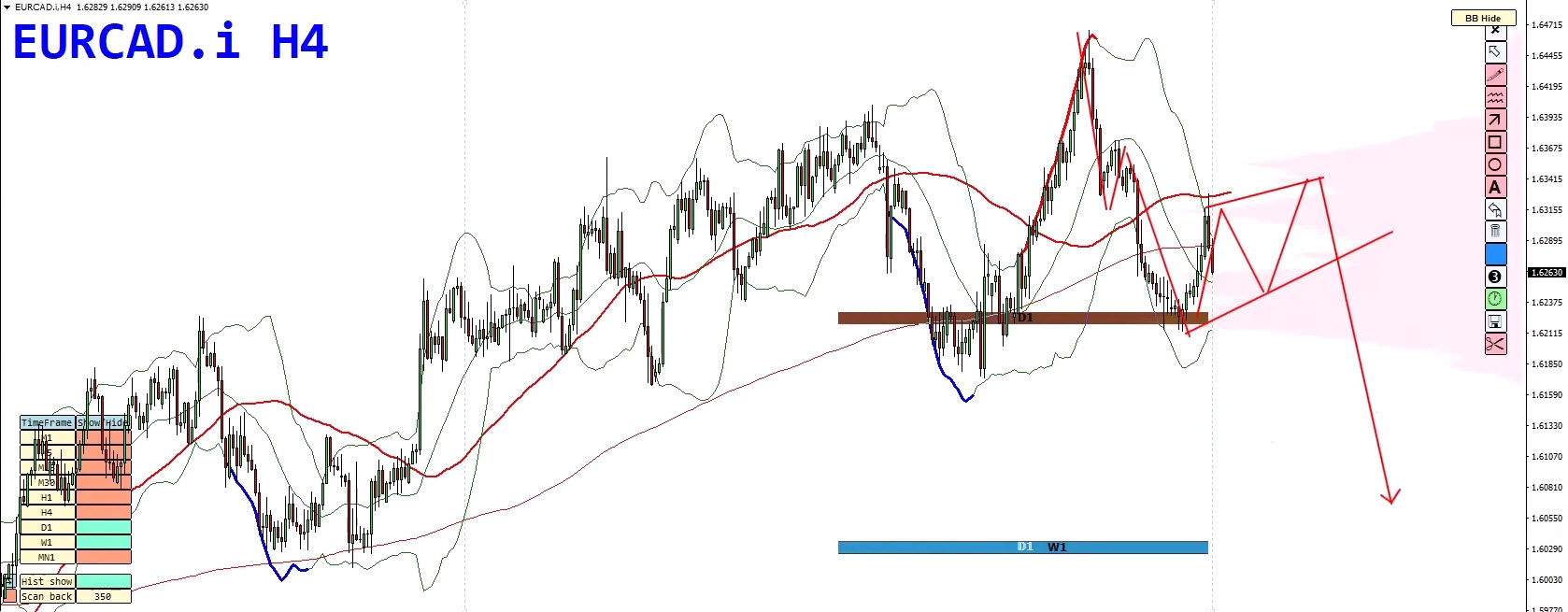

EUR/CAD – False Break Setup Forming ?

The Euro-Canadian Dollar is developing a classic false-break structure with strong downside potential.

On the daily chart, price has been riding the upper Bollinger Band for over 20 candles, forming a rising wedge pattern. Divergence is clearly visible: higher highs on price vs lower highs on MACD.

Technical Outlook:

-

Daily: Rising wedge and bearish divergence

-

4H: Strong downside momentum with lower highs and lower lows

-

Scenarios to Watch:

? Trading Plan: Once the pullback completes, look to sell the rallies or trade the breakout after confirmation. Momentum supports the bearish bias as long as price holds below the upper wedge line.

