Watch the webinar of Hidden Divergence – 3 KEY TRADING TIPS

Hi Traders, In this article, I would like to discuss about the three key tips involved in trading “Hidden divergence” strategy, which is one of my favorite ways of riding the trend. When I say hidden divergence I mean a specific condition between the price and the indicator (for hidden divergence I use MACD histogram). I consider this as one of the powerful tools available for traders. There are three important tips involved in trading Hidden Divergence to increase the probability to be on the winning side which are as follows.

Note: If you want to learn about Hidden Divergence you can find it in my free e-book here

In order to explain this, I will take an example that we discussed and traded in my trading club on GBPNZD.

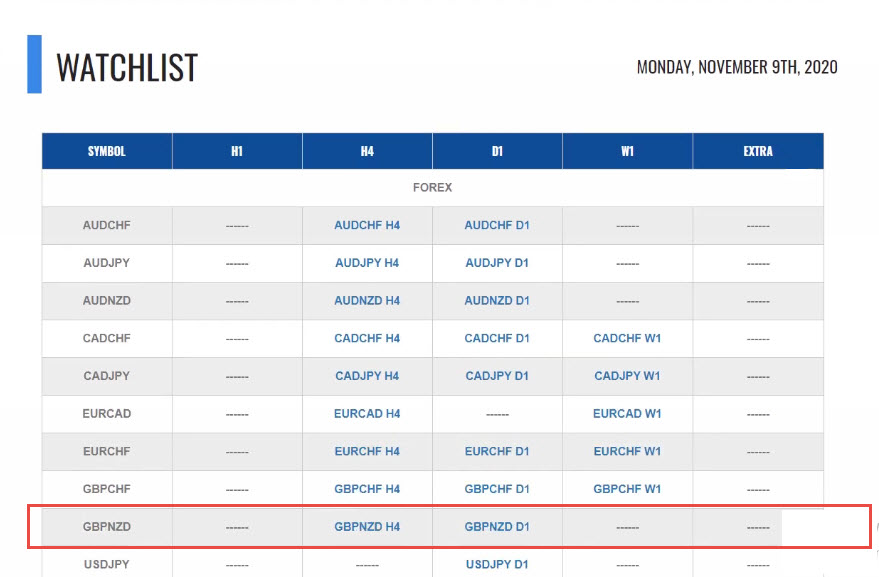

On the table below you can see my trading watch list. This list is all the trading opportunities I share with my followers on daily basis, in Traders Academy Club (you can join us here).

TIP 1 – Multiple time frame synchronization

The first tip involved in trading the Hidden divergence strategy is “multi-timeframe analysis”, we do this to find “multi-timeframe synchronization”. This is because I believe if the few following timeframes show the same trend or momentum, then the chances to find a good opportunity and finish it as a winner or at least not as a loss are increased. In the business of trading, we work with probabilities, to increase this probability we, first of all, have to analyze the instrument we wish to trade, and choose the synchronized ones. Meaning – the ones that have clean direction or trend on few time frames.

