Hi Traders! GBPAUD short term forecast update and follow up is here. On Sep 24th, 2024 I shared this “GBPAUD Technical Analysis And Short Term Forecast” post in our blog. In this post, let’s do a recap of this setup and see how it has developed now. If you would like to learn more about the way we trade and the technical analysis we use then check out the Home Trader Club. Spoiler alert – free memberships are available!

Explore My Free Mentorship Program

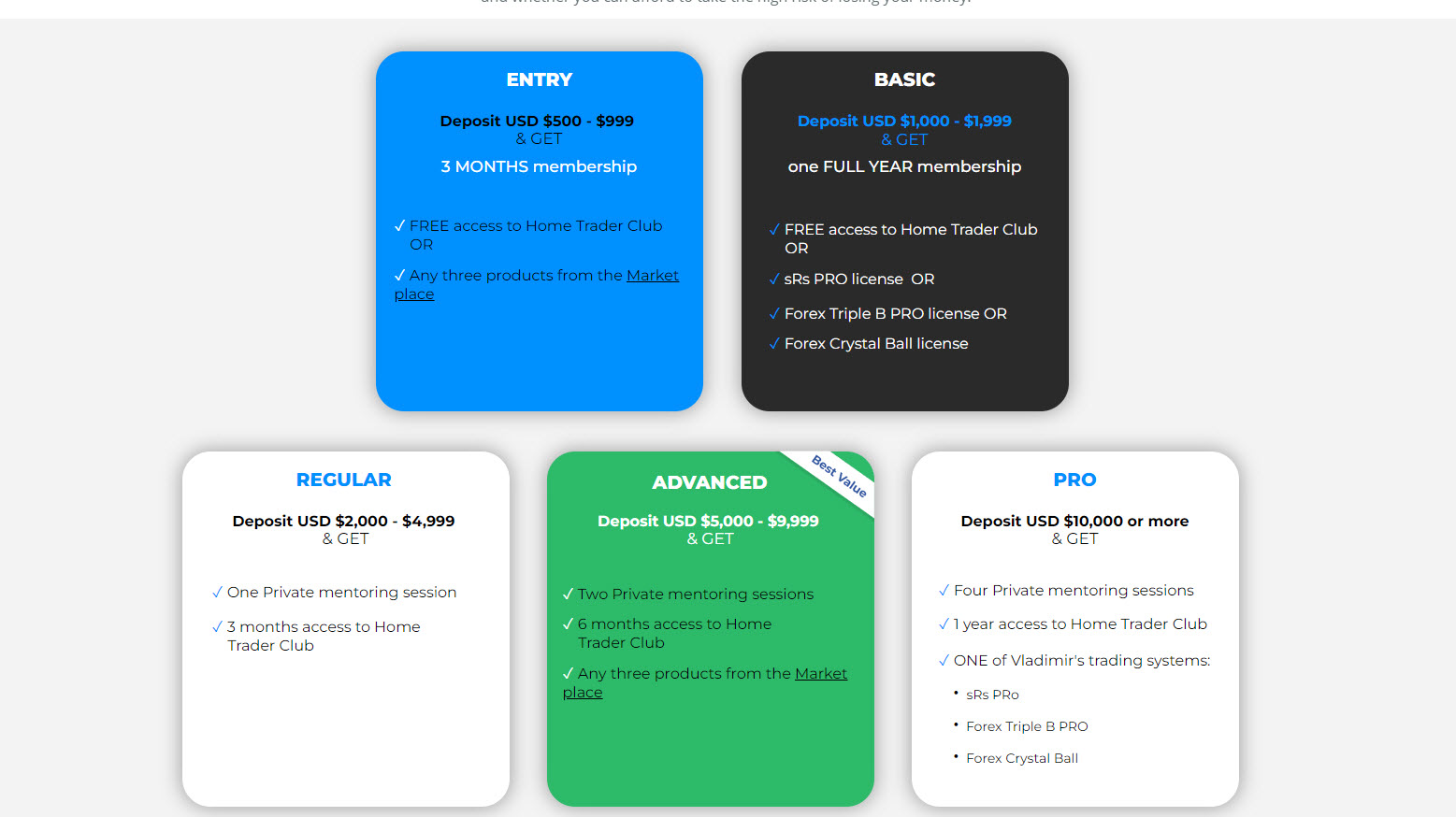

As an Internationally Certified Financial Technician (CFTe, IFTA) and former private capital hedge fund trader, I have successfully mentored numerous students who are now thriving in the trading world. Students who learned with me, are now full-time traders, work in the trading industry, run their own capital firms or are fully funded traders by private companies, develop automated trading solutions and manage others’ capitals. I am a very proud mentor and I am proud of the success stories I’ve helped create, and for a limited time, I’m offering my mentorship program for free through a partnership with Eight Cap broker. Join Eight Cap, become an active trader, and choose the offer that suits you best –

For more details, visit: Home Trader Club Mentorship Program

I’m excited to work with you and help you reach your desired level of success!

My Idea

Looking at the H1 chart, we could see that the price which was moving lower, reached a key support zone that has formed based on the 100%(1.93906) Fibonacci expansion level of the first wave. The price respected this key support zone, and is currently bouncing higher from this zone. Also, the price has broken above the most recent downtrend line and is currently holding above it, we may consider as evidence of bullish pressure. In addition to this, the ADX indicator gave a bullish signal here at the cross of +DI (green line) versus -DI (red line) and the main signal line (silver line) reads value over 25, we may consider this as yet another evidence of bullish pressure. Also, currently there are no signs opposing this short-term bullish view. So everything looks good here for the bulls and until the key support zone (marked in green) shown in the image below holds my short-term view remains bullish here and I expect the price to move higher further.

GBPAUD H1(1 Hour) Chart Current Scenario

Based on the above-mentioned analysis my short-term view was bullish here and until the key support zone holds I was expecting the price to move higher further. The price action didn’t follow my analysis here and this idea failed. After the most recent downtrend line breakout, the price which was moving lower reached the key support zone but the price didn’t hold in this zone as I expected it to. The price moved lower further and we got a valid breakout below this key support zone thus invalidating the bullish view here. So based on this my current view on GBPAUD is neutral.

So traders, this is why I wanted to show this example to help you understand why we should always trade based on the facts and hints provided by the market and take the right actions according to that. Even though we had various facts supporting the bullish view, the price didn’t hold in the key support zone as I expected it to and the price broke below it, which is a contradictory sign provided by the market opposing the bullish view. Also, you should keep in mind that losses are part of trading we can’t expect every trade to go as per our plan and provide us profits. In trading, we can’t avoid losses but in order to be successful in trading, we should know how to cut losses early and how to manage the trade when the price goes in the opposite direction.

Note: You can watch the webinar on how to cut losses early here

Not sure how to enter a trade? Spot reversals (bounces)? Not sure how to spot breakouts?

I invite you to

Also, you can get one of our strategies free of charge. You will find all the details here

Download our best forex indicators here

If you have any further questions, don’t hesitate to drop a comment below!

Happy Trading!

Arvinth Akash

Home Trader Club Team.