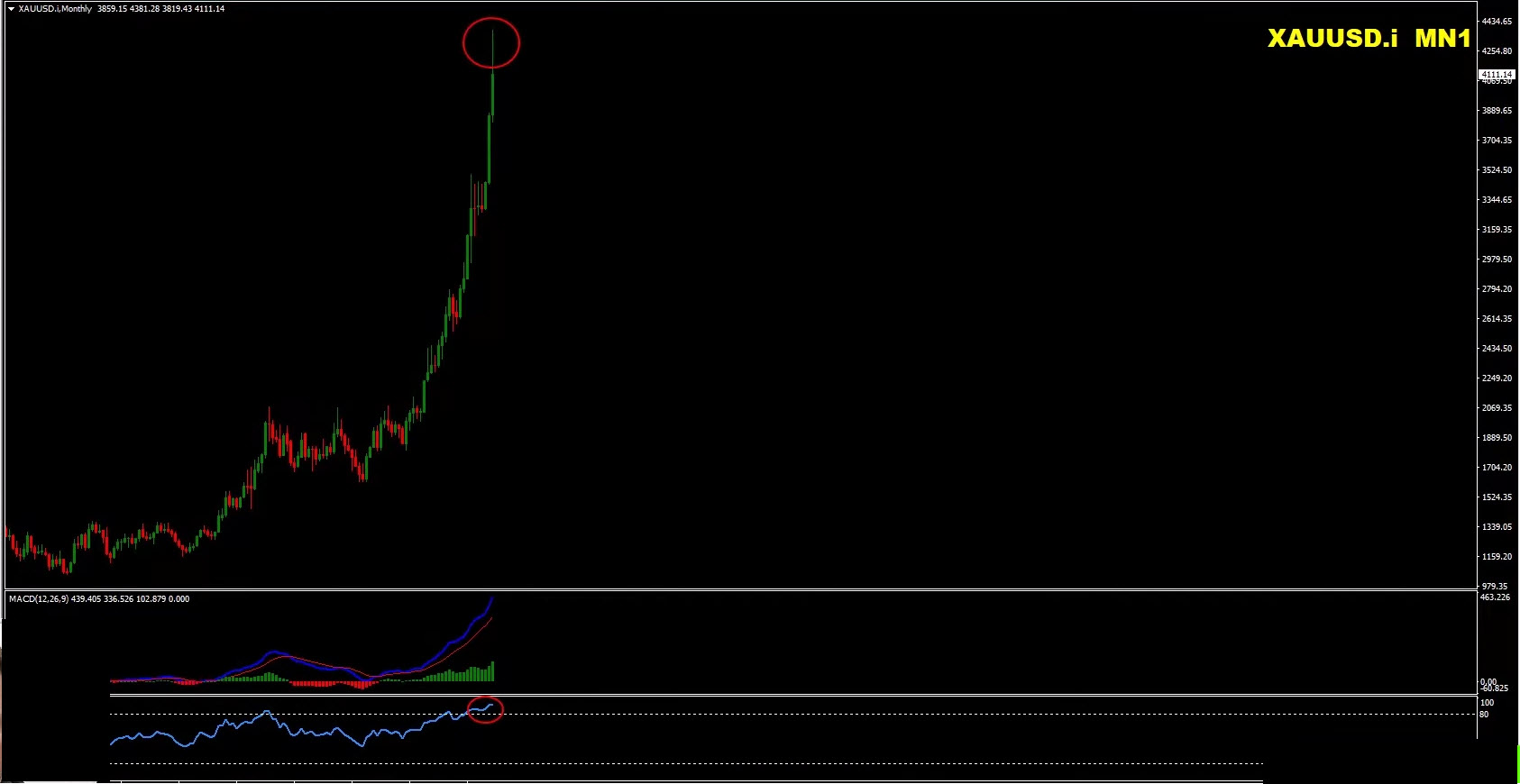

GOLD (XAU/USD) – Overbought and Double Top Formation ?

Gold reached extreme overbought conditions across multiple timeframes — monthly, weekly, and daily — with the RSI above 80 and sharp rejection candles forming.