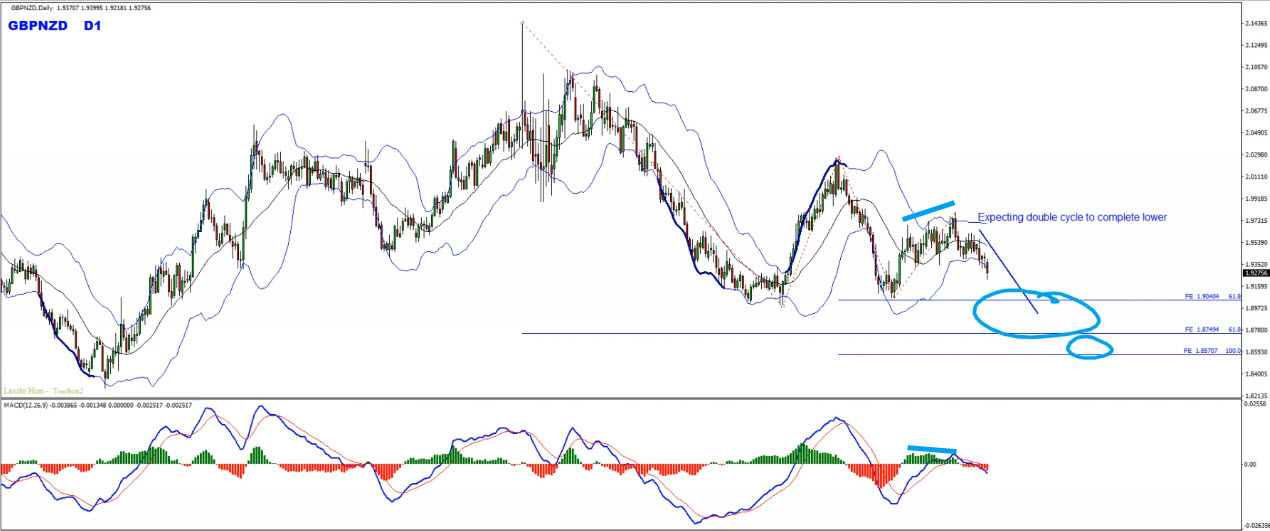

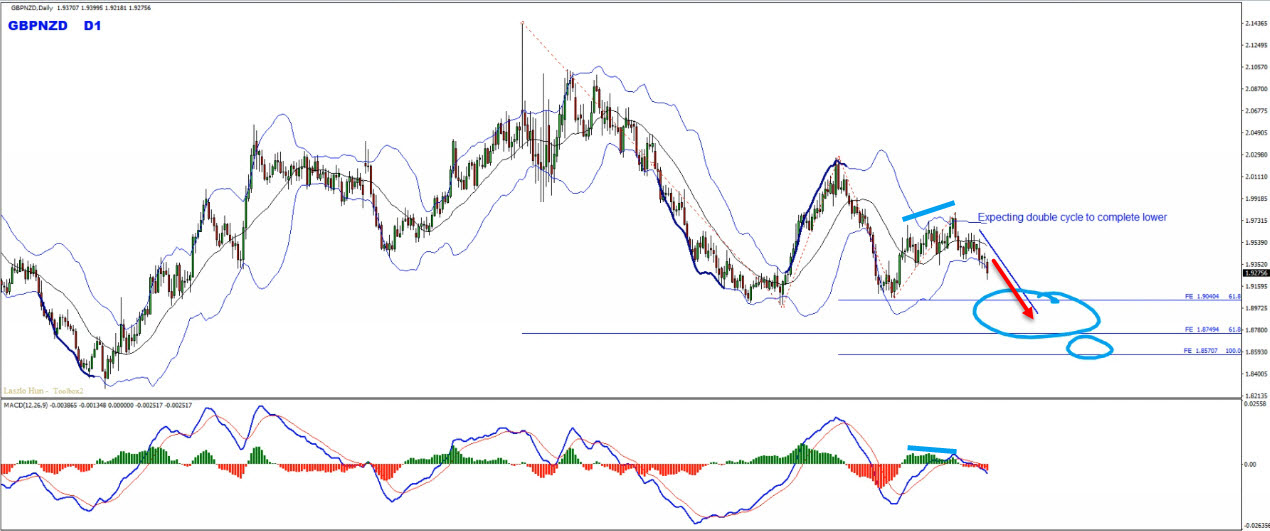

So in this example, I will start my analysis from the daily chart (which is the highest timeframe in this example’s multi-timeframe analysis). Looking at the daily chart, I could see that the price is in a pretty clear downtrend. Also, while measuring the big and small waves, we have a key support area formed by the 61.8% Fibonacci expansion levels of both these waves (see image below). We also have another key support zone slightly lower which is formed by the 61.8% Fibonacci expansion level of the big wave and 100% Fibonacci expansion level of the small wave. Price still has room lower towards these key support areas and the last divergence was a regular bearish divergence which can be considered as a fact supporting the bearish view. So based on all this, I personally expect the price to likely drop down to the key support areas shown in the screenshot below.

Note: If you want to learn more in-depth insights about divergences, you can benefit greatly from the videos on my channel here while also embarking upon Divergence University for comprehensive divergence education.

