* British Pound has a very bad time recently not only against the US dollar, but also against a few other major currencies.

* GBPUSD after trading below 1.3900 level recovered, but finding sellers near 1.4000.

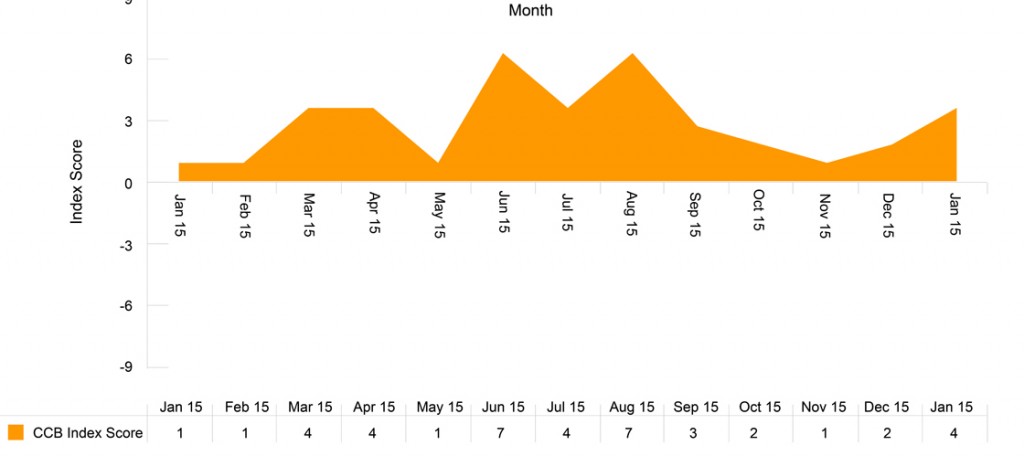

* Today the UK GfK Group Consumer Confidence figure was released, which posted a decline from 4 to 0 in February 2016.

* Today the US Gross Domestic Product Annualized will be released by the US Bureau of Economic Analysis, which may impact the course of the GBPUSD pair moving ahead.

UK GfK Group Consumer Confidence

Today, the UK GfK Group Consumer Confidence, which is a leading index that measures the level of consumer confidence in economic activity was reported. The forecast was slated for a decrease from the last reading of 4 to 3 in Feb 2016. However, the UK GfK Group Consumer Confidence declined and posted a reading of 0 in Feb 2016.

The outcome was definitely disappointing, and this only adds to tensions in the Euro and UK. There are all exit talks of the UK from the Euro Zone, which is causing a stir in the market.

Commenting on the report, Joe Staton, Head of Market Dynamics at GfK, stated “UK consumers remain resiliently bullish this month with no sign of the January Blues denting their view on the state of their personal finances for both the past year and also for the rest of 2016. And with post-Christmas bargain-hungry consumers evidently snapping up bumper discounts across the country, the Index was further boosted with shoppers agreeing that now was a good time to buy (+9 points)”.

Technical Analysis – GBPUSD

The GBPUSD pair was crushed this past couple of weeks, and the pair even traded below the 1.40 area. This clearly suggests that the pair is under a lot of bearish pressure, and may continue to trade down until tensions in the UK settles down.

If the pair attempts to recover from the current levels, then the 1.4000-40 levels must be watched, as it may now act as a resistance for buyers moving ahead.