Monthly

Weekly

Daily

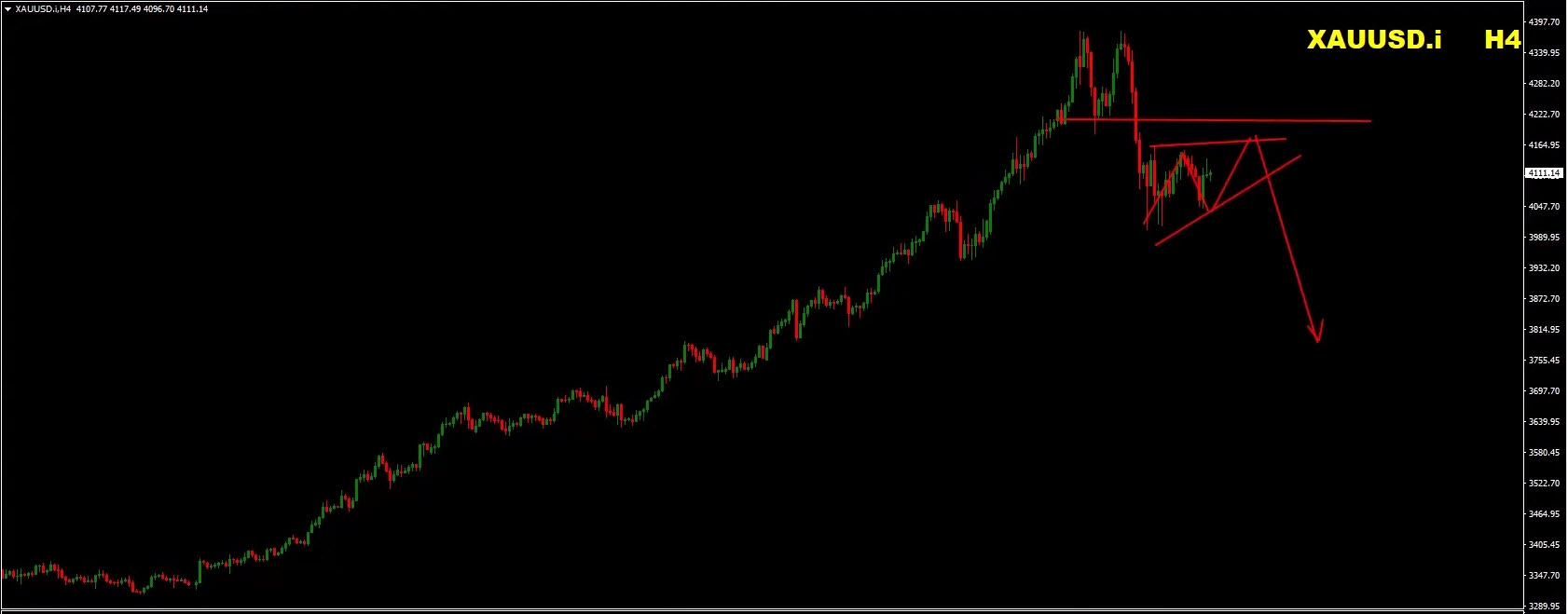

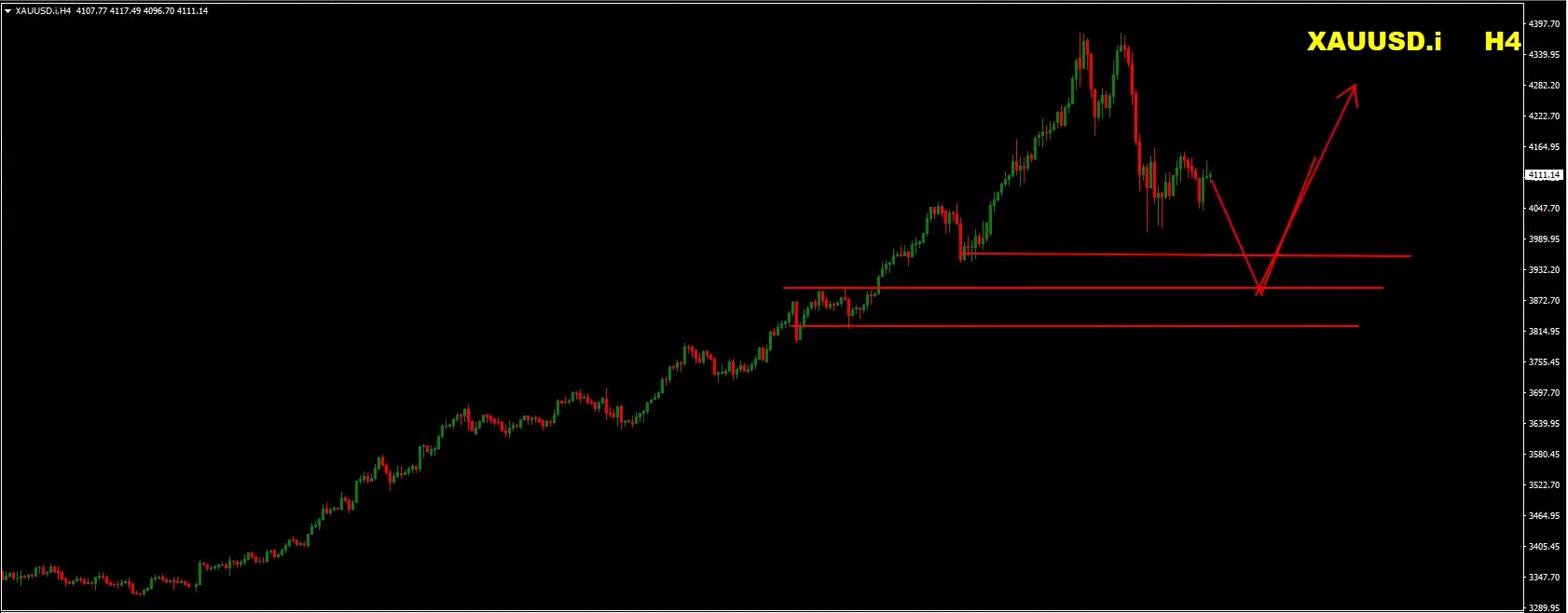

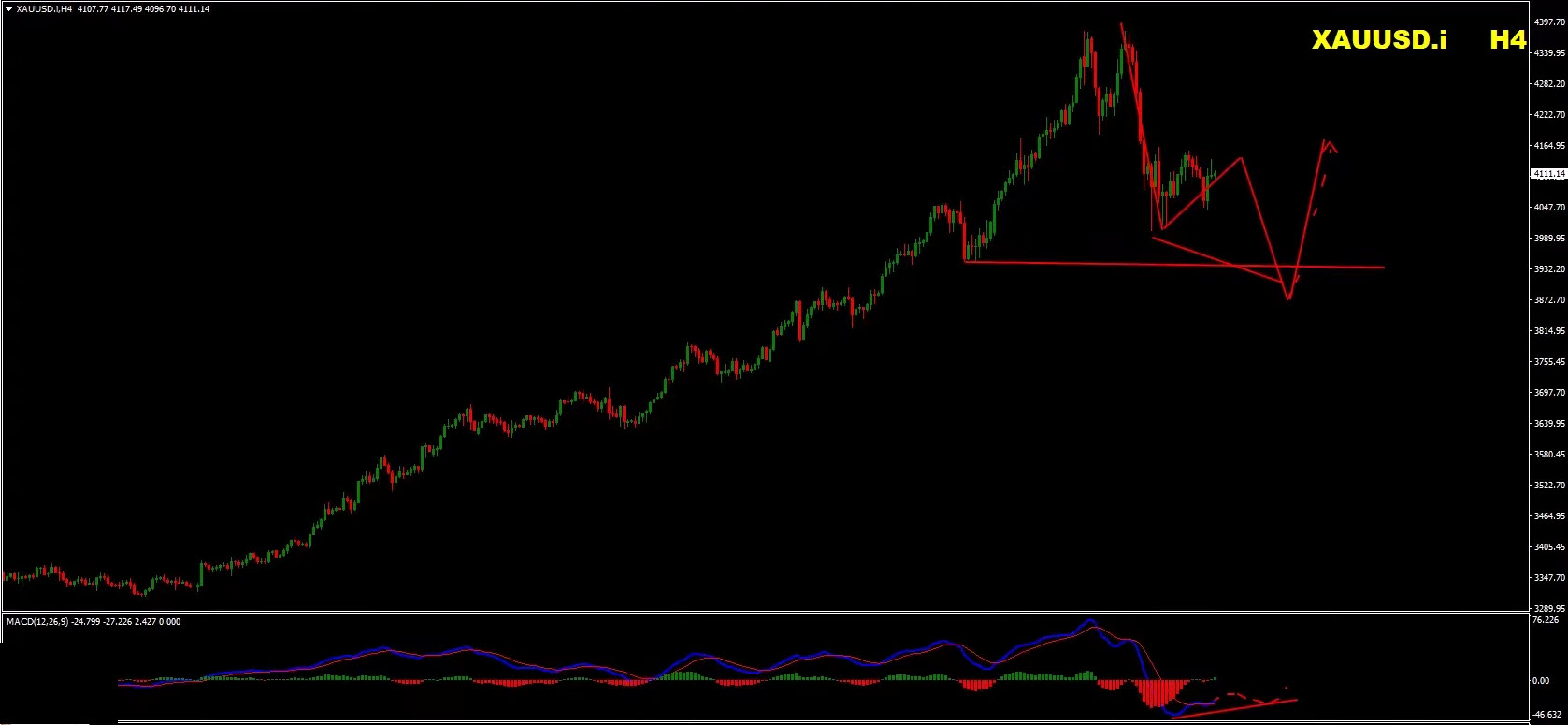

On the 4-hour chart, a double top pattern has completed alongside a break to lower lows on both the chart and the MACD.

Technical Outlook:

-

Overbought Conditions: Monthly, weekly, and daily RSI readings above 80

-

Double Top Confirmed: Price and MACD both turning lower

-

Scenarios to Watch:

-

ABCD Correction / Range Formation:

As long as previous support-turned-resistance holds, expect sellers to dominate. -

Deeper Pullback Then Buy Setup:

If price drops to clear the previous lows, watch for bullish divergence (lower lows on price, higher lows on MACD) for potential retracement opportunities.

-

? Trading Plan: Look for short opportunities under resistance for the near term. For buyers, wait for confirmed bullish divergence before any counter-trend setups.

Pro Trading Tip

Pro Trading Tip

Every forecast above is paired with two scenarios. Why? Because great trading is not about being right — it’s about being ready. Let the market confirm the bias. Use your system, manage risk, and execute only when the structure and confirmation align.

Join the Home Trader Club

Join the Home Trader Club

Want to access the tools, systems, and real-time education we use daily?

With Eight Cap Broker’s support, you can now enjoy up to one full year of access to the Home Trader Club — including:

-

All professional trading systems

-

Exclusive mentoring sessions

-

Real-time trade ideas and setups

-

Full access to our course library and trading marketplace

Wishing you a profitable week ahead!

Vladimir Ribakov

Internationally Certified Financial Technician

Home Trader Club