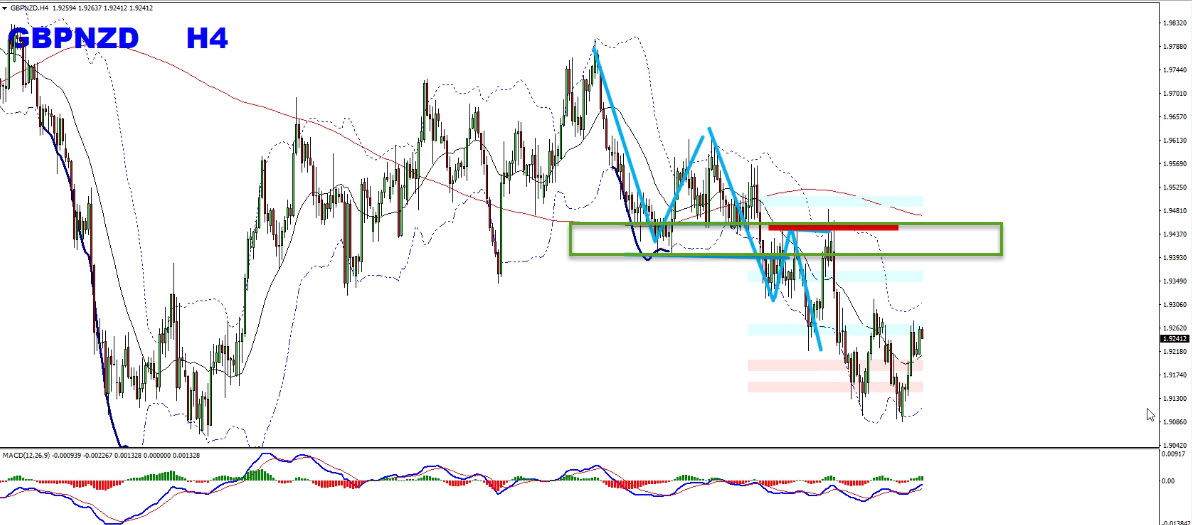

Moving down to one timeframe lower, on the H4 chart I spotted a bearish trending pattern in the form of three lower highs, lower lows which indicates a bearish momentum to me. Basically, I can see that the market is starting to move in some sort of a clear (bearish) direction inside a channel. Generally, after a bearish trend pattern, we may expect pullbacks and then a possible continuation lower. So basically I am looking for pullbacks here to provide me the opportunity to ride the ongoing bearish trend.

The price provided this pullback with a bearish hidden divergence between the two highs shown in the screenshot below. Where the price has created lower highs, and at the same time the MACD indicator has created higher highs. This is a clear sign favoring the bears as we can see that the buyers tried to push, and they created a bigger effort, but they failed to create higher highs on the chart.

TIP 2 – No signs against + Enough room for the target.

The next important tip is to make sure there are no signs against (no opposite evidences). That is in a bearish trend we do not want to face any bullish obstacles (such as bullish divergence, powerful support levels, critical trend line on higher timeframes, etc…) and vice versa for the bullish trend there shouldn’t be any bearish obstacles). For example, you don’t want to end up in a situation where the daily time frame has bullish divergence while you are trying to sell on the H1 chart. So make sure there are no signs against on the trading timeframe and two timeframes higher.

Next, you want to make sure there is enough room for the trade to develop. Meaning – If you are selling you want the swing low of the higher time frame to be far away. This is because if I spot the opportunity right next to the critical area as shown in the screenshot below then my opportunity loses credibility.

So in this example on the daily chart, the key support area is at the place shown in the screenshot below, and I could see that there is enough room for the movement.

Also on the H4 chart, the price provided the pullback, and the area marked at the bottom is the swing zone from the daily chart. So I can spot here an opportunity, and there is a lot of room for the price to go lower.

TIP 3 – Look for false breaks in your direction.

The third important tip is to look for false breaks in the direction of our trade. We can call it a false break when the price tries to break a certain area, or level, or trend line, and fails to do so. For example, if you are looking to sell, you want to see false breaks of important highs (alternatively if you are looking to buy you want to see false breaks of important lows). In general, it means the buyers are trying to create higher highs, but they are failing to do so. Why? Because the bearish trend is still valid, strong, and controlled by the bears.

In this example on the H4 chart, we have the most recent high (marked in red) and the levels of rejection (marked in green) as shown in the screenshot below.

On the H4 chart, the price which was moving higher tried to break above this high, but it failed, and we got the false break of the most recent high. The price has also created the false break of the most recent downtrend line as well. In addition to this, the price has also created a hidden bearish divergence, and the MACD ticks to the downside. All these evidences gave us a green light that the trend is likely to continue lower.

Management

The price indeed moved lower as we wanted it to per the analysis and reached the swing zone that we spotted on the higher timeframe shown in the screenshot below. Generally, once the price reaches a critical zone what we need to do is to pay attention to the opposite signs. The technique I personally work with is by spotting opposite divergence. In this case, we had a bullish divergence based on the moving averages, and histogram of the MACD indicator, and also on the RSI indicator as well.

This is an opposite evidence that we need to pay attention to. When such things happen then it is a good place to consider managing your trade and secure your profits (cash out or partial cash out or trailing protections or partial hedge, etc.. depending on the strategy that you work with).

Note: If you want to learn about Money Management you can find it here

This is because I personally rely on the market to give me the specific signs from the zone that I wanted to trade, and to show me the potential swing points to ride. In the same way, I rely on it to show me when to get out of the trade. So basically, in my technique, I rely on opposite divergences around the key zones as a warning sign to manage my trade.

Conclusion

So traders, these are the three important tips that you need to pay attention to when you work with Hidden Divergence, or any trend trading strategies. I personally love to work with cycles and waves and synchronized divergence. If you have a different way of analyzing, and choosing your market direction you can follow that, but make sure to follow these three important tips mentioned above.

Once again I invite you to join me in my club and enjoy from our Live Market Analysis and our trading reports on a daily basis and improve your trading with us.

Also, you can get one of my strategies free of charge. You will find all the details here

Thank you for your time in reading this article.

Yours to success,

Vladimir Ribakov

Certified Financial Technician

Thank you sir