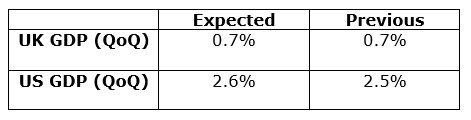

Today, there are two major fundamental events scheduled in the European and US session, US and UK GDP figures for second quarter. Economists are expecting growth to remain steady in both US and UK.

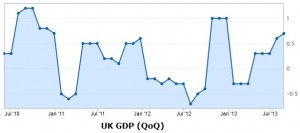

UK GDP (QoQ)

UK economy has been showing improvements from the last couple of months, and outlook has changed completely in the medium term. Service and labor sector has improved a lot recently, and as a result pound has also gained across major currencies. GBPUSD has gained more than 1000 pips in two months, and still poised to move higher if the data does not disappoint.

Gross domestic product for second quarter is expected to remain stable at around 0.7%. This will be second highest reading in past 12 months as shown in the chart below. I expect the outcome to be around expectations, and as a result pound may gain some ground in short term.

Looking into the technical details, GBPUSD is trading above a trend line on the daily chart as shown below and if this trend line holds I think the pair may set a new high before moving lower again. Two critical supports lie at around 1.5880 and 1.5760, which is also a confluence area of the trend line. Resistances are at 1.6160 and 1.6300, which are the last time highs as well. If the pair drops to the support, then I expect it to bounce again and if the pair continues higher, then 1.6160 followed by 1.6280 can cap the pair in short term.

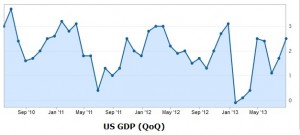

US GDP (Q0Q)

US economy is expected to grow by 2.6%, and if the outcome remains stable, the US dollar may find some bids as investors start to search the possibilities of taper sooner or later. After a dip in July, GDP figure is showing improvement as shown in the chart below. Recent data from the US was mixed, and was not convincing enough for fed to believe that the economy has improved to a greater extent. I am not expecting any major downside surprise today and as a result data release may not cause a lot of volatility in the market.

Looking into the technical details, EURUSD is also trading above a critical trend line as plotted on the 4 hour chart below. Yesterday, the pair bounced sharply from the trend line and support at around 1.3460/50. Previous high at around 1.3565 is the major hurdle for the pair, and if the pair manages to overtake this resistance, then it may continue higher to challenge 1.3660. Alternatively, if it drops again, then it would be interesting to see whether 1.3450 holds or not. A lot depends on the US GDP outcome.

So, watch closely both the events as it might turn out to be a game changer in short to medium term.

Trade safe friends!