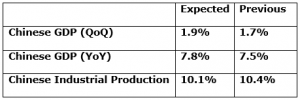

There is a high risk event coming up later in the week, which I think may impact risk correlated currencies like AUD, NZD and Euro. China’s GDP is scheduled to be released in early part of upcoming Asian session on Friday. Chinese GDP for Q3 is expected to accelerate at a pace of 7.8%, which is 0.3% more than the previous outcome. Chinese industrial production is also due at the same time, which is expected to register a small decline from 10.4% to 10.1%.

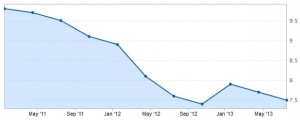

Historically, Chinese growth rate has been on the lower side compared to the growth rates in the year 2011 as can be seen in the chart below. It is also registering a decline from last two quarters as well. So, considering this any further miss in the expectations may cause an effect in outlook for the economy, and hopes of the government meeting its target will be vanished. A point to consider here is that fixed asset investment increased this time, which accounts about 50% of the GDP. This suggest that the market expectations can be met on this Friday.

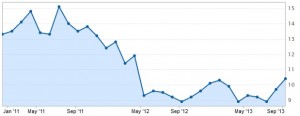

On the other hand, Chinese production data is showing improvement from last two months as can be seen in the chart below. Market is expecting a minor decline this time from 10.4%. Production data may be ignored if the GDP numbers come as expected.

Chinese growth concern always plays a major role in the market to assess other related economies like Australia and New Zealand. So, any disappointment may have an effect on these risk correlated currencies. NZDUSD and AUDUSD both are trading at weekly and monthly highs, and if the data does not disappoint, then we can see further gains in both the pairs. EURUSD may also gain some bids as the overall outlook for the global economy strengthens.

Looking at the daily chart of NZDUSD, the pair is trading at weekly and monthly highs. It is currently facing resistance in form of 76.4% retracement level at around 0.8441 of the last major drop lower as plotted on the chart below. If the pair breaks higher, then there are chances that it may reach previous high in coming weeks. Support comes in at around 0.8290, which is 61.8% retracement level.

Similarly, AUDUSD is trading at monthly highs, and above 38.2% retracement level of the last major drop at around 0.9510 as can be seen in the daily chart below. Next resistance comes in at around 0.9714, which is 50% retracement level. 0.9250 may now act as a strong support for the pair in short to medium term.

So, if the Chinese GDP does not disappoint, then I think both AUDUSD and NZDUSD may trade higher. One important point to note here for NZDUSD is that upside is limited now, and I am bearish on the pair from quite some time now. I think the more the pair rises, better would be the sell opportunity. So, keep an eye on this pair.

Get my Daily Market forecast with trade opportunities HERE: Vladimir’s Markets Forecast

Trade carefully friends!